You can hardly meet a person who would not like more money. Regardless of the level of earnings, there is always a desire to receive more. So today I want to talk about how to increase your income. This article will be useful to everyone who wants to become richer and improve the quality of their life. It is important not to focus on a single source of income, but to create several ways to attract money. I have selected several methods for you that will not require much time and effort, but can increase your balance. Moreover, giving pleasure from a new type of activity.

How to increase your income: start by saving

In order to receive money, increasing your income is not always important - in some situations it is worth trying to reduce your expenses. That is, to begin with, I propose to talk about ways to save money.

Unfortunately, not everyone wants to save money. Because this, one way or another, is perceived as a refusal of certain things, objects, and habitual spending. That is, a decrease in the overall quality of life. It is believed that when saving money, people are forced to buy low-quality goods.

Note!

However, the very principle of saving, as a way of increasing one’s own balance, is not pleasant to me personally. There is only one reason - in such a situation, a person’s motivation for further development disappears.

To correctly calculate your own balance, I recommend using such a concept as CASH FLOW. This is the part of the money that remains with you after you have received income but have taken away expenses. To learn how to save, I recommend that you count your finances:

- record the exact amount of money received;

- record all costs and expenses;

- determine exactly how to spend finances;

- record how much remains in your personal account.

As you can see, this is a great way to track exactly how money is moving in your account and increasing your income is then much easier.

Qualitative increase in income

To increase budget revenues, firstly, you need to think about their qualitative increase, that is, maximizing those cash receipts that already exist. For example:

- Talk to your boss about increasing your salary;

- Take a part-time job at your main job;

- Change your job to a higher paying one;

- Replenish your sources of passive income by increasing your capital.

Many people are thinking about how to increase their income, but only a small part of them are ready to make some changes in their lives. And without changes, increasing the income of the family budget is much more difficult, almost impossible.

If you're looking to increase your income, you can't choose stability over change. With stability, you will have consistently low incomes that do not suit you. There is no need to be afraid to talk to your boss about increasing your salary and if you are unable to look for a new job.

Optimize costs

I smoothly move from saving to optimizing expenses. This is a more acceptable method of increasing the balance on your personal balance. Although also not ideal. Its essence is to eliminate unnecessary costs.

To do this, carefully analyze all your expenses. Think about what purchases you can give up in order to reduce your overall spending.

Note!

Of course, don’t take things to the point of absurdity, don’t deny yourself little pleasures. For example, in a daily cup of coffee in your favorite cafe. By the way, here is another reason why I prefer to look for ways to generate additional income rather than optimize expenses - I don’t want to limit myself in anything, but, on the contrary, I prefer to get more and more from life.

Cost optimization implies the redistribution of financial flows and makes it possible to avoid unnecessary, unplanned expenses.

By the way, there are several methods to reduce costs:

- when going to the supermarket, make a list of only what you need and do not buy anything unnecessary;

- keep an eye on promotions in stores - they even allow you to buy products with a discount of up to 30%;

- review mobile tariffs - perhaps there is a more economical tariff;

- If you are used to driving a personal car, plan your route carefully, avoiding detours and getting stuck in traffic jams.

These are just a few cost optimization methods. There are others too. If you wish, you yourself can easily come up with additional ways to reduce expenses.

By the way!

And just like that, I smoothly move from saving and optimizing costs to how to really increase your own level of income by introducing additional methods of earning money.

Income diversification

And finally, the third area in which it is necessary to work is the diversification of family budget income. I have already partially described this direction in the second paragraph, but I specifically want to highlight it separately.

So, it is necessary not only to strive to ensure that income grows in quantitative and qualitative terms, but also to ensure that they are different (diversified).

That is, for example, if a person works as an accountant for 10 entrepreneurs, he has an excellent number of sources of income (as many as 10!), but they are not diversified. This means that if another unpleasant change in tax legislation is suddenly adopted, all these entrepreneurs (or the majority of them) will close their activities due to unprofitability, and our accountant will lose all of his large number of sources of income at the same time.

Therefore, while expanding the number of sources of income, it is necessary to try to diversify these incomes as much as possible. For example, work your day job as an accountant, write articles to sell online in the evenings, and work as a wedding photographer on weekends.

This concerns the diversification of active income. In addition, when thinking about how to increase the income of the family budget, it is necessary to develop towards passive income.

