Linear depreciation formula

For the linear depreciation method, we present formulas that allow us to determine the monthly amount of depreciation (AM) of fixed assets (fixed assets) and intangible assets (IMA) in accordance with the procedure provided for by PBU 6/01, PBU 14/2007 and Ch. 25 Tax Code of the Russian Federation:

| Formula for calculating depreciation using the linear method | ||

| in accounting | in tax accounting | |

| for OS (clause 19 of PBU 6/01) | for intangible assets (clause 29 of PBU 14/2007) | for fixed assets and intangible assets (clause 2 of article 259.1 of the Tax Code of the Russian Federation) |

| AM = C / SPI / 12 where C is the initial or replacement cost of the fixed asset; SPI – useful life of an asset in years | AM = C / SPI where C is the initial or current market value of the intangible asset; SPI – useful life of an intangible asset in months | AM = C * K where C is the initial or replacement cost of an asset or asset; K – depreciation rate of the corresponding object |

How to calculate the depreciation rate using the linear method in tax accounting? This norm, as in accounting, depends on the useful life. Therefore, calculating the depreciation rate using the linear method according to the rules of Ch. 25 of the Tax Code of the Russian Federation looks like this: 1 / SPI * 100%, where SPI is the useful life in months.

Despite the fact that the formulas for calculating depreciation using the linear method in accounting and tax accounting are at first glance different, the procedure for calculating depreciation values is essentially the same.

Therefore, to calculate linear depreciation, the formula for determining the monthly value (A) for simplification can be expressed as follows:

A = C / SPI

where C is the cost of the depreciable object, from which depreciation is calculated;

SPI – useful life of a depreciable object in months.

When is it beneficial to use?

The linear method is often called straight-line, uniform.

Each month the cost of the fixed asset is written off in equal amounts.

When is it convenient? First of all, in cases where the OS object has a long useful life.

For example, in tax accounting, the linear calculation method is even mandatory for buildings, structures, and transfer devices from 8 to 10 depreciation groups.

Thus, the uniform method of deductions is convenient if:

- the asset has a long SPI;

- the characteristics and capabilities of the asset change slowly over time;

- the object is operated evenly throughout its entire service life;

- there is no need to quickly replace or update the fixed asset.

Also, the method is often used by those companies that want to keep the same records for accounting and tax purposes.

The calculation procedure is almost the same, so the differences will be minimal or absent.

Another reason is the organization’s reluctance to understand non-linear methods and to constantly recalculate depreciation.

This is especially true for small enterprises with a small number of fixed assets.

Calculation of depreciation using the straight-line method: example

Let's show how to calculate depreciation using the linear method using an example. It doesn’t matter whether you need to pre-determine the annual amount of depreciation charges in a straight-line manner (as for fixed assets) or whether the monthly amount is immediately calculated, the final values of the monthly amounts in accounting and tax accounting will still be the same.

To confirm, we will provide the calculation of depreciation of a car using the linear method in accounting and tax accounting, and also show how to calculate depreciation using the linear method in accounting for intangible assets (for example, the exclusive right of the author to a computer program).

To calculate depreciation charges using the linear method, we use the same input data for the asset (garbage truck) and intangible asset (exclusive right to the program): the initial cost is 1,750,000 rubles. SPI – 10 years (120 months). In order to determine the amount of depreciation deductions using the linear method, we will use the above formulas.

And we present the calculation of depreciation charges using the linear method in the table:

| The procedure for calculating depreciation using the linear method (example) | ||

| in accounting | in tax accounting | |

| for garbage truck | for exclusive rights to the program | for any of two objects |

| AM = 1,750,000 rubles / 10 years / 12 = 14,583.33 (rubles) | AM = 1,750,000 rubles / 120 months = 14,583.33 (rubles) | |

Straight-line depreciation method - formula

To establish the monthly amount of deductions for depreciable property, you must first determine the depreciation rate separately for each object. When linear depreciation is determined, the formula for calculating deductions for different months will be the same. In all cases, the basis is taken as a valuation equal to the value of the original price. It is broken down over all months of use of the asset using the estimated depreciation rate.

