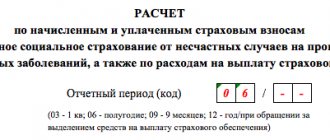

Taxpayers submit UTII declarations four times a year at the end of the quarter. In the article we will talk about the deadlines for submitting the declaration, changes for 2020, tax calculation and filling out the declaration, fines and zeros.

The latest UTII declaration must be submitted based on the results of the 4th quarter of 2020. From January 1, 2021, imputation will be canceled throughout the country. Choose your new tax regime using our free calculator. If you are going to switch from UTII to another tax regime, read our article - we have collected answers to the most popular questions about tax systems. Didn't find the answer to your question? Ask it in the comments, we will definitely answer.

Dates and place of submission of the UTII declaration

You must submit UTII by the 20th day of the month following the last month of the reporting quarter.

Report for the 1st quarter of 2020 - until April 20, 2020 (the 20th falls on a Saturday, so the deadline has shifted to Monday the 22nd) .

Report for the 2nd quarter of 2020 - until July 20, 2020.

Report for the 3rd quarter of 2020 - until October 20, 2020.

Report for the 4th quarter of 2020 - until January 20, 2021.

Tax on imputed income must be paid by the 25th day of the month following the reporting quarter.

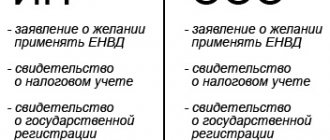

The UTII declaration is submitted to the tax office at the place of registration of the business or at the actual location. For example, for private cargo carriers, the workplace is constantly moving.

In the accounting calendar from Kontur.Accounting, you can see what taxes need to be paid this month and read how to do it.

When to report

The UTII declaration must be submitted to the Federal Tax Service no later than the 20th day of the month following the expired quarter. This is provided for in paragraph 3 of Article 346.32 of the Tax Code of the Russian Federation.

If the deadline for submitting the declaration falls on a weekend, it is postponed to the next Monday (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). In April 2018, such transfers will not be necessary. After all, the deadline for submitting the UTII declaration for the 1st quarter of 2020 is April 20, 2020 (Friday).

If you fail to submit your UTII declaration for the 1st quarter of 2020 or submit the document late, the company or individual entrepreneur may be fined. The amount of the fine is 5% of the amount of tax that is payable on the basis of the declaration. In this case, the total amount of the fine cannot be more than 30% of the tax amount and less than 1000 rubles. (Article 119 of the Tax Code of the Russian Federation).

Declaration on UTII from January 1, 2020

Back in 2020, section No. 3 appeared in the declaration with the calculation of insurance premiums that reduce tax. Remember that companies cannot reduce the amount by more than half, however, individual entrepreneurs without employees can even reset the tax to zero and not pay it at all.

To allow individual entrepreneurs to include a tax deduction for the purchase of an online cash register in their declaration, tax authorities have developed a new reporting form. It was approved by order of the Federal Tax Service dated June 26, 2020 N ММВ-7-3/ [email protected]

You won't have to spend a lot of time learning a new form. The form remained the same, but was supplemented with an additional section. Section 4 was introduced to reflect the costs of purchasing, installing and configuring online cash register systems by entrepreneurs. Let us remind you that on July 1, 2020, the transition to online cash registers ended, so there is a need to update the form. When purchasing cash register equipment in this section you need to reflect:

- name of the purchased cash register model;

- serial number of the cash register;

- registration number received from the tax office;

- date of registration of the cash register with the inspection;

- expenses for purchase, installation and configuration - expenses in the amount of no more than 18,000 rubles per cash register can be deducted.

New form of declaration of imputation

The UTII declaration must be submitted quarterly

. The due date is no later than the 20th day of the month following the quarter.

The Tax Service, by letter dated July 25, 2018 No. SD-4-3/ [email protected] , recommended using the new UTII report form. This declaration form must be used before the entry into force of the order that does not recommend, but approves a new declaration - until November 24, 2018.

And finally, by order No. ММВ-7-3/ [email protected] , which comes into force on November 25, 2018, a new form of declaration for UTII is established.

The new form has added a section where an entrepreneur can reflect the costs of purchasing a cash register. It is recommended to use this form starting from the submission of the UTII declaration for the 3rd quarter of 2018.

Until the 3rd quarter, in order to receive a cash register deduction, entrepreneurs had to submit a declaration and an explanatory note to the tax office

Thus, for the third quarter of 2020, two forms are valid simultaneously:

- Approved form - this form can be used by organizations and individual entrepreneurs that do not declare a cash register deduction in the reporting quarter (valid until November 24, 2020).

