Why is a desk audit carried out?

The objectives of the desk tax audit are:

-monitoring the taxpayer’s compliance with the legislation on taxes and fees of the Russian Federation;

-detection and suppression of tax violations;

-preparation of information for selecting an object for an on-site tax audit.

The object of the desk tax audit will be the tax return submitted to the Federal Tax Service. A tax return is submitted by each taxpayer for each type of tax payable by that taxpayer. The tax return must be drawn up on the prescribed form. At the same time, tax authorities do not have the right to require the taxpayer to include in tax returns information not related to the calculation and payment of taxes.

In addition to tax returns, during the desk audit, accounting reporting forms are used, submitted to the Federal Tax Service in accordance with paragraphs. 4 paragraphs 1 art. 23 of the Tax Code of the Russian Federation and legislation on accounting, as well as other documents requested from the taxpayer or submitted by him independently. When conducting a desk audit, the Federal Tax Service has the right to use any information it has about the taxpayer, if this information was obtained legally, namely:

- documents of the taxpayer submitted by him;

- tax returns and financial statements previously submitted by the taxpayer to the Federal Tax Service for previous reporting periods;

- information received by the Federal Tax Service from various government bodies, in accordance with the requirements of Art. 85 Tax Code of the Russian Federation.

It should be noted that during a desk audit, the Federal Tax Service has the right to use the rights to collect evidence of a tax crime under Art. 90,93,95,96,97,98 Tax Code of the Russian Federation. Earlier, I mentioned that such an audit is carried out without a special decision of the head of the tax authority and his deputy, however, employees of the Federal Tax Service Inspectorate, who are charged with carrying out such audits, have the right to conduct this type of inspection; as a rule, the Federal Tax Service Inspectorate has desk audit departments.

Documents during a desk tax audit

During a desk audit, tax officials may request additional documents from the taxpayer due to discrepancies between the information in the declaration and the submitted documents. Documents can be submitted to the tax office in person by the taxpayer or his representative, sent by mail or through the taxpayer’s personal account.

If a person has received a request from the tax office to provide documents, then he must comply with it within 5 days.

Based on the results of the audit, the tax office can issue a report if violations are identified.

Stages of a desk audit.

What does a desk audit include? The main stages of a desk audit are:

-checking the completeness of the information provided by the taxpayer. It should be remembered that the taxpayer may independently discover an error in the declaration submitted by him. In this case, he is obliged to make the necessary changes to the tax return in the manner prescribed by Art. 54 Tax Code of the Russian Federation. The issue of the responsibility of the taxpayer in the event of inclusion in the tax return is resolved taking into account the provisions of Art. 81 Tax Code of the Russian Federation. Here, as a rule, events develop in three ways:

1) if an application for amendments to a tax return is made before the deadline for filing a tax return, then it is considered submitted on the day the application for amendments is submitted;

2) if an application for amendments to a tax return is submitted later than the deadline for filing a tax return, but before the expiration of the tax payment period, the taxpayer is released from liability if the specified application was made before the Federal Tax Service Inspectorate discovered an error in the declaration submitted by the taxpayer, or about the appointment of a visiting tax audit;

3) if the application is submitted after the expiration of the deadline for filing a tax return and the deadline for paying the tax, then the taxpayer is released from liability if he submitted the specified application before the Federal Tax

Service Inspectorate discovered an error in the declaration submitted by the taxpayer, or about the appointment of an on-site tax audit;

-visual verification of the correctness of the submitted documents;

-arithmetic control of tax reporting data;

-checking the timeliness of tax reporting submission;

-checking the validity of tax rates and benefits.

What is a desk audit and why is it needed?

It does not matter for what purpose a citizen submits a declaration - with a deduction, on a mandatory basis, or for other reasons. The Federal Tax Service inspector, receiving the data in the document, must know whether the taxpayer has violated the legislation of the Russian Federation, including tax law.

A desk audit is a set of measures carried out by Federal Tax Service inspectors in order to check the real state of affairs of the declarant. The check has several tasks:

- Find out whether everything stated by the taxpayer in 3-NDFL is true;

- Check whether the citizen has money, securities or other assets hidden from taxes and, in general, from the state.

Responsibility for detected offenses.

As a rule, liability for tax offenses identified during a desk tax audit occurs under Art. 119 Tax Code of the Russian Federation, Art. 122 of the Tax Code of the Russian Federation, that is, for failure to submit a tax return and non-payment or incomplete payment of taxes and fees. In addition, the Federal Tax Service may initiate administrative proceedings under Art. 15.5 and Art. 15.11 Code of Administrative Offenses of the Russian Federation.

