Imputed income

Every person's personal finance is a rather difficult issue. But they influence such an item of the economy in a particular subject as imputed income. It is very important when drawing up economic forecasts for the country's development. The higher this indicator, the better.

Imputed income is the profit of a business entity, which is calculated taking into account certain factors. They influence the receipt of certain funds. We can say that imputed income is only the expected profit of a citizen or business entity. An important factor in economic forecasting.

Types of income

The following types exist:

State

Monetary assets that serve as the financial basis for a country's spending. Consist of tax and other types of charges. But taxation is the main reason for replenishing the state treasury.

The total income of the state reflects the development of the economy in the country in parallel with GDP and GNP.

Enterprise income

The income of an enterprise from the provision of services / sale of the results of production activities is called profit, taking into account the deduction of the personal income of the owner of the enterprise.

In other words, the income of an enterprise is the acquired economic profit, which led to an increase in the organization’s material property.

To increase the income of an enterprise, it is worth using calculations of the economic indicator of NPV before investing capital in investment projects.

Net present value is one of the most important indicators that evaluates the justification of investing in a project for the duration of its entire life cycle. It represents the difference between the receipts of tangible assets and the costs incurred over a time period.

Income of individuals

Individual income includes:

- Receiving a scholarship, salary, social benefits, pension contributions.

- Income from the sale of goods or services of own production.

- Awards.

- Receiving dividends or interest from bank deposits.

- Income from sales/rental property.

Income varies

It is worth paying attention to the fact that income itself can be varied. Their classification depends on several factors. What are the possible scenarios for the development of events?

First, there is a minimum income. As you might guess, this is the minimum amount of money that citizens will receive. There are no indicators below it. The lower limit, the “floor” in economics.

Secondly, there is a maximum income. By analogy with the previous option, these are funds that are received by the population (usually per month) as much as possible. We can say the upper limit (or, as it is also called, “ceiling”) in forecasting economic development.

Also, the profits of citizens are divided according to their stability. There is a constant income. As you might guess, this is a fixed amount of money that is received by one person or another every month for a long (regular) time. You could say on an ongoing basis. This option is the main source of budget formation. Both among the population and the state as a whole. Constant profit is stability, a guarantee of tomorrow.

The income is not constant. It usually turns out once or unstable. Moreover, its dimensions are often not clearly established. We can say that this profit is usually a pleasant addition to a person’s main source of income. In principle, this classification is enough to fully understand the sources of cash income of the population. So what options are there? What is included in the personal income of a person or citizens in general?

What is income in simple words

Income (profit) is the amount of money earned taking into account the cost of production. Moreover, the term means practically the same thing for individuals and legal entities.

Origin of the term

Income has a Slavic etymology. Old Russian “income” from doga (translated: to reach a certain place, limit, size, to be at the end).

It is identical to the Greek hodos - path, road.

Formula:

Income = [Revenue] - [Material costs] - [Indirect taxes, customs duties, excise taxes]

Material costs are money spent on the purchase of products and equipment.

Example Consider the case of a small business reselling goods. An entrepreneur bought 1,000 goods and sold each for 10,000 rubles. The cost of each was 7,000 rubles. Then: Income = Revenue - Cost = 10 million - 7 million = 3 million rubles.

As a result of income, there is an increase in assets or a decrease in liabilities, leading to an increase in capital not related to the contribution of capital owners.

Revenue and income are often confused. Revenue comes only from the main activity, and income can have more sources: payment of fines, interest from investments and bank.

- Difference between revenue, income and profit;

In accounting, income is divided from the source of its receipt into the following:

- Primary activity;

- Financial activities;

- Investment (shares, bonds);

- Sale of intangible assets;

- Non-operating income;

You can read about income in Art. 41 Tax Code of the Russian Federation.

Note Advances are not income.

Salary

So, the first and most obvious scenario is salary. This item, as a rule, is not only a citizen’s permanent income, but also the main source of profit. It is received only by the able-bodied population for performing certain works. It doesn’t matter whether you officially work or not. The fact remains a fact.

Earnings are remuneration for work. Usually paid in the form of advance and salary by employers. All of this is included in personal finance. After all, they will be managed by the one to whom the payment is made. As a rule, it is through this source that a person is provided with everything he needs for living and existence.

