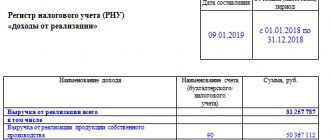

Filling out tax registers

The main purpose of the registers is to summarize information on the source data in relation to each type of tax. Do registers help control taxpayers? and allow payers themselves to check the accuracy of the calculations made for each type of tax liability.

The forms developed should ensure simplicity and ease of completion, contain the necessary columns and lines to reflect the necessary data, which allows you to check the accuracy of the calculation of certain types of taxes.

Registers are useful both for the tax office in order to control payers, and for the companies themselves. Correctly filled out register forms allow you to correctly generate tax reporting and simplify the perception of the information necessary for calculation.

You can fill out registers electronically or on paper. The tax authorities do not impose any special requirements in this matter.

Responsibility for filling out registers falls on certain persons, whose signatures must certify the documents being drawn up. These persons must ensure not only that the registers are filled out correctly, but also that they are properly stored and that unauthorized persons do not make corrections.

Only a responsible person can edit the register, certifying the adjustments made with a signature, date and explanations.

Answers to common questions about what tax registers are

Question #1:

Which company employee can be responsible for preparing tax register forms?

Answer:

An enterprise accountant or a specialist hired to resolve tax accounting issues (if one was hired by management) can develop tax accounting register forms.

Question #2:

Is it possible to prepare tax accounting registers in electronic format?

Answer:

Yes, the law allows you to keep tax registers both in paper form and in electronic form on a computer.

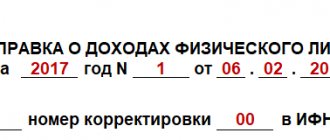

Personal income tax registers

The responsibility for accounting for income paid to employed persons falls on the employer, who acts as a tax agent in relation to the tax calculated on the income of individuals. To correctly calculate income tax, you need to properly organize the accounting of paid income. For this purpose, the company creates its own registers for maintaining tax records for calculating personal income tax.

Registers are necessary both for the tax office in order to control employers, and for companies that use hired labor. Collecting data about working individuals, amounts paid to them, benefits applied and personal income tax withheld allows the employer to:

- See the overall picture for all employees;

- Fill out 2-NDFL certificates at the end of the year;

- Determine the rights of employees to the “children’s” deduction, track the moment when this right ceases;

- Establish rights to other deductions of a standard nature;

- Identify cases of incorrect calculation and withholding of tax.

Formation of the register

The company has the right to decide for itself how it will account for income and the personal income tax calculated from it, and what accounting forms will be used for this. The Tax Code of the Russian Federation determines what needs to be reflected in tax registers. The necessary information to be included in the register is set out in paragraph 1 of Article 230:

- Identification data for each individual;

- Types of paid income;

- Provided personal income tax benefits that reduce the base for calculating the tax;

- Amounts of amounts paid;

- Dates for issuing amounts to staff;

- The amount of calculated tax;

- Dates of its retention and transfer;

- Information about payment documentation confirming payment.

This information is provided for each employee.

The tax register form for personal income tax is developed in order to ensure convenient work with information and clarity of its presentation. In this case, the form includes the necessary information required by the tax authorities.

Qualities that the developed register form must have:

- Simplicity – there should be no confusion in presenting employee data;

- Visualization - the data should be easy to read, the form should allow you to quickly transfer the necessary information to 2-NDFL;

- Brevity - unnecessary information is not needed, it does not carry any significance and creates difficulty in perceiving the information.

The register form must take into account the specifics of the organization’s activities and the types of income paid, therefore a universal register form has not been approved. Each enterprise draws up a document that will include the necessary information and have the above properties.

For convenience, a company can create several tax registers to fully reflect the necessary data for personal income tax accounting purposes. Tax legislation does not limit employers in this matter. You can use a separate register for each type of income or each individual.

Companies often take the previously valid 1-NDFL certificate form as a basis, using an example of which to prepare a suitable register.

