What is depreciation of fixed assets

The concept of “depreciation” refers to the procedure for gradually transferring the cost of fixed assets to products or services that the company offers.

Using the presented mechanism, the creation of new flows of funds is ensured. In the future they will be able to reproduce fixed assets.

This mechanism is also a good way to distribute large-scale costs over specific periods, taking into account the accrual method.

Find out in this article more about the list of necessary documents to open your own business.

During the operation of the company, it spends a certain part of the money on creating a full-fledged production, creates goods and sells them on the market.

Here you can learn more about small business support programs.

After the products are released, the cost of each proposal is formed.

It is necessary to add part of the money to it, which will play the role of profit. As a result, the final price of the product is formed.

Costs incurred on fixed assets should be included in the cost on an equal basis, since simultaneous write-off to cost will cause a multiple increase in prices.

Accordingly, they will be uncompetitive in the market.

How is depreciation calculated?

The amount of depreciation is calculated monthly. It is calculated separately for each existing item of property subject to depreciation. Calculation for items of necessary property, including items of fixed assets, the availability of rights to which must be approved as part of state registration, begins on the first day of the month following the period when the object was put into operation. This does not depend on the actual date of its state registration. The period ends from the beginning of the month that follows the time period in which the absolute write-off of the value of the object occurred, or when the object was completely excluded from the category of property subject to depreciation. The accrual itself is carried out in accordance with existing standards. Anything that is not depreciable for income tax purposes is excluded.

When is depreciation of fixed assets necessary?

Enterprises have the right to independently determine the optimal cost write-off methodology.

In accounting, several methods can be used for these purposes. But more on that a little later.

Depreciation can be applied based on the results of determining the efficiency of the enterprise , which is what the accounting department does.

The rates and procedure for depreciation deductions can be determined based on what types of assets you have to deal with.

Methods for calculating depreciation of fixed assets

At the moment, company managers can use one of four methods for calculating depreciation of fixed assets.

These are methods of depreciation of fixed assets such as:

- linear;

- reducing balance;

- write-off based on service life;

- relative to the volume of production.

Please note that domestic legislation does not provide for the possibility of depreciation of the following fixed assets :

- goods; water, land, subsoil, as well as other natural resources;

- documents and other securities;

- inventories of material and production type;

- objects related to long-term construction that have not yet been completed.

Enterprises have the opportunity, without outside help, to determine exactly what method will be used to calculate depreciation of fixed assets.

It is important to note that tax representatives can use linear and non-linear accrual methods.

The difference between one or another calculation method allows us to determine the specifics of the institution. Accordingly, a redistribution of the financial burden is achieved.

Depreciation groups of real estate - table

The table contains real estate objects in the context of their assignment to various depreciation groups for tax accounting purposes.

Table:

| Depreciation group | Useful life, l | Name of real estate |

| 4 | 5-7 | Non-residential buildings made of film materials, mobile structures, metal kiosks, fiberglass, wooden, pressed slabs |

| 5 | 7-10 | Non-residential prefabricated and mobile buildings |

| 6 | 10-15 | Lightweight residential buildings, including frame-reed buildings |

| 7 | 15-20 | Non-residential buildings (wooden and wood-metal, panel and frame, panel, adobe and similar) |

| 8 | 20-25 | Non-residential frameless buildings, the walls of which are made of lightweight masonry, with columns and pillars, ceilings made of metal, reinforced concrete, brick, wood. This also includes wooden structures made of timber and logs. |

| 9 | 25-30 | Warehouses for fruits and vegetables made of stone, as well as with columns made of brick and reinforced concrete. |

| 10 | from 30 | All other non-residential premises built from durable materials |

| All other residential buildings and premises |

Brick objects

Brick buildings are fixed assets with the longest service life from the point of view of both accounting and tax accounting.

These are the most durable and strong structures designed for long-term use without loss of original characteristics.

According to the Classification, such objects, both residential and non-residential, have the longest useful life of 30 years and are classified in depreciation group 10.

For a brick residential or non-residential building, any period over 30 years can be set; the organization itself determines which SPI will be determined.

If the building is not entirely built of brick, but has only brick floors, pillars, columns, then it belongs to depreciation group 8 and has a service life of 20 to 25 years.