Entrepreneurship and business

Recently, entrepreneurial activity in Russia has been gaining enormous momentum. And business too. All this is the personal income of citizens. That is, if you are registered as an individual entrepreneur or have your own business, then the profit that you will receive (of course, after paying taxes and all mandatory contributions, paying salaries to employees) is your personal income.

As a rule, this item is permanent, but it is received in different amounts every month. It rarely happens that a businessman or entrepreneur earns nothing and goes into the red. Thus, this source of profit is not very stable, especially at first. But you shouldn’t exclude it from options for getting extra money.

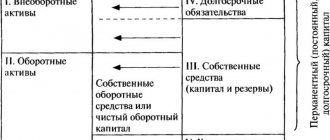

Distribution, calculation and accounting of personal disposable income

Disposable income is personal income minus mandatory and voluntary payments, social and income taxes. Mandatory payments include monetary fees established by law, evasion of which may be punishable by law. Therefore, as a rule, this type of payment is made first, and its amounts cannot be included in the available portion. Voluntary payments, such as life and property insurance or health insurance, are then subtracted from the face amount. The remaining amount is what you are looking for.

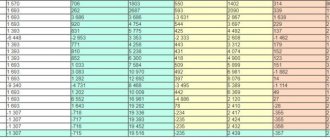

There are economic formulas that, in theory, can be used to calculate personal disposable income:

- Firstly, for the calculation, the amount of social payments, enterprise profits, and net interest are subtracted from the national income. Where net interest is the amount of profit from deposits after paying taxes. Transfer payments (that is, social payments to the population, taxes are not levied on them), dividends and net interest paid by the state are added to the amount received.

- Then we subtract taxes. The final number is the desired one.

Are social benefits considered personal income? Social benefits are pensions, scholarships and benefits. There is no need to pay taxes on them, since they do not have a commercial component, but are paid as social assistance. However, these payments are considered personal income.

Present

The income of citizens is varied. Sometimes you may not even realize that certain funds will be counted as personal profit. For example, gifts and gift deeds are also income. Albeit non-standard.

As you might guess, it is usually a variable quantity. Moreover, it is generally impossible to predict the size of gifts. So you can call this source just an additional pleasant “bonus” for your personal treasury. Gifts are not subject to taxes, unlike wages or profits from a business/business.

Pensions

The amount of income may vary. Of course, it’s good when you can more or less predict how much money you will receive in a given month. In addition to the personal income already listed, several stable sources of additional funds for citizens can be identified. For example, pensions.

You do not have to reach retirement age to receive this support from the state. Pensions can be paid for a variety of reasons. Usually they are fixed and are credited to the account monthly. That is, this is a permanent income that is provided to the population at the expense of the state treasury. True, its size, as a rule, is not too high. But it's better than nothing at all.

Functions

There are 5 functions of personal income:

- The reproductive function is the ability to continue to engage in profit-generating activities. For example, for an employee, this will be the ability to continue working for the benefit of the company.

- Stimulating – encourages you to engage in this particular activity. For example, an architect, receiving material satisfaction, will continue to design buildings.

- Social – is to maintain a higher standard of living of the population, which leads to greater social stability of the entire society.

- Status – determines the position of the employee in the structure of the organization. The higher up the career ladder, the more significant this function is for the employee himself.

- Regulatory – serves to ensure a balance of supply and demand in the labor market.

Benefits

Citizens' income is generated through numerous sources of funds. Sometimes it's easy to get confused. In addition to pensions, the state provides another type of assistance to the population. We are talking about payment of benefits.

This support, as a rule, will be assigned to certain citizens for a variety of reasons. For example, if you are registered with the labor exchange as unemployed, then you will receive unemployment benefits for a certain period of time. This is your personal income, although it is provided at the expense of the state, and not through your personal merits or as a result of your work activity.

There is also a disability benefit (paid to both adults and children), child care benefits (up to 1.5 and up to 3 years, respectively), and maternity benefits (one-time, paid only once in a fixed amount). So there are a lot of options. You can also find benefits for low-income families, as well as for large families. Typically, benefits are systematic; there are also lump sum payments, but there are not so many of them. Such personal income is not the main source of profit. Is it additional?

Real estate

What else is worth paying attention to? Average per capita income of the population is calculated taking into account the profits of all citizens. The higher this indicator, the more favorable forecasts are made regarding economic development. That is, personal profit has a direct impact on the economy of the country as a whole.

Real estate can be identified as another source of funds. Its implementation is included in personal finance. It can be either permanent or one-time. In the first case, it usually means leasing the property, and in the second, its sale. The first scenario is very common. Sometimes he is able to fully provide for his family with money. Such personal income is very pleasing with its stability. True, unlike benefits and pensions, it is taxed. Some citizens do not declare profit from property in order to save money. This is wrong, illegal. Try to declare all sources of your income. This will save you from many problems with the tax authorities in the future.

Kinds

Let's consider 3 types:

- Nominal is the amount of money you received in your hands.

- Disposable is personal income minus taxes, or the amount of consumption plus savings. This definition is given by a large economic dictionary. In simpler terms, the amount of money you can count on for consumer needs and savings. To get this figure, you need to subtract the amount of taxes from your personal income. Or add up your savings and the amount you usually spend during the reporting period.

- Real is the number of goods and services that you can buy with the money you received in your hands, i.e. for nominal income.

In addition, according to the source of formation, earned, portfolio and passive income are distinguished:

- Earned – remuneration in the form of wages for work activity. Limited by the ability of a particular worker to produce a certain volume of output per unit of time. As soon as a person stops working, the flow of money stops. The main disadvantage is that it is taxed at the highest rate.

- Portfolio – profit in the form of interest and dividends from various securities. Doesn't depend on whether a person works or not. Opportunities for increase are limited by the amount of funds available for investment. To make a profit in this way, you need to understand the basics of the functioning of the securities market, although you can entrust the money to professionals.

- Passive – income from rentals, royalties, copyrights, patents, etc. Doesn't depend on whether a person works or not. Allows the use of leverage. For example, you take out a mortgage loan from a bank, purchase real estate, which you then rent out. The monthly payment covers the loan installment, plus you still have some profit left over. Your investment is 10-15% of the value of the property. With proper planning, tax costs are kept to a minimum.

Scholarships

Personal finances of the population also include scholarships. They are usually paid to students who study on a budget basis at the university. This also applies to cadets. The scholarship is paid only to the student. And it is considered his personal finances.

As a rule, the size of such payments is not too high. A scholarship, like a gift, can be called a pleasant and regular addition to the family or personal budget. By the way, sometimes certain scholarships are awarded for certain services to the university.

Other

As you can see, personal income is varied. And you can find both regular and irregular profits. In addition to the options already listed, there are several other sources of funds that can be used by citizens.

We are talking about profits received from the sale of agricultural products, as well as interest on bank deposits. This also includes money received through the sale of any securities.

Personal income

Personal income is the total capital that an individual receives from various sources in the process of life over a certain period of time. Personal income includes not only wages, but also a number of additional income (for example, dividends on securities, transfers, pensions, social benefits, rent, and so on). Personal income is calculated before the deduction of personal taxes accrued to the subject.

Personal income is all types of income of the population, which includes cash receipts from the state budget (scholarships, pensions), wages at enterprises, income from one’s farm, and so on.

Personal income is an indicator that reflects the real well-being of people and their solvency (before taxes).

Classification of personal income

The formulations “profit” and “income” appeared even before the moment when a person began to consciously use money. The only difference is that in more ancient periods income was in kind, more tangible. The emergence of a monetary shell made it possible to perceive one’s capital as something substantial and tangible.

At the present stage, personal income has a rather complex structure. They can be classified:

1. Based on changes in consumer price levels:

- nominal income. This is the amount of capital that is received by a certain person in a specific period of time. This indicator reflects the real level of financial income, regardless of the level of taxes;

- disposable income. The money that belongs to this type of profit can be used to solve personal problems and saved as your savings. At the same time, disposable income is usually lower than nominal. This is explained by the need to deduct mandatory payments and taxes from the total amount;

— real income reflects how many people can purchase goods with the funds at their disposal over a certain period of time.

2. According to the form of the unit of measurement:

- cash income. This includes scholarships, pensions, business profits, wages at enterprises, and unemployment benefits. This also includes dividends on securities, profits from real estate, interest on deposits, profits from the sale of agricultural products, income from the sale of currency, insurance payments and others;

- natural income. Such profits include products that are produced on a subsidiary farm, payments from social funds, services provided by family members, and so on.