Personal income tax register form

The tax register being developed includes information from clause 1 of Article 230. The table below provides explanations for each type of information required.

| Mandatory register information | Explanations |

| Taxpayer identification information | Data on working individuals, including:

|

| Types of income | Each type of income paid must have a field to indicate a special digital code designation. The codes are approved by Order of the Federal Tax Service No. MMB-7-11/ [email protected] 10.09.15. It is not necessary to reflect data on income not subject to personal income tax, since they do not form the base. Income that is taxed within a limited limit must be reflected, since it can accumulate throughout the year. |

| Types of deductions | Deductions are reflected in the register indicating codes. Deduction codes are approved by the same order as income codes. |

| Amounts of income | It is recommended to indicate the amounts of income:

|

| Income payment dates | A field is provided to indicate the day when:

It is also recommended to provide a field to indicate the date of receipt of income according to the rules of Article 223 (in relation to salary, this is the last day of the month for which it was accrued). |

| Taxpayer status | The register includes a field to indicate whether an individual is a resident or non-resident of the Russian Federation. |

| Personal income tax withholding dates | In a special column, the actual day of tax withholding is indicated, which depends on the type of income. |

| Personal income tax transfer dates | Taken from supporting payment documentation. |

| Payment details | It is enough to indicate the number, date of payment and the amount of tax transferred for it. |

| Personal income tax | The calculated and withheld tax is entered into the register. |

If there are many employees, then it is more convenient to develop a register that would reflect data for each individual individual. The 1-NDFL form is built on this principle. You can take the specified form as a basis and adapt it to modern realities and the requirements of the Tax Code of the Russian Federation - add missing data, remove unnecessary, irrelevant ones.

The company maintains a register in a convenient form - paper or electronic.

Tax accounting register for personal income tax form 2020 free download

- Tax Basics

- Mandatory details of the tax accounting register for personal income tax

- Required Documentation

- The concept of personal income tax: payers and tax rates

- Do I need to print the document?

- Basic rules for formation

- Tax registers

- What day is considered the date of payment of income and what is the deadline for paying personal income tax?

- Extract from the register

- Frequency of preparation of the tax accounting register for personal income tax

- Sample filling

- Normative base

- How to fill out the personal income tax register?

- Where can I get the form?

- Basic rules for formation

- Sample filling

- Extract from the register

- Basic information

- Tax Basics

- Required Documentation

- Normative base

- Who signs the tax register?

- Basic requirements for compilation

- Where can I get the form?

- Frequently asked questions

- Do I need to print the document?

- Who signs the tax register?

Basic information Personal income tax is a tax that ranks next after profit tax and VAT.

Payers of this tax are citizens of Russia and other persons who receive profit within Russian territory (foreigners and stateless persons). Payers can be residents and non-residents.

The rate used in income tax calculations will depend on your status.

Tax card for personal income tax accounting for 2020 form free download

Hello, in this article we will try to answer the question "".

You can also consult with lawyers online for free directly on the website.

Apartment card issued upon registration of citizens in residential premises of the state, municipal, private housing stock, including housing construction and housing cooperatives, boarding houses for the disabled, veterans, single and elderly people, other social institutions, joint-stock companies and commercial organizations , other state and municipal organizations and institutions that have housing stock on the right of economic management or on the right of operational management.

Most often, a certificate of form 2-NDFL is required by banking institutions where an individual takes out a loan for a large purchase of money, for health improvement, mortgage, purchase of a car and other needs.

Also, when moving to a new job, the form is often requested by the human resources department of another company where the employee is moving.

Sometimes such a certificate is issued automatically by the enterprise upon dismissal of an employee.

Correcting errors using corrective tools is also prohibited. Document sheets must not be stapled or glued together. Sample 2-NDFL certificate cannot contain empty cells - if there is no data, the fields are filled in with dashes (zeros are placed instead of numeric parameters).

There should not be negative values of digital indicators.

Mandatory information in

How is the personal income tax register maintained?

> > > March 13, 2020 The personal income tax register is developed and used to reflect income received by an individual from an organization, for example, wages, as well as taxes withheld and transferred to the budget.

The preparation of such registers is the basis for assessing the correctness of the calculation and transfer of personal income tax. When developing a personal income tax register, it is necessary to take into account some requirements:

- Tax registers for personal income tax in 2020 must necessarily contain the following information:

- dates of tax withholding, its transfer to the budget and details of payment orders.

- types of income and deductions indicating the corresponding code;

- sign of tax residence;

- information to enable identification of an individual;

- amounts and dates of payment of income;

- The form and sample of the tax accounting register for personal income tax must be determined by the accounting policy.

- The register is maintained throughout the year for each employee.

- If, during a tax audit, tax accounting registers for personal income tax are not provided, the organization may be fined 10,000 rubles (120 Tax Code of the Russian Federation).

An enterprise accountant must clearly understand how to maintain tax registers for calculating personal income tax. The main purpose of this

Tax card for personal income tax accounting in 2020

If you pay citizens income subject to personal income tax, then you are a tax agent.

