General characteristics of the tax

Excise tax is included in the cost of goods or the tariff for services. So it is actually paid by consumers. When selling products at retail, no tax is allocated. Excise tax acts as one of the key sources of state budget revenue in modern countries. The tax amount for some categories of products can reach half, and in some cases even 2/3 of the cost.

Procedure for calculating excise taxes

The general scheme for calculating excise taxes is based on several basic principles:

- the tax base (TB) for each type of excisable goods (PT) is calculated separately;

- excise tax rates for calculation are taken from Art. 193 Tax Code of the Russian Federation;

- the formula for calculating the amount of excise tax (A) depends on the type of excise tax rate: for PT for which fixed (specific) rates are established:

A = NPT × SArub.,

Where:

NPT - the number or volume of sold PT in physical terms;

SArub. — excise tax rate (in rubles and kopecks per unit of measurement of PT);

- for PT for which ad valorem (interest) rates are established:

A = SPT × A% / 100%,

Where:

CPT - cost of sold PT;

CA% - excise tax rate (as a percentage of the cost).

- for PTs for which combined rates are set:

A = NPT × SArub. + SPT × A% / 100%.

The indicated formulas form the basis for the calculation of excise taxes in most situations with PT, however, in some cases, if the structure of the calculations is similar, specific indicators may be used - you can learn about this in the subsequent sections of our material.

Types of excisable goods

They are determined at the legislative level. According to the Tax Code, the following excisable goods are provided:

- Ethyl alcohol made from non-food and food raw materials, including denatured, “raw”, as well as wine, cognac, grape, Calvados, and whiskey distillates.

- Alcohol-containing products. This category includes excisable goods such as suspensions, solutions, emulsions and other products in a liquid state. The volume fraction of alcohol in them should be more than 9%.

- Alcohol products. It includes alcoholic beverages, vodka, cognacs, wine (sparkling, fruit, liqueur), wine drinks, beer and products made on its basis, and other liquids in which the alcohol content is more than 0.5%. The exception to this list is food products.

- Tobacco products.

- Motorcycles with engine power greater than 150 hp. With. (112.5 kW).

- Cars.

- Automotive gasoline.

- Motor oils for injection (carburetor) and diesel engines.

- Diesel fuel.

- Straight-run gasoline. It includes fractions that are obtained as a result of processing gas condensate, oil, associated petroleum and natural gas, coal, oil shale and other raw materials, products of their processing, except petrochemical products and gasoline.

- Household heating oil, which is produced from straight-run or secondary diesel fractions, boiling at a temperature of 280-360 degrees.

This list of excisable goods is considered closed.

How to determine the amount to be paid to the budget when importing excisable goods

We will consider separately the methodology for determining the amount of excise duty payable when importing PT:

- for PTs subject to mandatory marking;

- PT not subject to labeling.

The amount of excise duty calculated using the methods below is paid at customs.

The product is not subject to marking

When calculating excise tax on unlabeled PT, the following methodological aspects must be taken into account:

NB - is defined as the volume (quantity) of PT in physical terms (as of the date of their reflection on account 41 “Goods”);

SA - only fixed (specific) rates (TSA) are applied, the value of which is specified in Art. 193 of the Tax Code of the Russian Federation (domestic excise rates).

Formula for calculating excise tax (A):

A = V (K) × TCA,

where V (K) is the volume or quantity of PT imported from abroad in physical terms.

The product is subject to mandatory labeling

Tobacco and alcohol products (except for beer, beer drinks, cider, poire and mead) must be labeled.

The calculation of excise obligations is carried out according to the methods described above, depending on the applied rates (clause 2 of article 186.1 of the Tax Code of the Russian Federation):

- at combined rates (for cigarettes and cigarettes);

- at fixed (specific) rates (for other imported food products).

Study the application of various tax rates using articles prepared by specialists on our website:

“Tax rate under the patent tax system”;

“What are the tax rates for personal income tax in 2014–2015?”.

Exceptions

The following are not recognized as excisable goods:

- Medicines that have passed state registration and have been included in the relevant register of medicines. These include products, including homeopathic ones, which are manufactured by pharmacies according to prescriptions and requirements of medical institutions, packaged in containers in accordance with the requirements of regulatory documents agreed upon by the authorized executive federal body.

- Veterinary drugs included in the state register, developed for use in livestock farming in Russia. They must be bottled in containers no larger than 100 ml.

- Perfume and cosmetic products with a volume of no more than 100 ml and an alcohol content of up to 80% inclusive, or up to 90% if there is a spray bottle on the bottle, or bottled in containers up to 3 ml.

