A payslip is an official written notification to employees that they have been accrued wages, indicating the amount of earnings, bonuses or funds collected and the total amount of wages for the period worked.

Is it obligatory for an employer to notify his subordinates about wages, and what rules for issuing notification sheets are provided for by current legislation.

Is the employer obliged to issue, according to the Labor Code?

Article 136 of the Labor Code of the Russian Federation provides for the employer’s obligation to issue pay slips in order to inform employees about the accrual of earnings without fail. It does not matter how the salary is paid - in cash through the cash register or to the employee’s card.

This article states that the employer is obliged to notify each of his employees in writing about the accrual of wages for the period worked.

This notice is called a payslip and must contain the following information:

- all components of the salary received (salary, tariff rate, allowances and additional payments);

- other charges and compensations;

- amounts and reasons for deductions from wages;

- the total amount credited for wages.

Read more about what information should be on the sheet here.

The provision of a payroll slip is provided for all employees in the organization: those who receive earnings at the cash desk and those whose salaries are credited to a bank account.

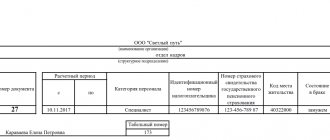

What details does the payslip contain?

So, the payslip, document form is developed by the employer independently and is fixed in the accounting policy. Regardless of the form of transfer, the document must meet the basic criteria of office work. It states:

- Company name;

- position and full name of the employee;

- month for which the sheet is issued;

- the department/shop in which the employee works;

- employee's personnel number.

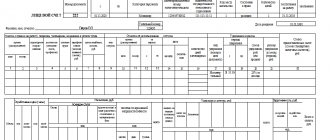

The main part of the document is a table consisting of several sections. The first is reserved for fixing the amounts of all types of accruals for the month, indicating the number of paid days/hours for each of them. It is also important to reflect the payment period, for example, vacation pay often covers two months - current and future. Therefore, the total amount is divided into corresponding ones for each month.

The deductions section reflects the corresponding amounts: the amount of personal income tax indicating the percentage, the advance payment issued for the first half of the month, information about other deductions, for example, by court decision. If necessary, all subsections are separated. If the company has a debt to an employee, or vice versa, he owes an employer, then this information is also reflected in the sheet in the corresponding subsection. The payslip form can be supplemented with other information, for example, about the amount of accrued mandatory contributions to the funds, indicate the payroll number and the date of payment of salaries, etc.

By carrying out a basic calculation, they indicate the total amount of accruals and deductions, calculate and reflect the amount of salary to be paid out.

How to give an employee a pay slip?

The Labor Code states that it is necessary to notify subordinate colleagues in writing. Often this requirement is carried out by notifying employees on paper.

The pay slip is drawn up and printed, after which it is given to each employee.

At the same time, Article 136 of the Labor Code of the Russian Federation says that the form of the settlement notice sheet for issuance to employees must be approved by the employer himself in a local regulatory act.

That is, an order must be created to approve the form of the pay slip, which is carried out taking into account the opinion of the bodies representing the interests of the labor collective.

The absence of local acts and an order to approve the form of the salary notice sheet is considered a violation of labor legislation and provides for criminal liability for the employer.

Providing sheets in electronic form does not contradict current legislation. It can be sent to the employee’s email or entered into the database of a special program that contains the organization’s salary sheets.

Such a procedure for issuing will be a legal action if such a form of notification is approved by an act and order of the company.

Thus, according to the law, wage slips can be issued in the following ways:

- on paper for signature in person;

- electronically by mail;

- in electronic form using special software.

The chosen method of issuing information to personnel should be enshrined in the local regulations of the employer’s organization.

Deadline for provision by law

According to the Labor Code, payment for the period worked in the form of wages must occur on time at least twice a month. Notification of accruals is made once a month upon the final payment of wages for that period.

In most cases, employers issue salary notices to employees upon payment of full monthly earnings.

It is not recommended to issue it for the advance period, since all the components of the monthly earnings are not fully known.

There is no need to notify about the transfer of vacation funds. But at the time of dismissal, a full calculation must be made and the employee must be notified of all accruals and deductions due to him.

Transfer order for signature

To protect itself from prosecution, fines and proceedings with employees, the employer can approve the documentary form of salary slips with their issuance against signature.

To do this, management draws up a normative act approving the form of the pay slip, while taking into account the opinions of bodies representing the interests of employees, a trade union, for example.

An order is also created to familiarize colleagues with the form in which they will receive such sheets - in paper for signature, in electronic or other form.

It is not necessary to print the sheets to obtain the employee's signature on receipt of information about his wages.

The issuance of salary slips against signature can be done in several ways:

- approve the form of the document with a detachable part on which the employee’s signature will be placed confirming its receipt;

- keep a journal or record of issuing written slips, where employees will sign upon receipt;

- enter employee signatures into the payroll.

However, the law does not oblige the employer to take signatures from employees regarding receipt of salary notices.

Is it possible by law to refuse the paper version?

The law does not prohibit, if necessary, the transition from a paper version of pay slips to an electronic one.

Such actions will be considered lawful if another form, not in paper form, is approved in the company’s local regulations and provided for familiarization to employees against signature.

Is it legal to send by email?

According to the resolution of the Ministry of Labor No. 14-1/OOG-1560 of 2017, sending electronic salary notifications to employees does not contradict the law.