- Recommended form - this form is recommended for entrepreneurs to fill out to apply for a cash deduction (valid until November 24, 2020).

Starting from November 25, 2020, the declaration form approved by Order No. ММВ-7-3/ [email protected]

Declaration forms for UTII

The tax authorities were a little too clever with the recommended and approved forms for UTII. Therefore, we suggest using the following table.

| Application period | Format | Declaration form | Note |

| From 11/25/2018 | 5.08 | Cancels all previously approved and recommended forms | |

| From 10/01/2018 (Q3 2020) to 11/24/2018 | 5.09 | Recommended form | |

| From 01/01/2017 (1st quarter of 2020) to 24/11/2018 | 5.07 | Approved Form - Valid at the same time as Recommended Form | |

| From 10/01/2015 (Q1 2020) to 12/31/2016 | 5.06 | To submit updated declarations |

Cash deduction

Let us remind you that from 2020, individual entrepreneurs can reduce the imputed tax on expenses associated with the transition to online cash registers, subject to a number of conditions.

- Deduction only for individual entrepreneurs

. - CCP is included in the register.

- The cash register is used in activities subject to UTII.

- The deduction amount is no more than 18,000

rubles for each copy of the cash register. - The cash register was registered

with the tax authority within the established time frame: from 02/01/2017 to 07/01/2018 for individual entrepreneurs - employers in trade and catering services, from 02/01/2017 to 07/01. 2020 – for other entrepreneurs. - The tax can be reduced for tax periods

, but not earlier than the period in which the cash register is registered: the periods of 2018 - for individual entrepreneurs in the field of trade and public catering with the involvement of employees, the periods of 2020 and 2020 - for other entrepreneurs.

The unaccounted amount of the cash deduction can be transferred to the following quarters without exceeding the deadlines specified in paragraph 6.

How to fill out a new UTII form?

Completing the recommended form is no different from the new approved declaration form.

For individual entrepreneurs who claim a cash register deduction

, the new declaration is filled out as follows.

- In section 3 “Calculation of the UTII amount” in line 040 you need to reflect the amount of the cash register deduction;

- It is necessary to fill out section 4 “Calculation of the amount of expenses for the purchase of cash registers”:

- on line 010 – name of the cash register model included in the register

- on line 020 – serial number of the cash register

- on line 030 – cash register registration number assigned by the tax authority

- on line 040 – date of registration of the cash register with the inspection

- on line 050 – expenses for the purchase of cash registers. The amount should not exceed 18,000 rubles.

If the cash register model is not in the register, then we recommend that you first indicate the model from the cash register registration card, and then (with a dash) the name of the model from the sales documents

For UTII payers who do not apply

deduction by cash register, fill out the new declaration form as follows.

- In section 3 “Calculation of the amount of UTII”, put a dash on line 040, on line 050 – the amount of tax payable to the budget;

- Do not complete Section 4.

Declaration on UTII for the 1st quarter

The reporting period for imputed tax is quarterly. Therefore, in April 2020, you must submit the report again. The generally accepted deadline is the 20th of the month following the reporting quarter. In 2020, April 20 falls on a Monday, so the deadline will not be postponed. Tax must be paid no later than April 25th.

Keep in mind that even if you did not purchase an online cash register and you do not have the opportunity to apply a deduction, you are required to use the new reporting form. Do not forget that from 2020, increased deflator coefficients are in effect, K1 is equal to 2.005, and check the value of K2 with your local tax office.

On the title page, enter the reporting year in the field as 2020, and in the tax period code as 21 for the first quarter. When reorganizing or liquidating an organization in the second quarter, enter period code 51.

Codes of tax periods for income tax

According to Order of the Federal Tax Service of Russia dated October 19, 2020 N ММВ-7-3/ [email protected]

