Financial communication between employer and employee is not limited only to wages and material incentives; financial assistance is also provided. The legislative framework does not have a clearly formulated interpretation of the concept of “material assistance”. At the same time, it is mentioned in various documents quite often. Let's figure out what it is and, most importantly, whether financial assistance is subject to personal income tax.

Cash payments, medicines and food, clothing and basic necessities - all this can be classified as material assistance that one person can provide to another. The relationship between a manager and a subordinate limits this list, in most cases, only to monetary payments, which are made in accordance with the procedure established by law. Financial assistance is not mandatory.

Financial assistance can be defined as the payment of funds to an employee in a difficult life situation or under special circumstances.

There is no strict guidance in the legislation regarding this type of payment. It follows from this that the manager himself has the right to decide on the need to provide financial assistance to his employees. The amount of payments, terms and grounds that will serve as a reason for paying assistance should be recorded in the employment contract or order. In this case, pay special attention to the wording of the concept of “material assistance”, as well as the list of cases in which payments will be made. Beware of vague definitions (“in cases like this”, “situations like this”). Everything must be extremely precise in order to avoid suspicions of an attempt to reduce the tax base on the part of the tax inspectorate. Financial assistance must be paid in accordance with drawn up orders or contracts.

Financial assistance not more than 4,000 rubles

If financial support exceeds the limit, then only the excess amount is taxed.

According to the Ministry of Finance of the Russian Federation, monthly financial assistance to a person on maternity leave can be subject to personal income tax, taking into account standard tax deductions, the amounts of which are contained in paragraphs. 4 clause 1 of article 218 of the Tax Code of the Russian Federation. This means that if an employer pays extra every month to a woman on maternity leave, he can reduce the amount of the extra payment by the so-called child deduction. This form of support may be a general type of financial assistance, and not a one-time payment in connection with the birth, although the basis here is the same - the birth of a baby.

What circumstances serve as a reason for prescribing financial assistance?

The reason for an employee to seek help can be both difficult life situations - the death of a relative, emergency circumstances (fire, flood, etc.), and joyful events - a wedding, the birth of children, the start of a vacation, etc. The possibility of receiving such a payment may be specified in the local documents of the organization - for example, in a collective agreement. If there are financial opportunities, the company has the right to help even its former employee who has not been working in the organization for a long time.

Is financial assistance subject to insurance contributions or not? The answer will depend on the specific situation.

Procedure for receiving financial assistance

First of all, the employee needs to inform the manager about the special circumstances in his life. To do this, you must submit an application addressed to the manager, which can be written in any form. It must clearly indicate the reason why he wishes to receive financial assistance. It is important to attach to your application the documents necessary for your case that may be needed to confirm the circumstances. For example, if financial assistance is needed in connection with the birth of a child, the employee must attach a copy of the child’s birth certificate to the application.

The legislation does not establish the amount of assistance provided in a particular case, so the amount of payment is determined by management independently. Often such a payment is specified in the employment contract and is an additional guarantee that protects the employee from unexpected expenses. It is very important that the wording of additional assistance be extremely clear, since vague definitions may arouse suspicion among the tax inspectorate, and the company’s management will be suspected of understating the tax base.

In what cases is financial assistance subject to personal income tax?

In some cases, financial assistance is subject to personal income tax:

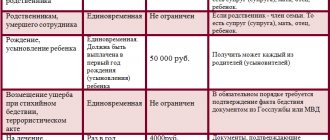

| Material aid | A comment | Normative act |

| In the part exceeding 4,000 rubles received on each of the following grounds for the tax period or reimbursement of payment for the cost of medicines that is not documented | · the amount of financial assistance provided by employers to their employees, as well as to their former employees who resigned due to retirement due to disability or age; · compensation (payment) by employers to their employees, their spouses, parents, children (including adopted children), wards (under the age of 18), their former employees (age pensioners), as well as disabled people for the cost of goods purchased by them (for them) medications for medical use prescribed by their attending physician. Tax exemption is provided upon presentation of documents confirming actual expenses for the purchase of these drugs for medical use. | clause 28 of article 217 of the Tax Code of the Russian Federation |

| In the portion exceeding 50 thousand rubles for each child | Employers to employees (parents, adoptive parents, guardians) at the birth (adoption) of a child, paid during the first year after the birth (adoption) | Clause 8 of Article 217 of the Tax Code of the Russian Federation |

Example 1. A son was born into the Smirnov family. The employer plans to provide financial assistance to both parents in the amount of 50,000 rubles each. Thus, financial assistance in the amount of 50,000 rubles paid to one of the parents will be exempt from personal income tax, and financial assistance paid to the second parent will be subject to personal income tax calculation.

In general, the Smirnov family will receive financial assistance in the following amount:

- 50000+50000-(50000*13%)=93500 rubles.

Everything you need to know about financial assistance

The money that the head of the organization allocates to an employee in need is called financial assistance. This could also be money allocated to students by the university trade union, and other types of payments. The main criterion of material assistance, which distinguishes it from other existing benefits of this kind, is that it is one-time.

Attention! Financial assistance was invented to make it easier for individuals who received it to survive certain situations in life financially. For example, the birth of children, the death of loved ones, treatment in a clinic, and so on.

When do you need to pay taxes?

In what situations is personal income tax not withheld?

In addition to the general rule regarding the amount of financial assistance, in order to correctly identify whether it is worth paying income tax on it, individuals need to take into account a number of additional situations. The following are special cases in which personal income tax is not withheld from monetary compensation of this kind:

- Natural disaster - individuals affected by extreme weather conditions, which resulted in damage to their property or health, have the right to apply for financial assistance and receive the one-time payment due to them by law without deduction of tax fees.

- Emergency cases - if some unforeseen situations occur that lead to injury or death of people, then the state is obliged to provide them or their families (if the victim has died) with a mat. help. Such circumstances include car accidents, serious malfunctions of production equipment, as well as a number of other unfavorable situations.

- Terrorist attacks - for those individuals who, while on the territory of the Russian Federation, became victims of terrorist attacks, their employer or government agencies must accrue material compensation and not withhold tax contributions from it.

- Deterioration of health – if an employee of an enterprise as a result of performing his job duties has deteriorated in health, and in connection with this he was forced to retire, then the employer must provide him with a one-time monetary compensation, on which there is no need to pay income tax to the budget.

- Death - if an employee of an enterprise dies, regardless of whether his death was caused by work-related injuries, illnesses or ailments that have nothing to do with the work process, his close relatives must receive monetary compensation. Payments of this kind are provided once and are not subject to personal income tax.

It should be noted that those individuals who want to learn in more detail about what conditions must be met in situations that give the right not to pay personal income tax when receiving financial assistance should familiarize themselves with the eighth and tenth paragraphs of Article 217 of the Tax Code of Russia.

One-time child assistance

The current tax legislation provides for cash payments provided to individuals for the birth of a child. Such compensation is awarded not only to biological parents, but also to employees who become adoptive parents or guardians. Financial assistance is issued during the first year of a child’s life and is a one-time payment.

Tax-free financial assistance (NDFL) in 2020: amount, conditions and calculation rules

Financial assistance is mandatory provided to employees or other persons as support in current special life situations. For example, when assistance is needed in paying for expensive treatment, in the event of the death of closest relatives or the birth of a child.

The question often arises: is any tax collected for receiving it?

According to the rules of Russian legislation, if the amount of financial assistance is within 4,000 rubles, then there are no insurance contributions or taxes.

If the amount is greater, then it is subject to taxation.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how to solve your specific problem

— contact a consultant:

The concept of financial assistance. By whom and to whom it is issued

But this explanation applies to citizens who suffered as a result of natural disasters or terrorist attacks.

There is no official definition of financial assistance for employees of enterprises and students at the legislative level.

But despite this, this designation is included in some documents, based on them, tax-free financial assistance is provided in the following situations :

- payment for damage caused to the health of a citizen;

- assistance in case of sudden material losses;

- assistance in events that require large expenses, namely: the birth of children, weddings, funerals, etc.

By the way, the Constitution of the Russian Federation does not oblige leaders to provide assistance under the above circumstances. The decision is made based on the entrepreneur’s own desires.

Financial assistance from the state is issued only if there are circumstances that have disrupted the livelihoods of low-income families or in a number of the following cases:

- if a citizen living alone has reached the age of 60 years or more;

- if one of the family members or a person living alone has unemployed status;

- if one of the family members or a person living alone is officially a citizen with disabilities;

- living in a family with a young child or several children.

The employer pays financial assistance only if the employee draws up the necessary application and documents the existence of reasons for its provision.

Confirmation may include:

- Marriage certificate;

- pregnancy/birth certificate;

- death certificate;

- medical certificates of illness...

After reading all the documents provided, the boss makes a decision in each specific situation separately. The issuance of financial assistance occurs based on a document that indicates the amount of assistance, the reason for its accrual and the timing. There are no rules with the exact amount and timing of payment; everything is decided at the discretion of the entrepreneur.

Personal income tax is not in full amount, but taking into account the benefits (Tax Code of the Russian Federation, Article 217, paragraph 8), is accrued when:

- birth of a child or adoption. If the amount of assistance does not exceed 5 thousand rubles and is paid for one year, then there is no need to pay tax.

- death of an employee or his family members. This paragraph does not cover assistance to former employees. If the assistance is one-time, then personal income tax is accrued in a partial amount.

- harm caused by a natural emergency or other sudden circumstances. Tax is not charged on assistance, regardless of its size and duration of payments.

- terrorist attacks on the territory of the state, as well as in the third point, personal income tax is not withheld.

In all other circumstances, taxation will not occur only if the citizen received a total of no more than 4,000 rubles . This means that tax assessment is based on material assistance that exceeds 4,000 rubles.

The state budget annually includes simultaneous financial assistance. It is paid to citizens who permanently live on the territory of the Russian Federation and find themselves in difficult life circumstances. Assistance is issued in cash format, it is sent by mail or transferred to a bank account, it depends on the data specified in the application.

It is distinguished by the following characteristics:

- One-time financial assistance is provided after submitting an official application, only once a year.

- the reason for considering a request for the necessary one-time assistance is a written statement that the victim writes on his own behalf, if he lives alone, or on behalf of the whole family.

- If a citizen is assigned one-time financial assistance, then he is obliged to spend it only for those purposes that are specified when submitting documents.

There are several reasons why the state may refuse to pay one-time financial assistance, namely:

- if the previously paid money was used for other purposes, which was the basis for the payments;

- the set of documents provided to the commission is incomplete or the information on income and family composition is distorted;

- if the applicant or his family members have not received all possible social support that is guaranteed by law in his individual case;

- if the applicant or his family independently resolved the circumstances that arose;

- if there are no difficult life circumstances or emergency situations in the applicant’s life.

To receive financial assistance, you must register it correctly .

First you need to write an application. It clearly states the reason why you need to get support.

the specified reason with documents . We attach to the application all documents and certificates indicating a specific situation that you are faced with and cannot cope with on your own. It is worth remembering that financial assistance is a one-time payment and is in no way related to the quality of performance of work duties by the employee.

The amount of accrued financial assistance will depend on the complexity of the circumstances specified in the application.

There are some frameworks that are used today:

- for categories of citizens specified in paragraph 2-21 of the Tax Code of the Russian Federation, assistance should not be more than five times the salary;

- for categories of citizens specified in paragraphs 22-24 of the Tax Code of the Russian Federation, assistance is awarded depending on the necessary expenses, subject to the availability of documents that can fully confirm these actions (directions and checks).

In order to understand how much you need to issue a personal income tax refund from financial assistance, you need to consider:

- Desk check. It is carried out within three months from the date of submission of documents. (Tax Code of the Russian Federation, Article 88, paragraph 2)

- After verification, the citizen is sent a notification letter about the return of personal income tax or about the refusal to transfer, explaining the reasons. This process lasts 1-4 months.

After receiving the response, the amount of overpaid tax is accrued to the applicant within a month. (Tax Code of the Russian Federation, Article 76, paragraph 6).

This means that if your application is processed quickly, you will have to wait about 4 months. But basically, this procedure lasts 7 - 10 months, there are cases that it can take up to 15. You can handle personal income tax return documents for three years.

Features of providing financial assistance to students

Today, the legislation stipulates many types of financial assistance for students in universities of citizens of the Russian Federation who need special attention and social support.

Like everyone else, financial payments to students occur once a year maximum.

priority rights to receive assistance:

- students with special physical needs;

- orphan students;

- students raised by one parent or a large family;

- students who have their own children;

- in the event of the death of a parent;

- sudden onset of illness or injury.

There are times when former employees of an organization need financial assistance. Leaders meet and support certain categories, for example, veterans. Such payments can only be made from funds received as profits of the company, and taxes and other payments can be deducted from the assigned amount.

The decision to pay financial assistance to a former employee is made by the manager or his deputy. or other authorized person. Assistance must be provided in accordance with legal requirements.

The accrual of financial assistance to former employees can also occur through cash receipts in format No. KO-2. This rule was established by the State Statistics Committee of Russia.

Since this is help for a former employee, and not a current one, the cashier must carefully consider the identification documents. When paying, you must take into account the TIN and pension certificate number; this data will be needed in the future for recording in income documents.

The rules for calculating and taxing financial assistance to employees are described in the following video tutorial:

Still have questions? Find out how to solve exactly your problem - call right now:

Popular in this section

Free legal consultation

Moscow and region

St. Petersburg and region

Copyright © 2020. Posobie-Help - help and advice on all types of benefits and benefits

Publication and copying of materials without the written consent of the author is prohibited.

Source: https://ymp3.ru/lgoty-i-vyplaty/materialnaya-pomoshh-ne-oblagaemaya-nalogom-ndfl-v-2017-godu-razmer-usloviya-i-pravila-nachisleniya

How to properly apply for financial assistance

Since the main characteristic of financial assistance is the transfer of it in a one-time payment, managers should correctly include this fact in the documentation so that the employee actually has the right not to pay tax on monetary compensation of this kind. In this regard, the manager must give the entire amount displayed in the order for the issuance of financial assistance to his employees at one time and in no case spread it over several payments.

Sometimes an employee is accrued such cash benefits in several payments. In such a situation, only the funds that he receives for the first time are not subject to personal income tax, and taxes must be withheld from all other amounts.

Employees who wish to receive a one-time financial compensation, using the instructions below, will be able to understand how this procedure occurs and will soon receive the money they are entitled to.

- Collection of documentation. Since almost any financial transaction requires a certain package of documents giving grounds for its implementation, in order to obtain a mat. assistance to individuals is also necessary to have documentation confirming certain life circumstances. For example, in the case of a new addition to the family, a copy of the birth certificate will be required, if someone has died - a death certificate, in case of work-related injuries - a certificate from the hospital.

- Submitting an application. Once an individual has documentary evidence of the right to a specific type of financial assistance, he needs to write an application addressed to the employer. In this document, you need to briefly outline the request for compensation and attach the necessary documentation to it.

- Publication of the order. The responsibilities of the manager who received the employee’s application for financial assistance for consideration include drawing up the appropriate order and submitting it to the accounting department. Some time after these actions are completed, the money will be transferred to the card of the employee in need of help.

Sometimes employers decide to reward their employees for career achievements with money and document these payments as financial assistance. This action is considered incorrect, so employees must transfer 13% of the payment received to the state treasury.

It is important to know: What social payments are due in the event of the loss of a breadwinner and their amount

Tax-free financial assistance in 2016-2017 - legal advice

Material assistance is support to the management of an organization for its employees in certain life situations, expressed in monetary or material equivalent.

It is worth noting that such payments should not be tied to the results of employees’ work activities, their achievements, and should not be systematic. In most cases, the grounds for paying assistance are reasons as:

- birth of a child;

- marriage;

- serious illness of an employee;

- loss of property due to fire or other natural disasters;

- death of a close relative.

The current legislation of the Russian Federation does not provide for the mandatory nature of financial assistance, therefore the payment of social support is not an obligation, but a right of employers.

In most cases, only state, municipal and budgetary institutions provide assistance to their employees. As a rule, for each type of organization an individual amount of benefits and the timing of its provision are established.

https://www.youtube.com/watch?v=PlEgh2ahrKk

Financial assistance becomes the right of employees carrying out their labor activities in private enterprises only in cases where such payments are provided for by local acts of the organization; their size and grounds are also individual for each enterprise and are based on the decision of management.

When is it taxable and when is it not taxable?

Financial assistance is not the employee’s income from work and serves to support his financial situation in a specific situation, and therefore should not be taxed.

An important role is played by the documentation of the manual, namely its wording. To avoid illegal tax evasion, the following list of tax-free payments has been established for enterprises:

- Amounts not exceeding 4000 rubles. for the year are not subject to taxes; funds accrued in excess of the maximum value are subject to income tax in full.

- Payments made on the occasion of the death of a close relative are not included in the tax base, provided there is appropriate documentary evidence.

- Assistance transferred in connection with damage to property due to natural anomalies, in the presence of supporting documents.

- Benefits provided to employees affected by terrorist acts.

- Assistance accrued in connection with the birth of a child is also not taxed upon presentation of a birth certificate.

- Payments in case of illness of an employee or members of his family must be made from the net profit of the enterprise; accordingly, they are not included in the tax base.

In all other situations, income tax must be withheld in full .

Documenting

Social payments to support employees are made on the basis of the following documents :

- Personal statement of the employee.

- An order issued by the management of the organization.

- Documents confirming the existence of grounds for calculating benefits.

Documents for download (free)

- Application for financial assistance

There is no legally established form of the order, so the document is drawn up in any form and contains the following mandatory information : personal data of the employee to whom the benefit is assigned, the basis for payment, the amount to be transferred, as well as the date of payment.

Reflection in enterprise accounting

Funds for paid financial assistance can be taken from sources such as past profits and funds intended for other expenses.

In the first case, payment of benefits can be made only after a positive decision is made at a general meeting by all founders or owners. There is no need to hold a meeting to pay funds from other expenses; the decision is made by the head of the organization.

To reflect social benefits in the organization’s documents, accounting uses the following entries :

In order to avoid controversial situations with inspection bodies, regulatory documents should indicate the exact wording of benefits , as well as the resources from which financial assistance will be paid.

Expense recognition

In accordance with the Tax Code of the Russian Federation, material assistance is not included in the organization’s expenses, and therefore is not taken into account when calculating income tax.

Such social benefits are awarded at the initiative of employers, who, in turn, are interested in the stable financial situation of their employees.

In addition, property transferred for use as material assistance is not reflected in the organization’s expenses .

Source: https://ubppro.com/grazhdanskie-dela/ne-oblagaemaya-nalogom-v-2016-2017-godah-materialnaya-pomoshh-yuridicheskie-sovety.html

Not taxed

The list of such income is specified in Art. 217 Tax Code of the Russian Federation. In particular, financial assistance, tax-free in 2020, is provided in the following cases:

- death of an employee or a close member of his family;

- natural disaster;

- purchasing sanatorium and resort vouchers on the territory of the Russian Federation (compensation depending on the type of support, for example, for accompanying parents of children with disabilities to a place of recreation and recovery);

- emergency situation (terrorist attack and others).

FAQ

The issues of calculating income tax on one-time financial assistance to employees are very controversial. In this light, accountants, HR workers and managers have many questions.

Video: personal income tax, tax history, residents and non-residents

The occurrence of certain emergency circumstances requires an individual approach from the company's management to assigning the amount of financial assistance and the procedure for its payment.

This is determined by:

- type of circumstances;

- the required amount of financial resources;

- specific conditions.

It is advisable to consider in more detail the process of providing financial assistance to employees in different situations.

Is it taxable in connection with the death of a relative (employee)?

Accountants and personnel officers often ask the question: is financial assistance for funerals subject to personal income tax?

As stated above, according to the provisions of the tax legislation of the Russian Federation, this type of support is not subject to income tax, regardless of the size.

In this case, non-taxable payments can be provided:

| In the event of the death of a close relative who lived with the employee | In this situation, you will need to submit documents confirming relationship and the fact of cohabitation |

| In connection with the death of an employee or his death at work, his relatives | In this situation, close relatives of the employee are required to file a statement at his place of work. |

In other cases, personal income tax for assistance upon death is still subject to personal income tax. Similar types of conditions apply to former employees of the company who have retired.

Financial assistance at the birth of a child

However, in general, this assistance will not be subject to income tax. However, some nuances should be taken into account:

- If the second employer cannot provide 2-personal income tax due to the fact that he is currently unemployed, then he is required to submit a certificate from the employment service.

If for vacation

When an employer decides to encourage its employees with additional support before a vacation, such financial support will not be subject to personal income tax if:

| It does not exceed the established limit | 4,000 rubles |

| Provided at a time within one tax period | Year |

When making larger payments, they are considered as bonus payments or “13th salary” and are therefore subject to personal income tax.

Is treatment assistance taxable?

Material payments that are provided to employees of organizations for their treatment, as well as for the treatment of their close relatives, may be exempt from personal income tax if the following conditions are met (Article 217 of the Tax Code of the Russian Federation):

- Availability of current certificates and other documents confirming the need for treatment.

- Availability of licenses from medical institutions that issued certificates and provided treatment.

- Transfer of funds by the employer directly to the account of the medical organization (non-cash).

If all the above conditions are met, the organization must also use funds remaining from the profits of previous years for payments.

Read about filling out an additional sheet of the sales book in 2020 in 1C here.

For a sample of filling out an extract from the sales book, see here.

What to do in case of fire

If an employee and his family suffered from a fire, then the organization in which he operates can provide him with financial assistance in any amount.

However, such payment will not be subject to income tax if the following conditions are met:

- The fact of force majeure must be confirmed by a certificate from the fire service of the Ministry of Emergency Situations of the Russian Federation.

This is important to know: Agreement between an organization and an individual: taxation

Thus, in general, material assistance provided to employees is subject to personal income tax, since it is a form of income.

At the same time, in 2020, tax legislation provided for a number of cases in which payments received by employees are not subject to income tax.

However, even in this case, the employee is obliged to provide certificates and other documents at the place of employment confirming the occurrence of an emergency.

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.