Purpose of auxiliary production

At large enterprises, the organizational structure may include auxiliary units that service the main production and, as a rule, do not produce products.

For example, auxiliary industries include:

- energy workshops for electricity, gas, steam and other various types of energy;

- transport services for transport services;

- OS repair shops;

- workshops for the production of building parts, tools, spare parts or enrichment of building materials in construction organizations;

- auxiliary units for the construction of non-title structures;

- mining of stone, gravel, sand, including other non-metallic materials;

- logging and sawmilling;

- salting, drying, canning agricultural products, etc.

However, ancillary industries may also provide services to third party customers.

The costs of auxiliary production can be direct, that is, for direct activities, and partially indirect for management and maintenance.

Types of service industries and farms

Housing and communal services

If there are houses, apartments, or dormitories on the company's balance sheet, accounting is carried out object by object and in the context of each cost item. This may include depreciation of fixed assets, salaries and taxes of personnel, expenses for repairs and maintenance of the building and local area, utilities and others. Income from running such a household can consist of payments received from residents, rental of premises, subsidies from the state, and charitable assistance (non-operating income of the enterprise).

Ateliers, repair shops

Account 29 will accumulate material costs for the purchase of components, depreciation of production premises and equipment, utilities, personnel salaries, taxes, etc. Provided that such workshops operate without loss, income from their activities also goes to the account of non-operating income.

Canteens, buffets

If the accounting policy provides for food for employees, then the expenses of such departments can be classified as direct costs and invested in the cost of production. Account 29 will allocate expenses in the field of public catering, which are sold by the canteen/buffet to employees and the population. Perhaps the canteen dates back to the enterprise and operates only for its employees and there is no income after the close of the period. In this case, the resulting losses are compensated by the profits remaining after taxes.

Children's preschool institutions

If the organization has a nursery or kindergarten on its balance sheet, then account 29 collects the entire list of expenses for the facility: depreciation of the building and equipment, staff salaries, utilities, etc. The indicated costs are not always covered by funds paid by employees as subscription fees. Most often, such activities are financed from budgetary allocations, or by the parent enterprise from the profits remaining at its disposal.

Sanatoriums, holiday homes

Many enterprises maintain sanatoriums, sports facilities, museums and others for their employees. The costs of such institutions are maintained on an objective basis. Income received from the sale of vouchers, cultural events, and sports competitions are quite capable of covering the costs of maintaining such facilities and are reflected in the reporting in the section of non-operating or income from non-core activities.

Non-profit organizations

These include cooperatives, gardening partnerships, credit, and insurance societies, in which, although membership fees are provided, the purpose of creating such enterprises is not initially to obtain commercial profit. The costs of such organizations correspond to the “Targeted Financing” account without affecting the section of profit and loss accounts.

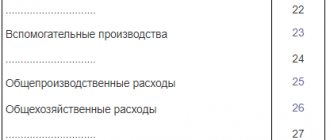

Account 23 in accounting

To account for the costs of auxiliary production in accounting, calculation account 23 is used:

- the debit of the account records the costs of auxiliary production;

- the loan reflects the actual cost of auxiliary production services provided to the main production or third-party customers;

- The account balance at the end of the month shows the value of work in progress:

Analytical accounting for accounting account 23 is carried out by type of production.

What is count 29 for?

According to the Chart of Accounts (order of the Ministry of Finance of the Russian Federation dated October 31, 2010 No. 94n), account 29 “Service production and facilities” exists to collect information on expenses incurred by divisions, the products (works) of which are not (are) the main one (are) for the enterprise , but serves (serves) to ensure the social and economic sphere.

Service industries include:

- housing and communal services divisions;

- repair departments servicing buildings and equipment not related to the production of main products;

- dormitories;

- canteens;

- kindergartens;

- sanatoriums, boarding houses, recreation centers;

- motor transport units (for example, intended for transporting employees to their place of work), etc.

For information on how to draw up a working chart of accounts for accounting, see the material “Working chart of accounts for accounting - sample 2015” .

