Responsibility of an individual entrepreneur for debts

If a legal entity is obliged to pay off a debt with funds obtained from the sale of the organization’s property, then the individual entrepreneur is forced to pay off the debt by parting with personal property or property acquired to promote his services. The common property of the spouses may also be seized to offset the debt.

In 2020, there are three types of liability that may result from violation of the law by an individual entrepreneur:

- Administrative . Reason: debt for taxes, duties, insurance premiums, etc. Punishment: penalties, the amount of which may vary.

- Subsidiary . Reason: debt to lenders, budget and financial institutions. Punishment: The debtor's personal property is confiscated and sold at auction. The funds received are used to pay off the debt. They are not confiscated only, according to Art. 446 of the Civil Code of the Russian Federation, the only housing, livestock, items necessary for professional work, if their price is not higher than 100 minimum wages and some other things.

- Criminal . Reason: especially serious crimes in the economic and tax sphere, fraud, etc. Punishment: significant fines, arrest, forced labor, imprisonment.

The Code of the Russian Federation on Administrative Offenses establishes penalties that arise from the unlawful economic activity of an entrepreneur. It should be noted that this year, for the debts of an individual, the administrative liability of an individual entrepreneur represents a lower fine than the one that would be imposed on a legal entity in a similar situation.

An entrepreneur should not forget about his debts to creditors. All the nuances concerning the relationship of individual entrepreneurs with banks and the state are reflected in the Civil Code of the Russian Federation. To repay the debt, the entrepreneur may have his personal and family property confiscated.

First of all, according to a court decision, money is written off from a bank account in favor of creditors, but if the amounts did not fully satisfy the lenders and were not enough to pay the debt, then the process of collecting property follows, which consists of its inventory and subsequent confiscation. If the proceeds from the sale of property were again insufficient, then the division of marital property proceeds.

Even within three years after the closure of the individual entrepreneur, the former businessman continues to bear property liability, since exactly three years is the statute of limitations. Here the entrepreneur will have to be responsible for unpaid tax debt and overdue payments to extra-budgetary funds. The tax authorities will not even need to go to court again, since they have the right to conduct the process based on the case on their own, waiting only for the decision of the tax inspector.

If an entrepreneur has violated the law, his actions will lead to certain liability, it does not matter whether he intentionally violated the law or not. It is important to know what requirements are being put forward for entrepreneurial activity this year in order to avoid unpleasant consequences.

Is it possible to close an individual entrepreneur if there are debts?

It should immediately be noted that debt can be different: to contractors, to hired employees and to the budget. By virtue of current legislation, an entrepreneur is liable for his obligations with all his property, except for that which cannot be levied under the law. Therefore, even in the case of unfulfilled monetary obligations under contracts and transactions, he still has the right to formalize the termination of his activities, and no one has the right to prohibit him from doing so. But in practice, the question of how to liquidate an individual entrepreneur with debts still arises.

If debts to counterparties are not repaid, you should not rely on termination of operations as a lifeline from existing obligations. The debtor will still have to repay them in full, but as an individual.

If there are unfulfilled obligations, it is possible to liquidate the business voluntarily by submitting documents to close the individual entrepreneur to the tax service. But it is also possible to initiate bankruptcy proceedings as an individual. This is the most difficult stage, which is subject to separate consideration, and has certain difficulties and nuances.

Is it possible to close an individual entrepreneur with debts in 2020?

The reasons why people decide to close an individual entrepreneur may vary: someone realizes that they liked working for hire more, someone decides to re-register as a legal entity, and someone simply did not have a business and accumulated a large debt. In recent years, people cite an increase in contributions to compulsory pension insurance as the main reason for closing individual entrepreneurs.

However, many businessmen decide not to immediately close their individual entrepreneurs because:

- they don’t realize that day after day their debt to the Pension Fund is only growing, and it doesn’t matter whether the individual entrepreneur has income or not;

- have a debt to the tax service and funds, but due to lack of finances they cannot repay it;

- they are afraid to begin the process of closing an individual entrepreneur, because they believe that this is an energy-intensive process that can take years.

