Enterprise cash register and cash register equipment (CCT) - what is the difference?

An enterprise cash register is something that every organization has. It registers all cash movements: revenue at the end of the day, receipt of loans, issuance of accountable funds, issuance of salaries, etc. Documents directly related to cash discipline are a cash receipt order, an expenditure cash order and a payroll.

The cash register is used by those who are directly involved in receiving retail revenue, accepting cash and payments through acquiring. The cash register records the movement of revenue. Thus, a cash register is part of an enterprise’s cash register, and its main document is a cash receipt.

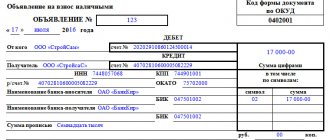

A cash receipt order (CPO) is generated whenever cash is received (each time money is received at the cash desk). With its help, the total amount of revenue for the day is drawn up; this PKO will be part of the cash book. With this PCO, you can issue a return of unused accountable funds from the employee.

A cash expenditure order (COS) is issued in cases where the organization's cash is spent - for example, money is issued for reporting. But, if you issue funds to your employees from the cash register in the form of wages, then the payroll sheet for the payment of wages is simply filled out for them. In this case, the cash receipt will not be issued. Because a cash receipt relates strictly to calculations, and not to interaction with employees.

Cash book: what is it?

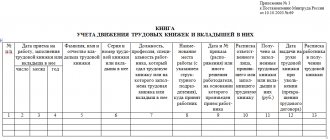

A cash book is a summary document that contains all the information on all receipts and cash movements in the organization. Entries in the cash book are made by the cashier (or a person replacing him) on the basis of each PKO and RKO.

The cash book can be maintained both on paper and electronically. But not everyone should lead it.

Individual entrepreneurs have the right not to draw up PKO and RKO and may not maintain a cash book (this is stated in the Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses "). If they want to legitimize this right, then they need to issue an appropriate order. However, Tatyana Evdokimova, a leading expert in the field of accounting at SKB Kontur, advises you to think seriously before making such a decision: when there are many employees, it is not easy to keep track of cash in order to somehow record it, it is still better not to refuse to register PKO and RKO and maintaining a cash book.

Individual entrepreneurs and employees should pay attention to the fact that if they issue money from the cash register as payment of wages, then they will have to compile a payroll statement.

Who is affected by the changes in the procedure for conducting cash transactions?

To one degree or another, innovations in the procedure for conducting cash transactions affected all business entities. In particular:

- individual entrepreneurs and organizations that are small businesses (you will find the criteria for small businesses in this article);

- organizations that are not small;

- organizations with separate divisions;

- persons using cash registers or strict reporting forms (read more about accounting for funds when using online cash registers here);

- employers giving money to employees on account.

Let us now consider these changes in more detail.

What can you spend cash on?

Without restrictions, cash proceeds can be spent on:

- salary payment;

- accountable funds;

- payment of income to individual entrepreneurs.

Limits apply to the following payments (no more than RUB 100,000 within one agreement):

- purchasing goods or services;

- when returning money for previously paid goods;

- when issuing cash when carrying out transactions by a paying agent.

If the equipment costs, for example, 99,000 rubles, you can issue a cash receipt order and buy the equipment for this money. But if the total cost of the contract exceeds 100,000 rubles. and you pay in cash, this is automatically considered a violation (Instruction of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U).

A violation of cash discipline is also considered to be exceeding the cash balance limit (according to Article 15.1 of the Code of Administrative Offenses, fines for an official range from 4,000 - 5,000 rubles, for an organization - 40,000 - 50,000 rubles).

When working with CCP, the following cases fall under violations:

- CCP does not comply with legal requirements;

- you accepted cash and did not knock out a receipt,

- The cash balance is not equal to the amount reflected in the document.

Everything you need to start a business for individual entrepreneurs and LLCs under 3 months

Details

Responsibility for violation of the rules for conducting cash transactions

And in conclusion, a few words about responsibility. For violation of the procedure for working with cash and the procedure for conducting cash transactions, administrative liability is provided under Art. 15.1 Code of Administrative Offenses of the Russian Federation. This is a fine: for officials - from 4 thousand to 5 thousand rubles, for legal entities - from 40 thousand to 50 thousand rubles.

In this case, violations include:

- making cash settlements with other organizations in excess of established limits;

- non-receipt (incomplete receipt) of cash to the cash desk;

- failure to comply with the procedure for storing available funds;

- accumulation of cash in the cash register in excess of established limits.

Read more about liability for violation of the procedure for conducting cash transactions in the article “Cash discipline and responsibility for its violation .

