Scope of application of the method

The declining balance method of depreciation is a technique that allows you to measure the value of property if the corresponding objects are characterized by uneven returns over their entire service life.

Moreover, this property shows its full potential in the first years after purchase. For example, this is relevant for digital equipment, which can become obsolete within a couple of years after purchase. Its price years later will not be comparable to the original one, although the performance characteristics may remain the same. The possibility of using the reducing balance method for depreciation in accounting is determined by clause 18 of PBU 6/01 “Accounting for fixed assets”.

The method differs slightly from the linear method, in which the initial cost is simply divided by the number of years of use. To better understand their essence, we present a simplified diagram of the first method, and also show what an example calculation looks like for depreciation using the reducing balance method.

From a letter to the editor:

“Our organization plans to apply the reducing balance method in relation to several fixed assets:

– we intend to purchase one object (equipment) in December 2015;

– the second object (vehicle) was purchased in September 2015.

In addition, we already have equipment that uses the declining balance method in 2020.

In this regard, questions arose:

1. How is depreciation calculated using the reducing balance method if the beginning of depreciation calculation coincides with the beginning of the reporting (calendar) year?

2. If an object is not accepted for accounting from the beginning of the reporting (calendar) year, how to correctly calculate depreciation using the reducing balance method in each reporting year during the period of operation of the object?

3. How is depreciation calculated in the last year of operation of the facility?

4. Is it possible to revise the acceleration coefficient during the period of operation of the object and from what point?

Inna Sergeevna, accountant"

General rule

Using the reducing balance method, you need to calculate:

– the depreciation rate, calculated based on the useful life of the object and the acceleration factor from 1 to 2.5 times, which was established by the organization;

– the annual amount of accrued depreciation based on the under-depreciated cost determined at the beginning of the reporting year and the depreciation rate (clause 42 of Instruction No. 37/18/6*).

_______________________

* Instructions on the procedure for calculating depreciation of fixed assets and intangible assets, approved by Resolution of the Ministry of Economy, the Ministry of Finance and the Ministry of Construction and Architecture of the Republic of Belarus dated February 27, 2009 No. 37/18/6 (hereinafter referred to as Instruction No. 37/18/6).

Now let's move on to specific questions.

If the beginning of depreciation calculation coincides with the beginning of the reporting (calendar) year

In the case of equipment purchased in December 2020, the start of depreciation will coincide with the beginning of the reporting year and will begin in January 2020.

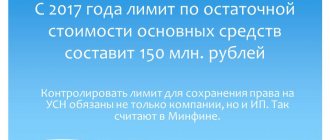

Let's assume that the initial cost of the equipment is 150 million rubles, and its useful life is 5 years. The organization decided to use the declining balance method with an acceleration factor of 2.

The annual depreciation rate in this case will be 40% ((1 / 5 years × 100%) × 2 = 20% × 2).

Note. Here and below, the examples indicate the annual amounts of depreciation charges. Depreciation must be calculated monthly in equal installments.

Accordingly, with the reducing balance method:

– in the 1st year of operation, the annual amount of depreciation charges is determined based on the original cost and will amount to 60 million rubles. (150 × 40%);

– in the 2nd year of operation, depreciation is calculated based on the residual value (minus the amount of depreciation accrued for the first year of operation (60 million rubles)) and will amount to 36 million rubles. (90 × 40%);

– in the 3rd year of operation, depreciation will amount to 21.6 million rubles. ((90 – 36) × 40%);

– in the 4th year of operation, depreciation will be 12.96 million rubles. ((54 – 21.6) × 40%);

– in the 5th (last) year of operation, depreciation should be calculated in the amount of the residual value of 19.44 million rubles. (32.4 – 12.96).

If the start of depreciation does not coincide with the beginning of the reporting (calendar) year

In the case of a vehicle purchased in September, the start of depreciation does not coincide with the beginning of the calendar year and begins in October 2020.

This raises the question: at what point should the residual be calculated?

(under-depreciated) cost – at the beginning of each calendar year (January 1, 2020, 2020, etc.) or October 1 of each reporting year?

Let me remind you that the depreciation rate (annual, monthly) is calculated at the time of making the decision to use the reducing balance method. It may remain unchanged in subsequent years of use of the facility (clause 42, appendix 2 to Instruction No. 37/18/6). But even with a constant depreciation rate, the under-depreciated (residual) value of the object is determined without fail at the beginning of each reporting (calendar) year, and it is this value that acts as the depreciable cost over the next reporting (calendar) year.