The forms of activity of individual entrepreneurs and legal entities are very similar: an individual entrepreneur can in the same way be one of the independent parties when concluding an agreement and be a participant in tax legal relations. In 2020, there are several possible reasons for the formation of debt:

- The individual entrepreneur improperly fulfilled his financial obligations under civil transactions;

- the individual entrepreneur has accumulated debt to banks and lending organizations;

- The individual entrepreneur did not make tax payments on time;

- The individual entrepreneur did not timely pay insurance fees to the Pension Fund and other extra-budgetary funds.

The above debts usually consist not only of the principal amount of the debt, but also of penalties: penalties, fines, interest and penalties.

But not many people know that in recent years, the closure of an individual entrepreneur can be carried out even when there are some debts. If this is a debt to contractors and employees, then it is possible to terminate business activities even without paying the debt, since the registration authority does not require this. Here you can see the difference between the behavior of a legal entity and an individual entrepreneur - the former is always obliged to inform creditors about its closure. In the case of an individual entrepreneur, this is not necessary, but the entire debt will be transferred to the individual. If a businessman has a debt to the budget, then it is also possible to close the individual entrepreneur without paying it.

The only thing that can prevent you from closing an individual entrepreneur is failure to submit reports to the Pension Fund. When the registration authority begins to carry out the procedure for liquidating an individual entrepreneur, it makes a request to the Pension Fund, and if it turns out that the individual entrepreneur has a reporting debt, it will be impossible to close the individual entrepreneur.

Consequences and responsibility

Debt to the Pension Fund and the Federal Tax Service are administrative offenses, and the law provides for liability for them. If an entrepreneur does not want to pay the debt to the Pension Fund, he is charged penalties and fines on top of the principal amount.

Taking into account various situations (partial payment of contributions, etc.), the fine can reach 40% of the total debt.

Accrued fines and interest are collected from the debtor according to the standard scheme:

- a demand is sent to pay the existing debt;

- if the requirements are ignored, payment will be charged from the bank account;

- if there is no money in the debtor's account, the Pension Fund files a claim in court.

The consequences of non-payment of debts to the tax service and the process of collecting funds are similar.

Closing an individual entrepreneur in 2020 with debts on contributions to the Pension Fund

If you do not make mandatory contributions to the employees of the individual entrepreneur in the Pension Fund, then a large debt is formed, which, as many businessmen think, prevents the closure of the individual entrepreneur. But in fact, both for individual entrepreneurs with debts and for individual entrepreneurs without them, the process of liquidating an organization is carried out in the same manner.

When an entrepreneur decides to close an individual entrepreneur, the Pension Fund is obliged to issue, upon request, a tax document confirming the absence of debt.

Such a request from the tax authorities can in no way influence the process of closing an individual entrepreneur, since according to the law in 2020, the debt can be repaid both before and after the termination of business activity.

Thus, the businessman can decide for himself when he will pay off this debt. Nothing will prevent him from paying off the debt, having already been freed from the status of an entrepreneur. When the individual entrepreneur is closed, data about this will go to the Unified State Register of Individual Entrepreneurs, and then to the Pension Fund.

If it happens that a person, having closed an individual entrepreneur, refuses to pay the debt, the latter may be forcibly collected when the Pension Fund reports the situation to the court.

Bottom line

As we could see, closing an individual entrepreneur is a simple procedure, consisting of several steps. And difficulties with the presence of debt on an entrepreneur can arise only when the debt is related to unpaid taxes. In all other cases, you can close the company, leaving payment for later.

The main thing is not to forget that the closure of an individual entrepreneur with debts does not lead to the elimination of these debts. Even after losing your entrepreneur status, you will still need to pay the required amount. Otherwise, the consequences will not be pleasant.

Also read the materials: “How to properly close an individual entrepreneur. Instructions for 2020”, “How to close an individual entrepreneur. Tax return for UTII."