Cash discipline and benefits for small businesses

In 2020, according to Federal Law No. 209-FZ dated July 24, 2007, enterprises are classified as small businesses if they meet the following criteria:

- The number of employees does not exceed 100 people.

- Revenue from the sale of goods, works or services excluding VAT is no more than 800 million rubles.

- The share of participation of other persons not related to small businesses is no more than 49%.

You can find out whether an organization is a small and medium-sized business on the website of the Unified Register of Small and Medium-Sized Businesses.

Small businesses can avoid the above fines if they take certain steps.

- They may not set a cash limit (paragraph 10, clause 2 of Bank of Russia Directive No. 3210-U dated March 11, 2014 (as amended on June 19, 2017).

To do this, you need to issue an order with approximately the following content:

“Based on para. 10 clause 2 of Bank of Russia Directive No. 3210-U dated March 11, 2014, I order:

1. Keep cash in the cash register without setting a limit on the cash balance.

2. Appoint cashier Ivanova I.I. to be responsible for the safety of funds.”

If you are an entrepreneur, then you can appoint yourself as responsible. If you are the only director in an organization, you can appoint yourself responsible for the execution of this order.

- They can correct cash documents, except for PKO and RKO (paragraph 2, subparagraph 4.7, paragraph 4 of Bank of Russia Directive No. 3210-U dated March 11, 2014). Moreover, errors can be corrected for previous periods.

The procedure for making corrections is standard: incorrect data is crossed out and correct data is entered in its place. You need to sign, indicate the date, last name and initials, and the position of the person who made the corrections. If these corrections lead to further corrections, then it is also important to reflect the latter in the cash book.

Conducting cash transactions: comparison of current and old rules

For clarity, we will present the main changes in the procedure for conducting cash transactions in the form of a table (comparison of current and previous rules, including taking into account those introduced by Directive No. 4416-U).

| Operations affected by changes | Current procedure for conducting cash transactions | The clause of the legal acts referred to by the current procedure for conducting cash transactions | Previous procedure for conducting cash transactions |

| Obligation to set a limit on the cash balance in the cash register | Individual entrepreneurs and small business organizations may not set a limit on the cash balance in the cash register. Note: the criteria for classifying organizations as small businesses are established by Art. 4 of the Law “On the Development of Small and Medium Enterprises in the Russian Federation” dated July 24, 2007 No. 209-FZ | Clause 2 of instructions No. 3210-U | There were no exceptions for individual entrepreneurs and small organizations. All legal entities and entrepreneurs had to set the maximum allowable amount of cash that could be kept in the cash register at the end of the working day, and hand over excess cash to the bank (clauses 1.2–1.4 of Regulation No. 373-P) |

| The procedure for calculating the cash balance limit | The procedure for conducting cash transactions allows you to choose one of 2 options for calculating the cash limit:

| Appendix to instruction No. 3210-U | The old rules for conducting cash transactions did not allow for the choice of a convenient option for calculating the cash limit. The second option (in terms of the volume of cash disbursement) was allowed to be used only in the absence of cash receipts. This was directly stated in the appendix to regulation No. 373-P |

| Registration of cash documents by individual entrepreneurs | Individual entrepreneurs who, in accordance with the legislation of the Russian Federation on taxes and fees, keep records of income or income and expenses and (or) other objects of taxation or physical indicators characterizing a certain type of business activity, may not formalize:

In particular, this applies to entrepreneurs who pay UTII, individual entrepreneurs who use a patent or simplified taxation system, as well as individual entrepreneurs who are payers of the Unified Agricultural Tax (see letter of the Federal Tax Service of Russia dated July 9, 2014 No. ED-4-2/13338). Note: entrepreneurs also keep records of income and expenses in the general mode - in the book of income and expenses and business operations of an individual entrepreneur (approved by order of the Ministry of Finance of the Russian Federation No. 86n dated August 13, 2002, Ministry of Taxes of the Russian Federation No. BG-3-04/430). From this we can conclude that this relaxation applies to all entrepreneurs without exception. | pp. 4.1, 4.6 instructions No. 3210-U | Along with organizations, individual entrepreneurs were obliged to:

|

| Method of maintaining a cash book and cash documents | The cash book and other documents can be prepared:

