Office management is a living, constantly changing area, into which new terms come every now and then. Recently, entrepreneurs, accountants and employees have come across the increasingly common concepts of “gross salary” and “net salary”. These terms indicate completely different amounts of the same salary.

We will try to explain below how to figure out what the differences between these phenomena are, whether it is possible to calculate one, knowing the other, how to navigate, what exactly is meant when offering this or that form of wages.

Origin of names

Initially, the terms “gross” and “net” go back to Latin, but their economic use is determined by their meanings in English.

Where does "gross" come from?

The word “gross” in English, where it came from in our economic vocabulary, has been used in the context of money since the 16th century. It transferred its meaning of “something general, total, total” to the calculation of finance. There are several meanings of this concept.

- "Gross". In the 16th century, English businessmen used the expression “gross profit,” that is, total profit not cleared of gross expenses and tax components. Today, instead of it, “total profit” is more typical for the English language. Thus, the first meaning of the epithet “gross” in the entrepreneurial sphere is similar to the Russian definition of “gross”.

- "Wholesale". Another meaning of this term, also going back to its “universality”, is transactions related to the trade in large quantities of goods - “gross”. In English, buy “by the gross” means a wholesale deal.

- "No deductions." The total composition of the salary, before the deductions required by law are made from it, is also “gross”. This is the meaning used in modern entrepreneurial vocabulary.

What about "net"

In Russian transcription, the word “no” in relation to salary does not sound very optimistic. But you need to take into account the English meaning of this word, which originates from the Italian “netto”, which means “pure”.

Along with the term “gross profit”, the antonymous “net profit” was also used, which, in turn, meant net profit, from which all consumable components were already excluded.

Today, the term “net” in relation to wages means the amount received by the employee in person.

Which is more profitable?

Today it is difficult to unambiguously answer the question of which form of remuneration will be the most profitable. It seems that the matter concerns single-digit amounts, since taxes must be paid.

However, when viewing advertisements offering work, it is better to immediately pay attention to the salary indication. Increasingly, it is done in gross, which leads to misunderstandings on the day of receiving the first paycheck.

You can take the following example:

- one company offers a designer position and a gross salary of 37,000 rubles;

- the second company needs a designer with a net salary of 34 thousand rubles;

- in the first case, after deducting income tax, the employee will receive 32,190 rubles;

- in the second case, he will receive 1810 rubles more. In addition, his total income is 27,586 rubles.

True, a certificate of your gross salary helps you get other dividends. Large numbers create prestige and a favorable impression, especially important for partners or credit institutions.

A considerable salary makes it easier to resolve financial problems and take out loans from your bank. Now the salary is transferred to the card and banks receive fairly comprehensive information.

If there is a small discrepancy of several thousand, it is better to go with the net option. The gross can be confident that he will receive exactly the salary that was indicated.

First of all, it doesn’t hurt to establish exactly what the actual amount will be paid. Here it’s better to dot all the i’s right away, because the employer has the right to use both gross and net.

It is better to immediately choose the best option before signing the contract. The amount is easy to figure out using simple mathematical calculations. You should immediately add other deductions and tax deductions to them.

Definitions of salary types

Salaries for hired personnel in Russia consist of the following components:

- salary;

- various allowances, if provided for by law and the employment contract;

- bonus or other incentive (if provided and/or deserved).

Wages constitute the main form of income for individuals, therefore they are subject to income tax - personal income tax. This factor is the determining factor in the difference between “gross” and “net” wages.

Gross salary in accounting refers to the amount of remuneration for an employee’s work, which includes all components of the salary, including personal income tax. Colloquial synonyms – “Salary according to documents”, “dirty salary”, “black salary”, “gross”.

Net-salary is a monetary amount from which all mandatory tax payments (NDFL) are excluded, that is, the amount of money received by an employee as payment for labor (at the cash register or on a bank card). Colloquial synonyms: “salary in hand”, “clean”, “white salary”.

Overview of concepts

The confusion stems more from ignorance of two concepts that have become firmly established over the past few years.

Not every employee has a clear idea of how many taxes and fees the employer needs to pay before wages are issued. Deductions must constantly flow to tax authorities and extra-budgetary funds. Delays may result in penalties and even suspension of activities.

When signing an agreement in the past, the amount that should remain after payment of mandatory contributions was usually indicated.

So what is the difference between the notorious gross and net:

- The term gross provides for an accurate and complete salary, which includes literally all tax and insurance deductions, taking into account the regional or district coefficient.

- In the future, mandatory payments, including income tax, are automatically withheld. Today it is 13 percent.

- Tax rates are differentiated and depend on the category of workers, working conditions, and place of residence. Tax deductions cannot be discounted; they will also affect the final salary figure.

- The concept of net means that exactly the amount specified in the advertisement and clause of the contract will be issued. It takes into account contributions required by the employer.

- The main difference is income tax, which will also be withheld unless we are talking about the income of an individual entrepreneur.

In fact, before deductions are made, the gross salary is indicated, and after deductions, the net salary is indicated. There is a clear analogy with the usual gross and net. But before you accept job offers, it doesn't hurt to do some calculations.

