Is personal income tax withheld from financial assistance in 2019?

The procedure for taxing personal income tax on material assistance in 2020 has not changed.

To answer the question of whether income tax is withheld from financial assistance, you need to know on what basis it is paid. Art. 217 of the Tax Code of the Russian Federation establishes which financial assistance is not subject to personal income tax, namely:

- The death of the employee himself or one of his relatives (Clause 8 of Article 217 of the Tax Code of the Russian Federation).

- Social support for a low-income employee, which is provided at the expense of the budget of the Russian Federation (clause 8 of Article 217 of the Tax Code of the Russian Federation).

- The onset of natural disasters (clause 8.3 of Article 217 of the Tax Code of the Russian Federation).

See “The Ministry of Finance named the condition for exemption from personal income tax for financial assistance to an employee in connection with a fire”.

- Financial assistance paid to an employee (or his relatives, in the event of the death of the employee) who suffered during terrorist attacks (clause 8.4 of Article 217 of the Tax Code of the Russian Federation).

- Payments by trade union committees to members of trade unions (Clause 31, Article 217 of the Tax Code of the Russian Federation).

- Purchasing sanatorium and resort vouchers for employees or members of their families (clause 9 of article 217 of the Tax Code of the Russian Federation).

For more information about the payment of financial assistance for a sanatorium-resort vacation, read the material “Vouchers of sanatorium-resort and health-improving organizations may not be subject to personal income tax .

- Compensation for the cost of medical services to an employee or members of his family (Clause 10, Article 217 of the Tax Code of the Russian Federation).

To learn about the cases in which expenses for physical education and sports are not taxed, read the article “Personal Income Tax and Measures for the Development of Physical Education and Sports in Work Collectives.”

Of course, the above list does not contain all possible payments for which income tax is not charged on financial assistance. Their complete list is given in Art. 217 Tax Code of the Russian Federation.

The right to the listed benefits is possible if the following conditions are met:

- Receipt and execution of documents confirming the occurrence of an event.

- Consolidation in the internal documents of the enterprise of the possibility of paying such assistance.

Conditions and procedure for receiving financial assistance

The provision of financial assistance to an employee and personal income tax is not related to entrepreneurial or other activities. To receive financial assistance from regional or federal authorities, as well as an employer, grounds are required.

The main role is played by obtaining the status of a low-income family, in which:

- The family member is not employed.

- A close relative retired. According to the new rules of pension reform, the return for women is 60 years, for men - 65.

- The citizen has the status of “pensioner” and lives alone from his family.

- The person has a disability group, i.e. with limited capabilities.

- The family has several young children.

Thus, only truly needy citizens have the right to receive financial assistance. To complete the procedure, social protection authorities are involved, and the level of income and living conditions are checked.

Read also: Birth certificate in 2020

Applicants send a package of documentation and an application to the relevant departments. Based on the results of the review, the institution announces a verdict on the provision or refusal to receive financial assistance payments. In a situation where the application is not satisfied, the agency is obliged to provide legitimate reasons for the refusal in writing.

Tax on financial assistance

Please note: funds for one-time support are transferred when appropriate circumstances arise. At the same time, assistance has no connection with the person’s performance of any functions or actions and does not entail the imposition of obligations.

When financial assistance is not subject to personal income tax in full and when income tax is taken from the full amount

The Tax Code of the Russian Federation also contains grounds for subjecting material assistance to personal income tax only partially.

Such payments, for example, include:

- Payment on the occasion of the birth of a newborn into an employee’s family – both their own child and one taken from an orphanage. At the same time, the non-taxable base on this basis should not be more than 50,000 rubles for each child, and payment of financial assistance must be made before the child turns one year old (Clause 8 of Article 217 of the Tax Code of the Russian Federation).

Read more about this in the material “To what extent is financial assistance at the birth of a child not subject to personal income tax?” .

- Material payments provided for by local regulations of the organization, but not more than 4,000 rubles. for the year (clause 28 of article 217 of the Tax Code of the Russian Federation).

In order for financial assistance to be subject to personal income tax in a reduced amount, the following conditions must be met:

- Availability of supporting documents.

- Reflection in the company’s internal documents of the possibility of paying these types of financial assistance.

It should be noted: if the taxpayer does not have the opportunity to take advantage of the personal income tax benefit, he becomes obligated to pay tax at a rate of 13% on the material payment.

In this case, personal income tax on financial assistance is withheld in the following cases:

- There are no supporting documents.

- The basis for non-taxable payment is not provided for by the Tax Code of the Russian Federation.

- Internal documents do not provide for the possibility of its accrual.

To learn about when and how financial assistance is reflected in the 6-NDFL form, read the article “How to reflect financial assistance in the 6-NDFL form?”

