What is bankruptcy procedure

An organization is declared insolvent by an arbitration court if it is impossible to satisfy the monetary claims of the company's creditors.

The process sometimes takes a long period and is regulated by Federal Law No. 127-FZ dated October 26, 2002. The start of a lawsuit does not always lead to the liquidation of a company, and it is quite possible to receive a salary in the event of bankruptcy of an enterprise. During the trial, judges have the right to order the following procedures:

- observation;

- financial recovery;

- external management;

- bankruptcy proceedings;

- settlement agreement.

At each of these stages, the employer continues to function. External or internal managers try to restore the solvency of the organization, and if this succeeds, the salaries of those working during the bankruptcy of the enterprise are even indexed, and people are paid all the money they worked out.

What should employees do if the organization’s management claims that there is no money to pay for labor?

Order of payments to employees in bankruptcy

From the moment bankruptcy proceedings begin, the manager is removed from office. The bankruptcy trustee begins to deal with the dismissal.

The process of terminating employment contracts may take a long time. The courts believe that in this case, employees have the right to count on 2/3 of their earnings due to downtime, despite the fact that they do not actually perform work duties.

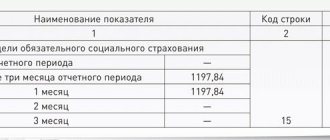

Depending on the moment of occurrence of wage arrears, two types are distinguished:

| Type of salary arrears | Moment of debt occurrence | Payment order |

| Current | After the court accepts a bankruptcy petition | Second (after paying for bank services) |

| Registry | Before the court accepts the said application | Debts under the register are repaid by court decision after payment of the current debt. Payments by an employee according to the register also correspond to the second priority |

Debts are repaid taking into account the chronology of their occurrence, i.e. first the earliest ones, then the later ones.

Why does the bankruptcy process begin?

The bankruptcy case is considered by the arbitration court. An application to declare a debtor insolvent is accepted by the arbitration court for proceedings if the total volume of claims against the debtor exceeds 300,000 rubles.

Both the company's creditors and its manager have the right to initiate recognition of an employer as insolvent (Articles 7-9 of 127-FZ). From September 2020, wage debtors have the right to file bankruptcy petitions, provided that:

- the court decision to collect arrears of wages and severance pay has entered into force;

- the amount of debt is at least 300,000 rubles;

- the period of non-payment exceeds three months.

In order to prevent the accumulation of debts and further bankruptcy of employers, the authorities invite employees to contact Rostrud regarding non-payment of wages. Inspectors, thanks to Federal Law dated December 2, 2019 No. 402-FZ and Federal Law dated December 2, 2019 No. 393-FZ, have the opportunity to collect debts for mandatory payments within the framework of labor relations without litigation. The decisions of inspectors on the forced execution of the obligation to pay accrued wages were equated to executive documents, and on the basis of such documents, banks are obliged to write off funds from the accounts of companies in favor of employees.

If the debts are not covered, the decision on enforcement will be transferred to the FSSP. And the bailiffs will begin to collect the debt.

Types of salary debts in bankruptcy

All salary debts of a bankrupt enterprise are divided into two types:

- Current. These are debts for wages accrued after the date of initiation of bankruptcy proceedings by the arbitration court. It is considered initiated from the moment the court issues a ruling to accept the application for declaring the debtor bankrupt.

- Registered. These are salary debts incurred before the above date.

The duration and procedure for paying wages in bankruptcy depends on the type of debt.

Let us note that when we talk about salary debts, we mean not only the salary itself, but also other amounts due to the employee as remuneration: bonuses, allowances, vacation pay, as well as severance pay. Although such debts in bankruptcy have payment priority over most other debts of the enterprise, the employee may not receive his money at all, but the likelihood of receiving a salary for the current debt is higher than for the registered one.

Determining the type of debt is simple: you need to use the online service “Card Index of Arbitration Cases”, where you can find a bankruptcy case by the name of the organization and look at the date of the relevant determination.

What happens to employees

In labor law there is no basis for dismissal due to the commencement of bankruptcy proceedings. This is due to the fact that declaring a company insolvent does not always lead to its liquidation. In the course of measures taken by management or an appointed arbitration manager, the solvency of the organization is sometimes restored, and wage debts in the event of bankruptcy of the enterprise are repaid according to a certain schedule.

If the termination of activities is expected, then the employees will face dismissal due to the liquidation of the organization (clause 1 of Article 81 of the Labor Code of the Russian Federation). In this case, the employee must be notified of the upcoming dismissal at least two months in advance.

After the introduction of bankruptcy proceedings and the appointment of a bankruptcy trustee by the court, all responsibilities of the manager are transferred to him. He has a month to notify employees of the upcoming dismissal.

Protecting the interests of workers, labor legislation provides the following guarantees:

- payment of wage arrears in case of bankruptcy of an enterprise;

- payment for unused vacation;

- provision of severance pay in the amount of average monthly earnings;

- preservation of earnings for the duration of employment, but no more than two months from the date of dismissal, with severance pay included.

If an employee doubts whether the salary debt will be paid if the employer is bankrupt, and does not want to wait for management to overcome all difficulties, he has the right to resign of his own free will or by agreement of the parties.

Guarantees for dismissal due to liquidation

If a company plans to cease to exist, it has certain responsibilities to its staff. She must pay debts for the work done in any case (Article 130 of the Labor Code of the Russian Federation). Also, in the event of liquidation, the organization is obliged to:

- Notify the employee of the upcoming dismissal at least 2 months before the date of separation (Article 180 of the Labor Code of the Russian Federation);

- Pay the average monthly salary to personnel whose employment contracts are terminated due to liquidation;

- Retain the average earnings for the second month following dismissal for those dismissed;

- Pay the average salary for the third month after dismissal, if confirmation is received from the employment service. To do this, the employee must register as unemployed within 2 weeks after dismissal.

Attention! The company has the right to terminate the employment relationship with the employee by mutual agreement before the expiration of a two-month period after the warning. In this case, she must additionally pay him two months’ average earnings (Part 3 of Article 180 of the Labor Code of the Russian Federation).

Despite the fact that payment of wages in the event of bankruptcy of an organization, as well as the above-mentioned compensations, is guaranteed by law, due to the unfavorable financial condition of the employer, their transfer does not always occur on time. As a result, a significant part of the accruals due to staff becomes the company's debt to them.

How to get paid if your employer goes bankrupt

The question that worries the company’s employees who continue to work and are fired in this situation is: will they pay wages if the company goes bankrupt, and when?

Typically, solvency problems, including wage arrears, arise in an organization long before the bankruptcy procedure is introduced. And Article 130 of the Labor Code of the Russian Federation guarantees payment of wages to employees in this case. But if an enterprise goes bankrupt, the laws do not say how to receive a salary. It is only indicated that the debt is divided into:

- current (arising after the procedure was introduced);

- registry (arising before the start of the procedure).

All debt of an organization declared bankrupt is repaid in order of priority. First, current debts are repaid, and then the debt included in the register of creditors (registry). A special procedure applies for inclusion in the register of wage debts incurred before the company was declared bankrupt. Employees do not need to take any action (apply to court, collect evidence of debt, etc.). The arbitration manager provides information for inclusion in the register of wage debts independently, based on the organization’s accounting documents.

Debts are repaid using property (cash and other assets). At the same time, the general order of debt repayment is observed. According to Article 855 of the Civil Code of the Russian Federation, wages are paid secondarily after payment of debt under enforcement documents for the collection of alimony and harm to life and health.

According to the law, employees have a high chance of collecting the resulting salary debts. If the bankrupt’s property turns out to be insufficient to pay off all the salary arrears, then it will be repaid to each employee in proportion to the amount of the debt after paying off current debts and paying off the priority registered debt.

How to collect registered wage debts

Wage debts accrued before the initiation of bankruptcy proceedings are included in a special register of creditors, which includes all debts, with the exception of current ones. It is usually conducted by an arbitration manager or a special registrar organization. Salary debts, like others, are included in the register by the manager or (on his recommendation) by the registrar.

If an employee has a writ of execution or a court order to collect a registered salary debt, you need to contact the arbitration manager directly with the document. Moreover, it is advisable to do this regardless of whether the employee is sure that his requirements are in the register or not. There is no point in contacting bailiffs, since with the onset of bankruptcy, enforcement proceedings against the enterprise will be suspended.

If there is no writ of execution, the employee can check whether his salary is included in the register by sending an official request to the arbitration manager for an extract from the register. The request is sent to:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

- By registered mail with a description of the attachment.

- Strictly at the address of the arbitration manager indicated on the portal of the federal register of information on bankruptcy.

The specified register of information will be useful to anyone who is interested in how to collect wages in bankruptcy, since all the details of the procedure are displayed there (including information about inclusion in the register).

In the event of a dispute about the amount of debt owed to an employee, the latter will have to go to the district court, since only a court decision can confirm its amount and serve as the basis for including the disputed debt in the register.

General procedure for establishing priorities for payments in bankruptcy

After the arbitration manager has accepted all applications and demands from creditors, he has compiled a complete register of such claims, and begins direct work on settlements with creditors in the following order:

| Sequence | Types of creditor claims | Reason: Law “On Bankruptcy” (Federal Law No. 127) | |

| Payments outside the main priority (current payments that arose after the organization began bankruptcy proceedings) | |||

| 1st stage | Various costs associated with the prevention of man-made/environmental disasters that may result from the cessation of activities of a bankrupt company | Article one hundred thirty-four, paragraph one | |

| 2nd stage | 1. legal expenses for the current bankruptcy, payment of monetary remuneration to the external manager, payment for the work of employees involved in the work of the arbitration manager (whose work is mandatory under current legislation) | Article one hundred thirty-four, paragraph two | |

| 2. payment of wages to employees (under employment contracts) working after the declaration of bankruptcy | |||

| 3. payment of wages to employees who were hired by the arbitration manager (except for those indicated in the first and second paragraphs) | |||

| 4. payments for utility expenses, if they are absolutely necessary for the operation of a bankrupt company | |||

| 5. other current payments | |||

| Principal payments (occurred before the organization began bankruptcy proceedings) | |||

| 1st stage | Requirements related to liability for causing harm to the life and health of individual citizens | Article one hundred thirty-four, paragraph four | |

| 2nd stage | Requirements for payments upon dismissal and arrears of wages to employees working under employment contracts, as well as payment of arrears under copyright contracts | ||

| 3rd stage | Settlements with all other creditors (net liabilities, taxes and fees, etc.) | ||

- Creditors and claims that are satisfied first.

These requirements include:

- any costs and payments associated with maintaining and complying with environmental, radiation and other safety standards, which may be associated with technological processes and conditions in which the bankrupt enterprise operates.

Current payments in bankruptcy

- all costs associated with the judicial arbitration process. This includes not only the payment of remuneration to the arbitration (competition) manager in the amount of 30,000 rubles. Legal costs also include costs associated with attracting various experts and specialists to conduct a full-fledged bankruptcy trial. Also paid are the expenses caused by the need to conduct an accounting examination of the financial statements of a bankrupt company, attracting audit companies and appraisers. In addition, this also includes those expenses that directly ensure the sale of the debtor’s property at special auctions - commissions and rewards for auction trading platforms and houses.

Accounting for bankruptcy expenses

- expenses and payments associated with providing a company or enterprise with the necessary utility infrastructure - water supply, heat, electricity, etc.

- The second priority of creditors and their requirements include:

- Payment of all arrears of wages to company personnel with whom there are concluded employment agreements or contracts. Also, all severance and social benefits to employees are paid from the funds of the bankrupt company, including payments for sick leave and other financial obligations to employees.

- expenses for mandatory payments to budgets of all levels are various federal, regional and municipal taxes. This also includes payments to extra-budgetary funds, such as the Pension Fund or NPF, FSS (Social Insurance Fund) and MHIF (Compulsory Health Insurance Fund).

Note. Particular attention should be paid to current taxes, since the bankruptcy law introduces special rules for their payment. Only payments for the unified social tax are made out of turn, which is specifically stipulated in clause 5 of Art. 134 of the Bankruptcy Law. When transferring to the budget amounts of personal income tax withheld from employees' wages, the debtor acts as a tax agent. Therefore, the established priority of payments for the debtor does not apply to cases of transfer to the budget of amounts of personal income tax (NDFL), which must be paid as wages are paid to employees. The remaining taxes calculated in bankruptcy proceedings are paid after the repayment of all debts according to the register

- The third priority for satisfying creditor claims includes: payments on loan obligations, debts to partner companies and contractors. The order of priority for the distribution of debt payments among this category of creditors is determined by the arbitration manager, based on the timing of obligations, the amount of outstanding debt, as well as the time of filing or receiving the corresponding application from the creditor.

Sale of bankrupt property at auction

If, in the event of bankruptcy of a debtor company, all its available material or monetary resources are not enough to fully repay debts to creditors of all three priority levels, then in this case

The law establishes a procedure for repaying the following priority financial obligations:

- Payment of compensation for sick leave and other disability compensation to company employees.

- Remuneration of employees, including existing debt for previous periods.

- Payments of taxes to budgets of all levels, as well as to extra-budgetary funds.

Payment of taxes in case of bankruptcy of a company

- Debts to other creditors are paid from the remaining funds.

The reduction cannot be paid: to whom only part of what was earned will be returned

All employees of the enterprise should, of course, receive the delayed wages. However, there are situations when the assigned payments require revision rather than satisfaction. This applies to those whose salary increased before bankruptcy or 6 months before that.

Such cases may be a coincidence, or they may be recognized as a transaction on the eve of bankruptcy and challenged. Often, such moments are accompanied by complaints against the arbitration manager from the labor inspectorate. An employee whose salary increased just before bankruptcy writes a paper, and the inspectorate looks into the situation.

And in such circumstances, it is necessary to be on guard, not for the employee, but for the manager, for whom an appeal to the “trudoviks” is an additional “bell” about the increase in payments. It is also worth noting that the “showdown” between the labor inspectorate and arbitration managers is “in the wrong place.” There is no relationship between the arbitrator and the employees, which means that the complaints were written “in vain.”

If the arbitration court grants the manager’s request, the employee’s salary will be reduced to the level “before the increase”, and the remaining difference will move to the end of the queue and will be paid if there is money left after paying off the claims of the remaining creditors.

In what cases does the order of payments to employees change?

If severance pay or other compensation upon dismissal is established by the employment contract in an increased amount, then the part of the debt exceeding that established by Art. 178 of the Labor Code of the Russian Federation, amount of severance pay:

- does not apply to the requirements of the second stage;

- repaid after satisfying the interests of third-priority creditors.

Such cases, paragraph 3 of Art. 136 of Law No. 127-FZ allows for certain officials of the debtor and its branch (representative office):

- the head and his deputies;

- chief accountant and his deputies;

- members of the collegial executive body.

The court, upon application of the bankruptcy trustee, has the right to revise the amount of payments in favor of employees. If the salary in the organization was increased six months before going to court to declare the company bankrupt, in the second place they will pay off the salary arrears without taking into account the increase, and they will try to pay the difference after paying off the debts to third-priority creditors (Clause 4 of Article 136 of Law No. 127-FZ ).

Changing the order of payments allows the manager to satisfy as many claims as possible from different creditors as part of the bankruptcy procedure.