For what debts are they not allowed to go abroad?

In 2020, residents of the Russian Federation owed 14.9 trillion rubles – 22.8% more than in 2017. Because of these debts, the list of those banned from traveling sometimes grew to 5 million people .

Who is at risk of being included in this list:

▪ Those who owe more than 30 thousand rubles . These are debts for housing and communal services, taxes, fines, bank loans, court-ordered debts.

▪ If the amount of debt for alimony, compensation for harm in connection with the death of the breadwinner, as well as harm to health, moral harm, property damage is more than 10 thousand rubles .

▪ If the debts are not expressed in a specific amount, but are indicated in the writ of execution. For example, you need to demolish a building, reinstate an illegally dismissed employee, hand over a child, move in a debtor, or evict a debtor.

Another important nuance: debts add up . A few small amounts can grow into a huge snowball!

Who determines whether a person is restricted from traveling abroad or not?

It’s not enough to accumulate debt. In order for the debtor not to be released from the country, he must be declared prohibited from leaving the country .

This can only be done by a bailiff by court order. Grounds – Part 5 of Art. 15 Federal Law of August 15, 1996 N 114-FZ “On the procedure for leaving the Russian Federation and entering the Russian Federation”, paragraph 1 of Art. 67 and part 12 art. 30 Federal Law of October 2, 2007 N 229-FZ “On Enforcement Proceedings”.

Thus, neither the bank, nor the MFO (microfinance organization), nor the collectors themselves can prohibit you from going abroad because of debts. But they have the right to go to court if, for example, you are 6 months .

Important: they won’t let you go abroad not because you have a debt. But only if you avoid paying it off. But voluntary payment is usually given only up to 5 days .

Only bailiffs also lift restrictions. The border guards will not be able to do this, even if you show them all your payment receipts.

Contact the lender

Notification methods are not established by law, which means they must appear in the loan agreement. Banks in contracts use the wording “at the request of the debtor” and thus avoid the obligation to independently send SMS messages with warnings about upcoming payments. Legislation (Federal Law No. 353) states the following: the lender is obliged to provide the borrower with information about the amount and repayment period of the loan once a month free of charge.

The borrower can contact the lender himself and find out whether he has a debt in several ways:

- Call the bank's hotline number. Any major bank has a toll-free number starting with 8-800 and a call center. You can call the hotline both day and night, however, during the day the borrower risks spending a quarter of an hour waiting for an operator to respond.

- Come to the bank in person with your passport. This method is completely unsuitable for borrowers living in small towns, because there may not be a branch of the lending bank there.

- Use your Personal Account. Internet banking is offered by most large financial institutions, because the Personal Account online service allows you to “unload” call centers and minimize queues at bank branches. Sberbank-Online is considered one of the most effective and functional Internet banking systems.

- Use question and answer. When visiting the bank’s website, the user will see a pop-up widget for quick communication with the organization’s employees. Here you can apply for a loan, provided that the loan agreement number and full name of the borrower are indicated.

From claim to court: how to collect a debt against a receipt?

How to reduce loan debt?

How to find out debt from the Federal Bailiff Service

We look at the website of the Federal Bailiff Service

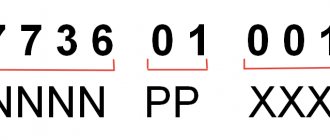

On the website of the Federal Bailiff Service (FSSP), go to the “Data Bank of Enforcement Proceedings”. Enter your full name (required) and date of birth in the form (so as not to dig into the records of namesakes). You can also search by production or document number.

In response, the system will issue all debts for which enforcement proceedings have been opened. You can pay them here.

You can also check for debt for anyone traveling with you. The data is open.

Judicial debts on the FSSP website: fssprus.ru

Is it possible to find out debt via the Internet?

As mentioned above, trying to find out someone else’s loan debt via the Internet can lead to big problems:

- such a request can be regarded as an attempt at fraud;

- sites offering such a service usually steal personal data of the DUL and cards in order to obtain online loans using false documents and write off other people’s money from accounts.