The Federal Tax Service of Russia has established a shortened period for conducting desk audits of taxpayers’ tax returns, which is 75 calendar days from the date of submission of the tax return. After 6 days, employees of the desk audit department verify the list of registered taxpayers. Based on the results of the reconciliation, the Federal Tax Service Inspectorate employee summons all non-reporting taxpayers with a written notification. This notice must contain information about the taxpayer’s failure to fulfill his obligations to submit a tax return and financial statements to the tax authority, provided for in Art. 23 of the Tax Code of the Russian Federation, and also indicates the need to submit a tax return and give explanations regarding late submission of reports. The right to call taxpayers is provided to the tax authority in clause 4, clause 1 of Art. 31 Tax Code of the Russian Federation. The notice to the taxpayer is sent by registered mail with notification.

If the taxpayer fails to submit a tax return within the prescribed period, the Federal Tax Service Inspectorate suspends all transactions on the taxpayer’s accounts in accordance with Art. 76 Tax Code of the Russian Federation. If, despite the measures taken, tax reporting is not submitted by the taxpayer, but the location of the taxpayer is known to the Federal Tax Service, in this case the desk audit department prepares a conclusion on the need to conduct an on-site tax audit.

Department functions

The desk audit department of the tax service carries out a significant amount of work. The main functions of the department can be divided into the following categories:

- inspection and control activities;

- collection of information about taxpayers;

- taking action against violators of tax laws;

- analytical work;

- preparation of tax notices and certificates;

- tax calculation;

- interaction with other departments of the tax authority;

- responses to taxpayer requests within the competence of the department;

- carrying out work to retrain personnel and improve their qualifications.

The department conducts desk audits of tax returns, income statements of individuals, documents on the basis of which taxes and fees are calculated and paid, the amounts of applied tax rates and deductions, as well as the legality of VAT transactions.

The department’s control activities relate to tax deductions for VAT, the application of minimum tax rates, and compliance by exporting taxpayers with current legislation in the field of taxes and fees.

The collection of information about taxpayers and their subsequent selection is carried out in order to form a plan for on-site tax audits. In addition, a fairly large-scale collection and analysis of information about taxpayers obtained from various sources is carried out.

Indicators such as the amount of electricity, water, etc. consumed by the taxpayer enterprise are collected. This information is analyzed, systematized and used to carry out effective control activities.

The department takes measures against violators of tax laws - suspends transactions on their accounts, transfers information about debtors to the debt settlement department.

Analytical work is carried out in the field of studying existing methods of tax evasion. Based on a comprehensive analysis, the department prepares proposals to prevent the operation of these schemes.

The department prepares tax notices for individual entrepreneurs and compiles certificates for taxpayers-exporters, which they need to interact with customs authorities.

He also deals with the calculation of property taxes for individuals and transport taxes.

In its activities, the Department of Desk Inspections interacts with other departments of the tax service - it prepares materials and certificates for them, and transmits the results of inspections.

In addition, feedback is provided to taxpayers in the form of preparing responses to written requests received from them.

The department also takes part in activities to improve the qualifications of tax authorities, their retraining, prepares and conducts seminars and meetings on those issues of the tax service that fall within its competence.

Current structure

The desk audit department is headed by a chief with a wide range of powers and responsibilities, and is staffed by highly qualified lawyers, accountants, economists and specialists in the field of high technology. In addition to their specialization, all employees are required to have a good level of training in the field of current tax legislation.

The nuances of conducting desk tax audits are presented in this video.

Responsibilities of the Chief

The head manages the current activities of the department, interacts with other departments of the tax service, deals with personnel issues, draws up job descriptions for employees, monitors the employees’ performance of their duties and their compliance with labor regulations, and plans activities.

The chief is personally responsible for the work of the department, compliance with current legislation, and the safety of the property included in the department.

Job of a state tax inspector

State tax inspectors, in accordance with their specifications, check taxpayers for compliance with tax legislation. Inspections of legal entities and individuals have their own characteristics, and there are also differences between on-site and desk inspections.

In addition, the responsibilities of tax inspectors include monitoring the timely payment of taxes and fees, maintaining tax statistics, and working with violators of tax laws (imposing various sanctions).

To perform their duties efficiently, tax inspectors systematically improve their professional level, undergo advanced training and retraining courses.

When conducting a desk audit, the tax authority conducts:

1.Checking the comparability of tax reporting indicators of the current period with indicators for the past period;

2. comparison of the indicators of the audited tax return with the indicators of tax returns for other types of taxes and financial statements;

3. assessment of the reliability of the tax return indicators, based on the information available to the tax authority;

4. analysis of the main indicators of the financial and economic activities of the taxpayer in comparison with the average indicators for a group of similar taxpayers.