Closing an individual entrepreneur in 2020 with tax debts

An individual entrepreneur may have a debt not only to the Pension Fund, but also to other public and private structures. Many people are concerned about the question: is it possible to close an individual entrepreneur in 2020 with a tax debt? Unpaid tax obligations will not allow the individual entrepreneur to be liquidated; first, the entire amount of the debt will have to be paid, as well as all fines and penalties attached to it. So it is important to understand that there may be large additional costs involved.

Before closing an individual entrepreneur with debts to the Federal Tax Service and the pension fund, you must definitely prepare a tax return for the entire period of the individual entrepreneur’s activity. This step is required even if there was no actual activity as such - in this case there will be neither income nor expenses. If the entrepreneur provided such reports regularly from year to year, then here it will be required only for the last tax period. If some circumstances arose that prevented the reporting from being submitted on time, this can be done even after the individual entrepreneur has been closed. 5 days are given for this.

It is clear that if you violate the deadlines for submitting documents, you will receive a fine, so in order to avoid unnecessary expenses, you need to try to do everything in advance. After all this, the amounts of all your debts will be clarified. The first step is to repay the debt to the state and only then make contributions to other organizations.

When an individual entrepreneur does not have enough funds to repay a debt, his property may be used as payment. It will, of course, go under the hammer at a reduced price, and they will also take additional money from the debtor for holding auctions.

But even if the entrepreneur does not have enough funds to pay the debt, it is possible to avoid a situation where he will have to lose his property. If a person closes an individual entrepreneur due to bankruptcy, the court in some cases meets halfway and softens the obligations on the debt: the payment deadline is postponed, payment by installments is carried out.

How to make sure that the IP is closed

On the sixth working day after sending the documents, the Federal Tax Service will send a USRIP record sheet to the email address specified in form P26001. But if you used the services of the Russian Post, the response period must be counted from the date the letter was received by the inspectorate, and not from the date it was sent.

The Unified State Register of Individual Entrepreneurs will indicate that an entry has been made in the register indicating that an individual has ceased to operate as an individual entrepreneur. You can also verify this information by requesting information from the registry online.

How to close an individual entrepreneur in 2020 with debt: step-by-step instructions

In order to remove the stone from your soul and calmly close an individual entrepreneur with a debt, you need to correctly plan the stages of liquidating the status of an entrepreneur. In 2020 this is done as follows:

- If an individual entrepreneur employs hired workers, then, as the law states, they must be notified of the closure two months in advance.

- You need to clarify all unclear issues regarding the payment of taxes to the budget with the tax inspector. Before doing this, you should reconcile the deductions and, if necessary, pay off the debt.

- If necessary, submit final reports and tax returns.

- Collect all documents required to close an individual entrepreneur.

- Notify the bank about the liquidation of the individual entrepreneur to close the current account.

- Before closing an individual entrepreneur, it is necessary to pay all employees the wages due.

- Each owner decides for himself when he makes full settlements with counterparties. But as practice shows, this is done long before the closure of the individual enterprise.

- After the individual entrepreneur has been closed, you need to pay all utility bills, pay off the rent debt, pay for the Internet, telephone, etc.

To close an individual entrepreneur with a debt in 2020, you need to contact the Federal Tax Service at the place of registration and submit the relevant documents there. This can be done either by the entrepreneur himself or by his authorized representative, but in this case his authority will need to be confirmed with a notarized document.

Many people are worried about the bureaucratic part of the matter. If an accountant does not work for an individual entrepreneur, then you will have to do all the paperwork yourself. You will have to be twice as careful and take into account all the schedules and laws so as not to accumulate new debt.

We offer you step-by-step instructions to understand how to close an individual entrepreneur in 2020 (with and without debt):

- The very first step is filing an application to close the business. There is a special form for this (P26001). To draw up such a document, you will need the identification data of the owner, the Unified State Register of Individual Entrepreneurs and the contact information of the entrepreneur.

