Concept

ATTENTION : If we describe what it is in simple words, then revenue includes the cost of goods or the purchase price plus added value. This is all the money that came to the company from the sale of the company's product.

From the point of view of economic justification, the definition of revenue is the total amount of money that was received during a certain period of activity from the sale of goods or the provision of services. It is expressed as a positive value, but it can also be equal to zero, the main thing is that it will never take a negative value.

In economics, the term “revenue” is the sum of all income from sales of goods, services and assets before deducting any costs . For many companies, revenue consists not only of sales, but also interest, royalties and other income. For an LLC or a company with another legal form, this is the totality of all goods and services sold.

For an enterprise, revenue is the basis of the business. It shows the demand for a product or service produced by a given enterprise. The work of most companies is based on receiving revenue, because, depending on this, the entrepreneur is able to assess the level of demand for a product or service, and resolve issues regarding the purchase and production of goods in his favor.

This economic indicator is the final completion of the enterprise’s activities, and the calculation of this indicator is carried out by multiplying the price by the number of units of goods sold.

For a company, revenue is the total of all goods and services sold . Formally, only periodic income accounted for in accordance with the appropriate accounting model adopted in a particular company is called revenue.

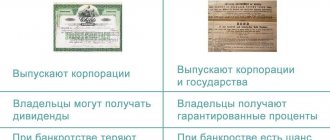

The higher the revenue, the better, the faster the company's shares can grow.

The concept and essence of income

Income is a broader concept.

State revenues include all sources of funds received into the state budget in accordance with established codes, laws, and other regulations, for example:

- taxes, fees, duties, excise taxes, fines

- receipts from the provision of public services

- from foreign economic activity

- from previously provided installment plans, loans

The income of a family or a citizen includes the benefits they receive in the form of wages, pensions, benefits, scholarships from the sale of what is grown on a farmstead, summer cottage or from the sale of a car, house construction, apartment and income from other sources.

Income of business entities includes income from all possible types of business activity minus indirect taxes and fees (value added tax, turnover tax, excise taxes).

For the purposes of accounting and statistical accounting, economic planning, income is usually distributed by type:

- From sales to customers for core activities.

- From financial activities.

For example, the current account received the interest established by the loan agreement for the past calendar quarter. Income - Investment (for shares, securities, shares in other entities). For example, dividends on the share in the authorized capital of the Beta company, and funds from the sale of shares of Capital Bank, were transferred to the current account of the Alpha company.

- From the sale of fixed assets and intangible assets.

- Non-operating income (from writing off accounts payable, funds received for designated purposes, fines, penalties, interest provided for in agreements with other business entities or by court decisions, charitable proceeds).

- Excess inventory items identified as a result of the inspection and inventory.

- Arising as a result of emergencies, force majeure situations (fires, flooding, destruction). Example. As a result of the fire, the carpentry shop burned down. The book value of the workshop was written off as a loss, and the bricks suitable for further operation or sale, remaining after dismantling the workshop, were placed in the warehouse. Its cost is included in income from extraordinary events.

What factors does it consist of?

The amount of revenue from product sales depends on the following factors:

- quantities;

- assortment range;

- quality;

- the price level for the goods sold.

The quantity of products planned for sale has a direct impact on the amount of revenue and depends on:

- production volume;

- changes in the value of goods that were not sold at the end of the planned period.

The range of products sold has a double impact on the amount of revenue:

- increasing the share of the assortment of high-value goods increases revenue;

- An increase in the total volume of sold products in the share of the assortment with a lower price reduces it.

The size of trading revenue is also directly affected by the price level, which is influenced by:

- quality and consumer properties of the product;

- implementation within the specified time frame;

- supply and demand in the market;

- financial situation of the raw materials market.

Revenue volume is affected by:

range;- quality and competitiveness;

- price level;

- the rhythm of the enterprise’s activities;

- completeness of products;

- nature of shipment;

- demand for these products;

- form of payment for products.

Factors beyond the control of the enterprise include:

- transport disruptions;

- late payment for products due to insolvency of buyers;

- delay in bank settlements.

You will learn how to find out a company’s revenue by TIN and on the Internet from this article.

Differences

Profit and revenue are not the same thing . Distinctive characteristics of profit from revenue:

- profit represents the total revenue from which the company's costs have been subtracted;

- Unlike revenue, profit can be obtained with a negative result.

What is common is that these economic values can always be predicted. Taking into account the indicators of the past period, we can predict what the profit margin will be in the future; we just need to take into account the expected costs and changes in market conditions.

Distinctive feature of income from revenue:

- the increase in income occurs as a result of the receipt of assets that increase the capital of the organization;

- income is an indicator that increases the capital of an enterprise;

- capital that arose through payments from founders and owners is not income;

- income for the enterprise is possible as a result of the implementation of the main activity;

- income is an indicator of net revenue received from the sale of services, work or goods for various purposes.

At first glance, the difference between revenue and income may turn out to be insignificant, although for the accounting of large enterprises and companies these are significantly different indicators from each other, where revenue will always be a positive value.

Gross profit is the result of the amount of revenue minus associated costs. For trading enterprises, gross profit is the difference between the selling price and cost (how do cost and revenue relate?). Gross profit indicators usually compare the degree of efficiency of different enterprises. Gross revenue is a more specific indicator that forms the completed stages from productivity to sales of goods.

You can read about the differences between revenue and turnover in our material.