So if you haven’t kept tax registers before, start doing so at least from the beginning of this year. If you have been issuing cards for a long time, now is the time to revise them.

After all, there are more personal income tax reports, which means that someone needs to change the card and add additional information to it. Our advice will help you prepare tax registers so that you can fill out personal income tax reports quickly and without difficulty.

The form of personal income tax cards has not been approved; you choose it yourself and approve it with your accounting policies.

However, it is important to indicate in the document all the information necessary to calculate personal income tax.

Their list is given in paragraph 1 of Article 230 of the Tax Code of the Russian Federation.

In addition, it will be useful to add additional data to the form that is required for the 6-NDFL report. We have compiled information about what needs to be indicated on personal income tax cards in a table (see below). So if you haven’t kept registers yet, develop your own form, including all the listed details.

If you already have these cards, for example, maintained in an accounting program, review them carefully.

Tax registers for personal income tax (filling sample)

Copyright: photo bank Lori Employers paying salaries to staff are tax agents for personal income tax, and therefore are required to maintain data registers on which tax calculations are based (Art.

230 of the Tax Code of the Russian Federation). The legislator does not establish a standard form for tax registers; enterprises independently develop and establish in their accounting policies the most acceptable form for themselves in accordance with general recommendations on the availability of mandatory details.

How this document is drawn up will be discussed in the publication.

Such a register is formed separately for each employee. All payment accruals and provision are recorded monthly.

The presence of non-taxable payments does not oblige the employer to indicate them in the register, but if they have restrictions on amounts, the excess of which is subject to taxation, then it is better to indicate them. The company determines the frequency of compiling the register independently.

It is easier and more convenient to do this monthly after salary payment: the risk of incorrect data reflection is significantly reduced, and the information available in the register will always be up-to-date. Article 230 of the Tax Code of the Russian Federation defines the data that should be indicated in the register.

- citizenship with country code;

- data on the number of days of stay in the Russian Federation (to determine tax status (resident, non-resident) for each month of the tax period).

In this part of 1-NDFL, the personal income tax tax base is directly calculated at rates of 13 and 30% (13% is the main rate in the Russian Federation, and 30% is the income rate for non-residents).

In form 1-NDFL, the form contains a table in which the indicators by income code are summarized monthly for the entire year and the deductions provided are also indicated monthly.

Income codes for the 2-NDFL certificate 2020 can be found in our article

“List of income codes in certificate 2-NDFL (2012, 4800, etc.)”

.

After this, the tax base is formed in 1-NDFL and the personal income tax is calculated. Information about income tax payers, that is, employees of the employer acting as a tax agent for personal income tax (TIN, full name, passport details).

Reflecting this information in this document will save time on preparing the 2-NDFL tax report. Taxpayer category (tax status).

Sample of filling out the tax register for 6-NDFL

> > > March 11, 2020 Tax register for 6-personal income tax - we will present a sample of this document in this publication - will help you organize accounting for personal income tax. Let's consider what details and information the correct register for 6-NDFL should contain.

Tax accounting registers serve to summarize the information necessary to calculate certain taxes. They, firstly, help tax authorities monitor the completeness of tax payments by taxpayers, and secondly, allow taxpayers themselves to check the correctness of their calculations for a particular type of tax liability and simplify the generation of tax reports.

IMPORTANT! Despite the fact that tax legislation obliges taxpayers to create and maintain such registers, their forms are not approved by law, and therefore each enterprise (or individual entrepreneur) is obliged to independently develop the structures of the applicable tax registers, and it is very desirable to approve them with accounting policies. Tax registers must meet the following general requirements:

- implementation of full disclosure of the procedure for forming the tax base;

- maintenance in paper or electronic form.

- ease of perception of information reflected in the register and ease of filling it out;

- continuous generation of tax accounting data in chronological order;

For more information on how to maintain tax registers, see the article. As for tax registers for personal income tax, Art.

Application of form 1-NDFL in 2020

Form 1-NDFL is perfect as a tax accounting register to reflect the income that the company, as a tax agent, paid to employees and other individuals.

The article contains the form and procedure for filling out the form.

Legislation obliges tax agents to record the income that they paid to their employees or individuals, for example, under GPC agreements (clause 1 of Article 230 of the Tax Code of the Russian Federation). Until 2011, the 1-NDFL report was used for these purposes.

Source: https://emelyanov-dokin.ru/registr-nalogovogo-ucheta-po-ndfl-blank-2019-skachat-besplatno-88050/