| Code | Name of period |

| 13 | First quarter for the consolidated group of taxpayers |

| 14 | Half-year for the consolidated group of taxpayers |

| 15 | Nine months for a consolidated group of taxpayers |

| 16 | Year by consolidated group of taxpayers |

| 21 | First quarter |

| 31 | Half year |

| 33 | Nine month |

| 34 | Year |

| 35 | One month |

| 36 | Two month |

| 37 | Three months |

| 38 | Four months |

| 39 | Five months |

| 40 | Six months |

| 41 | Seven months |

| 42 | Eight months |

| 43 | Nine month |

| 44 | Ten months |

| 45 | Eleven months |

| 46 | Year |

| 50 | Last tax period for reorganization (liquidation) of an organization |

| 57 | One month for a consolidated group of taxpayers |

| 58 | Two months for a consolidated group of taxpayers |

| 59 | Three months for a consolidated group of taxpayers |

| 60 | Four months for a consolidated group of taxpayers |

| 61 | Five months for a consolidated group of taxpayers |

| 62 | Six months for a consolidated group of taxpayers |

| 63 | Seven months for a consolidated group of taxpayers |

| 64 | Eight months for a consolidated group of taxpayers |

| 65 | Nine months for a consolidated group of taxpayers |

| 66 | Ten months for a consolidated group of taxpayers |

| 67 | Eleven months for a consolidated group of taxpayers |

| 68 | Year by consolidated group of taxpayers |

Please note: codes 35-46 and 57-68 are indicated by taxpayers paying monthly advance payments based on the actual profit received.

Declaration on UTII for the 2nd quarter

Prepare the second report in 2020 for the period April-June. The generally accepted deadline is the 20th of the month following the reporting quarter. This year, July 20 falls on a Monday, so the deadline will not be postponed. You can submit your declaration in electronic or paper form. On paper, the report can be taken to the tax office in person, delivered with a representative, or sent by mail. Tax must be paid by July 25th.

Don't forget to apply the new deflator coefficient K1, which is 2.005 this year. Ask your local Federal Tax Service for new K2 values.

On the title page, enter the reporting year in the field as 2020, and in the tax period code as 22 for the second quarter. When reorganizing or liquidating an organization in the second quarter, enter period code 54.

Declaration on UTII for the 3rd quarter

Submit the third report on the UTII system for the third quarter - for the period from July to September. The declaration must be submitted by October 20, but since this day falls on a Sunday, you can still have time to submit the reports on Monday. You can submit your UTII declaration in electronic or paper form. The paper report can be sent to the tax post office, with a representative, or brought in person. It is more convenient to submit an electronic declaration online through the Kontur.Accounting service.

Remember to apply the K1 deflator factor, which is 2.005 this year. Check the K2 values with your local Federal Tax Service.

On the title page, enter the reporting year in the field as 2020, and in the tax period code as 23 for the third quarter. When reorganizing or liquidating an organization in the third quarter, enter period code 55.

Declaration on UTII for the 4th quarter

The tax authorities are waiting for the fourth UTII declaration for the period from October to December. The declaration must be submitted next year 2021 by January 20. You can submit your UTII declaration in electronic or paper form. The paper report can be sent to the tax post office, with a representative, or brought in person. It is more convenient to submit an electronic declaration online through the Kontur.Accounting service.

Remember to apply the K1 deflator factor, which is 2.005 this year. Check the K2 values with your local Federal Tax Service.

On the title page, enter the reporting year in the field as 2020, and in the tax period code as 24 for the fourth quarter. When reorganizing or liquidating an organization in the fourth quarter, enter period code 56.

Codes of tax periods for corporate property tax

According to the Order of the Federal Tax Service of Russia dated March 31, 2017 N ММВ-7-21/ [email protected]

| Code | Name of period |

| 21 | I quarter |

| 17 | Half year (2nd quarter) |

| 18 | 9 months (3rd quarter) |

| 51 | I quarter during the reorganization of the organization |

| 47 | Half-year (2nd quarter) during the reorganization of the organization |

| 48 | 9 months (3rd quarter) upon reorganization of the organization |

| 34 | Calendar year |

| 50 | Last tax period for reorganization (liquidation) of an organization |

What sections does UTII consist of?

The UTII declaration consists of a title page and four sections. Individual entrepreneurs on UTII who wish to receive a deduction at the cash register must fill out all sections.

On all sheets of the declaration, the company’s tax identification number and checkpoint are indicated. If an organization is simultaneously registered at the location of a separate division (branch) and at the place where it conducts activities subject to tax on imputed income, then the declaration must indicate the checkpoint assigned to the company as a payer of this tax, and not the checkpoint of the branch.

There have been no changes to the title page. It must be filled out according to the old rules. Indicate basic information about the business: name or full name, tax period, reporting code, code for the place of representation, which OKVED code your business corresponds to, etc.

The first section is usually completed last. It reflects the obligation to pay UTII to the budget.

In the second section you need to calculate the amount of tax. The second section is filled out separately for each type of activity and for each OKTMO. Indicate in section 2 the address of work, UTII code, basic profitability and coefficients K1 and K2. On lines 070-090, indicate the value of the physical indicator by month of the quarter. Enter a tax rate of 15% (or less if your region has incentives) and calculate the tax for the quarter.

The third section contains financial information on the business and insurance premiums. Here you need to combine the information from the second and fourth sections to calculate the total tax amount. First, the tax is reduced by insurance premiums, and then by the deduction for the purchase of cash registers.

