What is an accounting certificate

In the process of accounting, situations often arise when the form of the primary document is not provided for a specific business transaction. At the same time, in order to reflect data in accounting, the availability of appropriate primary documentation is a prerequisite. A simple table or printed text is unlikely to be suitable for this.

Drawing up and signing a document

Business paper to reflect such transactions in accounting meets the following requirements:

- reflect specific details (number, date, title of the document, name of the legal entity (compiler of the business paper), full name and position of the employee who prepared the paper, signatures, stamps, etc.)

- clearly reflect the content of a business transaction

- the document does not contradict the law

In addition, the accountant periodically performs calculations to reflect certain data in the accounting records. This may include interest on loans, accounts receivable and payable, penalties for late payments, amount and exchange rate differences, etc.

Therefore, the concept of “Accounting certificate” was introduced, which is used for the purposes of both accounting and tax accounting. Thus, an accounting certificate is a type of primary document that serves as the basis for reflecting specific data in accounting.

For what purposes is an accounting certificate used?

Accounting statements are used to achieve two main purposes:

- Correction of errors and omissions in reporting (accounting or tax).

- Reflection of data in accounting.

Appendix to the report

At the same time, in order to make changes to the reporting, such business paper is sent to the regulatory authorities. In addition, such a document provides clarity in the event of deficiencies identified during the audit.

The certificate acquires no less importance as an internal document used by accountants. Each of the accountants or other authorized employees, if necessary, has the opportunity to determine on what basis this or that posting arose.

Instead of an accounting certificate, an organization has the opportunity to use independently developed document forms that reflect the same business transactions. However, it is advisable to use this method in cases where the same operation is periodic. Otherwise, it is easier to use an accounting certificate, since creating a form of a primary document (different from standard forms) requires labor and time.

In accounting, the certificate is used:

- in order to justify specific calculations

- to clarify or clarify data

- to document certain transactions

Sample certificate stating that the organization is a VAT payer

So, a certificate of application of OSNO is a document, the form and obligation to submit which are not regulated by law. This type of letter can be provided by both the taxpayer and the tax authority upon request. In addition to such a letter, a prudent taxpayer may need a large number of other documents to verify the reliability of the counterparty and confirm his own integrity.

This option is not suitable for everyone, since some organizations fundamentally insist on providing official documents from the Federal Tax Service. The presence of such a certificate is necessary for the organization so that in the future it will not have problems with VAT compensation from the budget. This document will serve as confirmation of the fact of preliminary verification of the counterparty at the request of the tax authorities.

What information is needed to prepare an accounting statement?

Like any primary document, an accounting statement reflects information about a transaction or events that have occurred that are reflected in accounting. In addition, it indicates the necessary details, the presence of which will allow the document to be recognized as valid:

- name (accounting statement-calculation, accounting statement)

- day, month and year of document creation

- full name of the legal entity or individual entrepreneur

- detailed description of the operation (composition and form depend on the purpose of using the certificate)

- units of measurement (if possible)

- information about the persons in the organization who are responsible for drawing up the certificate

- signatures

Letter on the applicable taxation system sample basis

The information letter will contain information that the taxpayer is on a simplified taxation system and has the right not to pay or charge VAT, and has also submitted declarations to the inspectorate under the simplified tax system for previous years. In what cases can land be used without providing it and establishing an easement? We talked about it here. Some categories of the population have the opportunity to receive land for individual housing construction for free.

It allows other organizations to verify whether they can accept VAT as a deduction after paying for goods and services. If you want to find out how to solve your particular problem, call the following numbers: Moscow, St. Petersburg. It is worth noting that it does not contain specific requirements for this certificate and, in general, does not assign the taxpayer an obligation to present it at anyone’s request.

Accounting certificate form

There is no developed and approved form of accounting certificate. Information on the procedure for drawing up such a document can be reflected in the accounting policy of the organization, and its form is developed and approved (accounting policy) individually within one legal entity. However, this condition is not mandatory, since there is an unlimited number of cases when it is necessary to draw up a certificate.