There are no legal and reliable services for obtaining information on someone else’s loan agreement. If the creditor has already gone to court and received a writ of execution, then information about such an unreliable borrower is necessarily displayed on the FSSP website.

We check at State Services

There is information here not only about court proceedings, but also about tax debts and fines for traffic violations. You can only check data about yourself.

Tax debts are checked on this page. To receive information, you will have to go through authorization and enter your TIN in the form that opens.

Here you can set up notifications to receive messages about debts when you log into the portal. The data is also shown in the mobile application (version for iOS, for Android).

Information about fines can be found here. In the form you need to enter data from your driver’s license and STS (vehicle registration certificate). If you saved them in your profile, the system will fill out the form automatically.

The site checks data on fines in the traffic police databases, as well as in the state payment system for Moscow and individual regions: these are Tatarstan, Udmurtia, Perm and Krasnoyarsk territories, Tver, Tyumen, Belgorod, Kaluga and Ryazan regions.

You can pay the fine immediately on the website or in the mobile application. Don’t delay: there is a 50% discount for the first 20 days from the moment the fine is imposed.

Legal debts are checked on this page. The site will also tell you whether there is enforcement proceedings and at what stage they are.

Services are free. You can find out about court debt immediately. The remaining data is provided within 17 working days . So it's worth checking in advance.

Debts and fines on State Services: gosuslugi.ru

How scammers use it

Sites that promise to provide confidential information about credit debts by last name are nothing more than a scam. At best, it is simply a matter of deception and collection of money for a service that cannot be provided. At worst, when accessing such a server, the client “leaks” his confidential data: DUL, cards, accounts, etc. In the future, fraudsters can apply for an online loan using forged copies of documents or write off money from the card.

In conclusion, I would like to emphasize that banks provide borrowers with many convenient ways to track the size of their current debt obligations. Credit history bureaus operate openly and promptly generate reports at the request of credit history subjects. It will not be possible to check the presence of debts on a loan from a stranger, since this is illegal. One can only make sure that there are no legal penalties on his property.

Find out if there are debts on utility bills

For this purpose there is a separate website based on State Services. Authorization by account on State Services.

The system for prosecuting debts for housing and communal services is as follows:

▪ From the 15th of the current month to the 3rd of the next month, submit instrument readings. Otherwise, they will be taken into account only in the next billing period.

▪ You must pay by the 10th day of the month following the end of the month, or according to the rules described in your apartment building management agreement.

▪ If you do not pay on time, a penalty . The first three months - for each day of delay. Then they can turn off the water, gas or electricity.

▪ If you still don’t pay, the management company has the right to go to court to collect the debt. Usually 6 months of delay is enough for this.

So don’t take late payments to extremes.

Debts for housing and communal services on State Services: dom.gosuslugi.ru

Let's go to your creditor bank

It happens that employees of banks and other credit institutions accidentally or intentionally do not close the loan, even if you have paid it off. It’s better to double-check this before your trip, even if you didn’t find any debts in the registries.

The easiest way is to go to your bank account and see if there are any debts.

Make a list of banks from which you could take out loans. Credit cards count too. Then take your passport to any branch of each bank.

There you will receive certificates about the absence or presence of debt.

How to find out loan debts by borrower's last name

Every citizen has the right to receive information about debts . This can be done either paid or free, depending on the chosen method. Below are the main ways to check your debts, which are available to everyone.

Find out loans by full name for free through the Federal Bailiff Service (FSSP)

The Bailiff Service is an open resource where you can get the necessary information for free. To do this you need:

- go to the website https://fssprus.ru/;

- go to the “Services” menu, then to “Data Bank”;

- select a region, indicate your full name and date of birth, click on the search button.

If there are debts, information on each type of encumbrance will be provided. Through the Bank of Enforcement Proceedings, you can check obligations for loans, fines, tax, insurance contributions, etc. The service is free and provided without restrictions on the number of checks.

Debt on loans from the Credit History Bureau

Loan debts by last name and other personal data can be found online by making a request to the Credit History Bureau. There are more than a dozen BKIs operating on the territory of the Russian Federation, and in each of them you can obtain the necessary information twice a year for free. In other cases, the service is paid, the cost depends on the organization to which the request is made.

To obtain information about your credit debts, you must first request information about the bank accounts in which the history is stored. To do this you need:

- go to the Central Bank website https://cbr.ru/ and go to the credit history section;

- click on the tab for obtaining information about the Bureau;

- select the status of the applicant (subject);

- note the presence of the subject code (it is assigned when you first apply for a loan, it can be found on contracts or requested from the bank);

- select the status of the subject (individual);

- fill out the form and send your request.

The response will be sent to the specified email in the form of a list of BKIs in which the applicant’s history is stored. Information about delays can be obtained by sending a request to any of them.

Find out debt through online services by last name

Another way to view information about payment problems is through online services. On the Internet you can find various companies that provide such information for a fee.

One of the popular ones is Service-KI. To find a debt, it is usually enough to indicate your full name, date of birth and email address to which the generated report will be sent.

Nuance. You can check your credit rating in this way only if your credit history is stored in the NBKI.

This way of obtaining information on debts is accessible and simple. It is better to request information on the official websites of financial organizations to eliminate the risk of personal information falling into the hands of fraudsters.

Find out debts to banks on loans by passport and card number

You can find out about the presence of debts to banks on loans by last name by contacting the financial institution directly. The service is free, you need to have your ID and card number with you.

Options for obtaining information:

- mobile application of your bank - you need to go to your personal account, to the loans section and view information about your current debt;

- any branch of a financial organization - you will need to show the employee an identification card and request a loan statement, which will contain data on the debt;

- ATM - you need to insert a credit card or attach the barcode of the credit agreement to the reader and see information about the current debt on the screen;

- hotline - tell the operator your details (full name, date of birth, account number, passport details). In many cases, you will additionally need the code word specified when registering the transaction.

You can obtain information on debts from the bank on the day you apply - the request is processed immediately after receipt.

We receive a statement from the credit history bureau

On the Central Bank website you can access the Central Catalog of Credit Histories (CCCH). It's easiest if you know your credit history subject code . It is created when drawing up a credit agreement or loan agreement.

You can do without a credit history subject code; there are many ways:

▪ Make a request at the Russian Post office. You need to take your passport with you. In your request, do not forget to have your signature certified by your telecom operator.

▪ Contact a credit institution. Our staff will help you make a similar request.

▪ Contact a credit bureau. In many of them, employees are authorized to accept such requests.

▪ Visit a notary. He has the right to certify your signature and request credit history information.

One request per year is free, each subsequent one is 200 rubles .

A response will be sent to your e-mail from the Central Control Commission. It will indicate which credit bureau stores your data. This is not the story itself!

Now contact your specific credit bureau, either in person or by mail.

Contact online credit history checking services

In addition to official resources - the Central Bank website or the EPGU State Services portal, information about the state of the borrower’s credit history is provided by numerous online services. Their number is constantly increasing, which clearly demonstrates the relevance of the problem under consideration.

Finding such online resources is not difficult - to do this, just enter the query “get a credit history” or something similar in meaning into the line of any search service. The program will find the most popular sites providing similar services. It is necessary to take into account that many of them charge a fee, regardless of the number and frequency of requests from a particular client.

It is important to note that to check current debt online, it is advisable to use the personal account of a microcredit company with which the person has already collaborated. Access to the Internet resource is provided to microfinance organizations without fail.

The only disadvantage of this method is the availability of information only about debts to a specific microfinance organization. On the other hand, it is not difficult to visit the websites of all microfinance organizations with which a particular individual has worked previously.