Timing for the transition to online cash registers for individual entrepreneurs on UTII

Almost all imputations will switch to online cash register on July 1, 2020. Initially, the deadline was 2020, but the government postponed the cash registers for another year (law of November 27, 2017 No. 337-FZ). Let us remind you that the deferment is enshrined in Federal Law 290-FZ, and Law 54-FZ “On Cash Register Equipment” does not regulate the timing of the transition.

Individual entrepreneur on UTII in retail or catering

- If there are hired employees - July 1, 2020.

- If there are no employees - July 1, 2020.

This applies to activities from paragraphs. 6–9, paragraph 2, art. 34626 of the Internal Revenue Code.

If an entrepreneur worked himself and then hired an employee, then within 30 days he must buy a cash register and register it.

- Rent an online cash register MTS cash desk 5

56 reviews

2 390 ₽

2390

https://online-kassa.ru/kupit/arenda-onlajn-kassy-mts-kassa-5/

OrderMore detailsIn stock

- Rent an online cash register MTS Kassa 7

43 reviews

2 390 ₽

2390

https://online-kassa.ru/kupit/arenda-onlajn-kassy-mts-kassa-7/

OrderMore detailsIn stock

The remaining individual entrepreneurs will switch to UTII in 2020

If an entrepreneur does not work in retail or public catering, he receives a deferment for online cash registers until 2020. It doesn't matter whether he has employees or not. The deferment is valid for entrepreneurs from paragraphs. 1–5 and 10–14, paragraph 2, art. 34626 NK.

Online cash registers for all types of businesses! Delivery throughout Russia.

Leave a request and receive a consultation within 5 minutes.

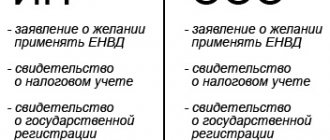

Combining UTII with simplified tax system or OSNO

Entrepreneurs on OSNO and simplified tax systems switched to new cash desks in 2017, except for representatives of the service sector.

It is necessary to keep separate records for different activities. Businessmen on the simplified tax system or OSNO are already required to use a cash register and send checks to the tax office. At imputation, you can issue BSO or payment documents according to the old rules and not use the online cash register until 2020 or 2020.

After the deadline for UTII, use one cash register if both activities are registered at the same address. To do this, the cash register and commodity accounting system must support several taxation regimes. The receipt must indicate the tax regime, and only one.

Subscribe to our channel in Yandex Zen - Online Cashier! Be the first to receive the hottest news and life hacks!

Beer sellers

Beer retailers are moving to online checkout just like everyone else. So, an entrepreneur with employees installs a cash register before July 1, 2020, and an individual entrepreneur on UTII without employees - before July 1, 2020.

But you still need to take alcohol into account in EGAIS.

Quote from the updated 171-FZ

Sellers of excise goods

They are switching to online cash registers in 2020 and 2020 (letter of the Ministry of Finance dated April 14, 2017 No. 03-01-15/22578).

UTII cannot be used when selling excisable goods from paragraphs. 6–10, paragraph 1, art. 181 Tax Code of the Russian Federation. That's why swindlers don't sell motor oil, gasoline or diesel fuel. Other goods can be sold on UTII.

Law 54-FZ does not say anything about separate deadlines for excise goods, so you can sell cigarettes without a cash register until July 1, 2020 and 2020.

1. Ask our specialist a question at the end of the article. 2. Get detailed advice and a full description of the nuances! 3. Or find a ready-made answer in the comments of our readers.

Do you need a cash register?

The state decided to introduce CCP gradually. It all started in 2015 and continues to this day. But the input was always accompanied by questions about the need for a cash register. So is CCT necessary for imputation?

The good news is that the UTII payer in the form of an individual entrepreneur is not always required to use cash registers. What does it mean? Online CCT UTII is not always needed. It is not needed if an individual entrepreneur only accepts cash from his clients. However, the condition must be met that strict reporting forms are drawn up.