The formula for calculating depreciation using the linear method is as follows:

- Valuation of the object x Norm of deductions for the object

Calculation of the depreciation rate in a linear way is carried out by dividing the unit by the value of the operating period. The time period during which the asset will actually be used is shown in months in the calculations. The straight-line depreciation formula in tax accounting requires the mandatory presence of a coefficient in the form of a deduction rate (the indicator is first converted to a percentage).

The procedure for calculating depreciation using the straight-line method involves the start of deductions not from the date of acquisition of the asset, but from the next calendar month. To derive the annual depreciation value, you must use the rate for one year. The annual amount of depreciation can be determined using the linear method by dividing the unit by the operating period calculated in years.

Linear method of calculating depreciation of fixed assets

The straight-line depreciation method involves writing off the cost of a fixed asset in equal proportional installments over the entire period of its use.

What objects does it apply to?

Each organization has the right to independently choose the method of writing off depreciation charges.

Fixed assets are divided into 10 depreciation groups depending on the time period of their operation. The straight-line depreciation method must be applied to buildings, structures and transmission devices belonging to three groups:

- Group VII - objects with a service life of 20-25 years;

- Group XI – objects with a service life of 25-30 years;

- Group X – objects with a service life of more than 30 years.

For other objects, it is allowed to apply any method of depreciation at the organization’s discretion, as specified in the order on accounting policies.

The straight-line depreciation method can be used both for new property and for objects that were previously in use (operation).

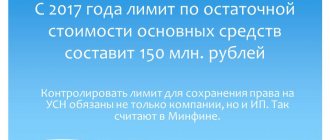

IMPORTANT! Until recently, the chosen depreciation principle could not be changed to another throughout the entire period of deductions for this object. From January 1, 2014, an organization has the right to make a transition from a nonlinear to a linear method once every five years. For the reverse transition - from linear to nonlinear - there are no time restrictions; this can be done at any time, having previously made amendments to the regulations on the accounting policies of the enterprise.

Video - methods for calculating depreciation of fixed assets:

To determine the amount of monthly depreciation deductions using the linear method, it is necessary to know the primary cost of the object, its operational life and calculate the depreciation rate.

Primary cost of the object

The primary cost of the object is used as the basis for calculation, which is calculated by summing up all the costs of its purchase or construction. If the value of the property was revalued, then an indicator such as replacement cost is used for calculation.

Operational period

The operating period is established by studying the classification list of fixed assets, differentiating them into depreciation groups. If the object is not recorded in the list, then its service life is assigned by the organization depending on:

- predicted time of use;

- expected physical wear and tear;

- expected operating conditions.

Depreciation rate formula

The annual depreciation rate is expressed as a percentage of the primary (replacement) cost of the property and is calculated using the formula:

K = (1: n)* 100%,

where K is the annual depreciation rate;

n – service life in years.

If you need to find out the monthly depreciation rate, then the result is divided by 12 (the number of months in a year).

Formula for calculating depreciation

With the linear depreciation method, the calculation formula is:

A = C*K/12,

where A is the amount of monthly depreciation charges;

C – primary cost of property;

K – depreciation rate, calculated according to the formula in paragraph 3.

If you need to calculate the annual amount of depreciation charges, then you do not need to divide by 12 (the number of months in a year), or it is enough to divide the initial cost of the property by its service life.

Depreciation procedure

When calculating depreciation evenly, they are guided by the general rules for making depreciation deductions, namely:

- depreciation must be calculated from the 1st day of the month following the month in which this property was placed on the enterprise’s balance sheet;

- make depreciation charges regardless of financial results;

- make depreciation deductions every month and take them into account in the corresponding tax period;

- grounds for suspending depreciation deductions are considered to be the conservation of an object for a period of 3 months or its long-term repair (more than a year). Contributions resume immediately upon return to service;

- depreciation deductions cease on the 1st day of the month following the month of write-off due to wear and tear, withdrawal from the balance sheet or loss of ownership rights to the property.

