RKO: in Excel

You can also use RKO in excel. It contains the same columns as in the word document - choose the one that is convenient for you.

Get the form for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form you are interested in in Excel or Word format

- Fill out and print the document online (this is very convenient)

RKO is issued in one copy. It is issued by the employee who issues the money, but the recipient also enters some information. How to fill out RKO - read on.

The cash disbursement order is filled in when you withdraw cash from the cash register:

- to the bank for crediting to the current account,

- on account - upon a written application from the recipient, in which he must indicate the amount and period for which he is taking cash,

- for personal use by an employee, for example, for travel expenses or as financial assistance,

- for the needs of the enterprise - in this case, you must indicate a specific purpose for issuing money, for example, for business expenses.

How to fill out RKO

The cash order is filled out by employees of the budget organization related to the issuance of funds. There are sites on the Internet that offer to fill out an expense cash order online and then download or print it. We will use an example to show you how to correctly fill it out yourself.

Step 1. Fill out the header

In the line “Organization” the full name of the organization is written, and the column “Structural unit” is the name of the unit that issued the cash register. If there is no such structural unit, then a dash is placed in the column.

OKPO is filled out according to data assigned by the statistics body.

The document number is indicated strictly in order throughout the calendar year.

The “Date” line indicates the date of issue from the cash register.

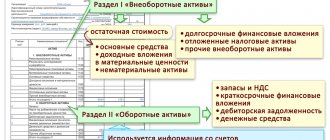

Step 2. Fill out the “Debit” and “Credit” sections

These lines of the cash receipt order are filled out according to the approved chart of accounts.

In the “Purpose Code” line, enter a code that reflects the purpose of using the funds issued from the cash register. If such codes are not used at the enterprise, a dash is added.

Step 3. Enter information about who the money was given to and why

The “Issue” line contains the last name, first name, and patronymic of the person to whom this money is issued.

The “Base” line displays the contents of the business transaction. For example, an advance for travel expenses, for the needs of the organization, etc.

In the “Amount” line, the amount is written in words.

In the “Appendix” line enter the information that served as the basis for issuing money from the cash register.

Step 4. Fill out the section with the personal data of the employee to whom the money was issued

The “Received” line is filled in by the recipient himself. He writes down the amount in words, puts the date and signature on the receipt. Below you need to indicate the details of the document presented for identification.

In the last line, the cashier or other responsible employee puts his signature and transcript.

Step 5. Manager's signature

The RKO is signed by the chief accountant and the head of the organization.

A ready-made example of filling out a cash receipt order for 2020 looks like this:

Example of filling out RKO

RKO can be issued on paper or electronically. It's easy to fill out the form. Download a sample of filling out a cash flow order that is current in 2020 - you can simply replace the data with your own.

RKO

Get a RKO sample for free!

Register in the online document printing service MoySklad, where you can: completely free of charge:

- Download the form or sample you are interested in

- Fill out and print the document online (this is very convenient)

The amount you enter in the KO-2 form should not exceed 100 thousand rubles. Anything that exceeds this limit must be carried out by bank transfer.

Cash order as a legal category

Expenditure cash order (RKO) as a separate legal category is enshrined in the Russian Federation by Resolution of the State Statistics Committee of August 18, 1998 No. 88. According to this legal act, RKO should be used by organizations to issue cash from the cash register.

RKOs are created in 1 copy, signed by the head of the organization, as well as the chief accountant or a person having the necessary authority. The name of the form of cash receipt order in accordance with Resolution No. 88 is KO-2. According to the OKUD classifier, it corresponds to number 0310002.

You can download the RKO form from the link.

ConsultantPlus experts have prepared step-by-step instructions for completing cash transactions:

If you do not have access to the K+ system, get a trial online access for free.

Registration of RKO

An expense cash order can be issued by:

- Chief Accountant,

- an accountant or employee (for example, a cashier) appointed by the manager,

- director (in the absence of a chief accountant and accountant).

RKO is always drawn up on the day the money is issued.

Start filling out the RKO by filling out:

- the full name of the company indicating the organizational and legal form,

- OKPO code,

- form numbers in accordance with internal document flow,

- dates of completion,

- code of the structural unit that issues money. If it is not there, put a dash,

- number of the subaccount in which cash is accounted for,

- analytical accounting code (if required),

- loan (i.e. account number that reflects the disbursement of funds),

- amounts in rubles (in numbers).

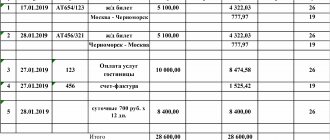

Next, the procedure for filling out the RKO is as follows:

- you need to enter the full name of the person you are giving the money to,

- indicate the basis for issuance, for example: salary, financial assistance, business trip expenses, etc.,

- indicate the amount in words,

- enter the name, date and number of the attached document on the basis of which you are issuing money. This could be a payroll, receipt, order, contract, etc.

The cash receipt order must contain the signatures of the director or authorized employee, as well as the accountant. They definitely need to be decrypted.

The next part is filled out by the employee who receives the money. He points out:

- The amount issued is in words, and kopecks are in numbers. The remaining blank part of the line must be filled with a dash.

- Date of receipt of money.

- Passport details.

Signatures are placed by the cashier who issued the money and the employee who received it. Without filling out this part, the RKO will be invalid. In this case, the money will be considered appropriated by the employee who issued it.

The cashier can draw up one cash register at the end of the working day for the entire amount issued during the day, but provided that there are fiscal documents of the online cash register - checks or BSO.

Corrections in the cash receipt order are not allowed.

To avoid mistakes, use the MySklad service - you can fill out online and print a cash receipt order in a few clicks.

How the unified form KO-2 is formed - cash receipt order ↑

The KO-2 order form is generated in a special journal of the enterprise’s primary documentation.

An employee of the accounting department creates a document in a single copy, the head of the organization and the chief accountant sign it. Next, it is registered in the order journal.

When the document arrives at the cashier, the following is checked:

- availability of required signatures;

- are the documents completed correctly?

- Are there any attached certificates?

Procedure for compilation

There are requirements for the process of issuing an expense order:

- the recipient’s personal data should not differ from those specified in the order;

- the amount of cash cannot exceed 100 thousand rubles;

- a personal signature of the recipient of the money is required;

- if finances are issued by power of attorney, then it must be attached to the order form.

Filling out an order is not difficult; it is important to know how to draw up the document correctly. There is a certain order for this. First, you need to indicate the name of the organization at the top.

If there is a structural unit, indicate it, as well as the code. You can find out the organization code from the State Statistics Committee.

The date in the document is the one when the money was issued from the cash register. The following sections must be indicated in the expenditure order:

| Name of the organization | Full; the institution from whose cash desk funds are paid in cash |

| Company code | Assigned during company registration |

| Order number and date of issue | The number must correspond to the one indicated in the registration log of documents |

The following stages are distinguished in the preparation of RKO:

- An accountant documents the implementation of a business transaction in cases where wages or bonuses are issued, cash on account, etc.

- Carrying out self-control of the money that was deposited.

- Transferring the order to the chief accountant for signature.

- Confirmation of the purpose of issuing funds, receipt of the document at the cash desk.

- Check by the cashier for correctness of preparation and presence of signatures.

- Reconciliation of recipient data, issuance of finance.

Which destination code should I indicate?

The designated purpose code is indicated if the funds were received at the cash desk in the order of designated funding.

To issue wages, the target codes in the cash receipt order are as follows:

| 02 | Issuance of wages and bonuses |

| 03 | Issuance of deposited salary |

| 05 | Business travel or business needs |

| 06 | Payments of a different nature |

| 16 | Salary issued |

| 15 | Funds issued on account |

The purpose codes in the cash receipt order in the budget are as follows:

| 250 | Free payment |

| 230 | Debt servicing to the state |

| 260 | Funds that were transferred to the social security fund |

Sample filling

There is a unified form for the cash register receipt form - KO-2.

Instructions for filling:

| Indicate the name of the institution | Which issues the document |

| If there is a structural unit | Specify |

| Document Number | Required |

| Enter the date | Issuing money from the cash register |

| In the “Debit” field, indicate the code of the structural unit | From which finances are issued - account and subaccount numbers |

| In the "Credit" column | Enter the accounting account number |

| The amount that is given | Registered in numbers |

| In the "Issue" column | The personal details of the recipient are indicated |

| In the "Base" field | Write the contents of a business transaction, for example, an advance |

| Write details of primary documentation | Which is attached to the order |

Signatures (of the organization's manager and senior accountant) and their transcripts are required.

After this there are fields that the recipient of the money must fill in:

- the amount is indicated in full (in letters), kopecks – in numbers;

- date of receipt and personal signature.

RKO: fill out online

You just need to enter the amount and basis of payment, select the expense item and recipient, and the system will automatically generate and number the document.

Fill out RKO online

Fill out the RKO online!

Register in the MoySklad online service - you will be able to: completely free of charge:

- Fill out and print the document online (this is very convenient)

- Download the required form in Excel or Word

In MyWarehouse you can also download a complete list of expenditure orders for all time. This is convenient for reporting - the total amount of funds issued is immediately visible.

More than 1,000,000 companies already print invoices, invoices and other documents in the MyWarehouse service Start using

How to fill out RKO: difficult cases

Although filling out the RKO is not difficult, in special cases problems arise. We've sorted out the most common ones.

Payment to the supplier through the cash register: how to issue cash settlement

Be sure to request a power of attorney from the supplier’s representative to receive from your company a specific amount under a specific agreement, delivery note, etc. It must be attached to the RKO. Note that:

- When filling out an expense cash order, in addition to the details of the power of attorney, you must indicate the full name of the representative and his passport details.

A power of attorney to receive money without it being signed by a RKO representative does not prove that he received it.

- In the “Bases” line, you must enter the details of the contract, invoice, etc., as well as the names of the goods.

- If payment is made under several contracts at once, it is better to draw up a separate order for payment for each of them. It will be clearly visible how much was paid for each delivery.

- When recording this order in the cash book, you need to indicate the full name of the representative, details of the power of attorney and the name of the supplier.

How to fill out cash settlements for the issuance of accountable amounts: sample

Since August 19, 2020, there has been an instruction from the Bank of Russia, according to which money can be issued on account by order of the director. An application from an accountable is no longer required. The main thing is to indicate the chosen issuance procedure (by application or by order) in the company’s accounting policy.