Expert opinion

Tatyana Nikolaevna

Chief Accountant

Ask a Question

However, this is only possible if we are talking about cash payments, which are carried out only with individuals.

There is even an individual entrepreneur who assumes cash payments with other organizational and legal forms, such as LLCs, other individual entrepreneurs, then in this case a cash register must be available in accordance with Federal Law 54. However, there are exceptions to any rule. In accordance with Article 2 of Federal Law 54, these exceptions are the following situations.

- We sell newspapers, magazines and related products.

- Sale of travel documents in a trolleybus.

- Reception of glass containers.

- Making keys and haberdashery.

- Providing food for employees and students of educational and children's institutions.

- Portable trade.

- Trade in kvass, milk, etc. from tank trucks.

- Shoe repair and painting.

- Sawing wood.

- Renting out residential premises that are owned by the individual entrepreneur.

Expert opinion

Kirill

Cashier specialist

Ask a Question

All these citizens are exempt from the need to have an online cash register until the relevant law is issued. This means that by July 2020 they should not worry. However, you need to closely monitor the law; perhaps there will be further changes in the form of imputations.

For whom checkouts have been completely cancelled?

- Other LLCs or individual entrepreneurs transfer money to the entrepreneur to a current account through a bank. When paying in cash, you need to punch receipts on a new cash register.

- The businessman lives in a remote area. Local authorities publish lists of hard-to-reach settlements on their websites.

- The entrepreneur lives in an area remote from communications. Then the individual entrepreneur does not sign an agreement with the OFD. But at the same time, he must buy a cash register, a fiscal drive and register them with the tax office.

Activities from clause 2 of Art. 2 54-FZ

Entrepreneurs who are engaged in certain types of activities can work without a cash register even after 2020.

The seller of excise goods is obliged to use the cash register, even if he falls into clause 2, art. 2, 54-FZ “On cash register equipment”.

Sell some goods at the market only with a cash register

Market sellers work without a cash register. But the government has approved a list of goods that cannot be sold without a cash register at markets, fairs and exhibitions. The list included sporting goods, furniture, computers and 14 other categories.

Which cash register to choose

When an entrepreneur is faced with a choice about which online cash register to purchase, the real problem begins. The fact is that many individual entrepreneurs have no idea what to work with, and most importantly, how. The situation is complicated by the fact that the choice is simply enormous. And unfortunately, among such a huge selection, you can easily get lost and buy something that is not at all what you need. The logic of buying the most expensive to be sure doesn’t work here.

But what to do?

Experienced entrepreneurs know that there are several principles that will help you understand which cash register you ultimately need and which one to buy. Let's try to figure it out together. There are many nuances that are designed to help you choose a device for your business. Let's look at what parameters you need to pay attention to when choosing an online cash register. The first parameter is the number of products you sell in the store. If you provide services and do not sell goods, then this also applies to you. Let's start with the fact that the greater the number of goods and services, that is, their names, the more functions you will need a device with. Ideally, it should be equipped with a fiscal drive. But if you have fewer than 50 types of goods and services, then the simplest online cash registers will suit you. Therefore, you can choose the simplest option. The next point is the number of clients. The higher the traffic, the faster your online cash register should work. Unfortunately, the simpler the model, the slower it works. However, if you want your online cash register to work quickly, you will need to purchase a more expensive model. The third point , which is also important, is the cash register parameters. If you provide services remotely, or you have very little space that you could spend on placing a cash register, then the mobile option is suitable for you. This means that such an online cash register is portable and very small. The last point, if you have a huge customer traffic and good turnover, at the same time, you offer a huge number of services, and at the same time you have space to place this cash register, then in this case, do not skimp and purchase a large device. It will be very useful to you. There is one more small nuance that is worth observing. So, it turns out that the online cash register can only be used in the store. But if an entrepreneur has a traveling job, that is, he often travels, or delivers services, for example, delivers manufactured goods, then in this case it is important to understand that it will be much easier for an individual entrepreneur to have a portable online cash register, and preferably a small one.