In the first 2 cases, the documents are signed personally by the responsible persons, and in the latter - they are confirmed by electronic signatures. The cashier checks whether the cash documents have signatures of management persons (chief accountant or director). Signatures are checked against samples, but only if the document was drawn up on paper. The cash book can be maintained not only by the cashier, but also by another authorized employee | pp. 4.7, 4.6 instructions No. 3210-U | The cash book and other cash documents could only be paper. Documents drawn up on a computer were necessarily printed out (clause 2.5 of regulation No. 373-P). Only the cashier was required to maintain the cash book |

| Making corrections to cash register documents | The new procedure for conducting cash transactions allows for corrections to be made in documents drawn up on paper, with the exception of cash receipts and debit orders. In this case, the correction must contain the date of entry, surnames, initials and signatures of the persons who prepared the documents to which the corrections were made. Making corrections to documents executed electronically after they have been signed is not permitted. | Clause 4.7 of instruction No. 3210-U | Under the previous procedure, corrections were not allowed (clause 2.1 of Regulation No. 373-P). The procedure for correcting electronic cash documents was not specified |

| To learn how the introduction of online cash registers has affected the management of cash documents, read the article “Do I need a cash book for an online cash register?” | |||

| The procedure for depositing excess cash at the bank | Cash for crediting to the account is submitted:

| Clause 3 of instructions No. 3210-U | In addition to the existing options (deposit to a bank or organization included in the Bank of Russia system), it was possible to transfer money to an account through the federal postal service organization (clause 1.5 of Regulation No. 373-P) |

| Indicating the amount in words on a cash receipt order | According to the current procedure for conducting cash transactions, when issuing cash according to a cash order, the cashier prepares the amount of cash to be issued and transfers the cash order to the recipient only for signature. There is no longer any need to require the recipient to enter the amount received into the order by hand. This amount can be printed | Clause 6.2 of instruction No. 3210-U | Conducting cash transactions in the previous manner required the recipient not only to sign the order, but also to indicate in his own hand the amount received (rubles in words, kopecks in numbers) (clause 4.3 of Regulation No. 373-P) |

| Read more about the rules for filling out cash registers in our article “How to fill out an expense cash order (RKO)?” | |||

| Issuance of money on account | To issue cash to an employee on account for expenses associated with the activities of a legal entity or individual entrepreneur, an expense cash order is drawn up in accordance with a written application of the accountable person, drawn up in any form, or an administrative document of the manager. The application or administrative document must contain a record of the amount of cash and the period for which it is issued, as well as the manager’s signature and date. If an application is drawn up for accountable amounts, then the manager is not required to indicate the amount of accountable funds and the period. The accountable himself can do this. And the manager will only sign and date it. Issuance on account is allowed if the recipient has not reported on the previous advance | Clause 6.3 of instruction No. 3210-U | According to the previous procedure for conducting cash transactions, the amount and reporting period had to be indicated by the manager in his own hand (clause 4.4 of regulation No. 373-P). In addition, until August 19, 2017, accountable money was issued solely on the basis of an employee’s application and only in the absence of debt on previous accountable expenses |

| Preparation of cash documents for settlements with cash registers or BSO | The current procedure for conducting cash transactions establishes the possibility of registering a general PKO and (or) cash settlement upon completion of cash transactions for the entire amount of accepted cash on the basis of fiscal documents provided for in paragraph. 27 art. 1.1 of the Law “On the Application of CCP” dated May 22, 2003 No. 54-FZ. If the cash receipt order is issued in electronic form, then the cashier can send the receipt at the request of the depositor to his email. If the cash receipt order is issued electronically, then the recipient of the money can put his electronic signature on the document | pp. 4.1, 5.1, 6.2 instructions No. 3210 | Regulation No. 373-P did not provide for the possibility of drawing up a consolidated receipt order for BSO and other similar documents. Clause 5.2 of Directive No. 3210 became invalid as of 08/19/2017. There was no possibility of sending a receipt by e-mail, as well as signing cash settlements with an electronic signature |

| Interaction between the head office and department offices | An organization that has separate divisions (SU) has the right to independently establish the procedure and timing for the transfer to the parent organization of copies of sheets of the SE's cash books, taking into account the deadline for drawing up accounting (financial) statements (clause 4.6 of Directive No. 3210-U) | The unit had to transfer its cash book sheet with the cash balance at the end of the working day to the organization no later than the next working day (clause 5.6 of Regulation No. 373-P) | |

In addition to Instructions No. 3210-U, businessmen must comply with Instructions No. 3073-U dated 10/07/2013. According to this document, firms and individual entrepreneurs have the right to spend cash received for goods (work, services) sold exclusively for payment:

- employee salaries;

- insurance compensations under insurance contracts;

- remuneration for work/services, as well as for payment for goods (within 100 thousand rubles under one contract);

- accountable funds;

- for personal needs of individual entrepreneurs not related to entrepreneurship;

- returns for goods (work/services).

Individual entrepreneurs can use a simplified method of conducting cash transactions. If you have access to ConsultantPlus, check whether you are accounting for the entrepreneur’s funds correctly. If you do not have access, get free trial access to the system and proceed to the Ready-made solution.

Let’s combine the requirements of the Central Bank Directives into a convenient scheme: