Service farms

In addition to their core activities, large enterprises often maintain infrastructure facilities that are not directly related to the production of their main products. We are talking about canteens for workers, rest homes, dispensaries, kindergartens, etc. The records may also include dormitories or even apartment buildings for employees.

The result of the activities of service organizations may be intended for:

- ensuring main and auxiliary production;

- ensuring the socio-cultural needs of workers (kindergartens and nurseries, boarding houses, rest homes);

- production and sale of products for the purpose of making a profit.

There are the following types of sources of financing for service farms:

- self-sufficiency;

- partial or full financing by the parent organization;

- membership fees or shares;

- state full or partial financing in the form of grants, subsidies, budgetary allocations;

- charitable contributions.

Types of service industries and farms

Housing and communal services

If there are houses, apartments, or dormitories on the company's balance sheet, accounting is carried out object by object and in the context of each cost item. This may include depreciation of fixed assets, salaries and taxes of personnel, expenses for repairs and maintenance of the building and local area, utilities and others. Income from running such a household can consist of payments received from residents, rental of premises, subsidies from the state, and charitable assistance (non-operating income of the enterprise).

Ateliers, repair shops

Account 29 will accumulate material costs for the purchase of components, depreciation of production premises and equipment, utilities, personnel salaries, taxes, etc. Provided that such workshops operate without loss, income from their activities also goes to the account of non-operating income.

Canteens, buffets

If the accounting policy provides for food for employees, then the expenses of such departments can be classified as direct costs and invested in the cost of production. Account 29 will allocate expenses in the field of public catering, which are sold by the canteen/buffet to employees and the population. Perhaps the canteen dates back to the enterprise and operates only for its employees and there is no income after the close of the period. In this case, the resulting losses are compensated by the profits remaining after taxes.

Children's preschool institutions

If the organization has a nursery or kindergarten on its balance sheet, then account 29 collects the entire list of expenses for the facility: depreciation of the building and equipment, staff salaries, utilities, etc. The indicated costs are not always covered by funds paid by employees as subscription fees. Most often, such activities are financed from budgetary allocations, or by the parent enterprise from the profits remaining at its disposal.

Sanatoriums, holiday homes

Many enterprises maintain sanatoriums, sports facilities, museums and others for their employees. The costs of such institutions are maintained on an objective basis. Income received from the sale of vouchers, cultural events, and sports competitions are quite capable of covering the costs of maintaining such facilities and are reflected in the reporting in the section of non-operating or income from non-core activities.

Non-profit organizations

These include cooperatives, gardening partnerships, credit, and insurance societies, in which, although membership fees are provided, the purpose of creating such enterprises is not initially to obtain commercial profit. The costs of such organizations correspond to the “Targeted Financing” account without affecting the section of profit and loss accounts.

Postings to account “29”

By debit

| Debit | Credit | Content | Document |

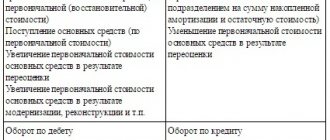

| 29 | 02.01 | Calculation of depreciation on a fixed asset item, which is accounted for on account 01 and is used in service industries and farms | Regular operation |

| 29 | 02.02 | Calculation of depreciation on a fixed asset item, which is accounted for on account 03 and is used in service industries and farms | Regular operation |

| 29 | 04.01 | Calculation of depreciation on an intangible asset that is used in service industries and farms. Depreciation is calculated by paying off the original cost of an intangible asset | Regular operation |

| 29 | 04.01 | Calculation of depreciation on an intangible asset that is used in service industries and farms. Depreciation is calculated by paying off the original cost of an intangible asset | Regular operation |

| 29 | 05 | Calculation of depreciation on an intangible asset that is used in service industries and farms | Regular operation |

| 29 | 10.01 | Adjustment of the cost of raw materials and supplies written off as expenses of service industries and farms | Regular operation |

| 29 | 10.01 | Write-off of the cost of raw materials and materials for the costs of service industries and farms | Request-invoice |

| 29 | 10.02 | Write-off of the cost of purchased semi-finished products, components, structures and parts for the costs of service industries and farms | Request-invoice |

| 29 | 10.02 | Adjustment of the cost of purchased semi-finished products, components, structures and parts written off as expenses of service industries and farms | Regular operation |

| 29 | 10.03 | Adjustment of the cost of fuel written off as expenses of service industries and farms | Regular operation |

| 29 | 10.03 | Write-off of the cost of fuel for the costs of service industries and farms | Request-invoice |

| 29 | 10.04 | Adjustment of the cost of packaging and packaging materials written off as costs of service industries and farms in organizations engaged in production activities or provision of services | Regular operation |

| 29 | 10.04 | Write-off of the cost of packaging and packaging materials for the costs of service industries and farms in organizations engaged in production activities or provision of services | Request-invoice |

