Document containing the procedure for calculating the cash balance limit

The rules for calculating the maximum amount of cash balance in the operating cash desk of a person who has cash in circulation are established by Bank of Russia Directive No. 3210-U dated March 11, 2014, dedicated to the procedure for conducting cash transactions.

In 2020, this document is used in the wording that resulted from the changes made to it by the Bank of Russia’s directive No. 4416-U dated June 19, 2017. What caused the changes? Mainly with the consequences of innovations introduced into the law “On the application of cash register systems” dated May 22, 2003 No. 54-FZ by the law on online cash registers (dated July 3, 2016 No. 290-FZ):

- The list of documents—the grounds for recording cash proceeds in the operating cash desk—has been clarified. These include cash receipts, BSO and other documents issued on new-style cash registers and having the ability to accept not only paper, but also electronic form.

- It has become available to issue electronic versions of cash receipt and debit orders, and to send the depositor an electronic receipt for the receipt order. In this regard, reservations have emerged regarding the need to monitor compliance with the sample signatures affixed on cash documents only for their paper version.

- The rules for working with imprest amounts have been updated. To issue them, an order from the manager will be sufficient, and the absence of a report on previously issued amounts no longer prevents the payment of new amounts.

Other rules for conducting cash transactions remained unchanged. Among other things, the updates did not affect the procedure in which the cash balance limit is set. That is, the calculation of the cash balance limit for 2020 should be carried out in the same situations and using the same algorithms as in previous years.

Read about the changes made to the original text of Law No. 290-FZ in this material.

What is closing a shift?

The shift is subject to opening and closing using a cash register

. The interval between these actions should not exceed 24 hours (according to clause 2 of article 4.3 of Federal Law No. 54). At the end of the shift, the cashier writes a final receipt, which is called a z-report or fiscal document. It is necessary to control revenue throughout the day.

When closing a shift using the terminal, reporting information is automatically redirected to the tax office.

After the report is generated, the cashier must transfer the proceeds to the collectors. Then he turns off the cash register and hands over all the attributes received for working with the cash register (receipt tape, change for change, keys to the cash drawer). The employee also needs to enter the following information from the document in the operator’s special journal:

- serial number and date of compilation;

- amount of money at the beginning and end of the shift;

- revenue for the reporting period;

- data on returns and non-cash payments.

Based on this, the accountant draws up a cash receipt order and makes a note in the cash book.

Why do you need a cash limit and how is it set?

Establishing a limit limits the amount of cash that may be in the operating cash desk at the end of the working day (clause 2 of Bank of Russia Directive No. 3210-U). The limit may be exceeded on days when employees are paid salaries, scholarships, social benefits, and on weekends if the legal entity carries out cash transactions there.

Determining the amount of the limit is mandatory for legal entities and separate divisions that independently deposit money to the bank. If separate divisions deposit money at the cash desk of a legal entity, then the total amount of the limit established by the organization also takes into account those limits that are provided for the divisions. Individual entrepreneurs and legal entities classified as small businesses have the right not to set such a limit.

Read about the cases in which a legal entity can be classified as a small business entity here.

The legal entity independently calculates the cash balance limit (for divisions and its total value) and approves its size with an administrative document. One of the copies of this document is sent to the division.

Sample calculation of cash limit based on cash expenses

Let's consider an example: an organization carries out only non-cash payments. Cash is withdrawn once every 3 days. The calculation period is the first quarter of last year. The organization operates 5 days a week. The volume of cash expenses for the specified period amounted to 1,600,000 rubles. Let's do the following:

- Let's calculate the number of days in the quarter under consideration: in January there were 15 working days, in February - 19, in March - 22. Total: 56 days.

- According to accounting data, the amount of expenses for January amounted to 520 thousand rubles, for February - 268 thousand rubles, for March - 812 thousand rubles.

- Let's calculate the cash limit for the first quarter: L = 1,600,000 ÷ 56 × 3 = 85,714 rubles.

Based on calculations, the head of the enterprise set the maximum allowable amount for each working day in the amount of 86,000 rubles.

In cases where the organization does not make expenses from the cash register and does not use cash payments, but only pays dividends, the limit is set based on the amount of money issued using a similar formula. In this case, it is not at all necessary to indicate all the days of the quarter, because funds are usually withdrawn once per period. The maximum collection period used for calculation is 7 days.

How to calculate the cash balance limit for 2020-2021?

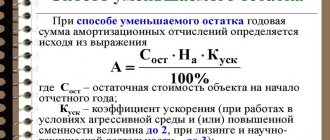

How to calculate the cash balance limit? Bank of Russia Directive No. 3210-U provides for such a calculation two outwardly identical formulas, which differ fundamentally only in the characteristics of the volume of turnover (real or planned) of funds involved in the calculation:

- Sales revenue volume. It does not take into account funds accepted by the paying agent (subagent).

- Volume of cash disbursements. It does not include funds for paying employees salaries, scholarships, and social benefits.

The first volume in Bank of Russia instruction No. 3210-U is designated by the letter V, and the second by R. And the formulas for calculating the limit (L) with these letters look like this:

L = V / P × N;

L = R / P × N;

where the remaining 2 indicators (P and N) are very similar in meaning, but characterize, respectively, the process to which one of the indicators that determine the calculation formula (V or R) relates:

- P is the billing period (defined in working days with the condition that their number does not exceed 92), during which either volume V is received or volume R is issued;

- N is the number of working days between the days of depositing money to the bank (for indicator V) or receiving it from the bank (for indicator R).