On the debit side, account 29 reflects costs directly related to the products of service departments, in correspondence with the accounts of inventories, salaries, etc. Costs of auxiliary departments are debited to account 29 from the credit of account 23.

At the end of the month, the costs accumulated on account 29 are written off, depending on the accounting policy and economic essence of the expenses, to the accounts of inventory and finished products of service departments, to the expense accounts of other departments using their services, or to account 90 “Sales” (if the products are sold to third parties consumers).

Analytical accounting for account 29 is carried out by each division and by cost item. To reflect such internal movement of funds, they use a posting from debit 29 to credit 29 .

For more information on accounting for the costs of service departments, see the material “Service industries and farms. Income tax" .

Postings to account 23 “Auxiliary production”

Correspondence and main entries for the “Auxiliary Production” account are presented in the table below:

| Dt | CT | Wiring Description | A document base |

| 08.03/01 | 23/08.03 | Capitalization of OS from your repair shop | OS-1, 301-APK |

| 10 | 23 | Cost of services for delivery of materials from suppliers | 134-APK, 4-P, 4-S, 301-APK |

| 15 | 23 | Reflection of auxiliary production services when procuring materials | Calculation of distribution of services, 301-APK |

| 20.03 | 23.01 | Reflection of the repair of equipment/mechanisms of industrial (auxiliary) production in your repair shop | 302-APK |

| 21 | 23.01 | Own semi-finished products taken into account | 264-APK, Report on distribution of services |

| 23 | 23 | Counter services of auxiliary productions | 301-APK, Accounting certificate |

| 28 | 23 | Attribution of the cost of rejected products (works/services) of auxiliary production | Product defect report, Accounting certificate |

| 29 | 23 | Attribution of the cost of work/services of auxiliary production for servicing production facilities/farms | 301-APK, TTN, etc. |

| 41 | 23 | Capitalization of auxiliary production products | Accounting certificate, Acceptance note |

| 23 | 68 | Calculation of payments to road funds | Accounting information |

| 23 | 69 | Calculation of the unified social tax to the Social Insurance Fund, Pension Fund, etc. | T-49, Calculation of determining the share of the single tax, Accounting certificate |

| 23 | 70 | Calculation of wages to employees | T-49,136-APK, 137-APK, etc. |

| 23 | 71 | Payment of various expenses through accountable persons | AO-1 + documents for the purchase of MPZ |

| 23 | 73.03 | Write-off as expenses compensation for the use of personal cars of personnel for production needs | Agreement for the use of personal transport, Accounting certificate |

| 23 | 76.08 | Reflection by the tenant of the rental amount (on the balance sheet) | Lease agreement, Calculation of payments under the agreement, Accounting certificate |

| 23 | 91.01 | Reflection of surplus work in progress | INV-19, Manager's Order |

| 23 | 94 | Inclusion in costs of the cost of missing MC/losses | INV-3, INV-19, Manager's order |

| 23 | 96 | Inclusion in costs of deductions to the reserve for future expenses/payments of auxiliary production | Accounting certificate, Calculations of reserves |

Service farms

In addition to their core activities, large enterprises often maintain infrastructure facilities that are not directly related to the production of their main products. We are talking about canteens for workers, rest homes, dispensaries, kindergartens, etc. The records may also include dormitories or even apartment buildings for employees.

The result of the activities of service organizations may be intended for:

- ensuring main and auxiliary production;

- ensuring the socio-cultural needs of workers (kindergartens and nurseries, boarding houses, rest homes);

- production and sale of products for the purpose of making a profit.

There are the following types of sources of financing for service farms:

- self-sufficiency;

- partial or full financing by the parent organization;

- membership fees or shares;

- state full or partial financing in the form of grants, subsidies, budgetary allocations;

- charitable contributions.

Examples of transactions and postings on account 23

Example 1. Carrying out work for the needs of a third party

Let's say the repair organization Vesna LLC has auxiliary production. Based on the results of the work for Leto LLC, the revenue of the auxiliary workshop amounted to 59,000 rubles, incl. VAT – 9,000 rubles, expenses for performing work – 29,000 rubles.

