On what basis does the individual entrepreneur act in the contract?

An individual entrepreneur is an individual who is engaged in entrepreneurial activities without forming a legal entity (Clause 1, Article 23 of the Civil Code of the Russian Federation).

At the time of registration, an individual entrepreneur acquires certain rights and obligations, which he must exercise under his own name, which directly includes his first name, surname and patronymic (Clause 1 of Article 19 of the Civil Code of the Russian Federation). This means that an entrepreneur, when signing an agreement, must indicate in it information that he acts as an individual entrepreneur. The individual entrepreneur acts in the contract based on the fact that he is registered as an individual entrepreneur.

In the event that a transaction is concluded on behalf of an entrepreneur by his representative, the agreement indicates that the latter is acting on the basis of a power of attorney, and also provides its details. If the representative is officially employed as an employee of the entrepreneur (for example, as a director), you will need to indicate the details of the employment contract concluded with him.

Agreement with the director of the individual entrepreneur

The law allows you to transfer control over the work of an individual entrepreneur to a third party.

To do this, the entrepreneur has the right:

- Hire a director (under an employment contract).

- Write a power of attorney to transfer a number of powers.

An entrepreneur who independently performs all economic and managerial tasks does not act as a director. An individual entrepreneur can hire himself to work as a director, but the result will only be additional costs associated with increased contributions to state funds.

The director of the individual entrepreneur actually becomes a representative of his interests.

Responsibility for the work of the director lies with the individual entrepreneur who issued him the power of attorney. The exception is violations of the Criminal Code and other intentional crimes on the part of the director.

On the basis of what document does the individual entrepreneur act after registration?

A representative of a legal entity entering into an agreement provides a link to a document granting him the authority to carry out legally significant actions on behalf of the company. An individual entrepreneur acting independently does not have such documents. That is why novice entrepreneurs have a question: on what basis can an existing individual entrepreneur put his signature in an agreement.

When registering a citizen as an individual entrepreneur, a corresponding entry is made in the Unified State Register of Individual Entrepreneurs. In accordance with paragraph 3 of Art. 11 of the Law “On State...” of 08.08.2001 No. 129-FZ, the entrepreneur or his representative is issued a document confirming the fact of making a registration entry in the Unified State Register of Individual Entrepreneurs (the so-called extract). It contains the following information:

- details of the entrepreneur's passport;

- permanent registration address;

- selected OKVED codes.

Details of the extract from the Unified State Register of Individual Entrepreneurs are used as a means of individualizing individual entrepreneurs when concluding contracts.

Thus, an individual entrepreneur acting as a party to a civil contract can include in the text of the document a record of the following type: “Individual entrepreneur Full name, Unified State Register of Entry sheet issued name of the tax authority, date of issue in the format dd.mm.yyyy "

Until 2020, entrepreneurs were issued state registration certificates. These documents are still valid today, therefore, if such a certificate is available, the individual entrepreneur can include in the contract the following line: “Individual entrepreneur F.I.O., acting on the basis of a state registration certificate No. ... dated dd.mm.yyyy.”

In addition, the document should indicate the OGRNIP and TIN of the entrepreneur, passport details, residential address, and bank account details. As a rule, this data is indicated at the end of the document and is certified by the signature and seal (if any) of the entrepreneur.

An example of filling out a contract header

There are several options to register the individual entrepreneur represented in the contract:

- You can write “full name, individual entrepreneur, acting on the basis of” and then indicate the date of receipt of OGRNIP as confirmation of state registration. This allows you to display the basis of the entrepreneur’s activity and indicate its difference from an individual.

- In the preamble, you can indicate that such and such individual entrepreneur acts on his own behalf, since at the end of the document his details will be spelled out in full. True, not all counterparties will agree to accept this form.

- You can write after the businessman’s full name his OGRN. But this option may not be suitable for counterparties.

No one forbids leaving the line about the basis on which the individual entrepreneur works empty. Another option is not to include it in the contract. This will not affect the legality of the document in any way, but it is better to agree on such an issue with counterparties in advance.

Partners planning to enter into an agreement with an individual entrepreneur may require its checkpoint. This is the code for the reason for tax registration. Every businessman needs to know that such encoding is provided exclusively for legal entities and is assigned to them upon registration.

This code consists of nine digits. The first four are the code of the tax authority with which the organization is registered. The next two indicate the reason for accounting (for Russian companies they range from 1 to 50, for foreign companies - from 51 to 99). Then follow three numbers that show how many times the legal entity was registered for this reason.

An individual entrepreneur cannot have a checkpoint. But if the documentation requires you to indicate the encoding, a dash or 0 is added. In some papers, the corresponding field is simply left blank. Thus, in reporting for extra-budgetary funds or the Federal Tax Service, a dash is enough; in payment and banking papers, the field is not filled in.

Counterparties putting forward such demands can be reminded of the norms of Russian legislation. And some individual entrepreneurs compile checkpoints themselves from the region code, the tax office where they were registered, as well as the registration code for legal entities - 01001. However, this option is not applicable for official documentation.

It should be remembered that contracts must contain certain information. This applies to:

- A detailed description of the essence of the agreement.

- Payment procedure and amount.

- Responsibility of the parties for violation of obligations.

- Details of the parties.

There are no regulations establishing a clear form for concluding contracts for individual entrepreneurs. You can draw up agreements in your own way, if this does not violate the norms of the Civil Code.

Results

So, when concluding contracts, an individual entrepreneur, unlike a representative of a legal entity, acts on his own behalf, therefore, it is not necessary to draw up documents allowing him to represent the interests of his own business.

A power of attorney will have to be prepared only if a third party representing his interests acts on behalf of the individual entrepreneur. The individual entrepreneur does not have statutory documents, so their presence is not necessary to successfully conclude an agreement with the counterparty. The documents presented to the future partner do not have the status of statutory documents, but at the same time they confirm the right of the businessman to enter into contracts as an individual entrepreneur. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

If the individual entrepreneur hired a director

By law, any entrepreneur can hire a director and entrust him with part of his affairs. But in order for him to be able to conclude contracts and carry out other actions in the interests of the individual entrepreneur, it is necessary to draw up and notarize a general power of attorney.

The director, unlike the individual entrepreneur, must indicate in the contract on what basis he is acting . Example wording: “Director Khryakin Mikhail Zuevich, acting in the interests of an individual entrepreneur on the basis of power of attorney No. 777/77 dated 12/15/17...”.

Even if the director signs the agreement instead of a private entrepreneur, he does not bear any responsibility under it. The business entity itself will be responsible for unfulfilled obligations and other omissions.

There is something else you need to know: even if an entrepreneur works independently, he is not a director. An individual holding the position of director, even in his own company and for personal interests, must pay additional contributions to pension, medical and social insurance.

Constituent documents of an individual entrepreneur

As such, individual entrepreneurs do not have constituent documents, since only legal entities have them. There are a number of documents that are mistakenly considered constituent documents, although they can be called registration or corporate:

As already mentioned, the Certificate of assignment of OGRNIP (state registration as an individual entrepreneur) is not issued from January 1, 2020. OGRNIP can be found from the Record Sheet, or from the Unified State Register of Individual Entrepreneurs.

Technically, OGRNIP is a unique (at least it should be) 15-digit number containing the subject code, tax number, serial number and checksum.

The TIN can also be found from the Record Sheet, or from the Certificate, if the individual received the TIN before registration. This is a 13-digit number, similar in logic to OGRNIP.

Extract from the Unified State Register of Individual Entrepreneurs

At the moment, the practice is that only an extract from the Unified State Register of Individual Entrepreneurs is sufficient as a basis for confirming the activities of an individual entrepreneur. Or the Record Sheet, which is essentially the same thing.

In the same way, it is not a constituent document, but rather a legal document, like all those listed above.

Constituent documents of individual entrepreneurs

Each individual entrepreneur who complies with the law goes through the process of registration with the tax authorities. He registers as a tax payer and entrepreneur, and in confirmation he receives a number of documents, which in the future will be a guarantor of the legitimacy of his activities.

First of all, this is:

- TIN;

- Certificate of state registration and OGRNIP until 01/01/2017;

- A record sheet confirming the fact of entry into the Unified State Register of Individual Entrepreneurs after 01/01/2017;

- Extract from the Unified State Register of Individual Entrepreneurs.

In the legislation itself there is no such thing as “constituent documents of an individual entrepreneur.” The wording arose by analogy with other forms of enterprises (LLC and other legal entities).

In fact, the folder with the documents on which the individual entrepreneur operates is much thinner, and it is easier to understand it than in the situation with an LLC.

Unlike an LLC, an individual entrepreneur does not need a Charter, so it is not included in the list of its constituent documents.

TIN

Each Russian citizen (whether engaged in entrepreneurial activity or not) who pays taxes is assigned an Individual Tax Number. If some citizens who do not have an official job can still do without a TIN, then for an individual entrepreneur the assignment of a tax number is mandatory.

A TIN is assigned to each citizen once in his life. If at the time of registration of an individual entrepreneur the entrepreneur already had a tax number, it remains unchanged.

First of all, it is necessary for the tax service to monitor taxpayers. But this number is part of the individual entrepreneur’s details, so they are sometimes asked to include it in contracts and other documents.

TIN is 12 digits. The first two of them are the region code, the third and fourth are the code of the specific inspection that issued the certificate.