Let's assume that a vehicle purchased in September 2020 has an initial cost of RUB 100 million, a useful life of 5 years, an acceleration factor of 2, and an annual depreciation rate of 40%. Since the useful life is 5 years, depreciation will be charged from October 2020 to September 2020.

In this case, the calculation of depreciation using the reducing balance method will be as follows:

– since the full year of operation of the facility does not coincide in this case with the calendar year, in the first calendar year of operation of the facility, depreciation will be accrued only for the 3 months remaining until the end of the reporting (calendar) year (from October to December 2020), and will amount to 10 million rubles (RUB 100 million × 40% / 12 × 3);

– at the beginning of 2020, the residual value will be 90 million rubles. (100 – 10).

At the same time, the depreciation rate is not revised (equal to 40%).

The amount of depreciation accrued for 2020 (January - December) will be equal to 36 million rubles. (90 × 40%);

– at the beginning of 2020, the residual value will be 54 million rubles. (90 – 36).

The amount of depreciation accrued for 2020 (January - December) will be equal to 21.6 million rubles. (54 × 40%);

– at the beginning of 2020, the residual value will be 32.4 million rubles. (54 – 21.6).

The amount of depreciation accrued for 2020 (January - December) will be equal to 12.96 million rubles. (32.4 × 40%);

– at the beginning of 2020, the residual value will be 19.44 million rubles. (32.4 – 12.96).

The amount of depreciation accrued for 2020 (January - December) will be equal to 7.78 million rubles. (19.44 × 40%);

– at the beginning of 2020, the residual value will be 11.66 million rubles. (19.44 – 7.78).

In order to complete depreciation, this residual value must be distributed over the remaining months of the useful life - 9 months (January - September 2020). The monthly depreciation amount will be 1.296 million rubles. (11.66/9).

Depreciation in the last year of the useful life

The question may arise: would it be correct to determine the under-depreciated cost at the beginning of the last reporting year and distribute it over the remaining months of the useful life? Or should the under-depreciated part of the cost be included in production costs (sales costs) in full in the last month?

Depreciation on fixed assets is accrued monthly until the cost of the object is completely transferred or disposed of (clause 32 of Instruction No. 37/18/6). Based on this, the organization must ensure depreciation in full (in the amount of depreciable cost) |*|.

* Information on choosing the optimal option for methods and methods of calculating depreciation is available to everyone on the GB.BY portal

I would like to note that the specific procedure for calculating depreciation charges using the reducing balance method for the years of use of the object, incl. in the last reporting year, not specified in Instruction No. 37/18/6.

Moreover, when using the declining balance method, if the depreciation rate does not change throughout the entire service life of the asset, at the end of its useful life, a portion of the under-depreciated cost actually remains.

Based on the above, in order to complete depreciation over the useful life of the object, the organization has the right in the last year of calculating depreciation using the reducing balance method, having calculated the residual value at the beginning of the last year, distribute it over the remaining useful life (evenly by month), as it was shown in the case of depreciation on a vehicle.

Revision of acceleration factor

With the reducing balance method, the organization chooses the acceleration factor from 1 to 2.5 times independently. At the same time, the rates of depreciation in the first and each of the subsequent years of the period of application of the non-linear method may be different.

Among the functions of the commission for implementing the organization’s depreciation policy is not only the selection of the acceleration factor when adopting the declining balance method, but also its revision (Appendix 1 to Instruction No. 37/18/6).

Although Instruction No. 37/18/6 does not define specific cases of possible revision of the acceleration factor when applying the declining balance method, in this case it is possible to be guided by the rules on permissible cases of revision of useful lives and depreciation methods (clauses 24, 37 of Instruction No. 37/18 /6).

That is, during the reporting year, revision of the coefficient is possible in the following cases:

– completion of modernization, reconstruction, partial liquidation, additional equipment, completion, technical diagnostics and inspections carried out, documented as capital investments by acceptance certificates for completed work;

– changes in operating conditions of the facility;

– unforeseen changes in production conditions, sales of products (works, services), leading to a deterioration in financial condition and the occurrence of losses.

From the beginning of the reporting year, a revision is also possible both during a revaluation with the involvement of an appraiser, and regardless of changes in operating conditions, the value of the object, etc. Please note that the possibility of any changes in the procedure for calculating depreciation must be fixed in the accounting policies of the organization.

As follows from the question, your organization has already taken into account equipment for which the reducing balance method is used in 2020. Let us assume that the acceleration factor is chosen equal to 2, the initial cost of the equipment is 90 million rubles, and the useful life is 6 years. The actual service life until January 1, 2020 will be 2 years, the amount of accrued depreciation until January 1, 2020 is 30 million rubles.