- Next, you need to pay the state fee for registering the termination of the individual entrepreneur’s activities. This year it is 160 rubles, you can take the payment order from the Federal Tax Service, or you can print it yourself using an online resource.

- Then you should visit the territorial inspector, submit a prepared application to him and provide a payment order confirming the absence of debt for paying the state duty.

- After this, observing the deadlines, you should come for documents on closing the individual entrepreneur. You will be given an extract from the Unified State Register of Individual Entrepreneurs and a certificate in form No. 65001.

As soon as the individual entrepreneur is closed, payments to the budget will stop. The tax inspector himself will send information about the closure of the individual entrepreneur to the Compulsory Medical Insurance Fund and the Social Insurance Fund.

Keep in mind that the law defines its own deadlines for each step to close an individual entrepreneur in 2020. An entrepreneur should adhere to all time frames so as not to create additional headaches for himself and not to accumulate new debt.

- To make an entry about the liquidation of an individual entrepreneur in the unified register of entrepreneurs, 5 working days are allotted.

- The time it takes to submit tax returns depends on the initial tax system.

- All debts under the Pension Fund must be paid within 15 working days after registration of the termination of the individual entrepreneur’s activities.

The entrepreneur himself must monitor compliance with all deadlines, compliance of documents with standards and elimination of debt. For your convenience, you can even create a calendar with notes on all upcoming events to close individual entrepreneurs in 2020. Late submission of documents and debt in payment will not bring you anything good, so be careful, and then the liquidation process will be quick and easy.

It is not necessary to personally go and submit all the documents to close an individual entrepreneur; this year they can be sent through the electronic service of the tax service or by Russian post. If you decide to resort to these options, then before sending, double-check the package of documents several times and make sure that everything is completed properly. Otherwise, the papers will be returned for revision, and this will slow down the entire process and will not allow the individual entrepreneur to close on time.

Application for termination of activity

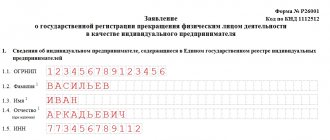

As mentioned above, an application for liquidation of an individual entrepreneur is drawn up in form P26001. Fill it out electronically.

How to fill?

This form has only one page:

- When filling out the application, you must provide information about the individual entrepreneur (1 point, subparagraphs 1.1-1.5):

- OGRNIP number;

- Full name of the person who is registered as an individual entrepreneur;

- TIN number.

- In the second paragraph, the box indicates the method of obtaining confirmation of liquidation, and also indicates contact information - mobile phone number or email address.

- Points 3 and 4 are omitted and left blank when submitting an application online. They are intended for an authorized person to personally contact the tax office.

The information provided in the application must be reliable. You must check all details carefully before submitting the form, otherwise your application will be rejected.

How to close an individual entrepreneur in 2020 with debts through the MFC

The MFC is a multifunctional center that can be contacted by individuals, individual entrepreneurs, and non-profit institutions. MFC provides a wide range of services, which can always be found on a special website.

In 2020, you can contact most regional MFCs to close an individual entrepreneur (with and without debt). The only thing that can force you to bypass this option is that the tax authorities are not too fond of the MFC, since the centers often do not check whether individual entrepreneurs have debt.

You will need the following documents to close an individual entrepreneur in 2020 through the MFC:

- businessman's passport;

- individual entrepreneur registration certificate;

- TIN of the entrepreneur;

- application to close a business;

- receipt of payment of state duty.

In this case, all bank accounts of the entrepreneur must already be closed, and the cash register that was used in the work must be deregistered.

The MFC may refuse, and you will not be able to close the individual entrepreneur if you provide an incomplete (or incorrectly collected) package of documents; if you have a debt to pay the duty; the data in the application does not agree with the data from the Unified State Register; The individual entrepreneur was incorrectly registered in the funds; There are no notarized authorities when submitting a package of documents through a third party. If you have done everything and formalized it properly, but you are nevertheless refused, you have every right to go to court.