The certificate is issued to:

- organization letterhead

- plain A4 sheet

In this case, you can also draw up a business paper in two ways:

- manually

- on computer media, by printing and putting the appropriate signatures

With each method of drawing up a document, there is no need to have an imprint of the organization's seal.

The accounting certificate is prepared in the following sequence:

Certification of the certificate

- The name of the enterprise is indicated in the upper left corner (as with constituent documents).

- It is allowed to write a legal address and TIN.

- Then the date of drawing up the business paper is put (as a rule, the time coincides with the date when the error was identified or the transaction was completed).

- The situation that occurred is described, the amounts, the procedure for action and the reflection of data in accounting (the specific form depends on the situation).

- Information can be presented in tabular form.

- You can indicate which document the certificate explains or corrects.

- If necessary, accounting entries are recorded.

- If an error is made, indicate its reason.

- Where possible, amounts and quantitative measures are indicated.

- The names and positions of those responsible for drawing up the document are indicated, and signatures are collected.

- The document is certified by the chief accountant.

Some types of certificates must be registered in the internal registers of the organization (for example, a certificate to reflect the amount of VAT must be reflected in the purchase book or sales book).

Certificate about the general taxation system sample free download

A businessman who opens his own business or enterprise is required to choose a taxation system. The further development of the case largely depends on this. In this article we will touch on the topic of the general method of taxation (OSNO).

These are laws: And also the Tax Code, subp. 4 paragraph 1 of Article 32. In general, the 59th Federal Law regulates the consideration of applications to the tax authority.

The last option by which you can confirm your right to use the simplified tax system is a copy of the title page of the tax return under the simplified tax system with a mark on its acceptance by the tax inspectorate.

It is advisable to produce a standard form of this kind if there are a large number of counterparties. In practice, there are situations when, when making a transaction for a large amount or entering into a long-term relationship, the buyer asks the supplier to present a certificate of application of OSNO from the tax authority.

Important point Many entrepreneurs are interested in whether a certificate of taxation system is issued (sample OSNO)? It should be said that the legislation does not provide for such a document.

If for some reason the second copy of the notification has not been preserved, you can order an information letter from the inspectorate about the application of the simplified tax system for the counterparty using form No. 26.2-7: you must submit a free-form request to the Federal Tax Service Inspectorate at the place of registration of the company or individual entrepreneur. IMPORTANT! If there is agreement between the parties to the transaction not to draw up invoices, then they are not issued not only for sales transactions, but also when receiving advances (letter dated March 16, 2015 No. 03-07-09/13808). Consent to not issue an invoice can be formalized in the transaction agreement. If the contract has already been concluded without this condition, we recommend that you draw it up.

Is it possible to make corrections to the accounting certificate?

If an error is found in a completed accounting statement, but it is not possible to write or print a new document and collect the necessary signatures, it can be corrected. To do this, you need to follow some rules:

- first, incorrect data must be crossed out with ink with the greatest care

- then you need to write corrective information on top of the crossed out data

- Finally, the surname, initials and position of the employee who made the corrections are indicated, his signature and the date of the correction are placed

Corrections by accounting certificate

Making corrections to reporting or accounting data is one of the purposes of an accounting certificate. This type of document should be drawn up on the basis of a typical form, but taking into account some features.

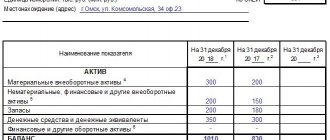

If corrections are made to accounting registers, it is necessary to indicate:

- Name, number and date of the document to which adjustments need to be made.

- The content of a business transaction is in strict accordance with the accounting register.

- The amount by which the data is changed (you can additionally indicate the amount reflected in the accounting).

- If appropriate, then indicate the data in physical terms (erroneous and new).

- The posting by which the correction is made (debit and credit account, if necessary, it is indicated that the correction is made using the “red reversal” method).