In accounting, a similar period can be determined. It is not prohibited to establish a smaller SPI in accounting, since the organization must focus on the criteria from clause 20 of PBU 6/01; accounting does not define specific deadlines.

Non-residential premises in a residential building

If the non-residential premises are located in a residential apartment building, for example, an office on the ground floor, then the same SPI is determined for it as for the real estate itself.

A residential building belongs to depreciation group 10, therefore, for non-residential premises located in it, a useful life of at least 30 years can be established.

In accounting, you can take a useful period of operation equal to that established according to the Classification in tax accounting.

Apartment

All residential apartments located in an apartment building have the same SPI as the entire building as a whole.

Residential buildings belong to group 10, so for the apartments located in them it is necessary to set a depreciation period of 30 years.

Garage

According to the Classification, a metal garage can be classified as depreciation group 4; its service life can be set from 5 to 7 years inclusive.

A brick garage can be classified as group 8, as a frameless building with lightweight masonry walls. For him, SPI can be taken from 20 to 25 years.

Schools

School premises are non-residential, as they are not intended for living and are used for educational purposes.

The school can be classified as group 10 and a term of 30 years can be set for it.

Used

The premises may not be received in a new condition; in this case, the task of the next owner is to correctly determine the period for the structure during which depreciation deductions will be made.

However, the rules for tax and accounting are different.

For tax accounting

If an organization receives a building that was previously used, then in tax accounting it is possible to reduce the period of its use for the period of operation by the previous owner.

This possibility is confirmed by the provisions of clause 7 of Article 258 of the Tax Code of the Russian Federation.

The period of use of the premises by the previous owner can be found out from the accompanying documentation.

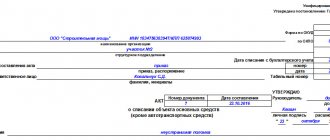

This period is indicated in the transfer and acceptance certificate OS-1a.

If the operating time of the structure is known and stated in the documents, then the new owner has the right to reduce the SPI.

If there is no such information and documentary justification, then the SPI cannot be reduced. In this case, for tax accounting it is necessary to determine the period for a previously used building as for a new one in accordance with the Classification and depreciation group.

If a building has been in operation for more than 30 years, then, depending on the initial SPI established for it, it can be completely depreciated.

In this case, the person who received such an old building has the right to independently set the period of use, taking into account its condition, based on safety requirements.

According to paragraph 12 of Article 258 of the Tax Code of the Russian Federation, the new owner of a structure or building that has been in operation for less than or more than 30 years must establish the same depreciation group for the object as the previous owner.

Reducing the useful life of a previously used premises during operation is not mandatory.

The new owner has the right to decide for himself whether he will reduce the SPI, so there are two ways for him to set the period for depreciation:

Take into account the time of operation by the former owner and calculate depreciation from the residual investment income - if there is documentary evidence.

Do not take into account the data of the previous owner and calculate depreciation based on the total useful life established for the depreciation group to which the real estate is assigned.

The chosen method of the company must be specified in the tax accounting policy.

Accounting

In accounting, SPI can also be established according to the Classification or independently, based on the factors prescribed in clause 20 of PBU 6/01.

It is not necessary to use any standards and Classification.

The useful period for accounting purposes can be determined taking into account a comprehensive assessment of the condition of the object, influencing factors, method of operation and the restrictions existing for it.

The organization has the right to independently choose a convenient method for determining PPI.

Depreciation periods for fixed assets

The concept of depreciation period of fixed assets is the time period during which the operation of fixed assets allows one to receive actual income.

For certain categories, the amount of time is usually determined depending on the volume of products or work that the enterprise expects to receive when using the specified facility.

The depreciation period is calculated in the process of accepting objects for accounting , taking into account the approximate level of productivity, expected physical wear and tear, as well as regulatory restrictions.

You can learn more about the concept of production profitability in this article.

In itself, accounting for depreciation of fixed assets is considered a rather complex matter, since determining the optimal strategy for the organization requires appropriate training. Calculations are carried out using specially designed formulas .

Without depreciation, a product or service will gradually become unprofitable for potential buyers, since the company will have to constantly increase the cost, thereby compensating for all costs and expenses.

