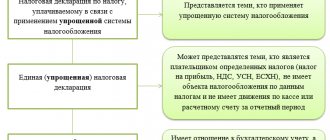

Simplified financial statements - balance sheet and income statement, which are located on one form and have an abbreviated form. The right to provide such reporting is granted to organizations classified as small businesses.

IMPORTANT!

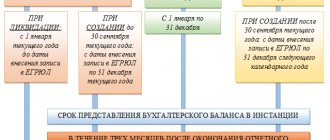

The due date has been postponed to 05/06/2020 - taking into account the postponement due to non-working days, letter of the Ministry of Finance No. 07-04-07/27289, Federal Tax Service No. ВД-4-1/ [email protected] dated 04/07/2020).

There are a number of features for preparing an annual report for small businesses. In particular, specifically for them, by order of the Ministry of Finance No. 66n, the KND form 0710096 was approved - simplified accounting statements. The timing and procedure for sending it to the bodies of Rosstat and the Federal Tax Service do not differ from those established for all other legal entities. The only privilege is a small form and no obligation to provide explanations. Let’s take a closer look at who submits simplified financial statements in this form and what exceptions exist.

Definition of small business

To begin with, let’s find out how this privilege provided for by Federal Law No. 402 of December 6, 2011 “On Accounting” is implemented, namely, we will understand who is considered to be representatives of small businesses. The criteria for classifying organizations and individual entrepreneurs into this category are specified in the current version of Federal Law No. 209 of July 24, 2007 “On the development of small and medium-sized businesses in the Russian Federation.” Thus, in 2020, a small enterprise is considered to be an organization that:

- the average number of employees for 2020 does not exceed 100 people (how to correctly count employees is described in Rosstat order No. 739 of December 30, 2014). A micro-enterprise is not allowed to employ more than 15 people;

- the amount of income from business activities does not exceed 800 million rubles per year for small enterprises and 120 million rubles per year for microenterprises. These values are set by the government. Similar restrictions are provided for the book value of the organization’s assets, which should be understood as the residual value of the organization’s fixed assets and intangible assets. This indicator is calculated only on the basis of accounting data.

- the share of participation in the authorized capital of the Russian Federation, its constituent entities, municipalities, public and religious organizations and charitable foundations, including Russian legal entities does not exceed 25%, and the share of participation of foreign organizations is 49%. But there are exceptions to this rule. Thus, restrictions on participation in the authorized capital do not apply to business companies and partnerships that work on the practical application of the results of intellectual activity, provided that the exclusive rights to these results belong to their founders. In addition, the requirement does not apply to organizations that have received the status of a project participant in accordance with, and other companies included in the List of legal entities providing state support for innovation activities in the forms established by the Federal Law “On Science and State Scientific and Technical Policy”, approved By Order of the Government of the Russian Federation No. 1459-r dated July 25, 2015.

It is important to remember that since August 10, 2016, the Federal Tax Service of Russia has maintained a unified register of SMEs, and in fact, only those organizations and individual entrepreneurs that are included in it are classified as small enterprises.

Group 2: not eligible for simplified accounting

In relation to most organizations in relation to reporting for 2016, the second group includes:

- any JSC (both public and non-public (subclause 1, clause 1, article 5 of Law No. 307-FZ);

- LLC, if it issues securities (for example, bonds) admitted to organized trading (subclause 2, clause 1, article 5 of Law No. 307-FZ);

- any organization if its revenue from the sale of products (goods) and work performed in 2020 exceeded 400 million rubles. (Subclause 4, Clause 1, Article 5 of Law No. 307-FZ; accounting data is taken into account here!);

- any organization if the amount of its balance sheet assets as of December 31, 2016 was more than 60 million rubles. (subparagraph 4, paragraph 1, article 5 of Law No. 307-FZ);

- an organization whose mandatory audit is separately established by federal laws (subclause 6, clause 1, article 5 of Law No. 307-FZ).

In relation to such organizations, a policy is being implemented to protect the property interests of citizens and investors - legal entities (potential investors), as well as the property interests of persons entering into civil legal relations with such organizations (including creditors, potential creditors).