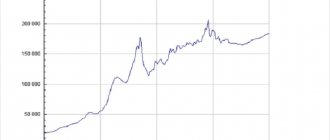

The presence of passive income in the family will also serve as an example of income diversification, which will have a beneficial effect on strengthening the family budget. And if the sources of passive income are also diversified (as they should be), even more so. You can read more about this topic in the publication How to increase income?, which also contains a visual illustration demonstrating the difference between the growth of a person’s active and passive income.

The more diversified the income of the family budget is, the stronger the family budget will be. Don’t forget that to effectively strengthen a family’s financial condition, you need not only active income, but also passive income.

When thinking about how to increase the income of the family budget, it is necessary to simultaneously move in each of the three above directions so that the increase in income occurs as efficiently and significantly as possible.

Own podcast

You can increase your income through your own podcast and share personal thoughts and observations with listeners on air.

To start this type of activity you need:

- decide on the topics of the programs;

- listen to several podcasts of successful presenters;

- analyze them to understand what exactly brought them success;

- think about how exactly you can attract listeners and what useful things you can provide them;

- and similar questions.

That is, after conducting a full analysis, you will be able to understand what and how to do to make money.

Advice!

After several successful posts, after you have gathered your audience, you can safely invite guests, authorities on your topic. It will also be beneficial for them to participate in recording programs, since they will be heard by a large number of people. But you will be able to invite guests only if you have really gained a wide audience of listeners.

As popularity increases, so will your earning potential. For example, you will be able to attract advertisers.

Quantitative increase in income

Even more important, in my opinion, is the quantitative increase in income, that is, an increase in the number of sources of cash income. For example, only one family member works in a family, and if the second one also starts earning money, the income of the family budget will increase.

To do this, it is not necessary to get a job in the traditional sense. You can, for example, find a job on the Internet that allows you to earn money in your free time. Even if the income is small, it will increase the income of the family budget in quantitative terms, which is very important.

But you shouldn’t stop there either. The more sources of income there are in the family, the better, since this, on the one hand, will increase income, and on the other, will make the family budget more durable. After all, if one of the sources of income is lost, this will not affect the general state of family finances as much as if it were the only one.

You can increase the amount of family budget income in the following ways:

Who wants the book '7 professions for making quick money online'?

Meet the book that will destroy stereotypes and tell you where to start! Get the book right now and find out how to make your life brighter in the coming days! Get.

- Find additional work;

- Find a job online;

- Get involved in network marketing;

- Try to make money from a hobby;

- Create different sources of passive income.

The more sources of income there are for the family budget, the better. A quantitative increase in sources of income will not only increase the income of the family budget, but also make it more resistant to various types of shocks.

How to increase income: invest

If you're looking for a way to increase your income passively, consider investing your personal savings. After all, you have probably heard more than once that money should work. Investing is a good way to keep them working.

When you buy shares of successful companies, you will receive dividend checks once a year. You won't have to do anything else. The main thing is to invest your money correctly. Income can be significantly increased if you choose companies that have shares with high dividends. For example, these include:

- IBM;

- Coca-Cola;

- and etc.

Although, of course, they are quite expensive. And initially you will have to invest in their purchase.

Advice!

One of the best investment options is to create your own online store. It will generate income in the first month after its creation and will pay off within 2-3 months. It all depends on the product you will be selling. If you already have an idea for a store, then sign up for my course on creating an online store from scratch. I will show you the whole path from creating a store to first sales.

Method #6: Invest

Investments will help you significantly increase your income. There are many great companies listed on the stock market. Promising stocks can bring you a significant portion of your profits and dividends.

It makes sense to consider other exchange-traded products. Such as ETFs and bonds. To avoid getting burned, invest your money for the long term, diversify your portfolio and read financial statements before buying shares of a particular company.

You can increase your income by creating a free room

If you live in a large apartment or house and have extra free space, why not turn it into money? Regardless of what city you live in, there is always the opportunity to make money from travelers by renting out a room to them.

By the way!

An interesting fact is that if a room is rented out for no more than two weeks a year, then it turns out there is no need to register income and pay taxes on it.

To do this, you should advertise on the relevant services. One of the most popular services is Airbnb:

- register;

- upload photos of the room;

- describe the living conditions;

- set the cost.

