How to secure a contract?

When concluding a contract, each party wants to receive certain guarantees. The buyer does not want the seller to refuse to complete the transaction or transfer the goods to another person. The seller, in turn, fears the buyer’s refusal.

To ensure that the parties avoid refusal before concluding a contract, the Civil Code provides for a number of measures. Among them:

- deposit;

- prepayment.

Each of the concepts includes the transfer by the buyer to the seller of a certain amount of money to pay for the contract and the receipt of a receipt.

An alternative option for securing a transaction is collateral. It involves the transfer not of cash, but of an object of material value (real estate, vehicle, jewelry). However, this option is used less frequently in practice.

Advance is what percentage of salary?

Most often we find this word in combination with the term wages.

In the modern labor code, the definition of an advance is not given, but it is generally accepted that an advance is a salary for the first half of the month.

Exactly how the advance should be calculated by the employer, and in what dates it should be issued, is indicated in the enterprise’s collective agreement, or employment agreement.

The rules for advance payments have been preserved since the times of the USSR, but are still in effect today.

The amount of the advance payment should not be less than the tariff rate for the period worked by the employee. We can say that an advance is not a percentage of wages , but payment for a period already worked.

It, according to the Ministry of Labor, is a smaller part of the salary, and takes into account all allowances, for example:

- for combining positions;

- work in difficult working conditions;

- replacing an absent employee.

But incentive bonuses are not taken into account when calculating the advance payment, since they are calculated taking into account the employee’s work for the entire month.

If you still need to clarify how much the advance on salary is as a percentage, the answer will be: no less than 40% of the employee’s basic salary.

Another definition of an advance is closely related to the previous one; it is compensation for expenses given to an employee by an employer when he is sent on a business trip or when transferred to work in another place.

The advance payment can be spent on transport services or for any business needs.

If we are talking about a business trip, after its completion the employee reports for how the advance payment was spent.

Briefly about the deposit

The most popular option for securing a transaction is a deposit

. The procedure for its provision is provided for in Article 380-381 of the Civil Code of the Russian Federation.

Features of the deposit:

- the amount is counted towards payment;

- the amount of payment is symbolic;

- the deposit is of a security nature;

- the transfer of funds is formalized in writing;

- when transferring a large sum, you can attract witnesses from each side;

- if there is a preliminary agreement, the deposit ensures the conclusion of the agreement on its terms;

- if the seller refuses to complete the transaction, then he returns double the amount;

- if the initiator of the refusal is the buyer, then the deposit remains with the seller;

- If, by refusing to complete a transaction, one party caused damage to the other, then the amount of damage is subject to payment, taking into account the deposit.

Important!

If a receipt for the transfer of the deposit is not issued, the amount paid is considered an advance.

When will a received payment not be considered an advance for VAT purposes?

Let's look at the interpretation of the norms of Chapter 21 of the Tax Code of the Russian Federation

10/04/2016

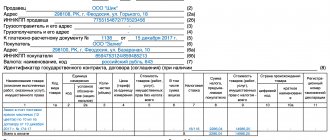

Obligation to issue invoices when receiving an advance

Based on paragraph 1 of Art. 54 of the Tax Code of the Russian Federation, taxpaying organizations calculate the tax base at the end of each tax period on the basis of data from accounting registers and (or) on the basis of other documented data on objects subject to taxation or related to taxation. This obligation does not bypass VAT payers either.

In accordance with Art. 163 of the Tax Code of the Russian Federation, the tax period (including for taxpayers acting as tax agents) for VAT payers is established as a quarter.

For the purpose of calculating the tax base for VAT (clause 2 of Article 153 of the Tax Code of the Russian Federation), proceeds from the sale of goods (work, services), transfer of property rights are determined based on all income of the taxpayer associated with settlements for payment for these goods (work, services), property rights received by him in cash and (or) in kind, including payment in securities.

Paragraph 1 of Article 154 of the Tax Code of the Russian Federation states that, as a general rule, when a taxpayer receives payment or partial payment for upcoming supplies of goods (performance of work, provision of services), the tax base is determined based on the amount of payment received, taking into account tax.

At what point should the taxpayer determine this tax base?

In paragraph 1 of Art. 167 of the Tax Code of the Russian Federation states that the moment of determining the tax base, unless otherwise provided by paragraphs 3, 7 - 11, 13 - 15 of this article, is the earliest of the following dates:

- day of shipment (transfer) of goods (works, services), property rights;

- day of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights.

That is, if you have received an advance payment for goods (work, services), then you, as the seller, must issue an invoice for the advance payment (clause 1 of Article 168 of the Tax Code of the Russian Federation).

In paragraph 3 of Art. 168 of the Tax Code of the Russian Federation states that when selling goods (work, services), transferring property rights, as well as upon receiving amounts of payment, partial payment on account of upcoming deliveries of goods (performance of work, provision of services), transfer of property rights, the corresponding invoices are not issued later than five calendar days, counting from the day of shipment of goods (performance of work, provision of services), from the date of transfer of property rights or from the day of receipt of payment amounts, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights.