The main advantages of the linear depreciation method:

- Easy to calculate. The calculation of the amount of deductions needs to be made only once at the beginning of the operation of the property. The amount received will be the same throughout the entire service life.

- Accurate recording of property write-offs. Depreciation deductions occur for each specific object (in contrast to non-linear methods, where depreciation is calculated on the residual value of all objects in the depreciation group).

- Uniform transfer of costs to production costs. With non-linear methods, depreciation charges in the initial period are greater than in the subsequent period (write-off occurs in descending order).

The linear method is convenient to use in cases where it is planned that the object will generate the same profit throughout the entire period of its use.

The main disadvantages of the linear method:

The method is not advisable to use for equipment subject to rapid obsolescence, since the proportional write-off of its cost does not ensure the proper concentration of resources necessary for its replacement.

Manufacturing equipment is characterized by a decrease in productivity as the number of years of operation increases. As a result, it will require additional costs for maintenance and repairs due to breakdowns and failures. Meanwhile, depreciation will be written off evenly, in the same amounts as at the beginning of operation, since the linear method does not provide otherwise.

For enterprises planning to quickly update production assets, it will be more convenient to use nonlinear methods.

The total amount of property tax over the entire life of the property to which the linear method is applied will be higher than with non-linear methods.

conclusions

The linear method of calculating depreciation assumes that physical wear and tear of the property occurs evenly throughout the entire operational period. This mainly applies to stationary structures, which do not wear out and become obsolete as quickly as equipment.

If it is impossible to accurately determine the rate of depreciation of property, then the linear method will be the most convenient and simplest. This method is also suitable if the company purchases property for a long period of use and does not plan to quickly replace it.

Many people try to find out what profitability is in simple words in order to quickly understand its essence.

How should an order be prepared to appoint someone responsible for fire safety in an office?

Today, when the lighting market pleases us with a wide variety of light sources. An ordinary chandelier on the ceiling or LED lighting for a bicycle no longer seems original and people strive for something new and unusual. And this is where a completely non-standard material comes to the rescue - luminous tape.

This is a special product that will make even the simplest bike look completely different in the dark. Our article will tell you what you should know about this product, as well as how you can illuminate the ceiling or car (wheel tuning, etc.).

Features of the tape

A tape or film that glows in the dark is completely different from the LED products we are used to. The only thing they have in common is a self-adhesive base. The main difference here is that such products accumulate light during the day, and begin to glow in the dark. All luminous products on a self-adhesive basis contain a special material that has light-absorbing or reflective properties. Glow in the dark tape has the following properties:

- accumulation of light energy. Moreover, over a short period of time, quite a significant accumulation of energy occurs;

- long service period;

- no decrease in the brightness of the glow, as well as no deterioration in the color spectrum. Such products will shine quite brightly throughout the entire period of operation;

- the cost is fully compensated by the benefits of the product.

Because of this, luminous tapes are actively used for a wide variety of purposes. They are especially often used for finishing the ceiling and decorating wheels on cars of any brand. With its help you can easily decorate even a bicycle and make it more visible in the dark.

Moreover, the installation here is extremely simple.

Tuning cars

Calculation for used OS

Many enterprises, in the course of their activities, acquire facilities that have previously been used. In addition to non-new property, items that were contributed as a contribution to the authorized capital are regarded as used. This category also includes property that remained at the enterprise after its reorganization.

Depreciation using this method for objects that have already been used is carried out in the same way as for new ones. Therefore, the calculation procedure is similar.

The exception is that used OSes will have a shorter service life. To calculate it, you need to subtract the number of years that the object was used by the previous owner from the service life indicator from the classifier. Further calculations are carried out using the previously described formulas.