The advantages of closing an individual entrepreneur in the MFC in 2020 are that the procedure will go quickly, such centers are multitasking in themselves, they have a high level of customer service and convenient operating hours. The disadvantages include the lack of knowledge of some employees in narrow industries, but even this is rare.

Loan debts: closure and responsibility of individual entrepreneurs

If you only have debts on loans taken for business development, the individual entrepreneur will be closed without any problems. Obligations to credit institutions have no relation to government agencies.

Debts will not disappear after the closure of the individual entrepreneur. Overdue loans will be accrued in accordance with the terms of the agreement.

What will happen if nothing is done? Sooner or later, creditors will go to court to collect funds. A court order will be issued, and then the case will be transferred to the bailiffs. They take a variety of measures: confiscation of property, seizure of accounts and property, temporary deprivation of driver's licenses, forced collection of funds from bank accounts.

How to close an individual entrepreneur in 2020 with debt via the Internet on the Federal Tax Service website

You can close an individual entrepreneur with debt in 2020 through the tax service website. To apply, take the following steps:

- Receive an electronic signature of the individual entrepreneur. To do this, you need to contact the organizations that generate the digital signature (the same MFC). Ideally, such a signature should be issued immediately when organizing an individual entrepreneur, then you can easily use government services via the Internet.

- Install a special program on your computer that generates documents with an electronic signature.

- To close an individual entrepreneur, draw up a document in form P26001.

- Log in to your account on the Federal Tax Service website as an entrepreneur and send the completed document by mail.

- Next, you should be patient and wait, since Federal Tax Service employees are given 5 working days to process the application. After this time, you are guaranteed to receive a decision and documents on the liquidation of the individual entrepreneur.

Documents confirming the closure of an individual entrepreneur (certificate and extract from the Unified State Register of Individual Entrepreneurs) can also be received by email. It would be better if you save them and print them out so that you have the opportunity, if necessary, to present them to representatives of authorized structures.

Even if you have debts on taxes or insurance premiums, in 2020 you will be able to close an individual entrepreneur in a similar way. It will be necessary to provide all documents that confirm the fact of filing the declaration with the Federal Tax Service and the Pension Fund. If they are not registered in advance, then, unfortunately, the submitted application will receive a negative response.

How to find out if you have a debt

To choose the best option for terminating business activities, it is necessary to estimate the amount of debts. If the amount of the obligation is insignificant, it is easier to liquidate it through the Federal Tax Service, voluntarily pay off the debt, or wait for the claim to be filed in court.

If the debts are large and there is nothing to pay, it is worth considering the option of closing the individual entrepreneur with debts through bankruptcy.

You can find out about current and overdue debts in the following ways:

- according to internal accounting data;

- according to certificates from banks and other credit institutions;

- according to certificates from the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund (since the tax authorities now administer all types of contributions and taxes, information can be obtained in one application to the Federal Tax Service);

- through government services (information about debts on taxes and fees, insurance premiums is available there).

We talked in more detail about how to find out the debts of an individual entrepreneur in this article.

If the creditor has already gone to court and the debt has been transferred to the bailiffs for collection, this information can be obtained from the FSSP through the database of enforcement proceedings.

How to close an individual entrepreneur in 2020 with debts through the Gosuslugi portal

The first thing you need to do is register on the portal. Here you will also need an electronic signature to confirm your identity on the site. If you do not have a signature, then this can be done through the MFC by providing the employees with a passport. Once you have a verified status on the portal, you will be able to take advantage of the full range of services offered.

Before taking steps to close an individual entrepreneur on the State Services website, report to the tax office (so that you do not have a debt), deregister from the Social Insurance Fund, deregister the cash register and close your bank accounts.

After this, you need to find the “Electronic Service” item on the website and register, and then enter your personal account. Next, you should provide all the necessary documents:

- copy of passport;

- registration certificate;

- paid receipt and application for closure.

After this, you need to wait a little until the application is accepted. Within 5 days, your personal account will receive either confirmation of the liquidation of the individual entrepreneur and registration, or a refusal. To obtain original documents, contact the Federal Tax Service.

According to Federal Law No. 129 of 08.08.2011 Art. 23, you may be refused for the following reasons:

- The passport information does not match the specified data.

- Inaccurate data provided by the entrepreneur.

- Administrative liability for individual entrepreneurs with punishment in the form of disqualification.

- Prohibiting court decision.

- Reporting violations.

- Registration of closure of an individual entrepreneur by a person not authorized to do so.

- The papers were submitted to the wrong Federal Tax Service.

- Incomplete package of documents.

The advantages of contacting Gosuslugi to close an individual entrepreneur in 2020: simplicity and accessibility of the process (all you need is a computer and Internet access), saving time (you won’t have to stand in lines for a long time), speed of document processing. There may be no downsides here if you immediately fill out all applications and papers correctly.

The question of how to close an individual entrepreneur in 2020 with debt is not difficult if you pay attention to all the requirements when submitting documents. Now it is possible to do this, either by submitting documents in person, or by carrying out the procedure via the Internet. The processing time for the application will be the same in both cases.

Closing business activities through the Public Services portal

Unfortunately, it is impossible to completely resolve issues related to the liquidation of individual entrepreneurs using the State Services website. Before submitting your application, you must meet some requirements for terminating self-employment.

Under what conditions can this be done?

Submitting an application requires compliance with certain formalities:

- Providing reporting to the tax department.

- Resolving all issues with taxes, contributions to the Pension Fund and Social Insurance Fund.

- Registration of official dismissal of employees with subsequent notification of the Employment Fund.

- Deregistration of cash register equipment.

- Liquidation of a bank current account. This condition is not required, but is recommended.

- Payment of state duty in the amount of 160 rubles. You can do this without leaving your home, cashless, using the Federal Tax Service website. Payment can also be made through any bank branch by printing a receipt. A document confirming the contribution will need to be uploaded to the portal.

To close an individual enterprise over the Internet, it is necessary to have an electronic digital signature - an electronic digital signature.

You can do this by contacting the MFC offices, providing your passport, its notarized photocopy, SNILS, INN and OGRN. It is best to liquidate your debts to counterparties, since penalties and fines will accumulate and it will not be possible to avoid legal proceedings in the future.

Does closing an individual entrepreneur free you from debt?

It is quite simple to close an individual entrepreneur in 2020, even with debts, but you should understand that if the entrepreneur had debts to third parties, then after the liquidation of the entrepreneurial status, the debts will not go away.

You will have to answer to every creditor, including the state budget, for non-payment of debt on taxes and various contributions. It turns out that this is a two-way dependence - an individual is responsible for the debts of the entrepreneur, and, conversely, the individual entrepreneur is responsible for the individual (in all cases this is one person!). It turns out that it doesn’t matter due to what circumstances the individual entrepreneur was liquidated, the financial debts will not go away.

There are two ways to pay off debts:

- voluntarily, according to one’s own will;

- compulsorily, by decision of the court and the FSSP.

In 2020, a person has time to pay off debts before creditors decide to sue, but even when the authorities have received a corresponding application, bailiffs give the debtor time to transfer all the missing amounts. The citizen will also be warned about the consequences of refusing to pay the debt. In 2020, these could include fines from bailiffs, bans on traveling abroad, seizure of bank accounts and property (except for that which is not subject to collection).

If a person is in no hurry to pay off the debt, then the bailiffs begin to work on collection: using legal methods, they find the bank accounts and property of the debtor, seize them and carry out collection. When the property has already been described and confiscated, it is sold at auction, and the profit made goes to pay off the debt.

In addition, in 2020 it is possible to recover the amount of debt from the future income of an individual or entrepreneur. We advise you not to let inspectors collect debts from you and seize your accounts. It is better if you try to avoid such a situation and resolve all controversial issues as they arise.

Now it becomes clear that closing an individual entrepreneur is not the same as eliminating debts. All debts - taxes, contributions to insurance funds, etc. - will have to be paid either voluntarily or forcibly.

Are debts written off after closing?