If, during a desk audit, errors are identified in filling out a tax return or contradictions between information, the Federal Tax Service Inspectorate within 3 working days informs the taxpayer about this and offers to make appropriate changes within 5 days. If the taxpayer does not make the appropriate corrections within the prescribed period, then the Federal Tax Service begins collecting evidence. Most often, this is done by: requesting from the taxpayer additional information, explanations and documents confirming the correctness of his tax calculations; requesting from other persons documents related to the activities of a given taxpayer; obtaining information from banks about transactions on the accounts of the taxpayer being audited.

It should be noted that the requirement to submit documents is signed by the INFS official conducting the inspection and handed over to the taxpayer against signature, or sent by registered mail with notification. The taxpayer’s refusal to provide the requested information or failure to provide it within the established time frame is recognized as a tax offense and entails liability under Part 1 of Art. 126 of the Tax Code of the Russian Federation.

Check period

The period for conducting a desk audit is 3 months. If during the audit, errors or inconsistencies in information are revealed, the taxpayer is sent a request asking for documents, explanations of the facts of violations identified and an updated declaration or calculation.

The taxpayer is given 5 days to provide explanations and clarifications. If during this period the taxpayer does not independently correct errors or does not provide the required explanations, he will be fined.

From January 1, 2020, the fine for this violation is 5 thousand rubles; if a similar violation is repeated within a calendar year, the fine will be 20 thousand rubles.

Explanations related to VAT returns are provided only in electronic form, through an electronic document management operator, in the format approved by Order of the Federal Tax Service of the Russian Federation dated December 16, 2016 No. ММВ-7-15/ [email protected] Explanations provided on paper are considered not provided .

Procedure for proceedings in a tax violation case.

Proceedings regarding a tax offense are regulated by Art. 101 Tax Code of the Russian Federation. The audit materials in this case are considered by the head of the tax authority. If the taxpayer submits written explanations or objections, the materials are considered in the presence of officials of the taxpayer's organization or in the presence of individual entrepreneurs or their representatives. Based on the results of consideration of the materials, the head of the tax authority makes a decision. Failure of tax officials to comply with the requirements of Art. 101 of the Tax Code of the Russian Federation may be the basis for the cancellation of a tax authority’s decision by a higher tax authority or court. The decision must be made by the head of the tax authority no later than 75 days from the date of submission of the tax return. In a decision to hold a taxpayer accountable, it is mandatory

the following is indicated: the circumstances of the tax offense committed by the taxpayer, established by the audit; documents and other information confirming the fact of a tax offense; the presence of mitigating or aggravating circumstances of the taxpayer; types of tax offenses; the amount of sanctions applied to the taxpayer with reference to Art. Tax Code of the Russian Federation. The department of desk audits, no later than the next working day after the day the head of the tax authority made a decision, transfers a copy of this decision to the department for collecting tax debts to prepare a request for payment of additional accrued amounts. A copy of the decision is given to the taxpayer or his representative against signature, or sent by registered mail with notification and is considered received 6 days after sending.

When does the countdown start?

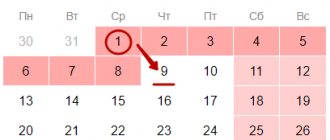

It is important to understand which day the Federal Tax Service considers the starting point. This is especially true when sending documents by mail. According to clarifications of the Ministry of Finance of Russia dated June 19, 2012 No. 03-02-08/52, the date of receipt of documentation from the taxpayer is considered the start date of the tax return , and not the date of their dispatch. So, for example, if you sent documents with a description of the attachment and personal delivery on March 20, and they arrived at the Federal Tax Service only on March 23, the start date of the inspection will be considered March 23.

In addition, the countdown begins anew every time a citizen makes corrections to the declaration. If the tax authorities sent 3-NDFL back to the applicant with comments, the new declaration will also be considered again within 3 months.

Order of conduct

Now that it has become clear what a tax desk audit is, it is worth considering the procedure:

- the completeness and timeliness of the provided documentation is checked;

- the correctness of the design is assessed (visually);

- the accuracy of calculations and the correct display of main indicators are checked;

- The correctness of the calculation of the taxable base is checked.

Desk tax audits are not only carried out remotely. There may be a need to call the head of a company or individual entrepreneur for tax questioning. They are required to appear, this is stated in the Russian Tax Code. In addition, according to Art. 86, as well as Art. 90-97 of the Russian Tax Code, inspectors have the right to perform the following actions:

- insist on an examination;

- call witnesses for questioning;

- seize business papers;

- attract specialists, use the services of a translator;

- inspect the territory and premises to obtain the necessary evidence;

- conduct counter checks (request business papers from both the taxpayer and his counterparties and other persons).

If the entity in respect of which the KNI is being carried out refuses to provide the documentation or other data requested by the inspectors, it faces liability in accordance with Russian laws. Thus, the Russian Tax Code (in its article 126) states that a fine may be imposed on the taxpayer. Its amount is 200 rubles, which will need to be paid for each document not provided.