OGRNIP

The All-Russian State Registration Number of an Individual Entrepreneur is the main confirmation that the individual entrepreneur is officially registered and can carry out his activities. Each individual entrepreneur is entered into the state register, where OGRNIP is his personal number.

USRIP

This abbreviation stands for Unified State Register of Individual Entrepreneurs.

The individual entrepreneur receives an extract from this register, which indicates:

- Series, passport number, when and by whom it was issued;

- Place of residence;

- Business activity codes (OKVED).

Such a statement may be required, for example, by a bank when opening a current account. In this case, the requirement may contain the maximum permissible “age” of the extract. Usually it is allowed to provide an extract from the Unified State Register of Individual Entrepreneurs no older than one month.

If any changes occur in the activities of an individual entrepreneur, he is obliged to report this in order to make changes to the register data.

Certificate of state registration of individual entrepreneurs is a document confirming the entry of data about the entrepreneur into the Unified State Register of Individual Entrepreneurs.

From 01/01/2017, the above Certificate is no longer issued. Basis - Order of the Federal Tax Service No. ММВ-7-14 / [email protected] dated September 12, 2016. Now the document confirming the status of an individual entrepreneur is the Unified State Register of Individual Entrepreneurs (USRIP) Sheet in form No. P60009. It contains: full name of the individual entrepreneur, date of issue, name of the tax office, date of entry in the Unified State Register of Individual Entrepreneurs, OGRNIP number.

OGRNIP – main registration number of the individual entrepreneur.

Other IP documents

In addition to the above, the folder of personal documents of an individual entrepreneur contains:

- Certificate of registration with the Pension Fund of Russia;

- Confirmation of submission of information on activities to Rosstat;

- Operating licenses (if required);

- Current account number and bank details (if you have an account);

- Confirmation of registration with the Social Insurance Fund (if the individual entrepreneur has hired employees).

How to spell an individual entrepreneur correctly in a contract?

The legislation does not provide a clear answer regarding filling out the details of the party represented by the individual entrepreneur in the introductory part of the contract. It is permissible to write in one of the following ways if the second party to the transaction agrees with the wording:

- "... individual entrepreneur Olesya Yulievna Kazarova (TIN: 645324832730, OGRNIP No. 319645100037131 dated 04/29/19), referred to as the “Executor” ...";

- "... individual entrepreneur Kupreev Nikolay Viktorovich, acting on the basis of a certificate of state registration in the Unified State Register of Individual Entrepreneurs, series 54 No. 005155654 dated 10/07/2016 ..." (for individual entrepreneurs registered with the tax authority before 01/01/2017, indicate the document number and date );

- in the case when on behalf of the individual entrepreneur the contract is signed by his representative, for example, the director of the store, the wording “... and the Director of the store Radoslav Sergeevich Matyushkov, acting in the interests of the individual entrepreneur Grigory Dmitrievich Lapochkin on the basis of power of attorney No. ___________ dated October 20, 2020, referred to as “Executor” is written "..."

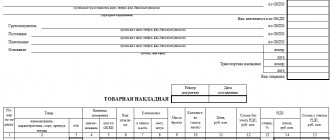

The agreement must include the following information about the individual entrepreneur, which must be contained in the details section:

- TIN;

- bank account details;

- exact registration address;

- OGRNIP registration number, registration date;

- personal signature;

- If there is a seal, its imprint is affixed.

In the absence of this data, the contract has no legal force.

It would be incorrect to use the full name of an individual without indicating that he is an individual entrepreneur.

Then the tax authority may consider the agreement as concluded with a citizen and oblige the other party to the agreement to calculate and pay personal income tax on the income paid, as well as pay a fine. Thus, a civil law contract can be reclassified as an employment contract.

Before drawing up a transaction agreement, it is recommended to check the individual entrepreneur for such status, i.e. registration with the tax authority. This can be done on the official website of the Federal Tax Service in the “Business risks: check yourself and your counterparty” service.

In the search request, you can specify the OGRNIP or full name of the entrepreneur and receive an extract. This information is open and publicly available. It confirms that the individual entrepreneur is indeed registered and has not been deregistered with the Federal Tax Service.

Many, especially novice lawyers, often fall into a kind of stupor when they find an individual entrepreneur in the “head” of the agreement instead of the usual “Romashka LLC” represented by the Director, full name, acting on the basis of the Charter.” And on what basis does the IP operate? There are also options with powers of attorney, which cause no less confusion, but what about individual entrepreneurs? Some people write “on the basis of the Charter” out of habit, others – as in the case of individuals. persons “on their own behalf”. The first is definitely wrong; individual entrepreneurs do not have a charter. The second is true, but partly, since an individual entrepreneur is not just an individual. He has the status of an individual entrepreneur. Although there is an opinion that it is enough to indicate “IP full name” in the header, without indicating the basis on which it acts.