After all, it will fit very comfortably and organically in his hands and will not interfere with travel. If it is possible to purchase such an online cash register, that is great. Also, despite its size, some models are truly comfortable and allow you to get a huge number of functions that are so needed.

Examples of payment documents

An entrepreneur and his employees provide hairdressing services and sell beauty products.

Retail must be transferred to cash register before July 1, 2020, and services must be transferred before July 1, 2020. Until these dates, the entrepreneur issues BSO to clients for hairdressing services. When selling goods, issues a sales receipt or receipt at the buyer's request.

In a store on UTII, customers can pay for goods with cards

Before purchasing an online cash register, when paying by card, issue a terminal receipt. At the buyer's request, a payment document must be issued. After purchasing cash register equipment, when making payments using a card, you need to issue two receipts - a terminal receipt and a cash receipt.

Types of activities on UTII

Before we understand the question of when cash registers are needed for individual entrepreneurs in 2020, we will tell you about the types of activities of this regime. UTII is applied only to certain areas of business. This includes retail trade and catering, as well as various services: household, veterinary, transportation, etc.

The full list of permitted activities for UTII is prescribed in Article 346.29 of the Tax Code. In addition, in this mode there are restrictions on the area of the trading floor or catering hall - no more than 150 square meters. meters in both cases. The number of employees is also limited - no more than 100 people.

Most retail outlets and catering establishments fit into such limits. Therefore, it is not surprising that more than half of retail and catering enterprises use UTII.

Often they choose to impute an individual entrepreneur without employees for road transport and for the provision of household services. In this case, the calculated tax is reduced by the entire amount of insurance premiums that the entrepreneur pays for himself. As a result, it often turns out that there is no need to pay tax at all, because it is reduced to zero.

And an additional advantage of UTII, as we have already noted, was the ability to work without a cash register. Instead of a cash receipt, when selling goods, a sales receipt was issued, and only at the request of the buyer. To confirm payment for services, a strict reporting form was issued - BSO. But now this cash benefit has been canceled, and the UTII regime itself will only be valid until 2021.

Free tax consultation

Which online cash register to buy for individual entrepreneurs on UTII

Atol 11 F is a fiscal registrar for stationary and away trade. This is a receipt printer that connects to a computer, laptop, tablet or phone. The device is battery-powered, so it is suitable for retail sales from a car. Connects to the Internet via Wi-Fi, wire or phone. Suitable for those who process up to 100 checks per day.

Evotor smart terminal is a receipt printer, tablet and cash register program in one device. There is a built-in application store, similar to GooglePlay. From the store you can download additional programs for analytics, accounting or working with EGAIS. The cash register can be used as a commodity accounting system and a printer of receipts for UTII, as long as there is no fiscal drive.

- Evotor 5 - mini version with battery, for outdoor trading.

- Evotor 7.3 - for small retail outlets.

- Model 10 is a terminal with a large horizontal screen. Suitable for catering, as the display contains a catalog tree and a sales screen.

Pioneer 114F is an autonomous cash register for individual entrepreneurs on UTII. Contains a built-in keyboard, a receipt printer and a small screen for system messages. It works without a computer, so it is suitable for traveling trade. If the batteries run out, you can use AA batteries.

Tip: buy cash in December

To avoid shortages of cash registers and fiscal storage devices, we advise purchasing equipment in advance. If your transition deadline is in 2020, then follow the algorithm:

- December 2020 - buy a cash register and use it as a receipt printing machine.

- February 2020 - buy a fiscal drive so that due to the summer deficit you don’t have to wait for several months for it and don’t overpay.

- July 2020 - sign an agreement with the OFD and register the cash register.

How to switch to online cash register cheaper?