Features of taxation of financial aid

If the amount of financial assistance does not exceed 4,000 rubles per year for any reason, personal income tax on financial assistance in 2020 is not withheld. But there are several special cases, which we will consider in detail.

1. Financial assistance that is completely exempt from personal income tax is financial assistance, which is issued in the case of:

- death of a close relative of an employee, death of a former employee;

- emergency circumstances, including natural disasters;

- prevention, suppression and other actions to prevent the commission of a terrorist act.

2. Non-taxable within the limit of 50,000 rubles:

- employees at the birth (adoption, establishment of guardianship) of a child.

According to paragraph 28 of Art. 217 of the Tax Code of the Russian Federation, such one-time financial assistance is excluded from the tax base for personal income tax; with regard to insurance contributions, the position of the Ministry of Finance is identical. The material assistance code in the 2-NDFL certificate up to 4,000 rubles is indicated in the Federal Tax Service order No. ММВ-7-11 / [email protected] dated 09/10/2015. This includes:

- income code 2760 (material for employees, former employees who left upon retirement);

- income code 2710 (other types of financial assistance not related to code 2760).

The deduction code for any material income code also depends on the basis for charging the employee.

IMPORTANT!

If material support exceeds the limit, then financial assistance is subject to personal income tax only on the excess amount.

The legislation establishes a number of cases in which material is completely excluded from the base for calculating tax, regardless of the amount:

- One-time payments to victims or family members of those killed as a result of a natural disaster or emergency (clause 8.3 of Article 217 of the Tax Code of the Russian Federation).

- Assistance to citizens injured as a result of a terrorist attack on the territory of the Russian Federation, and family members of those killed under these circumstances (Clause 8.4 of Article 217 of the Tax Code of the Russian Federation).

- One-time assistance to an employee in connection with the death of a member of his family. The payment can be made to a former employee who has retired (clause 8 of Article 217 of the Tax Code of the Russian Federation).

- Material for the birth of a child or his adoption. The legislation sets a limit - no more than 50,000 rubles for each child, and per each parent per year (clause 8 of Article 217 of the Tax Code of the Russian Federation). Such clarifications were given by representatives of the Ministry of Finance of the Russian Federation in a letter dated July 12, 2017 No. 03-04-06/44336. Officials withdrew previous clarifications that required providing a 2-NDFL certificate from the spouse’s place of work in order to receive the material.

- One-time financial assistance to an employee and a retired person to pay for medical services (Clause 10, Article 217 of the Tax Code of the Russian Federation). In order for the tax authorities to recognize this payment as financial assistance, it is necessary not only to document the circumstances, but also to make the payment exclusively from the net profit of the enterprise (letter of the Federal Tax Service dated January 17, 2012 No. ED-3-3 / [email protected] ).

Is material assistance received in kind subject to personal income tax?

In accordance with Art. 211 of the Tax Code of the Russian Federation, an employee can receive income in kind. Clause 8 of Art. 217 of the Tax Code of the Russian Federation provides for the possibility of providing material assistance in kind. This position is confirmed by the Ministry of Finance of the Russian Federation (letter of the Ministry of Finance of the Russian Federation dated February 4, 2013 No. 03-04-06/0-34).

In this capacity, certain material resources such as goods or materials can act, services can be provided or work can be performed. The main thing is that the assistance provided is documented and has a monetary value. In such circumstances, income tax on material assistance is taken as usual, and payments in kind are subject to personal income tax in the usual manner.

For more information about payments in kind and their taxation, read the material “Did the individual receive income in kind? Fulfill the duty of a tax agent .

Financial assistance in connection with the death of a close relative in 2020–2021

Separately, it is necessary to say about financial assistance in connection with the death of a close relative in 2020–2021.

The fact is that the employer can list in the salary regulations the immediate relatives of employees, in the event of whose death the employee is paid financial assistance. For example, this could be a spouse, children, parents, grandparents, parents-in-law, brothers/sisters. However, the procedure for assessing financial assistance with insurance premiums depends on whether the deceased relative was a family member or not.

Financial assistance in connection with the death of a close relative in 2020–2021 is not subject to insurance premiums only if these close relatives are family members within the meaning of Art. 2 of the Family Code of the Russian Federation (see letter of the Ministry of Labor of Russia dated November 9, 2015 No. 17-3/B-538). In this article of the Family Code, only the spouse, parents (including adoptive parents) and children (including adopted children) are considered family members. So if an employer pays financial assistance in connection with the death of, for example, a grandmother or parents of a spouse or brother/sister, then this financial assistance will be subject to insurance premiums in the general manner.

What is the deadline for transferring personal income tax on financial assistance?

Income tax must be transferred to the budget on the working day immediately following the day the income is issued. The deadline for transferring personal income tax on material assistance is set similarly. Let us explain the nuances of determining this starting point, since its incorrect indication can lead to sanctions from tax authorities.