| 29 | 10.05 | Adjustment of the cost of spare parts written off as expenses of service industries and farms | Regular operation |

| 29 | 10.05 | Write-off of the cost of spare parts to the costs of service industries and farms | Request-invoice |

| 29 | 10.06 | Adjustment of the cost of other materials written off as expenses of service industries and farms | Regular operation |

| 29 | 10.06 | Write-off of the cost of other materials to the costs of service industries and farms | Request-invoice |

| 29 | 10.08 | Adjustment of the cost of building materials written off as expenses of service industries and farms | Regular operation |

| 29 | 10.08 | Write-off of the cost of building materials for the costs of service industries and farms | Request-invoice |

| 29 | 10.09 | Inclusion of the cost of inventory and household supplies into the costs of service industries and farms upon transfer to operation | Transfer of materials into operation |

| 29 | 10.11.1 | Write-off of the cost of special clothing as expenses of service industries and farms during their useful life | Regular operation |

| 29 | 10.11.1 | Write-off of the cost of special clothing from use to the costs of service industries and farms | Disposal of materials from service |

| 29 | 10.11.2 | Write-off of the cost of special equipment from operation to the costs of service industries and farms | Disposal of materials from service |

| 29 | 10.11.2 | Write-off of the cost of special equipment as expenses of service industries and farms during the useful life | Regular operation |

| 29 | 19.04 | Inclusion of VAT on acquired material assets in the expenses of service industries and farms to which material assets were previously written off | VAT distribution |

| 29 | 20.01 | Return of raw materials and supplies previously released for main production | Operation |

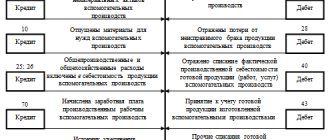

| 29 | 23 | Write-off of the share of actual costs of auxiliary production (shops) to the expenses of service industries and farms | Operation |

| 29 | 41.01 | Write-off of the cost of goods as expenses of service industries and farms | Request-invoice |

| 29 | 41.04 | Write-off of the cost of purchased products to the costs of service industries and farms | Request-invoice |

| 29 | 43 | Write-off of the cost of finished products for the expenses of service industries and farms | Request-invoice |

| 29 | 60.01 | Including the services of third-party organizations in the expenses of servicing industries and farms. Reflection of debt to the supplier for services rendered under the contract in rubles. | Receipts (acts, invoices) |

| 29 | 60.21 | Including the services of third-party organizations in the expenses of servicing industries and farms. Reflection of debt to the supplier for services rendered under the contract in foreign currency | Receipts (acts, invoices) |

| 29 | 60.31 | Including the services of third-party organizations in the expenses of servicing industries and farms. Reflection of debt to the supplier for services rendered under the contract in monetary units. | Receipts (acts, invoices) |

| 29 | 68.06 | Inclusion of land tax in the costs of service industries and farms | Regular operation |

| 29 | 68.07 | Inclusion of transport tax in the costs of service industries and farms | Regular operation |

| 29 | 68.08 | Inclusion of property tax in the costs of service industries and farms | Regular operation |

| 29 | 69.01 | Write-off of the amount of insurance premiums to the expenses of service industries and farms in the part transferred to the Social Insurance Fund | Payroll |

| 29 | 69.02.1 | Write-off of the insurance part of the labor pension for expenses of service industries and farms | Payroll |

| 29 | 69.02.2 | Write-off of the amount of the funded part of the labor pension for expenses of service industries and farms | Payroll |

| 29 | 69.02.3 | Write-off of contributions for additional pension payments to flight crew members as expenses of service industries and farms | Payroll |

| 29 | 69.03.1 | Write-off for expenses of service industries and farms the amount of insurance premiums in the part transferred to the federal compulsory medical insurance fund | Payroll |

| 29 | 69.03.2 | Write-off of the amount of insurance premiums to the expenses of service industries and farms in the part transferred to the territorial compulsory medical insurance fund | Payroll |

| 29 | 69.04 | Inclusion in the expenses of service industries and farms of the amount of the unified social tax in the part transferred to the Federal budget | Payroll |

| 29 | 69.05.1 | Write-off of the amount of voluntary contributions to the funded part of the labor pension at the expense of the employer for the expenses of service industries and farms | Payroll |

| 29 | 69.11 | Inclusion in the expenses of service industries and farms of expenses for compulsory social insurance against accidents at work and occupational diseases | Payroll |

| 29 | 69.12 | Inclusion in the expenses of service industries and farms of expenses for voluntary contributions to the Social Insurance Fund for insurance of employees in case of temporary disability | Payroll |

| 29 | 69.13.1 | Inclusion in the expenses of servicing industries and farms of expenses from the Social Insurance Fund for policyholders paying UTII | Payroll |

| 29 | 69.13.2 | Inclusion in the expenses of servicing industries and farms of expenses from the Social Insurance Fund for insurers using the simplified tax system | Payroll |