Liquidation of an individual entrepreneur only implies the termination of the commercial activities of a citizen in the status of an individual entrepreneur. But this does not free him from debt. In particular, after the closure of an individual entrepreneur, an individual will be obliged to repay the following types of debts:

- arrears to the budget and extra-budgetary funds, including penalties and fines accrued on them;

- debts to suppliers, lessor, buyers, and other contractors;

- wage debts in favor of employees, tax and pension contributions for them;

- bank loans and borrowings.

It must be remembered that, unlike the founders of a legal entity, an individual entrepreneur is liable for debts with his property. If the money in the individual entrepreneur’s accounts is not enough to pay off the debt, the property belonging to him may also be seized by bailiffs.

If the former individual entrepreneur does not repay all debts voluntarily or at least does not agree with creditors on the procedure and timing for their repayment, confiscation of property will be difficult to avoid.

Settlements with the Federal Tax Service and the Pension Fund when closing an individual entrepreneur

So, the individual entrepreneur is closed, and the Pension Fund demands that the debt on insurance contributions be repaid. Strictly speaking, this situation would apply more to 2020 and earlier. Since 2020, individual entrepreneurs pay contributions not to the Pension Fund, but to the Federal Tax Service: it is the tax office that currently administers contributions payments. In this regard, it is worth mentioning one more extremely important point.

The transfer of data from the Pension Fund to the Federal Tax Service on the status of settlements with individual entrepreneurs and LLCs as of January 1, 2020 was, to put it mildly, not entirely correct. A failure to unload balances caused a series of erroneous calculations and notifications of debt when in fact the entrepreneur did not have any. Other businessmen were luckier - they are listed as having non-existent overpayments, which, however, the Federal Tax Service is in no hurry to return. In this situation, you should, as always, rely only on yourself, and, to be more precise, on the data available to each payer on the amount of transfers to the budget. And if they really have debts for the last three years, then they should still be paid off when the individual entrepreneur’s activities are closed.

Bankruptcy of individual entrepreneurs

If an individual entrepreneur, in addition to debts to the Pension Fund and the Social Insurance Fund, has a debt to the tax inspectorate, as well as other creditors represented by counterparties, which he is unable to repay, then in this case it will not be possible to simply close the individual entrepreneur, in this case it is put the question of declaring an individual entrepreneur bankrupt with all the ensuing consequences.

A bankruptcy case for an individual entrepreneur can be opened only when the individual entrepreneur still has the status of an individual entrepreneur; after the procedure for closing the individual entrepreneur, it is no longer possible to apply for bankruptcy. In addition, the individual entrepreneur must document that he is not able to pay off the debt he has incurred on his own. To do this, he needs to prove that:

- The debt to budgetary organizations and creditors exceeds the amount of 10,000 rubles.

- The amount of debt exceeds the total value of all property owned by the entrepreneur.

- Inability to repay all debts an entrepreneur has within three months.

The final decision on recognizing or not recognizing an individual enterprise as bankrupt is made by the arbitration court after it receives a claim with a petition to recognize the bankruptcy of the individual entrepreneur.

Such a claim may be brought to court by:

- Any government organization to which an individual entrepreneur owes debt.

- The creditor to whom the individual entrepreneur has a debt.

- The entrepreneur himself is the debtor.

The arbitration court makes a decision on the appointment of a temporary manager who will evaluate the property that was used in the financial and economic activities of the enterprise, as well as the personal property of the individual entrepreneur. An individual entrepreneur is given a month to repay the debt. If after the expiration of this period the debts are not repaid, the court decides to declare the individual entrepreneur bankrupt, to seize the described property with its further sale. The proceeds from the sale of property are primarily used to repay debts to the state budget and then to creditors. Those debts that cannot be repaid are written off, and the former entrepreneur is released from all obligations.

If the court does not recognize the bankruptcy of the individual entrepreneur, then the entrepreneur, in addition to debts to creditors, will also have to pay all the fines imposed on him by the judge.

Answers to important questions