If the organization decides to revise the acceleration factor from January 1, 2020, reducing it from 2 to 1.5, it will be necessary to calculate the new depreciation rate based on the remaining useful life. In this case, this period will be 4 years (6 – 2), and the new annual depreciation rate will be 37.5% (1 / 4 × 100% × 1.5).

Calculation of depreciation from January 1, 2020 will need to be made based on the residual (under-depreciated) value, which as of January 1, 2020 will be 60 million rubles. (90 – 30). In 2020 (3rd year of depreciation), depreciation will amount to 22.5 million rubles. ((90 – 30) × 37.5% = 60 million rubles × 37.5%).

In 2020 (4th year of depreciation), depreciation will be equal to 14.06 million rubles. ((60 – 22.5) × 37.5% = 37.5 × 37.5%).

In 2020 (5th year of depreciation), depreciation will amount to 8.79 million rubles. ((37.5 – 14.06) × 37.5% = 23.44 × 37.5%).

In 2020 (the last year of depreciation calculation), the amount of depreciation should be calculated in the amount of the residual value of 14.65 million rubles. (23.44 – 8.79) |*|.

* Information about tools for optimizing depreciation charges, incl. application of the acceleration coefficient, is available to everyone on the GB.BY portal

I hope you received answers to all your questions. From the editor:

The material was coordinated with Irina Tolkun, an expert in the field of depreciation policy.

Sincerely yours, Olga Pavlovna

Acceleration factor

The examples above do not take into account that the fixed asset can be used very intensively and, therefore, wear out faster. How is the reducing balance method of depreciation calculated in such cases? One more variable is added to the calculation formula - the acceleration coefficient. The acceleration factor is not higher than 3, according to clause 19 of PBU 6/01, applied only with the reducing balance method. In all other cases, its use is not only impossible (there is some debate about this), but it is economically unjustified. However, the Ministry of Finance speaks out unequivocally: the acceleration factor is applied only with the reducing balance method (letter of the Ministry of Finance dated August 22, 2006 No. 07-05-06/220).

Please note: you should not confuse the rules for applying the acceleration factor in accounting and tax accounting, because an incorrect interpretation of these rules can lead to very negative consequences for the company in disputes with tax authorities. Thus, in tax accounting, the procedure for applying increasing coefficients is described in Art. 259.3 Tax Code of the Russian Federation. It applies to property:

- used in an aggressive environment (meaning any external factors that cause accelerated aging);

- located in close proximity to an aggressive technological environment that may contribute to an accident (fires, explosions, etc.);

- used in conditions of frequent shifts (as indicated in the Tax Code - increased shifts); this concept is not disclosed in the Tax Code, however, in its letters, the Ministry of Finance explained that this means the use of equipment in three shifts or more;

- with high energy efficiency - the list of such property includes various household appliances (refrigerators, microwave ovens, air conditioners, etc.).

The value of the acceleration coefficient in tax accounting in these cases can vary from 1 to 2.

A coefficient of up to 3 in tax accounting is applied to fixed assets held under a leasing agreement (any method of calculating depreciation). Any fixed assets can be included in a leasing agreement, with the exception of those belonging to depreciation groups 1–3.

Important! The value of the coefficient is established by the organization independently, but within the framework defined by law. It should be taken into account that the adopted coefficient value must have a convincing justification. It can be: technical documentation for the OS, permits from official bodies, work schedules, time sheets, acts of acceptance and transfer of OS (in the case of leasing), etc.

See also the article “The procedure for a taxpayer if he does not agree with the decision to hold him accountable based on the results of an audit.”

So, to calculate depreciation in accounting using the reducing balance method with an acceleration factor, you need to know:

- The cost of an asset at the beginning of the year.

- Useful life of an OS object.

- Acceleration factor.

Advantages and disadvantages

The advantage of the non-linear depreciation method is the ability to quickly write off property, the use of which is effective in the first years of operation.

This solution allows the funds from the depreciation fund to be used to purchase new equipment, which increases productivity and ensures the stability of business results.

Depreciation using the reducing balance method

The project manager has the opportunity to independently make decisions about the rate at which costs are transferred to the expense category. The disadvantage of the write-off method is the impossibility of its application to all types of property due to the presence of restrictions.

Calculation of depreciation using the reducing balance method - example

Let’s assume that the organization decided to apply an acceleration factor of 1.8 to the machine from the first example, the initial cost is 423,000 rubles, and the useful life is 8 years.

The annual depreciation percentage, as calculated above, is

100 % : 8 = 12,5 %.