How to avoid getting confused as an employee

The documents formalizing the relationship with the employer indicate the gross salary, that is, the official salary. This happens because it is the employer who is obliged to be a tax agent for his subordinate - to calculate and deduct the required amount of taxes from all wages even before they are paid to the employee himself, and also to report this to the tax authorities.

Sometimes the “gross” amount is indicated in hiring advertisements - after all, a more impressive amount is more attractive to applicants, and not everyone knows the meaning of the term. Thus, formally the advertisement does not contain false information, while the employee will receive a significantly smaller amount than he read.

IMPORTANT! If you are attracted by the number in the advertisement indicating the size of your future salary, do not rush to rejoice at the generous offer; check whether the employer means “gross” or “net”.

What is net

Salary net is the amount received by an employee monthly in person or on a card after the fact. We are talking about the money that goes to a person after taxes and contributions have been deducted. The term “net” is used to designate such a salary.

Most employees are required to pay personal income tax equal to 13 percent, that is, this amount will be deducted from the “dirty” salary.

Thus, net salary is actually the money due to the employee.

"Black" and "white"

It is no secret that black and white salaries are also popularly referred to as the amount “in the envelope” and the legal salary, respectively. An entrepreneur can pay “gross” to staff, and reflect a smaller amount in documents in order to reduce insurance payments and taxes for themselves. At first glance, it is more profitable for an employee to receive an amount from which personal income tax is not collected monthly. However, in fact, by not transferring the necessary funds to the Pension Fund, the employer “robs” the employee’s future pension. In addition, “black wages” is an economic crime, and if detected by tax authorities, it is seriously punishable.

We count “gross” and “net”. Specific calculation examples

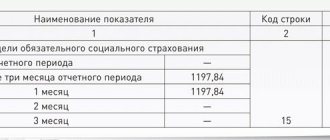

Since the difference between these types of payroll is directly related to income tax, its rate matters. For residents of the Russian Federation - the majority of employees who receive monthly salaries - it is 13%. If the salary is paid to a non-resident, 33% will have to be deducted from it monthly.

Therefore, knowing any of the indicators, you can calculate the required amount.

Let's look at specific numbers for Russian resident employees.

For example , the amount of gross salary specified in the employment contract is 100 thousand rubles. This means that the employee will receive 100,000 minus 13% every month, that is, the net salary will be 87 thousand rubles.

The calculation is the other way around: the employee received 15,800 rubles on his salary card.

How can I find out how much income tax my employer has deducted from me? To do this, we multiply the net salary by a coefficient of 0.87 (100%-13% personal income tax), and then compare the resulting values. So, 15800 x 0.87 = 13746, and then subtract 15800 - 13746 = 2054. Thus, the monthly amount of personal income tax is 2,054 rubles.

Salary Net: what is it?

Net is the real salary that the employee will be able to receive at the end of the month. Usually the amount that is indicated in the job advertisement and will be paid for labor resources.

Let's look at an example:

- An advertisement was posted indicating wages of 40 thousand rubles per month. This amount will be paid to the employee monthly, without any calculations. It is worth noting that this type of wage is gradually becoming a thing of the past, and most employers do not use such wages. It is worth remembering these points, and if you have any doubts about what type of salary is in the advertisement, carefully read its contents or call the phone number indicated in the advertisement and clarify all the details that interest you.

It is worth remembering that for this type of salary is set within the tax rate, which is 13% (for those who are registered in the Russian Federation) and 30% (for individuals registered in other states). Also, the tax amount may be less than the established norm, which is influenced by such significant factors as:

- presence of parents of disabled children in the organization;

- presence of military personnel;

- presence of guardians;

- presence of employees with minor children.

A question of benefit

Employees often ask which salary is more profitable, “gross” or “net”. Meanwhile, this formulation of the question is not entirely correct, since this is in fact the same value, the same indicator, simply presented in different forms. The amount of the salary expressed in “gross” is numerically greater than in “net”, but this is not important for the employee, since he will still receive the amount of money from which income tax has already been deducted, no matter how it is reflected in the financial documentation and employment contract.

NOTE! If you are a future or currently employed employee and are faced with the terms “gross” and “net” in relation to your potential salary, do not miss this important point so as not to experience disappointment, having received at the end of the month significantly less than you expected, and absolutely legal.

How much do you get in your hands?

Entrepreneurs try to indicate gross, since the salary level is growing and the amount looks quite impressive. In fact, the situation does not look so rosy.

It is enough to consider it with a simple example:

- an employee will be offered a gross salary of 50,000 for work in one company, and a net salary of 45,000 rubles in another;

- after deducting income tax, in the first case no more than 43,500 rubles will be issued, in the second - the salary remains unchanged;

- However, with gross or net, other deductions can be made, which can be one-time or permanent (this can be associated, for example, with the payment of alimony or loans);

- We must not forget that the gross usually includes other contributions, because the employer here acts more like a tax inspector.

You will have to take into account many criteria in order not to make mistakes when hiring.