Depreciation as an internal source of investment for updating fixed assets

The dynamic development of high-tech technologies and production capacities is impossible without timely renewal of production, its material and technical base, the basis of which is depreciation assets.

Depreciation is one of the sources of investment for the renewal (purchase) of fixed assets. Investment policy largely depends on the size of the sources of investment financing, and therefore on the method of calculating depreciation adopted by the organization.

The cost of fixed assets that are in an organization under the right of ownership, economic management, operational management (including fixed assets leased, free use, trust management) is repaid through depreciation, unless otherwise established by the Accounting Regulations “Accounting” fixed assets" (PBU 6/01) [3].

Depreciation of fixed assets (from the Latin amortisatio - repayment) is the depreciation of fixed assets calculated in monetary terms in the process of their use, production use.

Depreciation charges are the enterprise's accumulations to compensate for the depreciation of fixed assets and are taken into account in the cost of production.

Depreciation charges are included in production costs (selling expenses). When calculating the financial result, sales revenue is reduced by the amount of the cost of products sold.

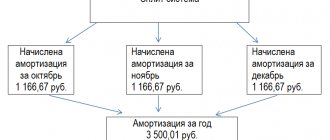

Depreciation is accrued monthly, while depreciation on retired objects stops accruing, and on new objects they begin to accrue from the first day of the next month.

Depreciation is calculated on fixed assets that are under repair, idle, unfinished or not documented with acceptance certificates, but are actually in operation.

The amount of depreciation is calculated for:

gradual accumulation of funds for complete restoration (purchase of new property);

calculating the cost value, which is the basis for determining the transportation tariff;

calculating the residual value for reflection in the balance sheet - determining the average annual residual value of fixed assets when calculating the tax base for property tax;

purposes of residual value assessment carried out by experts.

Fixed assets are accepted for accounting at their original cost. [1]

In tax accounting, the initial cost of a depreciable fixed asset is defined as the amount of expenses for its acquisition, construction, production and bringing it to a state in which it is suitable for use, with the exception of the amounts of taxes taken into account as expenses.

The initial cost of the property that is the subject of leasing is the amount of the lessor's expenses for its acquisition, with the exception of the amounts of taxes taken into account as expenses.

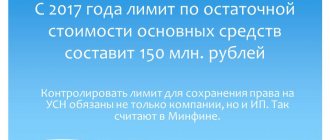

When classifying acquired property as depreciable fixed assets for accounting and taxation purposes, organizations must proceed not only from the useful life (more than 12 months), but also take into account the cost of the acquired object. The fact is that, in accordance with the changes (introduced from January 1, 2011) to PBU 6/01, assets worth no more than 40 thousand rubles. per unit can be taken into account as part of inventories and depreciation in this case, of course, is not accrued. If an organization decides to account for assets with a value within the limit (up to 40 thousand rubles) as part of inventories, then the accounting policy of the organization should reflect not only the fact of this choice, but also the size of this limit.

In accordance with paragraph 1 of Art. 256 of the Tax Code of the Russian Federation, depreciable property is property, results of intellectual activity and other objects of intellectual property that are owned by an organization and are used by it to generate income and the cost of which is repaid by calculating depreciation. Depreciable property is property with a useful life of more than 12 months and an original cost of more than 40 thousand rubles.

In addition, tax legislation (clause 3, clause 2, article 256 of the Tax Code of the Russian Federation) provides a wider list of property for which depreciation should not be calculated.

Depreciation accrued for accounting purposes is not taken into account when determining the tax base:

for property acquired using budgetary allocations and other similar funds;

for property received by the organization as part of targeted financing.

When calculating depreciation, the depreciation rate is determined, which is calculated based on the useful life of the fixed asset.

The useful life is the period during which the use of an item of fixed assets generates income for the organization.

The useful life is determined based on the following indicators:

the expected life of the facility in accordance with its expected productivity or capacity;

expected physical wear and tear, depending on the operating mode (number of shifts), natural conditions and the influence of an aggressive environment, as well as on the repair system;

regulatory and other restrictions (for example, lease term). [2]

The useful life in accordance with PBU 6/01 is determined by organizations independently on the date of commissioning of this depreciable property based on the Classification of fixed assets included in depreciation groups, approved. Decree of the Government of the Russian Federation of January 1, 2002 No. 1 (as amended (as amended on December 10, 2010).