It is better to do this gradually, experts advise. You can use the following algorithm:

- In December of this year it is worth purchasing a new device. Until the first of July it can be used as a check printing machine. The device has other bonuses: convenient supervision of sales of any time period, accelerated inventory, the ability to pay with a card of the issuing bank, reduction in the level of various abuses and errors on the part of cashiers, prompt customer service, BSO is no longer needed, and the check itself will contain everything necessary details;

- from January to March, you must add a fiscal accumulator to your shopping list - its cost is from six to eight thousand rubles. Last year there simply weren’t enough of them – we had to stand in line for months;

- Before the end date of the deferment, sign an agreement with the operator and register the device with the Federal Tax Service. It will cost from three to six thousand rubles.

Which fiscal drive to buy for imputation

According to 54-FZ, individual entrepreneurs on UTII are required to use a drive with a service life of 36 months. Only a few entrepreneurs can buy a 13-month storage drive:

- alcohol sellers;

- sellers of excise goods;

- seasonal business;

- when combining UTII and OSNO;

- residents of areas remote from communications who use the cash register in offline mode.

If you buy a drive with a service life shorter than required, you will be fined 2,000 rubles.

What should you do before purchasing a cash register?

Before purchasing, you need not only to choose a cash register model, having previously assessed its functionality based on the specifics of the business, but also to perform certain preparatory actions:

- Checking the cash register for compliance with legal regulations (it must print receipts, create their digital versions and send information in real time to the operator, and then to the tax authorities). A list of recommended devices is available on the Tax Service website.

- Selecting a fiscal data operator with whom to sign an agreement. It is usually concluded for a year. The list of OFD companies is also posted on the IFTS portal.

- Purchasing a fiscal drive. It is valid for thirteen, fifteen or thirty-six months (it is the three-year period that is used by individual entrepreneurs on UTII). After its service life has expired, it must be replaced.

- Purchasing an additional software package if the business requires it (alcohol, tobacco, meat and dairy) or the entrepreneur uses several taxation systems.

When an entrepreneur buys a cash register, he must register it with the tax office and with the FD operator. To do this you need to submit an application. After checking the registration information, the tax authorities will send a number, which the businessman then enters into the machine, generates the first fiscal report and sends it to the inspectorate. After confirmation and registration of the registration card, the device is ready for use.

Individual entrepreneurs will receive a tax deduction at the online checkout

The deduction can include the cost of a cash register, storage device, cash register programs, services of a fiscal data operator and a service center.

The maximum deduction amount is RUB 18,000 for each device. If you have several businesses on UTII, then you can get a deduction for each. But you cannot reduce taxes by 10,000 rubles for one activity, and 26,000 rubles for another. The tax can be reduced even to zero - there are no restrictions. You can take into account expenses in any period; it is not necessary to apply the deduction in the quarter in which you paid for the cash register.

To receive the deduction, you need to buy a cash register and register it before July 1, 2020. Catering and retail with hired employees must register cash registers before July 1, 2020.

You can reduce the tax for 2020 and 2020. To do this, UTII indicates cash expenses in the tax return.

Tax deduction document: Law dated November 27, 2017 No. 349-FZ

Example of a tax deduction

An entrepreneur on UTII must pay 15,000 rubles in taxes for the first quarter.

In January 2020, he bought a cash register for 20,000 rubles and registered it with the Federal Tax Service. Also in the first quarter I paid 45,000 rubles in insurance premiums.

According to the law, an entrepreneur can reduce tax by a maximum of 50% through contributions. He reduced his UTII by 7,500 rubles due to contributions and must pay another 7,500 rubles. He reduced the remaining tax amount to zero through a deduction on the cash register.

As a result, the businessman does not pay UTII for the first quarter. In the second quarter, you can still get a tax deduction at an online cash register - 10,500 ₽.

Online cash register - new business opportunities

Creating an environment of trust

Tax authorities have fewer reasons to bother you, since all information on fiscal data, revenue and its automated analysis will be available to the Federal Tax Service online.