Detailed instructions on how to submit your ads are described on the service itself.

Creating sources of passive income

Creating passive income is the surest and most correct way to increase income, which does not require constant physical and time expenditure. And you will receive income regularly. There are many sources of passive income, for example:

Investments

One main and profitable source of passive income. Moreover, thanks to the World Wide Web, it is now available to everyone. Moreover, you don’t have to have millions to start investing. There is only one “but”. Investments require increasing your level of financial literacy. Moreover, independently, since this is not taught either at the institute or at school.

Creation of a creative/intellectual product

If you have talent in any field, and you are ready to spend your time and energy on creating some unique product (book, invention, computer program, etc.), then this product (if it is popular) will start bring you a constant income.

Renting out your own property

If you have property, or you are able to purchase it, then you can rent it out and receive income from it. The role of property can be real estate (apartment, garage, cottage, etc.), as well as transport or some equipment.

Receiving due payments from the state

Certain categories of citizens have the right to receive state benefits: pensioners, disabled people, large families, etc. But not everyone who is eligible receives them, and only because they are not familiar with the legislation. So don’t be lazy, find out your rights, and demand it. What is yours by right.

Network marketing

Oddly enough, MLM can also generate passive income. The main thing here is not to run into a financial pyramid (they are very similar), and to constantly learn and develop your own marketing knowledge. If you manage to build a good internal structure, then it can bring you a very good regular income.

Own business

In other words, building your own system that will bring you income from the efforts of 100 people, and not from 100% of your own efforts. By spending several years developing your own business, you will provide yourself with constant passive income for many years.

Website or blog

A person can create his own blog or website. But creating a website takes time. Although, you are not doing this in vain. After all, in 1-2 months it will generate income. Income from a personal website comes 9-12 months after its implementation. But remember that for the first 1-2 months you need to devote at least 2-3 hours a day to your own website.

Know your real worth

Regardless of how you work - you run a personal business or work for someone else - but in any case you get money. You can increase your income by asking for more money for your services.

Think about the last time your salary was raised, when the last time you raised the price of your services.

If you decide you deserve more money, you probably do. So don't be shy!

Opening your own business is a quick way to increase your money

Having a certain amount of your own funds, you should seriously think about opening your own business. To do this, first of all, you will need a well-thought-out business plan, which anyone can draw up, approaching the matter with great responsibility. When drawing up a business plan, rely only on yourself, your strengths, and financial capabilities.

In order to choose the right direction, analyze all possible market niches, what is the demand and what is the supply. If you have identified what is missing in the market, make sure that you can provide it to the consumer in a quality that no one else can. One head is good, but two are better, so you should seek advice from people more experienced in this area.

Choosing an idea for starting your own business is the most difficult question. But the most important aspect in this matter is not to choose what you are not familiar with and what you do not know how to do. Even if an area unknown to you is quite profitable, taking it as a basis is a big mistake. Work with what you know, and even better, with what you like. No one can guarantee that your business will immediately be highly profitable and successful, but if you competently delegate and invest all your knowledge in the development of your own business, success will definitely await you.

From personal experience. Two people, identical in terms of their level of business development, simultaneously start a business selling draft beer in a small town. One of them was looking for premises with lower rent in order to cover as many retail outlets in the city as possible, while the other did not chase quantity and placed only one retail outlet, but in the busiest place in the city, sparing no money on renting the premises, since calculated his benefit from the investment.

As a result of this competitive struggle, a person who opened only one point allowed himself to open two more points in no less busy areas of the city the next month, and a person who opened several points at once on the outskirts of the city had to close them and end with this type of business forever .

This example of the wrong approach to doing business is one of many, so even here there are risks, which only self-education and self-development will help you avoid.

Learn and develop

Even if you have been working in your field for many years and are a true professional, this is not a reason to relax and lower your demands on yourself. Be sure to study, improve your skills and abilities, improve your qualifications. If you don’t do this, you will quickly be overtaken and your income level will not only remain the same, but will also decrease.

Therefore, in order to be able to offer your clients something new, perfect, and get more money, be sure to study.

Choice: become richer or start saving

According to statistics, most of the population suffers from a problem with the general formulation “Not enough funds.” It can be viewed from the perspective of “expenses exceed income.” Then the person begins to think that it is better to cut expenses, and thinks about where to save an extra penny. If you rely solely on savings, then this is a failed approach, not only unable to lead to financial independence, but also leading to a decline in the quality of life. Desires cease to play a primary role and are limited to a minimum, with an eye to needs. There should be savings, but they should be reasonable, not total.

It is better to approach the problem from the other side - “Income does not reach expenses.” It would seem that the difference in wording is small. But here the desire to increase profits, and not to personal restrictions, is realized. A person is looking for additional sources of income to fulfill his own desires. He who seeks will always find, and most importantly, you will begin to notice opportunities flowing by. Thus, you can understand how to increase your income.

You already understand how to increase your income. Now about what to do with the money

You understand that income can be increased in several ways. However, it is necessary not only to be able to earn money, but also to properly manage the profit received. There are three options for the development of events:

- save all the money you earn and live in the same spending regime;

- spend all the money received immediately;

- Set aside some of the money and spend some of it to improve your quality of life.

The third option is ideal. It is best to put 50% into a bank account, and spend another 50% on yourself, on your family, on travel. Depending on your requirements, capabilities, preferences.

By the way!

A girl or woman should first spend her extra income on herself, on cosmetics, at a beauty salon, etc.

In addition, it is recommended to donate at least 10% to charity. Be generous and don't be stingy.

Provide special assistance to your parents. They deserve your help. Besides, there is nothing more pleasant than making surprises for loved ones.

In your spending, also provide a certain percentage for your own development, training, improving your qualifications, and acquiring new knowledge. This money will definitely return to you a hundredfold - after all, the higher the level of knowledge, the more experience a person has, the more he can do, the more he can earn!

Prohibition of being rich

Money is one of the most difficult and taboo topics. It evokes a lot of feelings and emotions, which is why it can be so difficult to answer the question: “How much do you earn?” Someone else's wealth causes a feeling of envy.

Psychologists even coined the term “money stress effect.” It describes the emotional overload of people's attitudes towards finances and the relationships between people in situations involving money. Often, family upbringing, cultural or religious dogmas, and experience are to blame for financial troubles.

Some experts recommend performing the following exercises to determine your personal attitude towards finance:

- Identify and write down all personal negative thoughts about money and wealth in general. These should be the first judgments that come to mind.

- Then identify the same judgments, but made on behalf of parents, friends, acquaintances and relatives.

- Now they are the same, but from the lips of those around you during your youth.

- Compare lists.

There is a high probability that opinions will converge. There are many similar attitudes at the subconscious level, and we need to fight them. You should not be afraid of wealth, but direct your efforts to increase your own profits.

Natalya Chukhrova, coach, says: “You should always start with a goal. In coaching, there are a number of questions that help you understand the topic of income:

- How much do I want to receive per month, per year, over five years? Look carefully, are you concentrating on one number, or are you planning for some growth? If the number is stable, then perhaps you don’t believe that income can grow over time or you don’t understand how to do it. Set a goal. Look how realistic it is? Are you ambitious? Find some balance. And don’t be afraid to set big goals, they are harder to miss.

- Why is it important for me to have this particular amount? This question will help you increase your motivation to increase your income. After all, the answer to the question “why” often becomes the driver for the question “how”.

- What do I have now? This will show starting point A.

- How can I do this? Tell yourself in detail about your skills, habits and abilities that help you have a current income.

- What am I best at?

- How can I use this? What are the next steps? Everything is simple here - we outline an action plan.”

Ways to increase income

Ways to increase your income can be different, have different directions and require different efforts. However, listen to each of them.

Money to increase income: to summarize

I have given you 10 simple, proven and effective ways to increase your own income. They are attractive because they can be used in parallel with your main activity.

Among the listed methods, the best, in my opinion, is to create your own website. By actively working on its development for several months, you will be able to receive a real solid income that will allow you to feel great and travel, live for your pleasure.

How to make your own website if you have no experience, skills and abilities in programming, design and SEO promotion? It’s very simple – sign up for my author’s training. On it you will not only create your website, but you will understand how to properly maintain it, develop it, promote it and attract users. The training lasts only four days, and it is based on practical tasks. If something doesn’t work out for you, the technical support group will help you solve any problems that arise.

I repeat, in my opinion, this is the best way to increase income. After all, it gives you the opportunity to earn passive income. What could be better?

With these specially selected 50 tips on how to increase your income, you can easily solve all your financial difficulties.

Hundreds of thousands of people have already tested the effectiveness of these tips – now it’s your turn!

Just start acting in this direction right now and remember that “water does not flow under a lying stone.”

Section “Saving means earning”

1. Save 10 percent of every income you earn

Spend less than you earn - this is the basic principle of financial well-being!

2. Don't save money!

Savings don't work. Instead, optimize your expenses. Think about how you can buy everything you need at a more reasonable price. For example, shop at small wholesale stores rather than at retail stores near your home.

3. Don't go hungry to the store to buy food.

It’s proven that you buy a lot of extra stuff. Buy only what you really need

4. Before going to the store, make a shopping list

Plan your purchases by making a written list in advance. Not so as not to forget to buy something, but so as not to buy too much

5. Pay in cash in stores

Numerous studies convincingly prove that using bank cards leads to more expensive purchases. It is much easier for us to part with invisible money from a bank card than with real banknotes

6. Look for analogues

Buy less popular brands instead of well-known brands. With comparable quality of the product itself, the difference in price between the brand and its analogue is very significant.

7. Don't get carried away with discounts

Promotions, sales and discount flyers are not a reason to make a purchase! Beware of sellers' advertising traps. They care not about your wallet, but about increasing their sales

8. Study the market

Once every few years, switch to newer and more economical tariffs (mobile communications, Internet access, access to pay television, etc.)

9. Do I need it?

Before you pay for your purchase, ask yourself, “Do I really need this?”

Too many people spend money they haven't earned to buy things they don't need to surprise people they don't like. Will Smith

10. Shop out of season

Buy summer items in winter and winter items in summer. This way you will save a lot of money from your family budget

11. Have cash ready in advance

Have you decided to withdraw money from your card at an ATM of someone else’s bank? Be prepared to lose money - you will pay increased interest for this service

12. Exchange things

Borrow from your friends (or rent) things that you will only need once in your life. Don't waste your money on this! Why fill your garage (balcony, closet) with unnecessary things.

13. Prevention is much cheaper than cure

Any doctor will confirm to you that preventing disease is not only easier than treating an advanced disease itself, but also much cheaper! Yes, we don’t like (are afraid) to go to the dentist for examination. And it’s completely in vain - treatment of caries and other unpleasant things costs significant money.

14. Morning exercises in the fresh air

Daily morning exercise will help you maintain your health (and your money on medications). Exercise at home or in a nearby park. It is not at all necessary to sign up for an expensive fitness club or go to the gym

15. Barter instead of money

Pay for the purchase of something by barter (reciprocal services, etc.). Give money last. Exchange things and services. This good habit will significantly strengthen your family budget.

16. Bargain!

Always ask for discounts. In half the cases they will easily give them to you. Remember that money is a part of your life that you spent to earn it. Respect the results of your work

17. Get rid of expensive loans

If you have accumulated a large number of different loans, quickly pay off the one with the highest interest rate first. Once you close it, get rid of the next loan with the highest rate, and so on.

A bank is a place where they will give you a loan if you can prove that you don't need it. Bob Hope

18. Set goals

Remind yourself of your financial goals often, especially when making regular purchases in stores - “I need to pay off a loan,” “I need to do home renovations,” etc.

19. Advertising is the engine of trade

Watch (read) less advertising. It uses professional techniques to manipulate a person’s consciousness, forcing him to buy things he doesn’t need.

20. Save energy

Turn off lights and electrical appliances when you don't need them. Use energy-saving modes on your home appliances

21. Compare prices

Before making a purchase, look at prices online for this product in different stores in your city. There are many sites that provide this opportunity.

22. Save your money

According to statistics, a salary instantly disappears in the first 2-3 days after receiving it. Don't rush to spend money.

23. Save your money

Place the money saved by the methods described above into a special savings account in a bank (deposit). Over the course of a year, a quite tangible amount accumulates, which can be invested in a business, used to replenish the “financial cushion” or make new investments.