| 29 | 70 | Payroll calculation for employees of service industries and farms | Payroll |

| 29 | 71.01 | Inclusion in the expenses of service industries and farms of the amount of expenses incurred by the accountable person in rubles. | Advance report |

| 29 | 71.21 | Inclusion in expenses for expenses of service industries and farms of the amount of expenses incurred by the accountable person in foreign currency | Advance report |

| 29 | 73.03 | Inclusion in the costs of service industries and farms of the amount of accrued compensation to workers for the use of a personal car to perform transport work | Operation |

| 29 | 76.01.1 | Write-off of payments for property and personal insurance to the expenses of servicing industries and farms in rubles. | Receipts (acts, invoices) |

| 29 | 76.01.2 | Write-off of payments for voluntary insurance of employees to the expenses of service industries and farms | Receipts (acts, invoices) |

| 29 | 76.02 | Write-off for expenses of servicing industries and farms the amount of claims not satisfied by arbitration or court (against electricity, water supply organizations, etc.) in rubles. | Receipts (acts, invoices) |

| 29 | 76.05 | Inclusion in the expenses of servicing industries and farms of the services of other suppliers and contractors under the contract in rubles. | Receipts (acts, invoices) |

| 29 | 76.21 | Write-off of payments for property and personal insurance in foreign currency to the expenses of servicing industries and farms | Receipts (acts, invoices) |

| 29 | 76.22 | Write-off for expenses of service industries and farms the amount of claims not satisfied by arbitration or court (against electricity, water supply organizations, etc.) in foreign currency | Receipts (acts, invoices) |

| 29 | 76.25 | Inclusion in the expenses of service industries and farms of services of other suppliers and contractors under a contract in foreign currency | Receipts (acts, invoices) |

| 29 | 76.32 | Write-off for expenses of servicing industries and farms the amount of claims not satisfied by arbitration or court (against electricity, water supply organizations, etc.) in c.u. | Receipts (acts, invoices) |

| 29 | 76.35 | Inclusion in the expenses of servicing industries and farms of the services of other suppliers and contractors under a contract in c.u. | Receipts (acts, invoices) |

| 29 | 94 | Inclusion in the costs of service industries and farms of the amount of identified shortages within the limits of natural loss norms | Operation |

| 29 | 96.01.1 | Attribution to the expenses of service industries and farms of the recognized estimated liability for upcoming vacations (expenses for the formation of a vacation reserve) | Accrual of estimated liabilities for vacations |

| 29 | 96.01.2 | Attribution to expenses of service industries and farms of the recognized estimated liability for upcoming vacations in the part transferred to the Social Insurance Fund, Compulsory Medical Insurance Fund and Pension Fund of the Russian Federation (expenses for the formation of the vacation reserve) | Accrual of estimated liabilities for vacations |

| 29 | 96.09 | Attribution of the recognized estimated liability (expenses for the formation of the reserve) to the expenses of servicing industries and farms | Operation |

| 29 | 97.01 | Inclusion in the costs of service industries and farms of a portion of future expenses for labor remuneration | Regular operation |

| 29 | 97.21 | Inclusion of part of the expenses of future periods into the costs of service industries and farms | Regular operation |

| 29 | 97.21 | Inclusion of part of the expenses of future periods into the expenses of service industries and farms | Regular operation |

Analytics and subaccounts

Analytical accounting for account 29 involves opening a number of sub-accounts. The organization independently determines the number and composition of second-order accounts - this is done based on the specifics of its accounting policies.

The chart of accounts for account 29 provides for the following sub-accounts (by types of service farms listed above):

- 29.1 Housing and communal services;

- 29.2 Production of consumer services for the population;

- 29.3 Catering establishments;

- 29.4 Children's preschool institutions;

- 29.5 Institutions for cultural and social purposes;

- 29.6 Other production and facilities;

- 29.7 Non-commercial activities.

What about debit and credit

The debit of account 29 reflects:

| Direct costs associated directly with the production of products, performance of work and provision of services | They write off to account 29 from the credit of accounts for inventory accounting, settlements with employees for wages, etc. |

| Expenses of auxiliary production | Write off to account 29 from the credit of account 23 “Auxiliary production” |

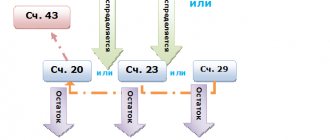

On the credit account 29 reflect the amounts of the actual cost of completed products, work performed and services rendered. They are written off from account 29 to the debit of the accounts:

- accounting for material assets and finished products produced by service industries and farms;

- accounting for the costs of divisions - consumers of work and services performed by service industries and farms;

- 90 “Sales” (when selling to third-party organizations and individuals works and services performed by service industries and farms), etc.

The balance of account 29 at the end of the month shows the value of work in progress.

As part of analytical accounting, transactions on account 29 are carried out for each service production and enterprise and for individual items of their costs.