Sample accounting certificate

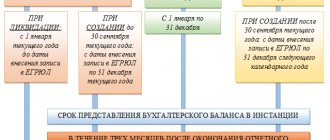

When correcting significant errors in reporting, it is important to rely on the fact whether the reporting has been submitted and approved:

- if the reporting period has not yet ended, then the correction must be made in the month in which the error was identified

- if the reporting period has ended, but the reports have not been approved, then the corrections are reflected in December of the reporting period

- when the reporting has passed all stages of verification and approval, corrections are made by the date the error was discovered using the retained earnings account

Tax reporting is corrected by submitting a new declaration, but the accounting certificate in this case is used as an internal or explanatory document.

Accounting certificate-calculation

In the process of activity, an accountant often has to make calculations that are not reflected in the accounting registers. For greater convenience and improved internal control, it is advisable to prepare accounting statements.

A calculation certificate may be needed in the following cases:

Necessary calculation of indicators

- If necessary, calculate the depreciation of an intangible asset or fixed asset.

- To calculate the book value of a fixed asset for its sale (in this way you can justify the sale price).

- To distribute VAT amounts.

- To distribute different types of costs.

- When calculating exchange rate or amount differences.

- To write off accounts receivable or payable for various reasons.

- To calculate vacation pay or wages.

- To process all kinds of transactions related to loans and borrowings.

- For profit distribution, etc.

When preparing such a certificate, it is best to describe all the details of the calculations. In this case, it is advisable to indicate information about documents that are directly related to calculations, and, if possible, refer to acts of legislation.

Certificate of write-off of the “creditor”

Overdue accounts payable, for which the time for filing a claim has passed, the enterprise is obliged to include in non-operating income. This is how clause 18 of Art. 250 Tax Code of the Russian Federation. Usually this is done during inventory and is accompanied by the preparation of an accounting certificate for writing off accounts payable. It should include:

- full information about the debt (contract number, links to the “primary”, etc.);

- calculation of the limitation period.

EXAMPLE At Guru LLC, on March 30, 2020, an inventory of settlements with counterparties was carried out, as a result of which an accounts payable to Septima LLC was identified in the amount of RUB 143,000. The statute of limitations on it expired on March 13, 2020.

Here is an example of how to write an accounting statement for this situation:

LLC "Guru" ACCOUNTING REPORT No. 24 DATED 03/30/2017 ON THE WRITTEN OF ACCOUNTS PAYABLE As a result of the inventory of settlements with counterparties on March 30, 2020, accounts payable to the limited liability company "Septima" were identified (TIN 7722123456, KPP 772201001, address : Moscow , Shosseynaya St., 7, building 9), for which the statute of limitations has expired (Act of Inventory of Settlements with Buyers, Suppliers, Other Debtors and Creditors dated March 30, 2020 No. 2-inv). This debt arose under the contract for the supply of goods dated April 25, 2014 No. 63-p. Clause 3.8 of the said agreement establishes the payment deadline - until March 15, 2014 (inclusive). The amount of debt for goods supplied is 145,000 rubles, including VAT - 26,100 rubles. The statute of limitations expires on March 13, 2020.

Thus, accounts payable in the amount of 145,000 rubles are subject to inclusion in non-operating income tax income for the first quarter of 2020 on the basis of paragraph 18 of Article 250 of the Tax Code of the Russian Federation and write-off in accounting. Chief accountant_____________Shirokova____________/E.A. Shirokova/

Remember: the accountant must correctly determine the statute of limitations, as this affects the result of calculating income tax. To avoid mistakes, refer to Articles 196, 200 and 203 of the Civil Code.

Explanatory certificate for reflecting business transactions

With the help of such business paper, you can clarify some business transactions or create a basis for reflecting any process in accounting. To do this, you must specify:

- base

- content

- accounting method

It is advisable to provide links to other documents.

Thus, the accounting certificate contains basic details and additional information, which it is advisable to describe in as much detail as possible.

Top

Write your question in the form below