What documents and registers are used when calculating salaries?

Since 2013 (after the new Accounting Law 402-FZ came into force), organizations have the right to independently develop and approve the forms of primary documents used.

To do this, it is necessary to comply with the requirements for mandatory details (clause 2 of Article 9 402-FZ) and approve the form used by local regulations. But many companies still use document forms approved by Goskomstat in their practice. Or, based on them, they develop their own, supplementing them with the necessary rows, columns, and other details. This also applies to the primary accounting of employee payroll.

The forms used for calculating wages are approved by Resolution of the State Statistics Committee of January 5, 2004 No. 1.

Types of statements for calculation and payment of salaries

Each enterprise or individual entrepreneur can independently choose a document that will become the main one in the matter of monetary relations with the employee. To give an employee money, you first need to make an accrual on paper. Some employers prefer to prepare a separate statement for each employee in order to maintain trade secrets about the monetary remuneration of each employee. This is necessary to avoid disagreements within the team.

This is also important to know:

Gray salary: judicial practice, is there any point in suing, employer’s responsibility

But preparing an individual wage statement is labor-intensive and costly, because in order to report to the inspection authorities, each document must be attached to the report not in electronic form, but in paper form. Just imagine how much money you will have to spend just to pay salaries for each employee. It is also worth taking into account vacation pay, advances and sick leave.

To give an employee money, you first need to make an accrual on paper.

Therefore, general wage statements were adopted. The only difference is in the form the company uses:

- Payroll sheet for all employees.

- Statement for issuing wages for all employees.

- A unified form where payments are made and money is issued at the same time.

Which form to choose is up to you.

The procedure for using unified forms

For the calculation and payment of wages, Resolution No. 1 provides three forms of statements:

- T-49 - settlement and payment;

- T-51 - design;

- T-53 - payment.

If the organization has decided to use the T-49 form for calculating and paying wages, then there is no need to draw up documents using the T-51 and T-53 forms. This order is not entirely convenient. After all, the document contains information about accruals and payments to all employees, so when receiving money, any employee gets access to information about the amount of remuneration for all other employees.

In turn, if the T-51 “Payroll” form is used to calculate wages, then to pay wages through the enterprise’s cash desk it is necessary to issue a T-53 payroll. To process non-cash payments, documents are drawn up in accordance with the requirements of the bank in which the organization has opened a salary project for its employees.

Payroll

The unified RPV form is a unified document that immediately combines information on accruals and payments to employees. In essence, this is RV and PV in one large document.

The accountant records accrual information in a similar manner. Takes into account data from primary accounting and accounting documentation, orders, time sheets, sick leave and other things. Registers information about deductions and advance payments made for the first half of the working month. The amount payable is calculated as the difference between the total amounts of accruals and payments and deductions made.

When receiving money from the cash register, the employee signs next to his last name. The RPV form allows the employee to immediately familiarize himself with salary information. If salaries are transferred to the bank accounts of employees, then there is no need to prepare a RPV.

IMPORTANT!

The creation of a payslip does not relieve the employer of the obligation to issue payslips monthly!

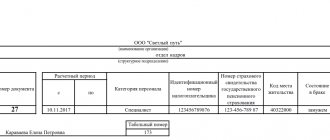

A sample payroll slip looks like this:

Form T-51 (pay slip)

Today we will look at the procedure for preparing a payslip. As mentioned above, its form is established by Resolution of the State Statistics Committee dated January 5, 2004 No. 1

: T-51 uniform

The payroll is prepared in one copy by the accounting employee responsible for payroll. Calculation of amounts to be accrued is made on the basis of primary documents, which may include:

- employment contracts;

- time sheets;

- provisions on payroll and bonuses;

- orders for the calculation of bonuses and allowances;

- other documents established by the company’s internal document flow.

Responsibility for violation of the procedure for maintaining and preserving frames of documents

In the absence of mandatory personnel documents approved by the organization, the inspecting labor inspector may bring the organization to administrative liability. Thus, in accordance with Article 5.27 of the Code of Administrative Offenses of the Russian Federation, violation of labor and labor protection legislation entails the imposition of an administrative fine:

- for officials - in the amount of 1,000 to 5,000 rubles,

- for legal entities - from 30,000 to 50,000 rubles. or suspension of activities for up to 90 days.

Violation of labor and labor protection legislation by an official who has previously been subjected to administrative punishment for a similar administrative offense entails disqualification for a period of one to three years.

In accordance with Article 13.20 of the Code of Administrative Offenses of the Russian Federation, for violation of the rules of storage, acquisition, accounting or use of archival documents (such documents include: work books, personal cards of employees, orders for personnel, etc.) entails:

- warning or imposition of an administrative fine on citizens in the amount of 100 to 300 rubles,

- for officials - from 300 to 500 rubles.