24. Pamper yourself

Allow yourself to make pleasant expenses, because we only live once. Allocate 10% of your income to the “pleasure and entertainment” item

Section “Multiple Sources of Income”

25. Become a professional in your field

Improve your professional level in your field of activity. Professionals are paid top dollar. There are few professionals and they are always worth their weight in gold

26. Climb the career ladder

Don't stand in one place. Plan your career growth . Be prepared to change your job and region of residence

27. Sell yourself dearly

Master self-presentation skills, learn how to sell. And then you are guaranteed an increase in income. Money comes to us through other people. Learn to communicate and negotiate correctly

28. New sources of income

To become a financially secure person, it is not enough just to “work somewhere.” Look for additional sources of income , develop your ability to earn money. Strive to work not more, but more efficiently and productively.

Read my book “7 Steps to Financial Freedom” - look for it on ozon.ru or in bookstores in your city

29. Income from the Internet

Learn to make money on the Internet. Sell unwanted items through free message boards. Register on the freelance exchange. Explore affiliate programs

30. Sell your skills

Think about what you can do well (optionally, tutoring, massage, sewing, repairs, etc.). Sell it . Do it again and again. Put it on stream, hire employees.

31. Look everywhere for opportunities to increase your income.

Try to take advantage of every opportunity. Learn to see them. Develop the skill of being in the right place at the right time.

Section "Family Budget"

32. Accounting for your income and expenses

Record all income and expenses of your family budget every day. This will help you start to feel the movement of your money. Experience has shown that keeping records can reduce up to 30 percent of your standard monthly expenses.

33. Finance in one hand

Gather a family council and choose one person responsible for managing your family finances.

34. Live within your means

Learn to do without excesses, “interest-free loans” and “installment plans”, because it is at their expense that bankers get rich. Remember: you take other people’s money for a while, but you give yours forever

35. Friends or duty?

Don't lend money - you'll lose friends. Tested many times. Better to just give them some money (without having to give it back to you)

36. Increase financial literacy for all members of your family

More materials on the topic of money await you on the educational portal “ABC of Money”. Pay attention to the “Books” tab - there is an excellent selection of books on personal finance, investing and creating new sources of income

37. Drones must work

Stop indulging the able-bodied adult slackers in your family. Their requests should be reduced to “to eat.” Smoking, alcohol and other excesses are not supported. This will motivate them to find a job faster.

38. All the best goes to children!

The best gift for your children will be your own financial independence in old age and not having to support you. Be an example of good money management and your children will learn this from you.

Section "Investments"

39. Invest in yourself

In any case, knowledge will pay off handsomely

40. Start small

Open a deposit in a bank and regularly replenish it with amounts that are comfortable for you. Develop the habit of saving and saving your money. Don't wait until you make millions. You need to start now, even with minimal amounts!

41. Invest in stocks

Start with index mutual funds (mutual investment funds). If you invest small amounts of money in an index fund over 10 years, you will be better off than those who invest the entire amount.

42. Invest in precious metals

Open a compulsory medical insurance (an impersonal metal account). Remember that it is very easy to get burned by daily fluctuations in the value of metals (stocks, currencies, commodities). Therefore, aim for long-term investments

43. Invest in your future

Think about retirement, education for your child and other long-term goals. Remember John Rockefeller’s rule - “1 dollar saved and invested today will bring 5 dollars of net profit tomorrow.”

44. Beware of scammers!

Stay away from financial pyramids and scams. Stay away from those who offer you huge returns, high interest rates and quick ways to get fabulously rich.

October is the most dangerous month to play on the stock exchange. The same months are July, January, September, April, November, May, March, June, December, August and February. Mark Twain

Section "New Thinking"

45. Ask yourself the right questions

“Who do I need to become?”, “What kind of person do I need to become so that I can earn more?”, “What do I need to change in my head?”, “What do I need to learn so that I can get everything I want? » - ask yourself these questions more often and your life will change in amazing ways

46. Honest or rich?

Get rid of financial cockroaches in your head - like “money is evil”, “you can’t earn big money honestly”, etc. Such internal beliefs greatly prevent you from increasing your income, because your subconscious blocks all your good intentions.

47. Prioritize

Engage in activities that bring you the most income. There are important things, and there are urgent things. Learn to distinguish between them. Don't let the daily grind distract you from implementing good ideas

48. New habits

Get into the habit of spending money only after you have earned it. Spending based on future income will play a cruel joke on you

49. Think or do?

Think less and do more! Get used to making decisions quickly and remember - “only those who do nothing make no mistakes”

50. Praise yourself

Write down your successes and victories every day. This increases your self-confidence, and high self-esteem is an excellent foundation for your financial well-being

51. Make stops

Rest more, restore strength and energy. Chronic fatigue is the scourge of our time. Set aside 10% of your income for fun. You only live once!

52. Develop willpower

Limit thoughtless spending of money. Our desires will always outstrip our capabilities. Our expenses are growing along with our income. Replenish your emergency fund every time your income increases (or when you receive unplanned income)

53. Team

Find like-minded people who share your values and desire to increase your income. And then mutual support and exchange of experience are guaranteed to you

Even if you are very talented and put in a lot of effort, some results just take time: you won't get a baby in a month even if you get nine women pregnant. Warren Buffett 54. A marathon, not a hundred meters

Develop strategic thinking (like chess). Calculate your steps ahead. This will greatly speed up your movement towards a prosperous life, because... you will stop wandering in the dark

55. Affirmations

Program your subconscious. Learn to focus on the good. For example, you are walking down the street and a car splashes you with water from a puddle. Tell yourself: “This is for money.” If you find yourself in an unpleasant situation or make an unfortunate mistake, tell yourself: “This is for money.”

56. Mistakes are good!

Learn from your financial mistakes. Don't let them block your path to your financial freedom.

57. Go beyond

Every now and then, leave your comfort zone and do something you're afraid of. Alternatively, implement at least some of these tips

And finally

Constantly study the topic of money! Remind yourself often of the famous saying: “ If I’m so smart, then why am I so poor?”

Each person chooses for himself whether to be rich or poor. What do you choose?

I wish you financial prosperity!

Alexander Evstegneev

P.S. _

Pay attention to the “Books” tab - there is an excellent selection of books on personal finance, investments and earnings

Saving

Life from paycheck to paycheck is not at all enjoyable and constrains the actions of most families.

A limited budget affects the quality of life, the ability to realize ideas, travel, eat well and look after your health. Often the thought arises of increasing your income so that life takes on completely new colors and brings pleasure.

But earning income is not always associated with the implementation of new projects and the emergence of additional income. You can increase your income by reviewing your expenses, and no matter how strange it may sound, the method is the simplest and most effective. Most readers immediately perceive this method with hostility, since it implies the renunciation of some benefits. It begins to seem that the transition to money saving mode is associated with a general decrease in the quality of life, but this is not entirely true.

To understand what you can actually save on, you need to follow simple rules:

- After receiving your salary, record the amount in a special financial notebook;

- Throughout the month, record your expenses in a notebook or a special mobile application. You can also deposit receipts from stores, cafes, salons and other places where the funds were spent;

- Before the start of a new month, it is worth writing in advance a list of what you should buy, let's call them essential purchases;

- After a month of tracking expenses, look at how much money is left in the family budget.

By making simple calculations, you can objectively understand where most of the money goes, whether you are spending your budget rationally, and whether there are any imbalances in income and expenses.

For example, looking at the notebook of family income and expenses, you can see that the bulk of the money is spent on food, and in general there is no money left for cultural recreation and leisure. Or, on the contrary, you spend a lot of money on entertainment venues, which creates a huge hole in the family budget.

The method allows you to track the movement of money and identify the most problematic issues. During the shopping process, we may not realize that some of the purchased items are simply useless, and some are more expensive than their cost.

In addition, saving helps to increase income at the first stage; then you can use other techniques, but you should not forget about the habit of counting expenses. History knows many examples from the lives of the richest people on the planet who treated spending wisely and respected every dollar earned, not wanting to say goodbye to capital because of trifling whims.

Investments in real estate, one of the ways to increase your capital

If you have an impressive amount in your savings, then the most reliable investment would be buying real estate. In terms of its profitability, investing in real estate can only be compared with the purchase of precious metals.

Real estate will always be in price and always in high demand. Real estate prices mostly rise and rarely stay the same. Therefore, there is practically no risk of losing your money.

It is very profitable to invest money in shared construction; in this case, the cost of an apartment will be one and a half times lower than the cost of finished housing.

After purchasing real estate, questions will arise about utility costs and payment of property taxes. In this case, it is worth considering your apartment as a permanent source of income. Renting out residential premises is a fairly profitable business that covers not only the costs of housing and communal services, but also brings a stable income to the owner’s pocket.

If you do not have enough free time, then rent out the apartment for a long time, to permanent tenants, but if you have enough time, then a more profitable type of rental housing is daily. Daily housing is rented by employees who are sent on a business trip to your city.

When choosing where to stay: in a hotel or rent an apartment, there is no doubt that the renter will choose the apartment. After all, the price of a room per night in a hotel is much more expensive than in an apartment, and the quality of the services provided leaves much to be desired.

In order to choose your apartment, take care of good advertising in advance, using free platforms for posting ads on the Internet.

How to get the most out of your investment

In order for your money to work to the maximum with the highest efficiency, you need to combine them and use different investment tools.

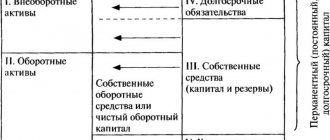

So that all your goals do not remain just dreams, the first thing you should start with is to draw up a Personal Financial Plan*

Personal Financial Plan is a strategy for managing your personal finances, including the selection of optimal investment instruments, their quantity and investment timing.

A financial plan also includes properly managing your expenses and optimizing your income.

You can draw up such a plan either independently or by contacting a specialist on these issues, which will naturally be more effective.

And the first thing you should start with after drawing up such a plan is to insure your financial risks in case of disability.

American billionaire and human development coach Brian Tracy argues that our main asset in terms of earning money is our ability to earn that money.

And the first method will be devoted specifically to this topic.

Where to spend extra money

The funds received can be:

- save and spend them as before;

- spend in an instant;

- set aside part of the money and spend the rest on improving your quality of life.

But experts recommend setting aside 50% of the funds received and spending the remaining 50% on personal needs.

For example, you can spend them on yourself, your family, or travel. Experts also recommend donating 10% of profits to charitable organizations.

Remember: women should spend additional money on themselves . They can buy cosmetics and visit a beauty salon.

- In addition, do not forget about your parents, who also need financial assistance.

- Don't forget about your own development. It is also advisable to set aside funds for it. Moreover, it is not worth saving on yourself, because... The money you spend on yourself will definitely come back.

- In addition, there are additional earning options that do not require large investments.

For example, a person can earn:

- in your deposit account . He can deposit a large sum of money in the bank and receive decent interest on it. Moreover, you can place your salary in a savings account and also receive interest from it. Payments can be made from a credit card and no interest will be paid for using borrowed money. Now, using a savings account, a client can receive from 6 to 8% of net profit. The main thing is that the payer sets a limit on the card that does not exceed his expenses, and a reminder about the payment deadlines. The client can also set up “Autopayment” on a credit card. This way, he won’t even need to remember about the due date of the payment every month.

- On cashback . The client only needs to pay for purchases with a card and receive a decent cashback from each purchase. Currently, the cashback amount varies from 1 to 10%. But the client himself can choose the card that suits him.

Individual investment account

Individual investment accounts (IIA) were introduced in 2015 as a tool to attract Russians to long-term investment in securities. You must deposit money into it in rubles, but not more than a million “On Amendments to Articles 10.2-1 and 20 of the Federal Law on the Securities Market” dated June 18, 2017 N 123-FZ per year, and you can invest in shares and bonds.

Everything is clear with them, but IIS allows you to receive income, even if you simply store money on it without moving. You can apply for a tax deduction of up to 52 thousand rubles annually.

Terms of profit: from three years; If you withdraw the money earlier, the tax deduction will have to be returned.

Risks: higher than that of a deposit, with a fairly low return, since the investment account is not insured by the Deposit Insurance Agency.

Purchasing real estate under construction

Investing in real estate has long been considered a reliable way to invest. Far-sighted people try to pay for housing even at the zero stage of construction. Because they understand how to double your money.

A house is usually built within 1.5 – 2 years. During this time, square meters have time to increase significantly in price, sometimes by 2-3 times. This circumstance allows you to get rich if, after putting the house into operation, the apartment is sold at an increased cost.

Of course, not every area with a house under construction is suitable for this method of investing and receiving excess profits.

But a competent approach to investing money will help identify the advantages in achieving your goal. Many factors will matter:

- reliability of the developer company;

- neighborhood infrastructure;

- remoteness from vital facilities;

- layout;

- project delivery deadlines