- Waste intended for subsequent use for technical purposes or subject to processing, generated during the production of ethyl alcohol from vodka, food raw materials, alcoholic beverages and complying with regulatory documents approved by the federal executive body.

- Beer, fruit, grape must, wine materials.

General procedure for calculating the tax base

Once the excise tax rate has been determined, calculate the tax base for each type of excisable goods. Currently, for all excisable goods (except for cigarettes and cigarettes), the tax base is determined as the volume of sold (transferred) excisable goods in kind. In this case, the volume of excisable goods sold should be calculated in those units of measurement that are indicated in the excise tax rate.

This procedure follows from the provisions of Article 187 of the Tax Code of the Russian Federation.

If an organization sells goods of the same type, but with different excise tax rates, determine the tax base separately for each subtype of products sold (transferred), in relation to each rate (clause 1 of Article 190 of the Tax Code of the Russian Federation). To do this, it is necessary to maintain separate records (clause 2 of Article 190 of the Tax Code of the Russian Federation). If maintaining such records is impossible, tax all sold (transferred) products at a single tax rate. It must be determined based on the maximum excise tax rate provided for a given type of goods. This is stated in Article 190 of the Tax Code of the Russian Federation

An example of determining the tax base for excise duty when selling one type of product for which different tax rates are established

Alpha LLC produces beer of various strengths. Thus, Alpha’s assortment includes the following varieties:

- non-alcoholic beer (with a volume fraction of ethyl alcohol up to 0.5 percent);

- beer (with a volume fraction of ethyl alcohol from 0.5 to 8.6 percent);

- strong beer (with a volume fraction of ethyl alcohol over 8.6 percent).

Each of these three groups of beer has different excise tax rates.

If Alpha keeps separate records of beer transactions across these three groups, then to calculate the excise tax it must determine three tax bases and apply the appropriate rates to them.

If Alpha does not maintain separate accounting, it will have to determine a single tax base for beer. Then calculate the excise tax based on the maximum excise tax rate provided for beer (37 rubles per 1 liter).

An example of determining the tax base for the sale of excisable goods for which a fixed excise tax rate has been established

Alpha LLC produces beer. In July, the organization sold 500 bottles of beer (with an alcohol content of 0.5 to 8.6 percent by volume). Of the total number of beer bottles sold, 400 bottles were 0.5 liters and 100 bottles were 0.33 liters. The contractual cost of goods sold is 23,600 rubles. (including VAT - 3600 rubles, excise tax - 3495 rubles). The excise tax rate for beer with an alcohol content by volume from 0.5 to 8.6 percent is set at 20 rubles. for 1 l.

Alpha's accountant made the following entries in the accounting.

In July:

Debit 62 Credit 90-1 – 23,600 rubles. – revenue from beer sales is reflected;

Debit 90-3 Credit 68 subaccount “Calculations for VAT” – 3600 rubles. – VAT is charged on sales proceeds;

Debit 90-4 subaccount “Excise taxes” Credit 68 subaccount “Calculations for excise duties” - 4660 rubles. ((400 bottles × 0.5 l + 100 bottles × 0.33 l) × 20 rub./l) – excise tax is charged on the sale of beer.

Objects of taxation

The following actions are recognized as them:

- Sales of excisable goods on the territory of the country by persons producing them. It also includes the sale of collateral and the transfer of products under an agreement on the provision of novation or compensation.

- Sales by subjects of ownerless or confiscated excisable products transferred to them in accordance with court decisions and sentences of arbitration and other authorized bodies, as well as goods that have been abandoned in favor of the state and which must be converted into municipal/state property.

- Transfer of products on the territory of the Russian Federation by persons producing them from customer-supplied raw materials to the owner of the latter or other persons. This operation also includes the receipt of ownership of these excisable goods in payment for the service of their production.

- Transfer of products within the enterprise structure for subsequent production of products that are not subject to taxation. The exception is the receipt of straight-run gasoline for the further manufacture of petrochemical products in an organization that has a certificate of registration of the entity carrying out the relevant operations.

- Transfer by persons producing excisable goods of manufactured products to the authorized capital of a company, mutual funds as a contribution under the terms of a simple partnership agreement.

- Import of products subject to taxation into the customs territory of the Russian Federation.

- Transfer by an organization producing excisable goods of manufactured products to its participant upon his exit from the company, as well as upon the allocation of his share from the common property (in a simple partnership).

- Production of denatured alcohol by an enterprise that has permission to produce non-alcohol-containing products.

- Transfer of manufactured products for processing on a toll basis.

- Obtaining straight-run gasoline from an enterprise that has a certificate for its processing.

Taxpayers and objects

In Art. 179 of the Tax Code of the Russian Federation indicates all persons who are payers of excise tax. These may be:

- companies;

- individual entrepreneurs;

- citizens who transport excisable products through customs control and are determined by customs legislation.

Objects of taxation are presented in Art. 182 of the Tax Code of the Russian Federation. These are transactions performed with excisable goods. It can be:

- sale of manufactured products in the Russian Federation;

- certain types of product transfer;

- transportation of products through customs control.

At the same time, in Art. 182 of the Tax Code of the Russian Federation states that the sale of excisable products is an operation that involves the transfer of ownership rights from one party to another, free of charge or for a fee.

Important point

The taxpayer sets the maximum value independently for each brand. The entity is obliged to submit a notification about the maximum prices to the control body at the place of its registration no later than 10 days from the beginning of the month from which they will be used. The established maximum value specified in the notice cannot be changed during the reporting period.

How to determine excise tax rates on excisable goods

Every year there is a review and establishment of new values. Typically, such operations are carried out 2-3 years in advance so that manufacturers can plan their cash and commodity turnover. There are usually three types of bets:

- Specific, they are hard. They are distinguished by a fixed markup for each unit of delivery. They are installed most often and currently apply to all types of products except tobacco. For example, in 2020 in Russia one liter of sparkling wine must be paid additionally at the rate of 40 rubles.

- Ad valorem. They vary, depend on the price of the product itself, and are calculated as a percentage. Now they are actually not used.

- Combined. From the name it is clear that they include both accrual systems. This happens, for example, with cigarettes. There is a single rate (at the moment it is 1966 rubles for every thousand cigarettes), in addition to this, 14.5% of the price of the pack is charged. It is for this reason that prices for cheap tobacco itself are so high.

What kind of tax is an excise tax and in what proportion do excise taxes apply to different types of budgets of the Russian Federation

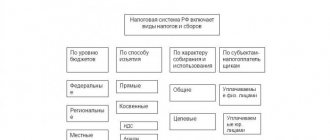

To figure out what type of taxes excise taxes are , let’s use the diagram:

Excise taxes belong to the group of taxes “federal taxes” and for certain objects of taxation and excisable goods are subject to credit:

- entirely to the budget of the Russian Federation (for cars, tobacco, ethyl alcohol, etc.);

- partially to the budget of the Russian Federation and the budgets of its constituent entities (motor oils, motor gasoline, etc.);

- entirely to the budget of the constituent entities of the Russian Federation (for household heating fuel, alcohol with a strength of less than 9%, etc.).

The articles posted on our portal will introduce you to the peculiarities of the structure of tax systems in different countries:

“Tax system of the Russian Federation: concept, elements and structure”;

"Tax system of the USA and other foreign countries".

What is included in the state indirect tax system besides excise taxes?

Let us dwell on the 2 main taxes that, together with excise taxes, are included in the group of indirect taxes - VAT and customs duties.

When comparing excise taxes with VAT, one can note the characteristics that distinguish them, for example:

- individualization of rates - for excise taxes, rates are set in different amounts for specific groups of transactions or excisable goods, while VAT rates are limited to three values (0, 10 and 18%) and are applied to a wide range of goods (works, services);

- types of tax rates - for excise taxes, fixed, ad valorem and combined rates can be applied, while VAT is always set only as a percentage of the tax base;

- relation to the production process - excise taxes have no relation to production costs and do not depend on them in any way, and VAT is levied on the value formed at each stage of production of any product (work, service);

- other distinctive features.

A comparison of excise taxes with customs payments shows that, unlike VAT, customs duties are similar to excise taxes in terms of individualization of rates, but depend not only on the type of goods (imported, exported or moved through the territory of the Russian Federation), but also on the country of issue and specific conditions established by interstate contracts.

How to choose and input excise taxes on excisable goods

In a normal batch purchase situation, the tax amount should be included in the wholesale cost of the product. If excise raw materials were used for the production of another, secondary product, then the costs for it were included in expenses, which means that the amount of costs can be reduced. Under conditions:

- the tax base for raw materials and the final result must be of a single volume;

- First, you should actually pay the tax in full, and then take advantage of the tax deduction opportunity;

- You will need official documentary evidence of transactions - invoices, customs declarations and other documents.