Access to fiscal data for all retail outlets will also reduce unfair competition.

Sales control and analysis

By connecting a cash register to the OFD, you receive analytics for each point and a general summary of company data in the personal account of the fiscal data operator.

- Product rating

- Revenue, average bill, etc.

- Cashier reports

- Comparison with the market

One step to complete trading automation

- With OFD you already have accounting for retail outlets. All you have to do is add data on the receipt of goods and on the accounting of money - and you have a complete picture of your business.

- In order to make your business more efficient, choose a system that combines CRF and accounting.

Fines in 54-FZ for individual entrepreneurs on UTII

- Work without cash register equipment - 25–50% of unaccounted revenue, but a minimum of 10,000 rubles.

- Repeated work without a cash register, if the unaccounted revenue for both times is more than 1 million rubles - disqualification for 1-2 years.

- The cash register does not comply with the law 54-FZ or is registered incorrectly - 1500–3000 ₽ or a warning.

- They did not issue a check to the client or made a mistake in the details - 2000 ₽ or a warning.

A warning is issued if the violation is not serious and the individual entrepreneur has violated it for the first time (Law dated July 3, 2016 No. 316-FZ). Officials will independently determine whether this is the first violation or not - they will look in the internal database.

Sanctions for the absence or incorrect use of an online cash register

When an entrepreneur does not send purchase data on time, does not monitor the serviceability of the device and the consistency of the Internet connection, uses equipment that does not comply with the law, or does not register the cash register at all, although federal legislation obliges him to do so, the tax office will charge a fine:

- in the absence of the necessary equipment - from a quarter to half of unrecorded revenue, but not less than ten thousand rubles;

- incorrect use of equipment or installation of a device not included in the list of approved equipment will cost the entrepreneur from 1,500 to 3,000 rubles;

- for failure to issue a receipt to the consumer, the company will simply be warned or charged two thousand rubles.

Let's sum it up

- Almost all individual entrepreneurs set up cash registers on UTII from July 1, 2020.

- Catering and retail with hired employees - July 1, 2020.

- There are no separate deadlines for beer sellers.

- Before purchasing an online cash register: issue a BSO to everyone, and a sales receipt to those who ask.

- After purchasing an online cash register, issue checks and BSOs to everyone.

- Sellers of excise goods and beer indicate the name of the product on the receipt, others do not.

- If you use a drive with a shorter service life, the tax office will fine you 2,000 rubles.

- The cash deduction of 18,000 ₽ can be stretched over several tax periods.

- If it is the first violation, the tax office will issue a warning rather than a fine.

Technical support of equipment. We will solve any problems!

Leave a request and receive a consultation within 5 minutes.

Are cash registers needed for individual entrepreneurs working on “simplified” and “imputed”?

For payments in the area of business where a simplified taxation system operates, a cash register is needed; for activities that are still subject to deferment, receipts do not need to be entered through online technology. But in any case, with a combined taxation system, legislative norms still continue to apply. After the end of the deferment, one cash register working with two tax types will be sufficient in the future. But here it is worth remembering that you cannot enter goods from different systems into one receipt.

Update

Despite the government’s promises to consider extending the grace period for entrepreneurs on UTII regarding the use of online cash registers, no changes have occurred.

A very small category of individual entrepreneurs using UTII may not use online cash registers until July 1, 2020. Such individual entrepreneurs include entrepreneurs working in the field of providing services to the public, as well as working personally without the use of hired labor in the field of trade and catering.

From July 1, 2019, all of the above categories of individual entrepreneurs on UTII are required to use online cash registers. Since there is not much time left before this deadline, we recommend that you start purchasing and registering cash registers now, so as not to get in line during the influx of people wanting to register cash registers at the Federal Tax Service.

The material was updated on February 23, 2019, taking into account current changes in the legislation of the Russian Federation.