In Vesna LLC, the performance of work for the needs of a third-party organization is reflected in the following entries in account 23:

| Dt | CT | Transaction amount, rub. | Wiring Description | A document base |

| 23 | 10/70/69 | 29 000 | Costs for work performed are taken into account | 261-APK, 264-APK, 267-APK, 265-APK, 136-APK, 137-APK, T-49, Accounting certificate |

| 62 | 90.01 | 59 000 | Sales revenue taken into account | Repair work acceptance certificate |

| 90.02 | 23 | 29 000 | Expenses written off | Report on the distribution of auxiliary production services, 301-APK |

| 90.03 | 68 VAT | 9 000 | VAT charged | Repair work acceptance certificate |

| 90.09 | 99 | 21 000 | Reflection of the financial result (profit) from sales at the end of the month | Repair Work Acceptance Certificate, Accounting Certificate |

When is the posting debit 29 credit 29 used?

Posting from debit 29 to credit 29 is rarely used in practice. When forming the cost of production and determining financial results, costs written off for production are attributed to a specific type of product, which is reflected in debit 29 credit 29 . The same thing happens with the products of service industries.

Posting from debit 29 to credit 29 is used depending on the accounting policy of the organization. The cost price is calculated both for service industries as a whole and for each type of production separately, forming the corresponding subaccounts, for example 29/pool, 29/buffet, etc. (for example, from debit 29 to credit 29 for subaccounts). At the end of each month, the accountant redistributes expenses, including between service farms. debit 29 to credit 29 is used .

For example, employees of a motor transport workshop live in the organization’s dormitory. At the end of the month, her accountant makes an entry: to debit 29 from credit 29 , writing off expenses on the credit of account 29, the subaccount “Dormitory” to the debit of account 29, the subaccount “Motor transport workshop” and thus forming the cost of production of the motor transport workshop.

Chart of accounts. Account 23 “Auxiliary productions”

Accounting ~ chart of accounts >>

Account 23 “Auxiliary production” is intended to summarize information about the costs of production that are auxiliary (auxiliary) for the main production of the organization. In particular, this account is used to account for production costs that provide:

service with various types of energy (electricity, steam, gas, air, etc.);

transport services;

repair of fixed assets;

production of tools, dies, spare parts; building parts, structures or enrichment of building materials (mainly in construction organizations);

construction of (temporary) non-title structures;

extraction of stone, gravel, sand and other non-metallic materials;

logging, sawmilling;

salting, drying and canning of agricultural products, etc.

The debit of account 23 “Auxiliary production” reflects direct costs associated directly with the production of products, performance of work and provision of services, as well as indirect costs associated with the management and maintenance of auxiliary production, and losses from defects. Direct costs associated directly with the production of products, performance of work and provision of services are written off to account 23 “Auxiliary production” from the credit of inventory accounts, settlements with employees for wages, etc. Indirect costs associated with the management and maintenance of auxiliary production, are written off to account 23 “Auxiliary production” from accounts 25 “General production expenses” and “General business expenses”. If appropriate, production maintenance costs can be taken into account directly on account 23 “Auxiliary production” (without prior accumulation on account 25 “General production expenses”). Losses from defects are written off to account 23 “Auxiliary production” from the credit of account 28 “Defects in production”.

The credit of account 23 “Auxiliary production” reflects the amounts of the actual cost of products completed by production, work performed and services rendered. These amounts are written off from account 23 “Auxiliary production” to the debit of the accounts:

“Main production” - when releasing products (works, services) to the main production;

“Service industries and farms” - when releasing products (works, services) to service industries or farms;

“Sales” - when performing work and services for third parties;

“Output of products (work, auxiliary production) at the end of the month shows the value of work in progress.

Analytical accounting for account 23 “Auxiliary production” is carried out by type of production.