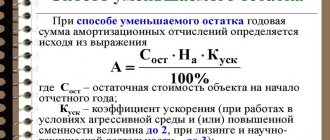

Currently, there are four methods of calculating depreciation in accounting: linear; reducing balance; write-off of cost based on the sum of the numbers of years of useful life; write-off of cost in proportion to the volume of products (works).

So, for example, when choosing a method for calculating depreciation of a vehicle, you must strive to choose the most effective option.

When accounting for motor vehicles, the choice of method for calculating depreciation depends on a number of factors, the set and degree of influence of which are determined by the essential features of motor vehicles that manifest themselves during their operation and consist in the fact that with an increase in service life and, therefore, total mileage:

average annual mileage decreases;

annual production in physical terms decreases;

the duration of maintenance and repair increases;

MTBF is reduced;

the specific annual income from one vehicle decreases.

The amount of accrued annual depreciation included in the cost must correspond to annual income and take into account the listed features.

With the linear method, depreciation is charged in equal shares throughout the entire life of the object until its value is completely transferred to the cost of the products (works, services) produced, which does not correspond to the real wear and tear of the vehicle, which increases with the total mileage.

Using the reducing balance method to calculate depreciation allows you to reduce costs and thereby increase the competitiveness of a motor transport organization. The calculation of depreciation using the reducing balance method corresponds to the dynamics of changes in the performance indicators of road transport. However, this method of calculation does not provide for the accrual of depreciation charges equal to the original book value over the useful life of the vehicle and, therefore, is slow. It is obvious that when a vehicle is written off after the end of its useful life, depreciation for which was accrued in this way, there will be a decrease in profit by the amount of underaccrued depreciation. [6]

The essence of the method of writing off cost by the sum of the numbers of years of useful life is that at the beginning of the service life depreciation charges will be higher, and in the subsequent period they will be lower. The feasibility of using this accelerated method of calculating depreciation for vehicles is manifested in the fact that the amount of depreciation included in the cost is higher for new vehicles, which are usually operated more intensively and generate more income. At the same time, as mileage increases, downtime for repairs increases and, as a result, operating time decreases, while income decreases, and at the same time the amount of depreciation charges decreases. Consequently, this method takes into account the characteristics of the operation of vehicles.

When writing off the cost in proportion to the volume of production (work), depreciation is calculated based on the natural indicator of the volume of production (vehicle hours of operation, mileage) in the reporting period and the ratio of the initial cost of the fixed asset object and the estimated volume of production for the entire useful life of the fixed asset object. This method of calculating depreciation allows you to bring the accrued depreciation closer to the actual depreciation of the vehicle, determined by the actual mileage, and to quickly calculate the amount necessary to purchase a new vehicle.

In this case, the standard mileage before write-off is the amount of work performed over the entire useful life of the vehicle.

The method of calculating depreciation in proportion to mileage most closely matches the actual wear and tear of vehicles. [4]

The use of such an own source of financing for the reproduction of fixed assets as depreciation charges is not reflected directly in the organization’s accounting accounts. The amount of depreciation accumulations for the complete restoration of fixed assets is determined as the balance in regulatory account 02 “Depreciation of fixed assets,” which is intended to account for the residual value of an item of fixed assets, and not to identify the source of financing for the renewal of fixed assets. The cost of the service provided by road transport, including the amount of depreciation charges included in it, is reimbursed by the proceeds from payment for the transportation service provided. It follows from this that the receipt of funds from the sale of services implies the receipt of depreciation amounts accrued in a given reporting period for vehicles used to provide the service. Due to the fact that the amount of funds necessary to finance the renewal of fixed assets is not formed on a separate accounting account, it is determined by calculation. To generate the necessary information used for making management decisions, it is necessary to keep analytical records of depreciation and accumulate it for the purpose of using it to update fixed assets [5].

According to Art. 259.3 of the Tax Code of the Russian Federation, when calculating depreciation, in some cases taxpayers have the right to apply special coefficients. As a result of their use, there is a reduction or increase in the useful life of the corresponding fixed assets (paragraph 2, clause 13, article 258 of the Tax Code of the Russian Federation).