We make an adjustment for the acceleration coefficient -

12,5 % * 1,8 = 22,5 %.

The annual depreciation of the declining balance will be:

in the 1st year - 22.5% of 423,000 rubles. = 95,175 rub.;

in the 2nd year - 22.5% of the residual value of 327,825 rubles. (RUB 423,000 – RUB 95,175) = RUB 73,760.63;

in the 3rd year - 22.5% of the residual value of RUB 254,064.37. (RUB 327,825 – RUB 73,760.63) = RUB 57,164.48

In subsequent years, the amount of annual depreciation is calculated similarly. Thus, the value of the property will be written off faster than when calculating without a coefficient.

We recommend that you familiarize yourself with another method of calculating depreciation in accounting: “How to correctly use the cumulative depreciation method?”.

Reducing balance method - we calculate with a coefficient

Let's take the equipment data from the beginning of the article as an example. Its initial cost is 654,000 rubles, its useful life is 10 years, its coefficient is 1.7.

The depreciation percentage for the year, as previously determined, will be:

100% / 10 = 10%.

Taking into account the acceleration coefficient, it will be equal to:

10% × 1,7 = 17%.

The annual depreciation amount will be:

- For the first year - 654,000 × 17% = 111,180 rubles.

- For the second year - 92,279.40 rubles. We obtain this amount as follows: residual value 654,000 – 111,180 = 542,820 rubles. multiply by 17%.

- For the third year - 76,591.9 rubles. The amount turned out like this: residual value 542,820 – 92,279.40 = 450,540.60 rubles. multiply by 17%.

And so on until the cost of fixed assets reaches zero.

Similar articles

- Features of the cumulative depreciation method

- Calculation of depreciation of fixed assets

- Depreciation in tax accounting

- Calculation of depreciation of fixed assets using the straight-line method

- Methods for calculating depreciation of fixed assets: linear method

Acceptance of fixed assets for accounting

So, the company has an operating system on which depreciation is calculated in accounting and tax accounting.

It doesn’t matter whether the property was purchased, donated or contributed as payment for the authorized capital, the procedure for calculating depreciation does not depend on the method of obtaining fixed assets. But initially the asset is reflected as an investment in non-current assets. When should it be transferred to the operating system and start accruing depreciation? In accounting, this should be done when the asset is ready to be used for its intended purpose. For example, a purchased machine that does not require installation is transferred to the OS immediately after it is received by the organization, since it is at this moment that you can begin to use it. In tax accounting, the situation is different: property that is used to generate income is initially recognized as depreciable (see Table 1).

Acceptance of fixed assets for accounting and choice of depreciation calculation procedure

| Name | Accounting | Tax accounting |

| Acceptance of fixed assets for accounting | The property is transferred to the fixed assets at the moment of readiness for operation (clause 4 of PBU 6/01 “Accounting for fixed assets”), the actual use of the fixed assets does not matter | Depreciable property is property that is used to generate income (clause 1 of Article 256 of the Tax Code of the Russian Federation), the actual use of fixed assets matters |

| State registration of property rights does not affect the acceptance of fixed assets for accounting: | ||

| see PBU 6/01 and clause 52 of the “Methodological guidelines for accounting of fixed assets” (approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n) | see paragraph 4 of Art. 259 of the Tax Code of the Russian Federation, valid from 01/01/2013 | |

| Methods for calculating depreciation and conditions for their selection | Selected once for all operating systems or for a group of operating systems: — linear method; — reducing balance method; — method of writing off value by the sum of the numbers of years of useful life; — method of writing off cost in proportion to the volume of products (works) | Selected for all OS in accordance with the accounting policy of the organization: — linear method (always prescribed for 8–10 depreciation groups, see clause 3 of Article 259 of the Tax Code of the Russian Federation); - nonlinear method. The “tax” method can be changed from January 1 of the next year, but you cannot leave the non-linear method earlier than 5 years from the start of its use |

| Depreciation calculation | Monthly from the first day of the month following the month the asset was accepted for accounting : | |

| see clause 24 PBU 6/01 | see paragraph 4 of Art. 259 Tax Code of the Russian Federation | |

Please note that the need for state registration of the right to property at the time of acceptance of OS for accounting and tax accounting does not affect. For example, if in March 2014 an organization received from the seller purchased non-residential premises in a condition suitable for the planned use, then, regardless of the state registration of the right and even the fact of filing documents for registration, it must include it in the operating system in the same month.

Web service for small businesses. Clear for the director, convenient for the accountant! The first month of work is free.

To learn more