In accordance with Article 90 of the Labor Code of the Russian Federation, persons guilty of violating the rules governing the receipt, processing and protection of employee personal data are subject to disciplinary and financial liability in the manner established by the Labor Code and other federal laws, and are also subject to civil penalties , administrative and criminal liability in the manner established by federal laws.

The same provision applies to employees responsible for maintaining, storing, recording and issuing work books.

In accordance with Article 137 of the Criminal Code of the Russian Federation, illegal collection or dissemination of information about the private life of a person, constituting his personal or family secret, without his consent, or dissemination of this information:

- in public speaking

- publicly displayed work,

- in mass media,

are punished:

- a fine of up to 200,000 rubles,

- or in the amount of wages or other income of the convicted person for a period of up to 18 months,

- or compulsory work for up to 360 hours,

- or correctional labor for up to 1 year,

- or forced labor for a period of up to 2 years with or without deprivation of the right to hold certain positions or engage in certain activities for a period of up to 3 years,

- or arrest for up to 4 months,

- or imprisonment for up to 2 years with deprivation of the right to hold certain positions or engage in certain activities for up to 3 years.

This is also important to know:

What is unemployment benefit and how to get it

In this case, the same acts committed by a person using his official position are punishable:

- a fine in the amount of 100,000 to 300,000 rubles,

- or in the amount of wages or other income of the convicted person for a period of 1 to 2 years,

- or deprivation of the right to hold certain positions or engage in certain activities for a period of 2 to 5 years,

- or forced labor for a period of up to 4 years with or without deprivation of the right to hold certain positions or engage in certain activities for a period of up to 5 years,

- or arrest for up to 6 months,

- or imprisonment for a term of up to 4 years with deprivation of the right to hold certain positions or engage in certain activities for a term of up to 5 years.

The timeliness, completeness and correctness of maintaining personnel documentation, as well as compliance with labor legislation and other regulatory legal acts containing labor law norms, are controlled by the State Archive and the Labor Inspectorate, which conduct periodic scheduled and unscheduled inspections.

Complaints from employees can be considered by the Prosecutor's Office together with the Labor Inspectorate.

Actions in case of loss

According to the Letter of the Ministry of Labor dated November 27, 2001 No. 8389-YuL, responsibility for storing the salary slip rests with the employer.

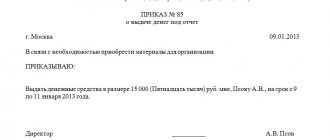

If lost, it is necessary to issue an order to create a commission to investigate the incident. It includes employees of the accounting department, personnel department, etc. The Commission must request explanatory notes from all parties who were responsible for storage. After conducting an investigation, a report is drawn up. It indicates the reasons that led to the loss of the statement and recommendations for measures to restore it.

The best option to solve the problem is to restore the document. To do this, the payslip is reprinted. All signatures are affixed, including employees.

If it is impossible to fill in the lines due to the dismissal of some employees, you should leave them blank or indicate “could not be restored.”

Free legal consultation

We will answer your question in 5 minutes!

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

Ask a Question

The duplicate statement must be marked “Duplicate”.

Thus, the salary slip is an integral document when calculating wages to employees. Depending on the method of issuing money, the document is divided into forms No. T-51, No. T-53, No. T49.

The accountant fills out the document. The chief accountant and the head of the enterprise signs and is responsible for incomplete payment of wages to employees or payment in excess of what is necessary.

This is also important to know:

How study leave is paid: registration procedure, leave for distance learning

If mistakes are made, corrections are allowed. The statement is kept in the accounting department for 5 years.

Filling out the title page

The payslip can be filled out by hand, or in printed form using software. It is compiled separately for each month and consists of a title page and a tabular part, which, in fact, reflects information about salaries. Our sample salary slip will help you understand all the stages of filling it out.

We start filling out with the title page. It must be written in:

- name of company;

- document number and date;

- the period for which the document is generated.

If the organization has a complex structure and the number of employees is very large, then you can fill out a separate payslip for each structural unit. In this case, it is necessary to fill in information about the department of the organization also on the title page.

Why do you need a payroll slip?

Form T-51 is a convenient document in which you can calculate wages for each employee separately, followed by summarizing data on accruals, deductions and amounts payable.

The payslip can be replaced with the payroll T-49, which, in addition to calculations, will also allow you to process the issuance of salaries to staff.

Form T-49 is more universal and differs only in the presence of space for indicating the salary paid, that is, it also performs a payment function. Form T-51 only allows you to calculate wages; for settlements with personnel, an additional payment document, form T-53, is drawn up.

The employer decides independently which form to use for calculation. In particular, he has the right to develop his own form for calculation, having approved it by internal order.

Filling out is carried out based on the results of the past billing month in accordance with the time worked.

How to fill out form T-51 for payroll calculation?

The payroll consists of a title page and a tabular part.

Filling out the title page of form T-51:

- company name and OKPO;

- the name of the department is optional;

- Document Number;

- Date of preparation;

- reporting period - the month for which wages are calculated.