In this case, the invoice must indicate the number of the payment and settlement document (subclause 4, clause 5, Article 169 of the Tax Code of the Russian Federation), on the basis of which the advance payment was received.

The total amount of tax is calculated based on the results of each tax period in relation to all transactions recognized as an object of taxation in accordance with subparagraphs 1 - 3 of paragraph 1 of Article 146 of this Code, the moment of determining the tax base of which, established by Article 167 of this Code, refers to the corresponding tax period, with taking into account all changes that increase or decrease the tax base in the corresponding tax period, unless otherwise provided by this chapter (clause 4 of article 166 of the Tax Code of the Russian Federation).

Can an advance payment be considered if it was received in the same tax period in which the goods (work, services) were sold?

The Constitutional Court of the Russian Federation spoke well about the nature of the advance payment in its Determination No. 318-O dated September 30, 2004: “... the choice of a specific method of payment for goods when making civil transactions depends on the discretion of the parties to the transaction (except when otherwise provided by law ). By virtue of the requirements of the Civil Code of the Russian Federation, payment for the goods sold is allowed both before the actual shipment of the goods to the buyer - advance payment (payment by the advance method), and after the date of actual shipment of the goods - subsequent payment for the goods. The formal difference between the advance payment method and the subsequent payment method is manifested in which of the dates is earlier - the date of receipt of funds for the goods or the date of actual shipment of the goods.

Since the contested provision of subclause 1 of clause 1 of Article 162 of the Tax Code of the Russian Federation uses the concept of advance payments received on account of upcoming deliveries of goods (performance of work, provision of services), then in this case, in order to increase the tax base of the value added tax by the amount of these payments, it is necessary so that the date of receipt by the taxpayer of payments from buyers in payment for goods (performance of work, provision of services) precedes the moment of actual shipment by the taxpayer of goods (performance of work, provision of services) to these buyers.”

The Presidium of the Supreme Arbitration Court of the Russian Federation in Resolution No. 10022/08 of March 10, 2009 noted the following:

“For the purposes of Chapter 21 of the Tax Code of the Russian Federation, an advance payment received by the taxpayer in the same tax period in which the actual sale of goods occurred cannot be recognized as, according to paragraph 1 of Article 54 of the Code, taxpayers-organizations calculate the tax base based on the results of each tax period based on the data accounting registers and (or) on the basis of other documented information about objects subject to taxation or related to taxation.”

This conclusion is repeated by the arbitration courts of lower instances. For example, in the Resolution of the North Caucasus District dated 07/07/206 in case No. A01-638/2015.

In other words, when receiving payment for an upcoming delivery, if the delivery occurred in the same quarter, there is no need to indicate the payment document number in the invoice.

Taxpayers need to take these points into account.

Post:

Comments

Differences in prepayment

Depositing funds before concluding a contract is considered an advance payment.

.

This form of payment is used primarily for payment for work or delivery of goods. The seller provides goods or performs work only after preliminary payment of funds to pay for the contract in whole or in part.

In the case of purchasing goods, for example, the purchase and sale of real estate, prepayment is rarely used. Transferring a significant amount of money to a private person, even with a receipt, is impractical.

Prepayment proves the buyer's desire to conclude an agreement. If the seller accepts funds, he confirms his intentions to sell the goods. The prepayment amount is counted towards payment under the contract.

Register now and get a free consultation from Specialists

Refund of prepayment

You can return previously issued funds:

- if the terms for the provision of services or transfer of property were not met;

- if the goods or service received do not meet the required quality, or if other property is provided that is not the subject of the transaction.

You can return not only the deposited funds, but also request (Article 395 of the Civil Code of the Russian Federation):

- penalty;

- interest on the use of transferred funds (Article 823 of the Civil Code of the Russian Federation);

- compensation for damage (material and moral) resulting from a violation of the agreement.

If the document does not state that the penalty is collected for failure to make an advance payment, then the court will refuse to collect the money, in accordance with the provisions of the agreement.

Features of the advance

In turn, an advance is not a security measure. Advance means funds contributed towards payment under the contract.

Distinctive features of the advance:

- the payment is a partial payment under the contract;

- the advance payment is made for the amount of work that is actually completed (when performing the work);

- the contract must include conditions for making advance payments;

- if you refuse to execute the transaction, the advance payment is refundable in full (upon payment of funds for the goods);

- The procedure for providing an advance is not regulated by law.

If the agreement does not provide for the procedure for making advance payments, then when depositing funds it is necessary to issue a receipt. It is advisable to have the document notarized. Otherwise, an unscrupulous owner may refuse to return the funds.

The concept of advance payment is also provided for in labor law. The Labor Code does not include a precise definition. The law provides for the need to pay employees at least 2 times a month. In practice, advance payment is considered to be payment of wages for the first 15 days of the working month.

The concept of advance in the civil code

Many people come across this concept when completing any transactions for the rental or sale of real estate and other property.

An advance is a certain amount of money that confirms your intentions to purchase any real estate or use a service.

Article 380 of the Civil Code of the Russian Federation specifies only the concept of the term “deposit”, therefore the definition of “advance” follows from the practice of making transactions between individuals or companies.