Such actions of the employer will be considered lawful if the electronic form of the sheets is approved by a regulatory act or specified in an employment or collective agreement with familiarization in the team under signature.

The main thing is that the procedure for issuing pay slips is brought to the attention of employees and is officially approved by local acts and orders.

Composition of the document

The payroll slip must include the following mandatory items:

1. Full name employee. 2. Amount of time worked. 3. All components of the employee’s salary. 4. Total amount excluding taxes and withholdings. 5. Payment upon dismissal.

You can download your salary slip using the button below:

The amount of deductions from wages should not exceed 20%. But there are cases (their list is provided for by the federal laws of the Russian Federation) when penalties can reach 50%.

The following must be indicated in separate items on the payslip:

- various awards;

- fines;

- overtime;

- additional payment for hazardous working conditions;

- work on weekends.

Possible deductions typically include:

- personal income tax;

- contributions to insurance companies and trade union committees;

- an advance that was issued at the expense of wages (but provided that it was not worked out);

- amounts that were accrued in error (for example, due to system failures);

- alimony.

Due to the fact that the payslip is issued to the employee during the main salary, it must include all amounts that the employee received for the month. You can download a sample salary slip using the following button:

Can the company show the sheets to other employees?

Article 88 of the Labor Code of the Russian Federation talks about maintaining confidentiality when transferring personal data of employees.

Employees who have access to personal data of staff must be familiarized with the provisions on the confidentiality of personal data upon signature.

Displaying information about an employee to other persons without his written consent is prohibited by law.

Since the pay slip contains information about the employee (his last name, first name or personnel number), as well as data on his earnings, it should be handed out to the employee himself.

Transferring leaflets through third parties who do not sign the agreement on maintaining the confidentiality of personal data may be regarded as an illegal action.

Pay slip

The employer is obliged to inform the employee about his salary using a document such as a payslip each time he makes payments to individuals (Article 136 of the Labor Code). A written explanation is provided to the main employees, as well as to all other categories of workers (part-time workers, temporary employees, etc.) not only in terms of accrued remuneration for the current period, but also on the types of compensation, vacation pay, other amounts due and deductions.

What form of payslip is relevant in 2020? How often should such a document be issued to employees? What liability are provided to employers for ignoring this requirement? Let's consider all the nuances further.

Shelf life

Is it necessary by law for an organization to keep sheets containing information about the components of employees’ salaries?

According to the order of the Ministry of Culture of the Russian Federation No. 558, pay slips are stored subject to control checks for five years, and in the absence of personal accounts for 75 years.

However, current legislation does not provide for the need to store copies of payslips.

To provide inspectors with wage notices, two copies should be created, and the employer keeps the second one for himself.

Rules for issuing pay slips

At the federal level, the basis for providing pay slips has been approved. They are specified by local regulations of the employer.

The main principle is strict formality, timeliness, and reliability of information.

The employee must have an idea of the accrued wages, including contributions and deductions that the employer makes for him.

When another person receives a salary for an employee under a power of attorney, you should ask whether the power of attorney provides for the opportunity to receive pay slips. If the content of the power of attorney is universal, then the employer must hand over the document to the employee’s principal.

Based on the contents of the document, the employee sees:

- what components make up his salary;

- the amount of net income;

- the amount of additional payments and bonuses;

- deductions and deductions.

The amount of payment according to payslips includes: salary, overtime, payment for work on holidays, sick leave, etc.

Most organizations still do not issue such documents to employees on a monthly basis, which is formally considered an offense.

The payslip is provided not only by the main employer, but by the head of the enterprise where the employee works part-time.

The document can also be obtained by home-based employees or employees collaborating with the company remotely.

What should you do if you don’t give information about your salary at work?

The Labor Code provides for mandatory notification of employees about the payment of wages, indicating the accrued amounts, bonuses, deductions and the total amount of earnings.

Failure to issue pay slips will be considered an unlawful action that entails administrative liability.

In this case, the employee should contact the accounting department of his organization with a request to issue pay slips, which is obliged to do this.

If such a request is ignored, you can contact the labor inspectorate of your city. When conducting an audit at an enterprise and establishing the fact of non-issuance of salary slips, the employer and the employee responsible for issuing them will be subject to administrative liability in the form of fines.

Liability and penalties for non-delivery

If it is established that Article 136 of the Labor Code of the Russian Federation has not been fulfilled in terms of issuing slips, namely the absence of written notifications to employees about the accrual of wages, allowances and deductions, monetary fines will be imposed on the organization.

According to the Code of Administrative Offences, such a violation is punishable by:

- for officials a fine of 1,000 to 5,000 rubles;

- for entrepreneurs a fine of 1,000 to 5,000 rubles;

- for legal entities a fine of 30,000 to 50,000 rubles.

In the case of a secondary offense, the amount of the fine increases for officials to 10,000 rubles, for legal entities to 70,000 rubles.

Features of compiling and issuing an electronic pay slip

In the conditions of the information society and computer technology, a number of employers have a desire to switch to issuing paperless pay slips - in electronic form. However, this can only be done in addition to the main issuance method.

Article 312.1 of the Labor Code of the Russian Federation allows you to send a leaflet by email only to remote workers. Any accounting program has the ability to generate salary information in the form of a payslip and send it by e-mail to employees.

If the employee does not work remotely, issuing a “settlement” is the responsibility of the employer and must be done within the prescribed period in paper form.