3. According to the degree of intervention of government agencies:

— primary incomes are formed under the influence of a powerful market mechanism;

— secondary income is inevitably associated with changes in the country’s policies.

Essence, structure and functions of personal income

In modern society, the concept of “personal income” is understood as total profit accrued (received) in kind or in cash. Often this includes funds accrued by employees of enterprises for unworked time (for example, compensation for holidays, vacation pay, and so on).

In a modern market economy, the main sources of personal income include the following profit:

— wages of liberal professions, employees, and enterprise personnel. This also includes various allowances, bonuses, vacation pay, and so on;

- additional payments. Such payments can be made for work in hazardous conditions, for irregular working hours, for performing the functions of a supervisor. In addition, additional payments may be for combining several professions, for working in an area with increased radioactive contamination, for working at night, and so on;

- profit in business. Here we are talking about the profit of the subject in the process of entrepreneurial activity without taking into account the taxes paid;

- income from personal property (for example, receiving funds from renting out real estate). This type of profit is considered one of the most sustainable sources, which is not associated with human entrepreneurial activity. This also includes dividends received from issuers by holders of shares or other securities;

- money from government agencies and companies, which is distributed among relevant groups of the population and employees. This includes social payments - social insurance programs, state assistance, benefits, social pensions, and so on;

— capital from personal subsidiary plots. Income received from grown and sold food products and animals;

- loan interest - money that comes from lending money to another person;

— pensions for citizens assigned by age or length of service;

- Other income. These include revenue from the sale of personal items through second-hand stores, buying points or the Internet, income from the sale of scrap metal, and so on.

The structure of personal income is formed on the basis of the state structure, the state of the economy, traditions within the country, forms of ownership, and so on. At the same time, the quality of the income structure and timeliness of payments largely depends on:

— motivation of the population, which directly affects the development of the economy of the country as a whole, a region or an enterprise in particular;

- relationships between individual individuals or groups of people (collectives);

— the quality of life of the population, which shows overall satisfaction with the actions of the authorities and their country as a whole. At the same time, we are talking not only about material, but also about spiritual and intellectual satisfaction.

In the process of studying the essence of personal income, special attention is paid to their functions. It is important to understand what role the volume of personal income plays in the development of the country and certain social groups. Today we can distinguish the following functions of personal income:

- reproductive function. Its essence lies in the normal supply of production with labor, taking into account the normal level of consumption. In essence, we are talking about calculating the nominal wage that would ensure optimal reproduction and a stable price level. If an employee is not satisfied with the profit he has from a standard job, then he is forced to look for additional sources of income. At the same time, the state has problems with additional income. In particular, human activity in several directions leads to a general decrease in potential, a decline in professional qualities, and a decrease in discipline (both production and labor);

— status function. Here we are talking about the correspondence between a person’s status in society and the salary paid to him. The very concept of “status” characterizes the position of an individual in the system of social connections. For example, as a labor status, one can imagine an employee’s career growth, that is, his position at work in relation to other employees. Moreover, the higher the status, the higher the salary should be. Such nuances are stipulated in employment agreements concluded between the employee and the employer;

— the stimulating function is important, first of all, from the position of the head of the company, who must stimulate his employees to a more responsible approach to work and high-quality performance of their job duties. With proper stimulation, labor productivity, the output of each individual employee increases significantly, work activity increases, and so on. To achieve maximum results, managers tend to link an employee's salary to his success at work. Otherwise, the stimulating function decreases, initiative disappears, and the person puts less effort into work;

- the regulatory function is directly dependent on one of the most important relationships - the level of demand and supply of labor. In addition, the degree of employment of people, as well as the quality of personnel formation in general, depends on the regulatory function. In essence, the regulatory function allows you to balance the interests of business managers and potential employees. To implement such a function, it is necessary to divide income among different groups of employees, by characteristics, priority, and so on;

— the production-share function reflects the extent to which the share of labor of a particular employee is involved in setting the price for a particular product. That is, when determining the cost of a product, the costs of its production are taken into account. Determining this share allows you to see how cheap labor is and how competitive the labor market is as a whole. The manager's task in this case is to maintain the lower limit of labor costs as much as possible.

Personal income can be calculated using the following formula:

Personal Income = National Income – Taxes – Retained Corporate Income – Social Security Contributions + Transfers.

Disposable income = Personal income – Income taxes – Non-tax payments.