Account 23 “Auxiliary production” corresponds with the accounts

| by debit | on loan |

| 02 Depreciation of fixed assets 04 Intangible assets 05 Depreciation of intangible assets 07 Equipment for installation 10 Materials 11 Animals for growing and fattening 16 Deviation in the cost of material assets 19 Value added tax on acquired assets 21 Semi-finished products of own production 23 Auxiliary production 25 General production expenses 26 General business expenses 28 Defects in production 40 Release of products (works, services) 43 Finished products 60 Settlements with suppliers and contractors 68 Settlements for taxes and fees 69 Settlements for social insurance and security 70 Settlements with personnel for wages 71 Settlements with accountable persons 76 Settlements with various debtors and creditors 79 On-farm settlements 80 Authorized capital 91 Other income and expenses 94 Shortages and losses from 96 Reserves for future periods 97 Expenses of future periods | 07 Equipment for installation 08 Investments in non-current assets 10 Materials 11 Animals for growing and fattening 15 Procurement and acquisition of material assets 20 Main production 21 Semi-finished products of own production 23 Auxiliary production 25 General production expenses 26 General business expenses 28 Defects in production 29 Service production and farms 40 Output products (works, services) 43 Finished products 44 Selling expenses 45 Shipped goods 73 Settlements with personnel for other operations 76 Settlements with various debtors and creditors 79 On-farm settlements 80 Authorized capital 90 Sales 91 Other income and expenses 94 Shortages and losses from damage to valuables 96 Reserves for future expenses 97 Future expenses 99 Profits and losses from damage to expenses |

Accounting ~ chart of accounts >>

How analytical accounting is carried out on account 29: nuances

The account in question is synthetic, and various analytical accounts (or sub-accounts) can be opened within it for the purpose of detailing (additional identification) of business transactions. Analytical accounting for account 29 is carried out in accordance with:

- with industry standards;

- corporate standards.

If we talk about industry standards, the Ministry of Agriculture of Russia recommends using the following subaccounts (Order of the Ministry of Agriculture of Russia dated June 13, 2001 No. 654):

- 29.1 (for accounting for utility costs);

- 29.2 (used by agricultural enterprises to account for expenses aimed at ensuring productivity associated with caring for animals);

- 29.3 (household expenses);

- 29.4 (expenses within the activities of kindergartens on the balance sheet of the organization);

- 29.5 (activities of medical and preventive institutions);

- 29.6 (activities of cultural institutions);

- 29.7 (activity of catering facilities).

At the same time, the enterprise has the right to open any subaccounts to account 29. They must be fixed in the working chart of accounts, which is approved in the accounting policy.

***

An organization, in addition to its main production and those complementing it, may have various service capacities. Those expenses that are incurred on them may be related to the work of the service department for itself, to activities in the interests of other divisions of the company, or aimed at meeting the needs of third parties.

An example of making entries for account 29

Let's consider a situation in which an enterprise runs a children's health camp. Gradually, cost items will be formed that will need to be reflected in accounting data. For example: as a result of the first shift of children’s holidays, the following expenses arose:

- depreciation of fixed assets in the amount of 3200 rubles;

- use of utilities – 21,000 rub. (VAT RUB 3,784);

- staff salary – 100,000 rubles;

- mandatory contributions – 22,000 rub.

Account 29 will be replenished with the following entries:

- Dt 29 Kt 02 for 3200 rub. – reflects the amount of depreciation of the camp property;

- Dt 29 Kt 60 for 17,216 rub. – utility costs are taken into account (excluding VAT);

- Dt 19 Kt 60 for 3784 rub. – accepted for accounting for VAT on utility bills;

- Dt 29 Kt 70 per 100,000 rub. – wages for camp staff were accrued;

- Dt 29 Kt 69 for 22,000 rub. – the amount of contributions to extra-budgetary funds was posted.

Accounting for production costs (in this case, for the provision of educational and health services) was reflected in the debit of account 29. The final result will be written off to account 91.

Typical accounting entries

If we look at typical accounting records, they will look like this:

1) Dt 29

Kt 28 – inclusion of losses from defects in the cost of manufactured goods;

2) Dt 29

Kt 71 – expenses of accountable persons employed in service businesses;

3) Dt 45

Kt 29 – transfer of products produced by the service department to third parties;

4) Dt 80

Kt 29 – transfer of work in progress to service facilities;

5) Dt 97

Kt 29 – costs of the designated division as part of deferred costs.