Filling out the tabular part of form T-51 (18 columns):

- 1 — serial number of the table row;

- 2 — employee personnel number (assigned to each employee upon hiring);

- 3 - full name of the employee;

- 4 - position or profession;

- 5 - salary, tariff rate (prescribed in the employment contract);

- 6 - number of days or hours worked in working days for the billing period;

- 7 - number of weekends or holidays/hours worked during the billing period;

- 8 - 11 - various types of accruals by type of payment (salary, tariff, bonuses, incentive payments, etc.);

- 12 - total amount of charges;

- 13 - personal income tax withheld from wages (13 percent of the accrued amount from column 12);

- 14 - other types of deductions (based on writs of execution, damage, alimony);

- 15 - total amount of deductions;

- 16 - the amount of wages owed by the organization as of the date of calculation;

- 17 - the amount of wages owed for employees as of the date of calculation;

- 18 - the total amount of wages due for payment (accruals from column 12 minus deductions from column 15 plus the debt owed to the employer from column 16 minus the debt for employees from column 17).

The employee needs to pay the amount that is reflected in the final final column of the T-51 payroll.

If there is no data to fill in, then a dash is placed in the corresponding column.

The person responsible for filling out the statement and carrying out the calculations puts his signature at the bottom of the tabular part of the T-51 form.

Who signs?

The completed payroll form must be signed by the employee responsible for conducting payroll calculations - for example, a payroll accountant.

The signature is affixed after summing up all the results for payment.

There should be no other signatures on the T-51 form. The manager or chief accountant is not required to sign this document. These executives sign the payroll.

Filling out information about employees

Information about accruals and deductions is reflected line by line for each employee. If the company has few employees, then the order of filling out is not so important. If the number is larger, it is convenient to form the list in alphabetical order.

For each employee we indicate:

- FULL NAME.;

- job title;

- Personnel Number.

Data on salary or tariff rate are indicated in accordance with the employment contract concluded with the employee. It is there that the basic conditions for remuneration are stipulated.

At the same stage, we reflect information about the time worked for the billing month. They are filled out based on the working time sheet.

In what cases is statement No. T-51 used and what are its differences from other forms?

The payslip numbered T-51 is one of the most important accounting documents. It is used to calculate and pay wages to the organization’s personnel. Based on this document, salaries are issued to employees. In cases where employees receive their salary on a plastic bank card, you can limit yourself to statement No. T-51 and not draw up any more documents - neither settlement, nor settlement and payment.

Statement No. T-51 is not used in cases where a payroll statement No. T-49, which has a more universal scope of application, has been compiled.

There are three accounting documents with partially overlapping functions. All of them were approved by government decree on January 5, 2004 (Resolution of the Government of the Russian Federation No. 1).

- Form No. T-49 is a settlement and payment document covering a wide range of functions. If this form is used, no additional documents for calculations and payments are required.

- Form No. T-51 - settlement document. If payments are made in cash, payment documentation is required.

- Form No. T-53 - payroll. Used exclusively for accounting payments.

You can learn about all types of payrolls described above from a separate material.

We calculate accrued wages

Let's move on to the calculations. To do this, fill out the “Accrued” section. It calculates the amounts. It is advisable to reflect each type of accrual in a separate column. This will allow you to check the accuracy of the calculations and analyze the accruals.

In our case, all employees have a time-based bonus payment system. Everyone works a five-day work week. In November there are 21 working days on schedule. Two of the employees did not work the entire month, so they need to calculate their salary for the time worked.

All other accruals (bonuses, allowances) are indicated on the basis of the orders of the manager, other administrative documents, and employment contracts.

It is necessary to calculate the total amount accrued to each employee. For example, “Total accrued” according to S.S. Sidorov. will be equal to:

We withdraw the amount to be paid and complete the registration

Filling out the tabular part of the payroll is completed by displaying the amount to be paid. If at the beginning of the month the organization had arrears in paying wages to the employee or vice versa, they also need to be taken into account when calculating.

After completing all calculations and checking the result, the person responsible for filling out registers his position and full name. and signs.

Let's sum it up

To simplify the work of an enterprise or individual entrepreneur, special payroll forms were approved. For state enterprises - one form, for commercial organizations, individual entrepreneurs or legal entities - other types of forms.

What to choose as a basis, each employer decides for himself. The unified form T-49 for private owners, 0504401 for public sector employees, is popular. But such documents can be used if wages are paid in cash through the organization’s cash desk. If the employer switches to issuing money to employees via plastic cards, then there is no need to issue a unified form. Here you only need a payslip, which only the accountant signs. The employee's signature is not required anywhere.

If you issue salaries to employees on a bank card, then you do not need to fill out the T-49 statement.

Payrolls are very important in the work of an entrepreneur; their preparation must be taken seriously. If the enterprise has the concept of a trade secret, then it is more convenient to maintain individual statements for each employee.

Subscribe to the latest news