The fourth section must be completed for each unit of cash register purchased for work on UTII. The amount of expenses for purchasing a copy of the cash register is accepted for deduction and is indicated in line 040 of Section 3.

How to calculate UTII

The following formula is used to calculate tax:

Tax amount = Tax base × Tax rate.

To calculate the tax base (the amount of imputed income), the following formula is used:

Imputed income for the month = Basic profitability × K1 × K2 × Physical indicator

Basic profitability is determined by the type of business in accordance with clause 3 of Art. 346.29 Tax Code of the Russian Federation. There you can also find physical indicators for UTII.

The physical indicator depends on the type of activity. If you provide household services and are an individual entrepreneur, then your physical indicator is your employees. And for an entrepreneur on his bus that transports passengers, the physical indicator is the seats in the car. Accordingly, the tax base will be different.

As for the adjustment deflator coefficients K1 and K2, they can be found in Order No. 595 dated October 30, 2018 (K1) and in the decision of the local government authority at the place of registration of the business (K2). K1 has increased to 2.005 since 2020.

Formula for calculating UTII

The UTII calculator program contains a tax calculation formula derived based on the requirements of paragraphs. 2, 4, 10 tbsp. 346.29 and the norms of Art. 346.31 Tax Code of the Russian Federation.

The formula for calculating UTII is as follows:

UTII = BD x (FP 1 month + FP 2 months + FP 3 months) x K1 x K2 x 15%, where

- BD - basic profitability (its size is shown in the 3rd column of the table contained in clause 3 of Article 346.29 of the Tax Code of the Russian Federation);

- FP is a physical indicator (it is easy to find out which units should be counted from the 2nd column of the table above);

- coefficient K1 (it is already included in the calculator), which changes annually (in 2020 it is equal to 1.915, and in 2020 - 2.005);

- coefficient K2 (set by the constituent entities of the Federation); To test yourself, you should make sure that its value is in the range from 0.005 to 1.

Read more about the correction factor in the article “What you need to know about the K2 coefficient” .

- tax rate, which is 15%.

To calculate tax using an online calculator, all of the above values should be filled in the appropriate columns of the service.

Zero declaration on UTII

Even if the company/individual entrepreneur did not conduct any activity in the reporting quarter, it is not worth handing over an empty (zero) UTII. You will still be charged tax, but for the last period when there was non-zero reporting.

The fact is that the tax is calculated based on physical indicators, not actual income. The absence of physical indicators is a reason to deregister, and not to refuse to pay tax. Even if the payer has not worked under UTII for some time, he must submit a declaration indicating the amount of tax calculated on the basis of the physical indicator and the rate of return.

What you need to know before filling out the UTII declaration

Before moving on to the specifics of working in an online service, let’s understand the formula for calculating UTII. The difference between this regime and others is that the tax imposed here is imputed, i.e. supposed by the state, and not actually received income.

All components of the tax calculation formula (FP * DB * K1 * K2 * 15%) are indicated in the declaration, so you need to understand what it is:

- FP is a physical indicator by type of activity (it can be the number of employees, units of freight transport, seats, sales floor area, etc.);

- BD – basic profitability per one unit of FI per month;

- coefficient K1 – takes into account the growth of inflation, set by the Government, in 2020 it is equal to 2.005;

- K2 coefficient is a reduction coefficient that is established on the territory of the municipality for each type of UTII activity, and can vary from 0.005 to 1.

The standard rate for UTII in 2020 is 15%, but in some municipalities there is a reduced rate for certain types of activities - up to 7.5%. True, this is a rather rare situation, because the taxes that UTII payers transfer to the budget are already quite small.

FP and DB are established by Article 346.29 of the Tax Code for each type of activity. For example, the basic profitability per employee (including the individual entrepreneur himself) in the field of veterinary services is 7,500 rubles. You can find the required FP and DB values for your type of activity in the original source or in this article. We have already indicated the value of the K1 coefficient above. It remains to find the coefficient K2.

This coefficient does not have a general federal significance, because it is established by regulations of municipalities. Moreover, in some cities the value of K2 for the same type of activity will be different in the center and on the outlying streets. Often local authorities introduce additional gradations depending on what the store sells or what household services are provided. You can find out the value at the tax office at the place of imputed activity or on the Federal Tax Service website.

You need to find out the value of the K2 coefficient and the tax rate on the Federal Tax Service website. By following the link, select your region at the top of the page, after which a legal act with the necessary information will appear at the bottom of the page in the “Features of regional legislation” section.

So, follow the link and register in the service by indicating your email address.