When determining the number of days that make up the value of the indicator N, the facts of acceptance and issuance of funds not included in the volumes (V and R) are not taken into account. It has been established that the number of days that make up the indicator N should not exceed 7, and if there is no bank in the locality where the legal entity is located, then 14. Although the value of this indicator may depend on such things as:

- force majeure circumstances;

- location, structure and features of the legal entity’s activities.

An example of calculating the cash register limit taking into account the volume of receipts from ConsultantPlus: Cash revenue of Rassvet LLC from the sale of goods for the billing period from 09/01/2020 to 11/30/2020 (64 working days) amounted to RUB 2,385,648. Revenue is surrendered daily (once a day)... Read the continuation of the example in the legal reference system. And if you don't have access to K+, get a trial demo access for free.

For examples of calculating the cash balance limit, see the article “How to calculate the cash balance limit?”.

What is a Z-report

The State Interdepartmental Expert Commission on Cash Registers (GMEC) approved the List of basic alphabetic symbols printed on check and control tapes used in cash registers, which indicates that the letter Z denotes a report with cancellation - the final receipt displaying transactions and the amount of revenue for the day.

In the new version of the legislation, this report is called a shift closure report.

To prepare such a report, no additional financial, material, labor or special time costs will be required. Cash register equipment is programmed to independently generate a Z-report; there is no need to enter auxiliary information.

The cashier only needs to know which buttons to press (according to the instructions for the cash register), as a result he will receive a printed receipt with the final data.

Important!

The law specifies that the time interval between two Z-reports cannot be more than 24 hours.

Modern cash register equipment is often programmed in such a way as to eliminate such factors as cashiers’ forgetfulness: if you do not issue the next one within 24 hours after issuing the previous Z-report, it will be blocked.

Results

The figure corresponding to the amount above which the cash balance in the legal entity’s operating cash desk at the end of the working day cannot be exceeded should be determined by the legal entity itself, using a legally established formula.

The formula has 2 outwardly identical options, which differ fundamentally in the characteristics of the volume of cash money involved in the calculation: this is either the volume of sales or the volume of payments for a certain period. Other indicators included in the formula are similar in meaning, but their meanings depend on what specific (sales or payments) volume of cash is taken as the basis for the calculation. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

What is a cash limit

When a point of sale or organization accepts payment, the cashier makes accounting transactions with cash.

After collection of funds accepted for the day, the cash register balance should not exceed the maximum allowed limit. Excess money is credited to the organization's current account before the next collection date. Above-limit funds can be left for wages and planned social benefits (pensions, scholarships, sick leave, etc.). Money may be used as exchange for retail outlets or for accountable payments for household expenses and travel expenses.

So, the cash limit is the maximum allowable limit of the remaining cash that can be stored after collection.

What to do if it exceeds?

The establishment and observance of this limit assumes that there should be no excess cash in the cash register of a business entity by the end of the operating day.

Any excess of a given limit - an over-limit amount - is subject to transfer/credit to a commercial bank.

In what cases is it permissible to disrupt cash flow?

Excess cash may be stored at the organization's cash desk only on certain days:

- Working days established by the business entity itself for payments to employees. The maximum duration is 5 (five) days.

- Weekends/holidays – if cash transactions are made.

Penalty for exceeding

Unauthorized storage by an organization of excess cash is considered a failure to comply with cash (financial) discipline, for which current legislation provides for administrative liability - the imposition of a fine.

Penalties for exceeding the cash limit:

- Individual entrepreneurs, officials of organizations - minimum 4000, maximum 5000 rubles.

- Legal entities (enterprises) – minimum 40,000, maximum 50,000 rubles.

Money from the cash register for personal needs

Everything that an organization earns is its property. Therefore, even if there is only one founder in an LLC, he still does not have the right to dispose of the organization’s money at his own discretion. Accordingly, the founders cannot take cash from the cash register for their personal needs.

Individual entrepreneurs, unlike LLCs, have the right to take cash from the cash register or withdraw it from a current account at any time. The amounts that an individual entrepreneur can spend on his personal needs are not limited (the most important thing is to avoid arrears in paying taxes and insurance premiums).

Note

: if the individual entrepreneur has not issued an order canceling the maintenance of cash documents, then when receiving cash from the cash register, he needs to draw up a cash settlement with the wording:

“Issue of funds to the entrepreneur for his own needs”

or

“Transfer to the entrepreneur of income from current activities

.

Who must comply

The need to maintain cash discipline does not depend on the availability of a cash register or the chosen taxation system.

Even if you do not have a cash register (for example, you fall into the exceptions from Article 2 of Law 54-FZ), you must still follow the rules of cash discipline. There is only one rule here - if there is cash flow, then cash discipline must be observed.

However, since June 2014, a simplified procedure for maintaining cash discipline

, which most affected individual entrepreneurs. Now individual entrepreneurs are no longer required to maintain a cash register on a par with organizations and draw up cash documents (PKO, RKO, cash book). Entrepreneurs only need to generate documents confirming the payment of wages (payroll and payslips).

Also, according to the simplified procedure, individual entrepreneurs and small enterprises (number of employees no more than 100 people and revenue no more than 800 million rubles per year) are no longer required to set a limit

cash balance at the cash register.

All rules of cash discipline are listed in the instructions of the Bank of Russia (Instruction No. 3210-U dated March 11, 2014 and Instruction No. 3073-U dated October 7, 2013).