Available range

Luminescent film

Today, products that can glow in the dark and be used for a wide variety of purposes (ceiling decoration, staircase lighting, car wheel tuning, bicycle decoration, etc.) come in the following types:

- luminescent or photoluminescent films and tapes. To make such a product, photoluminescent film is used, which is the main light source. Cutting is carried out automatically. In this case, it is allowed to apply a certain image to the base;

- reflective or reflective films. Such a film will reflect the light that was directed onto its surface.

Reflective film

Let's look at what photoluminescent products there are. This type of light-absorbing products today is represented by opaque and transparent varieties. They are made using an adhesive layer. Both options are used to create additional lighting for the ceiling, making the car look impressive (applied to the wheels). You can also use them to decorate a bicycle.

Specifications

Ceiling lighting

Products that have reflective or light-absorbing properties are sold in rolls, but if desired (especially if you need tuning of a car, its wheels or a bicycle), you can cut the products into strips. Also, in cut form, such film can be sold in specialized stores. To know how a tape that can glow in the dark can be used in various areas (for the ceiling, on a bicycle or car, on walls, etc.), it is necessary to find out the technical characteristics of such non-standard products.

Photoluminescent films have the following characteristics:

- film base – PVC;

- energy charging occurs from any light source, be it a light bulb or the sun;

- the film must comply with state standards (GOST R 12.2.143, which was adopted in 2009);

Note! During operation, the light-absorbing tape is safe for animals and people, as well as the environment. But these properties are preserved only in a situation where the film is used for its intended purpose.

Where is it in demand?

Reflective and light-absorbing films have different uses. Today, light-absorbing products are considered more in demand. They are used:

- on the road surface in order to distinguish the road surface from the pedestrian sidewalk at night;

- are applied to the clothing of fire department employees, as well as road transport service employees. In addition, very often such tape is sewn into the clothes of schoolchildren and medical staff;

- as a decoration on a car. Such a film can be applied along the entire body or form a special pattern. Many car enthusiasts decorate their wheels in this way. In addition to cars, such a film is often applied to a bicycle (both its frame and wheels);

Bicycle tuning

- marking trucks in order to make them more visible at night when moving from one city to another;

- marking of roadside posts and road signs.

Note! The most extensive area of application of such products is focused on ensuring greater safety for all road users at night (both pedestrians and vehicles themselves).

This is due to the fact that at night the risk of traffic accidents increases due to insufficient visibility, and the use of lights to illuminate the road is not always possible due to a number of reasons (lack of funding, complex terrain features of the road section, etc.). d.). Today you can even find light-absorbing films in parking lots. As for pedestrians, reflective inserts on clothing (special vests, jackets or pants) make a person much more visible to passing cars. In addition to roads and transport, products of this kind are often found in housing and communal services. For example, such a film today can be applied to flights of stairs, steps, and paths between buildings. It is also actively used for illumination of industrial, warehouse and medical institutions of various profiles. In turn, reflective films have also found wide application in the field of transport and road lighting. When hit by light coming from the headlights, it begins to glow, which serves as a visual signal that there is a road sign or that the road is blocked.

Reflective film

In addition to the areas of activity described above, such products are also quite actively used at home.

Advantages and disadvantages of the linear method

The main advantages of the linear depreciation method:

- Easy to calculate. The calculation of the amount of deductions needs to be made only once at the beginning of the operation of the property. The amount received will be the same throughout the entire service life.

- Accurate recording of property write-offs. Depreciation deductions occur for each specific object (in contrast to non-linear methods, where depreciation is calculated on the residual value of all objects in the depreciation group).

- Uniform transfer of costs to production costs. With non-linear methods, depreciation charges in the initial period are greater than in the subsequent period (write-off occurs in descending order).

Another advantage is that the legislation provides for the possibility of using this method both in accounting and tax accounting, which avoids the occurrence of differences under PBU 18/02.

The linear method is convenient to use in cases where it is planned that the object will generate the same profit throughout the entire period of its use.

The main disadvantages of the linear method:

The method is not advisable to use for equipment subject to rapid obsolescence, since the proportional write-off of its cost does not ensure the proper concentration of resources necessary for its replacement. Manufacturing equipment is characterized by a decrease in productivity as the number of years of operation increases. As a result, it will require additional costs for maintenance and repairs due to breakdowns and failures. Meanwhile, depreciation will be written off evenly, in the same amounts as at the beginning of operation, since the linear method does not provide otherwise. The total amount of property tax over the entire life of the property to which the linear method is applied will be higher than with non-linear methods. For enterprises planning to quickly update production assets, it will be more convenient to use nonlinear methods.

Linear method as a means of calculating depreciation: advantages and disadvantages

The straight-line depreciation method has the following set of advantages:

- Costs are transferred to cost evenly. If you use non-linear methods, then at first the deductions will be more, and then less.

- The write-off of the value of property is taken into account with maximum accuracy. Deductions are tied to each of the objects that are in operation.

- Simple computational circuits. The calculation is carried out only once, when the operation of the facility is just beginning.

As long as the service life is valid, no changes occur to the amount.

Example, wiring

The fixed asset was purchased by the company. The cost indicator is 590,000, of which VAT is 90 thousand rubles. 10 years is the period during which the maximum benefit will be obtained.

Divide 100 percent by 10 to get 10 percent depreciation for the year. 5 tens of thousands of rubles will be the amount of deductions. To calculate, subtract 90 from 590 thousand and multiply the result by ten.

Each month the amount of deductions will be equal to 4167 rubles - this is reflected in the posting.

Depreciation can be calculated in another way; you can see an example in this material.

Example of depreciation calculation.

How to calculate depreciation of fixed assets using the straight-line method

To determine the amount of monthly depreciation charges using the straight-line method, it is necessary to have data on the initial cost of the object, establish the useful life and calculate the depreciation rate.

1. Initial cost of the object

The initial cost of an object is calculated by adding up all the costs of its acquisition or construction.

2. Useful life (operational period)

The useful life (operational period) is established by studying the list (classification) of fixed assets, in which fixed assets are divided into depreciation groups.

If the object is not indicated in the list, then its service life is assigned by the organization depending on:

- predicted time of use;

- expected physical wear and tear;

- expected operating conditions.

3. Formula for depreciation rate

The annual depreciation rate is calculated using the formula:

K = (1: n)* 100%,

where K is the annual depreciation rate;

n – service life in years.

If you need to find out the monthly depreciation rate, then the result is divided by 12 (the number of months in a year).

4. The formula for calculating depreciation using the linear method is as follows:

A = PS*K/12,

where A is the amount of monthly depreciation charges;

PS – primary cost of property;

K – depreciation rate, calculated according to the formula in paragraph 3.

If you need to calculate the annual amount of depreciation charges, then you do not need to divide by 12 (the number of months in a year), or it is enough to divide the initial cost of the property by its service life.

Based on these formulas, it becomes clear that the main difference of this method is the uniform transfer of the value of property to the company’s costs.

Thus, it is advisable to use the linear method of calculating depreciation if economic activity is stable, brings uniform profit and does not require rapid write-off of fixed assets.

Linear calculation is not suitable for calculating wear on quickly worn-out objects, with high intensity of production processes, as well as with premature obsolescence of property.

If new production is being developed, it is recommended to slow down the write-off of wear and tear; and in cases where the organization does not lack cash and can promptly update obsolete assets, accelerated depreciation with subsequent replacement of written-off equipment, machinery, tools, etc. would be optimal.

Example. Straight-line depreciation method

The organization purchased passenger vehicles for RUB 400,000. excluding VAT.

According to the classification rules, the car is included in 3 gr.

The useful life is set at 48 months.

To calculate monthly/annual depreciation amounts, you need to determine the annual depreciation rate and then the depreciation amount.

Annual depreciation rate = 1/4 = 25%;

monthly depreciation rate using the straight-line method, expressed as a percentage = 1/48 = 2.083%.

Monthly depreciation = 400,000 rubles. x 2.083% = 8332 rub.

Annual depreciation = 400,000 rubles. x 25% = 100,000 rub.

If the initial cost of the fixed asset and the useful life in tax accounting are established similar, the organization will recognize a monthly expense in the same amount when calculating the income tax base.

Linear calculation formula

Knowing the cost and operating term, as well as calculating the annual depreciation rate, you can make a subsequent calculation. For these purposes, a linear depreciation formula is used, into which known variables must be inserted.

The formula itself looks like this:

A = C * K / 12

Wherein:

- A – the amount of monthly depreciation;

- C – the initial cost of a specific fixed asset;

- K is the annual rate, which is determined using the formula presented above.

As a result of applying this formula, it is possible to calculate how much is to be written off during the month in the form of depreciation. If the result of multiplying indicators C and K is not divided by 12, the amount to be written off within 1 year will be known.

Basics of the method on video:

Postings for calculating depreciation using the straight-line method

When calculating depreciation, standard entries should be made monthly depending on where the fixed asset or intangible asset is used. The accounts used depend not only on the type of depreciable property (for loan 02 - for fixed assets, and 05 - intangible assets), but also on the type of its use. For example, depreciation of industrial objects is reflected, as a rule, in the debit of account 20, and trade organizations usually accrue depreciation in the debit of account 44. The attribution of depreciation to expenses in accounting is reflected by the following entries:

- Debit of account 20 Credit of account 02 - reflects the write-off of depreciation of the object for the main production.

- Debit of account 23 Credit of account 02 - reflects the write-off of depreciation of an auxiliary production facility.

- Debit of account 25 Credit of account 02 - reflects the write-off of depreciation of an object for general production purposes.

- Debit of account 26 Credit of account 02 - reflects the write-off of depreciation of a general purpose object.

- Debit of account 44 Credit of account 02 - reflects the write-off of depreciation of the object of trading companies.

- Debit of account 91 Credit of account 02 - reflects the write-off of depreciation for an object leased.

- Debit of account 20 (23, 25, 26, 44) Credit of account 05 – the write-off of depreciation for intangible assets is reflected.

Methods and methods for calculating depreciation

Depreciation of fixed assets is calculated in accordance with the Regulations on the procedure for calculating depreciation of fixed assets and intangible assets, approved by the resolution of the Ministry of Economy, the Ministry of Finance, the Ministry of Statistics and Analysis, the Ministry of Architecture and Construction of the Republic of Belarus on January 24, 2003. No. 33/10/15/1.

The straight-line method consists in the organization evenly (over the years) accruing depreciation over the entire standard service life or useful life of the fixed asset item. The rates for calculating depreciation in the first and each of the subsequent years of the operation life of an object for one balance holder or owner are the same. A discrepancy between these standards is possible in cases of changes in the operating conditions of the facilities (shift ratios of machinery and equipment, the environment in which they are operated, other deviations from the established basic operating modes and other conditions in accordance with current legislation). With this method, the annual amount of depreciation is determined based on the depreciable cost of the fixed asset and the standard service life or useful life of it by multiplying the depreciable cost by the accepted annual linear depreciation rate.

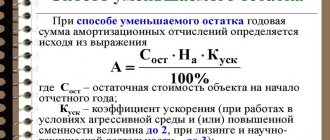

The non-linear method consists in the organization's uneven (over the years) accrual of depreciation over the useful life of a fixed asset item. For calculating depreciation using this method, the objects are the following: transmission devices; workers, power machines and mechanisms, equipment (including communications equipment); computer and office equipment; vehicles and other fixed assets that are directly involved in the production process of products (works, services), including antennas, runways, measuring and control instruments and devices (civil aviation system devices, landing system equipment and ground-based aircraft driving aids, dispatch control equipment for special types of communications and others), tools, draft animals and others.

The nonlinear method has two methods:

the annual amount of depreciation is calculated using the sum of the numbers of years of the useful life of the fixed asset;

The annual amount of depreciation is calculated using the reducing balance with an acceleration factor of up to 2.5 times.

The sum of the numbers of years of the useful life of an object is determined by the following formula:

, (1.1)

where: SSL is the sum of the numbers of years chosen by the organization independently within the established range of the useful life of the object;

Lifetime is the useful life of an object, independently selected by the organization within the established range.

With the declining balance method, the annual amount of accrued depreciation is calculated based on the under-depreciated cost determined at the beginning of the reporting year (the difference between the depreciable cost and the amount of depreciation accrued before the beginning of the reporting year) and the depreciation rate calculated based on the useful life of the object and the acceleration factor (up to 2.5 times) adopted by the organization.

With the productive method, depreciation is calculated based on the depreciable cost of the object and the ratio of natural indicators of the volume of products (works, services) produced (performed) in the current period to the resource of the object (the number of products (works, services) in physical indicators, which in accordance with technical documentation can be released (performed) for the entire life of the facility).

With this method, depreciation charges are calculated in each reporting year using the following formula:

, (1.2)

Where; АОt is the amount of depreciation charges in year t;

AC - depreciable cost of the object;

OPRt is the volume of products (works, services) predicted during the life of the facility in year t;

t = t…n – years of useful life of the object.

The monthly depreciation rate for linear and non-linear methods of its calculation is 1/12 of the annual amount.

For leased fixed assets, depreciation is carried out by the lessor or the lessee, depending on the form of lease and the terms of the agreement.

Fixed assets are accounted for in physical and monetary terms. Natural indicators are used to calculate production capacity, draw up equipment balances, determine the technological composition and condition of fixed assets. Valuation of fixed assets is necessary to take into account their dynamics, plan their reproduction, establish wear and tear, calculate depreciation, calculate product costs, profitability of enterprises, etc.

The valuation of fixed assets is the monetary expression of their value. In accounting and planning practice, three types of valuation of fixed assets are used: initial cost, replacement and residual value.

The initial cost of fixed assets is the sum of the costs of acquisition, their construction (construction), including the costs of their delivery, installation and other costs necessary to bring the facility to a state of readiness for operation. (In this case, the total cost is taken into account in prices valid during the period of acquisition or creation of fixed assets, i.e. in mixed (by level) prices, which leads to a distortion of their actual values and the amount of depreciation.) In this regard, another one is used type of assessment - replacement cost.

The replacement cost of fixed assets is the cost of their reproduction in modern conditions, regardless of the time of their commissioning. It allows you to compare the means of labor received or built in different years and obtain accurate data on their size.

The magnitude of the deviation of the reproduction cost of fixed assets from their original cost depends on the rate of acceleration of scientific and technical progress in agro-industrial production, the level of inflation in the country, etc.

Depreciation: Definition

Property, and especially fixed assets (Fixed Assets) involved in the production process, always wears out, that is, they lose their original value. Therefore, it is necessary to calculate the amount of depreciation, reducing the cost of the object. The legislation has developed a harmonious system for classifying various property units according to certain criteria, such as useful life (USL), i.e. the time during which the object generates income for the company. For example, machinery and equipment depreciate faster than a building or other capital structure. Based on the time of productive use of the object, strict deadlines have been developed for each group of fixed assets, after which the value of the property is written off completely. Paying off the cost of property is called depreciation. Fixed assets are classified according to technical characteristics, making up groups, for example, buildings and structures, power machines and equipment, etc.

The existing classifier of fixed assets distinguishes 10 groups based on the duration of the operational time: the first groups include objects with a shorter useful time, the last - with a longer one.