The main features inherent in this concept:

- It is made as a down payment , but it does not require obligations to complete the transaction;

- Refund of the advance may occur upon first request , regardless of whether the participants agreed to draw up an agreement or not;

- If the agreements fail, the advance amount is paid in full to the buyer;

- Payment of an advance does not require the obligation to draw up a separate document to confirm it; it is enough to include a special clause about the payment made in the main agreement.

It turns out that the concepts of “advance” and “deposit” are very close in meaning , but they have differences in the legal component.

Difference between advance, deposit and prepayment

When purchasing a home, the buyer has the right to make an advance, prepayment or deposit. The main condition is the consent of the owners to accept funds. Let's look at the difference between the payments.

- The advance does not have a security nature. This is a partial payment for the object after the conclusion of the contract. In case of refusal to conclude the transaction, the funds are returned to the buyer. The amount can be any, at the discretion of the parties. In practice, the payment amount is 20% of the contract amount.

- Prepayment ensures the buyer's right to receive the goods. If the conditions are not met, the buyer may demand interest for the use of other people's money. The prepayment amount can reach 100% of the contract price.

- The difference between a deposit is that it is aimed specifically at securing the transaction. If the agreement is violated by the seller, the amount is returned in double amount. The buyer who refuses loses the deposited funds. The amount is not limited, but rarely exceeds 5% of the contract price.

Register now and get a free consultation from Specialists

What is the difference between an advance and a prepayment?

Prepaid expense

– a sum of money or other property that is transferred by the debtor to the second party in order to fulfill the obligation before its occurrence.

In other words, the advance is transferred so that the planned transaction enters the initial stage of its existence. Until the advance is made, the executor or creditor does not begin to fulfill his obligations under the transaction. Prepayment presupposes the fulfillment of an obligation assumed by the responsible person, and it begins to take effect only when the prepayment specified in the agreement is made in cash or by bank transfer.

What is the difference between advance payment and prepayment? An advance involves the contribution of a sum of money or other property to account for the execution of future operations, and it does not serve as security for the conclusion of an agreement. If the obligation has not been fulfilled, the advance must be returned in full, since it does not remain at the disposal of the person responsible for the execution of the contract. The advance plays two roles - on the one hand, although not in all cases, it is a kind of execution of the contract, and on the other hand, it is a guarantee that the customer agrees to the terms of cooperation and is ready to pay the remaining amount of money under the contract. As for the prepayment, it is also made to ensure the transition of the transaction from the initial starting point to the next stage. By prepayment, the customer guarantees that he is ready to cooperate with this contractor and undertakes to pay the second part of the funds on the terms and within the terms established by the contract. It should be noted that, according to the law, prepayment should never be made at the time of implementation of the activities specified in the contract, but only before they begin.

We recommend reading: Confirmation of residence permit 2020 Methods of confirmation

Restrictions on the use of the deposit

The law does not provide restrictions on the use of prepayment and advance payment. However, when making a deposit, you must take into account the following features:

- When concluding a real estate purchase and sale agreement, the contract is subject to state registration in Rosreestr. The document is given legal force only after registration. If the contract includes a requirement for a deposit, then the condition is considered invalid until the documents for registration are submitted. Therefore, upon termination of the agreement, it is illegal to demand their return in double the amount.

- When buying an apartment, you need to study the property documents. All owners must be present when concluding the deposit agreement. If funds are transferred to one of them, in the absence of a power of attorney from the other owners, the transfer of the deposit is considered illegal.

- If the owners carried out redevelopment of the residential premises, information about the work performed must be indicated in the technical documentation. When transferring the deposit, the buyer must read the documents.

When depositing funds with the seller, the buyer should exercise caution. Even written documentation will not help to return funds from an unscrupulous owner. Therefore, it is advisable to involve witnesses and notarize the transfer of funds.

Advance and deposit: what to choose when making a transaction

Today, simply shaking hands is no longer enough to conclude an agreement. For this reason, in the practice of carrying out various transactions, including real estate transactions, deposits and advances are increasingly used. Advance and deposit are the most common methods of prepayment for a transaction. However, people often do not see the difference between a deposit and an advance, and this, in turn, can lead to undesirable consequences for the parties to the transaction. What kind of agreement should be concluded - about an advance or a deposit? To understand, it is necessary to understand the very legal nature of the terms “deposit” and “advance”.

There are several groups of contracts that are considered concluded from the moment of state registration. Such agreements include all transactions with residential real estate. Agreements with non-residential premises and land plots are considered concluded from the moment they are signed. This creates a situation where the inclusion of a provision on a deposit in an agreement that comes into force from the moment of state registration, and the payment of the deposit amount before the state registration of such an agreement will not lead to sanctions provided for by the provisions on a deposit. This is due to the fact that such contracts are considered concluded from the moment of state registration by virtue of clause 3. Article 433 of the Civil Code of the Russian Federation. Fortunately, when such situations arise, the courts tend to recognize this amount as an advance, and it is still returned to the owner, but in this situation you will have to forget about a double return.

We recommend reading: Temporary registration rent