For payments in the form of financial assistance, income is considered received on the day when funds are transferred to a bank account or money is issued from the cash register. If financial assistance is received in kind, then the date of receipt of income will be the day the resources are issued (clause 1 of Article 223 of the Tax Code of the Russian Federation).

The moment of personal income tax withholding is also tied to the receipt of financial assistance. Tax should be withheld on the day when funds are paid, and in the case of payment in kind - immediately after the receipt of cash income, which may not be associated with this particular situation, but comes to the taxpayer.

The procedure for obtaining financial assistance in an organization

To receive money, the employee writes a free-form application. In some cases, he will have to prove his right to financial assistance of 4,000 rubles. (taxation 2020, insurance premiums) and provide relevant documents, such as a birth or death certificate, a certificate of accident, etc. Based on the application, the manager issues an order. Below are samples of documents that can be used when applying to an employer for financial assistance at the birth of a child.

Sample application for financial assistance

Sample order for financial assistance

Results

Many taxpayers have a question about whether financial assistance is subject to income tax, since such payments to employees are private in nature. The Tax Code of the Russian Federation contains an exhaustive list of types of such assistance, according to which companies have the opportunity either not to pay tax on it, or to pay it not on the full amount of funds issued. However, in order to take advantage of such benefits, they must be documented.

To learn how material assistance is taken into account for income tax purposes, read the article “How does material assistance to employees affect income tax?”

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

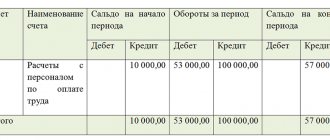

Postings for calculating financial assistance

To avoid disputes with inspection authorities, it is recommended to establish internal regulations the types of payments equivalent to financial assistance, their amount and the documents that employees must provide in order to receive it.

Mat. assistance will be assigned to the employee upon his written request, based on the order of the manager.

The accrual of this payment to employees of the organization should be reflected by posting: Debit 91.2 Credit 73 .

If payment is made to persons who are not employees of the organization, then the posting looks like this: Debit 91.2 Credit 76 .

The company can make the payment from retained earnings. To do this, it is necessary to hold a meeting of the founders and draw up a decision in accordance with which the money will be paid. To reflect the accrual for this situation, you need to make an entry Debit 84 Credit 73 (76).

The process of transferring funds is reflected by posting: Debit 73 (76) Credit 50 ().

How to get financial assistance at work

To receive a sum of money at the main place of work, an employee must:

- write an application for financial assistance;

- attach documents, certificates, examinations confirming the right to receive it.

A package of documents along with the application is submitted to the clerk/secretary or directly to the manager to make a decision on the payment of funds. If the decision is positive, the documents are transferred to the accounting department for execution. In budgetary organizations, the process of transferring financial assistance is slower than private firms, since statements are transferred to the financial department, treasury, and only then to the bank.

Due to difficult financial situation

When submitting an application for the provision of financial resources due to a difficult financial situation, the employee must write an application and attach documents confirming the right to receive funds:

- certificate of income of family members (if there is official employment);

- certificate of family composition;

- other documents confirming the difficult situation (for example, an act of unsuitability of housing).

For treatment

When applying for funds for the treatment of the employee himself or a member of his family, the following are provided along with the application:

- conclusion of a medical institution on the need for treatment;

- checks and receipts issued to the employee for the purchase of medicines, payment for operations and other expenses.

For the anniversary

Anniversary payments are classified as targeted assistance. Often singled out by order of the leader without the knowledge of the hero of the day. But if such an order has not been received, the hero of the day can take care of himself by submitting an application and the following documents:

- a copy of the passport (the page with the date of birth);

- petition from the immediate supervisor for assistance.

In such cases, payments to former employees are also possible (by decision of the manager and/or trade union committee).

At the birth of a child

The benefit for the birth or adoption of a child is established by a collective agreement, which specifies the amounts tied to the employee’s salary, or 50 thousand rubles. To complete it you need:

- employee statement;

- a copy of the child's birth certificate;

- a copy of the marriage certificate (if available).

For a wedding

When an employee gets married, funds are allocated according to the following documents:

- a petition from the immediate supervisor for assistance (in large organizations) or an oral request to the director;

- an application addressed to the manager for the provision of financial assistance.

Due to the death of relatives

Social benefits for funerals are negligible, so it is often impossible to do without the help of an employer. As a rule, payments from the company are issued promptly so that the employee has the opportunity to pay for funeral services. Financial assistance in connection with death is issued with the provision of documents:

- application addressed to the head of the organization;

- a copy of the death certificate, which is issued by the registry office after receiving a medical certificate at the hospital (morgue).