From January 1, 2014, a ban on the simultaneous application of several increasing factors to the basic depreciation rate was enshrined in law (clause 5 of Article 259.3 of the Tax Code of the Russian Federation). Let us recall that the Russian Ministry of Finance previously adhered to a similar position (Letter dated September 14, 2012 N 03-03-06/1/481). The financial department also indicated that if there are grounds for applying several increasing coefficients, the taxpayer should provide in the accounting policy which of these coefficients will be applied.

Consequently, the method used for calculating depreciation affects the amount of accumulated depreciation charges if all depreciation accrued annually is reserved. The best methods for accumulating your own funds to finance the purchase of new vehicles are methods based on the sum of the numbers of years and in proportion to the mileage, since they allow you to accumulate a large part of the total amount of depreciation during the first half of the service life of the fixed asset. If necessary, the amount of accumulated depreciation on two vehicles (using the last two methods) can be used to purchase a new vehicle, even if its value increases due to inflation compared to the previously purchased one. [7]

Literature

1. Vasilyeva, E.A. Accounting and analytical support for sustainable development of an economic entity [Text] / E.A. Vasilyeva // Economics and entrepreneurship. - 2013. - No. 7 (36). — P. 229-232.

2. Vasilyeva, E.A. Information support for management analysis [Text] / E.A. Vasilyeva // Economics and management: new challenges and prospects. - 2013. - No. 5. - P. 86-88.

3. Vasilchuk, O.I. Procedures for auditing the activities of small and medium-sized businesses aimed at ensuring economic security [Text] / O.I. Vasilchuk // Innovative development of the economy. - 2011. - No. 3. - P. 17-26.

4. Volkov, O. I. Enterprise Economics [Electronic resource]: textbook. manual for universities in economics. specialties and directions / O. I. Volkov, V. K. Sklyarenko. - M.: INFRA-M, 2013. - 263 p.

5. Druzhilovskaya, E. S. Improving the methodology for accounting assessment of fixed assets [Text] / E. S. Druzhilovskaya // International. buh. accounting — 2012. — No. 32. — P. 8-17

6. Krupina, N. N. Accounting for depreciation of fixed assets: Russian and international standards [Text] / N. N. Krupina, N. N. Bartkova // International. buh. accounting — 2010. — No. 16. — P. 21-27

7. Korostelev, A.A. Management of information flows in analytical activities [Text] / A.A. Korostelev, T.V. Komar // Azimuth of scientific research: economics and management. - 2012. - No. 1. - P. 42-45.

FAQ

What is straight-line depreciation?

Straight-line depreciation is widely used in accounting because this method is extremely easy to use.

According to the Tax Code of the Russian Federation, organizations choose the method of depreciation of property independently.

When applying the linear method, the amount of accrued depreciation for one month is determined as the product of the original cost of the fixed asset and the corresponding depreciation rate.

The main essence of the straight-line depreciation method is that the process of physical wear and tear occurs uniformly over this time.

This is more true for fixed structures than for equipment where operation or time are more important factors . In addition, another element of depreciation, i.e. obsolescence does not necessarily occur at the same rate all the time.

What happens to depreciation after modernization in tax accounting?

The cost of modernization of fixed assets cannot be written off at a time (clause 5 of Article 270 of the Tax Code of the Russian Federation). According to paragraph 1 of Art. 258 of the Tax Code of the Russian Federation, depreciable property is distributed among depreciation groups in accordance with its useful life. In this case, the company determines its useful life independently on the date of commissioning of the depreciable property in accordance with the provisions of Art. 258 of the Tax Code of the Russian Federation and taking into account the Classification of fixed assets included in depreciation groups.

The company has the right to increase the useful life of a fixed asset after the date of its commissioning if, after modernization of the object, its useful life has increased. An increase in the useful life of fixed assets can be carried out within the time limits established for the depreciation group in which such fixed assets were previously included. Thus, in accounting the period increases based on technical characteristics, but in tax accounting it is limited by the terms of the depreciation group! And again we are faced with differences in the amount of depreciation if these periods do not coincide!

The question arises: based on what depreciation rate should depreciation be calculated after the modernization of the facility?