Main purpose

In essence and in form, the document is an act of acceptance and transfer of specific movable objects related to fixed assets. This does not include buildings, industrial structures and other real estate for which there is a special form OS 1a. In addition, the act is not drawn up in relation to the following property objects:

- movable property, the value of which is currently estimated at 3,000 rubles or less;

- movable belonging to the library collection.

Acceptance of fixed assets occurs for various reasons:

- In accordance with the agreements on the acquisition of funds: purchase of equipment, exchange, donation of property, its rental, receipt under a leasing agreement.

- Manufacturing of equipment and putting it into operation for an appropriate fee (for the enterprise’s own needs).

- Disposal of property from the company's fixed assets (similarly - sale, exchange for the benefit of another organization).

In some cases, the entry of property is carried out on the basis of other documents - such situations are prescribed separately in the legislation (there is a separate procedure).

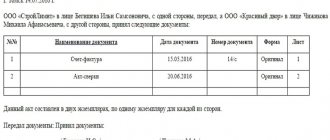

The act is always drawn up in 2 identical copies, which have equal legal force. Often it is accompanied by technical documents that accompany the transferred (acquired) property.

NOTE. Each company has the right to use both a standard form and a document of its own form. The main requirement is that all key information is included (as shown in the form below).

In what cases is it necessary to use an act of form OS-1?

Form OS-1 is issued:

- when recognizing an object as a fixed asset and recording its commissioning;

- upon disposal of fixed assets in connection with its transfer to a third party (sale, exchange, etc.).

An act in form OS-1 is not issued for structures, buildings and other fixed assets, the transfer, acceptance or commissioning of which is carried out in a special manner in accordance with legal requirements.

The unified form was approved by Decree of the State Statistics Committee dated January 21, 2003 No. 7. You can download it on our website.

Form and sample 2020

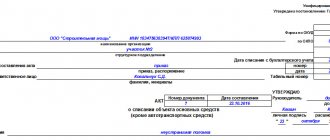

The form consists of 3 pages and looks like this:

A sample of filling out OS 1, which can be used as an example, is presented below. Here is a copy that is completed and intended specifically for the recipient. Accordingly, the deliverer enters information in those columns that are provided specifically for him.

Direct filling and signing depends on the characteristics of the object being transferred to the enterprise. If the production equipment is structurally simple and does not require any installation work, the act is signed immediately at the time of actual purchase. If assembly is required, then installation is carried out first, and only then the act is signed.

Instructions for filling

It should be noted that information is not entered in all columns: it all depends on who exactly the copy belongs to: the receiving or transmitting party.

Page 1

The title page provides the following information:

- Visas are “Approved” by a representative (most often the general director) of the sending and receiving company. Each copy is stamped with appropriate visas – i.e. The 2 documents of the recipient and the sender will be different.

- The print space (MP) is intended for applying the original print. However, the absence of a seal is acceptable if the company does not officially use it in its work.

- Information about the recipient - the abbreviated name of the company, for example, ICS LLC, its details (TIN and KPP).

- Codes for OKUD and OKPO.

- Legal address of the company, indicating the region and postal code.

- Bank details – current account, name and BIC of the bank, correspondent account details.

- The name of the structural unit where the fixed asset was received (for example, a finished goods warehouse).

- The legal basis for the transaction is most often the relevant purchase and sale agreement.

- Document number (usually continuous numbering throughout the year) and date of completion.

- The date when the asset was accepted for accounting is the date the act was drawn up.

- Numbers – inventory, factory, and depreciation group

- The official name of the property (for example, a car model), the manufacturer of this property.

- The location of the object refers to the company (and address) where it was specifically at the time of transfer.

- There are situations when the purchased property is owned by several companies at once. Then filling occurs in accordance with the size of the share in ownership. In addition, it is necessary to put a note about each participant in the share and its size. This information is recorded on page 1 of the form (section “For reference”).

Page 2

The second page requires filling out two sections at once:

- If equipment or other property has already been used as a fixed asset, Section 1 should be completed. It indicates key information about the object that is relevant on the date of its transfer:

- date or year of issue;

- date of official start of operation;

- date of last overhaul;

- number of years and months of the entire period of use;

- useful life data;

- the total cost of wear and tear;

- residual value;

- purchase price (according to agreement).

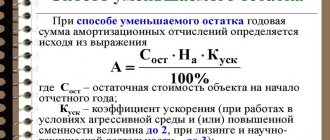

- The information in section 2 is recorded only by the recipient, and it is filled out only in his copy of the form. All current information on property depreciation is provided:

- the value of the property on the day when it was officially accepted for accounting;

- total useful life (calculated in full months);

- method of calculating depreciation - name of the method and norm.

Also on the second page information is entered with the characteristics of the fixed asset:

- Name;

- quantity;

- a note on the content of precious metals and stones (if any in its composition); in case of absence, dashes are placed in all columns.

If any significant characteristics were not reflected in the tabular part, they are separately written in the lines after the phrase “Other characteristics”.

Page 3

Finally, on page 3 of the form, all data on the commission accepting the fixed asset is filled in:

- The date on which the test result of the property was recorded (usually this is the date the report was issued).

- The result of the tests: a mark “complies” and a mark about possible modifications (required or not required).

- Official conclusion of the receiving committee: usually indicate that the equipment is in working order and suitable for use.

- Next, write down the official names of all technical documents that accompany this equipment (fixed asset).

- Then the following persons put signatures, transcripts of signatures and job titles:

- chairman of the commission (usually the general director);

- the head of the structural unit where this property is supplied (for example, a warehouse manager)

- general accountant who accepts the funds for accounting.

- Finally, a note about the direct reception and transmission of the object is given: each party fills out its own column. The deliverer enters all the information after the word “Passed”, and the receiving organization fills in the data after the word “Accepted”:

- who exactly accepted (position, signature and transcript of the signature);

- the basis for the emergence of the authority of acceptance (power of attorney - number, date, who issued it and to whom);

- who accepted the property for safekeeping (similar to the position, signature and transcript of the signature);

- a note from the chief accountant, which confirms the fact of creating an accounting card, the number of the entry in the inventory book and the date of its compilation (signature and transcript of the signature).

How to fill out Form OS-1 correctly?

The document includes 3 pages.

On the 1st sheet it is indicated:

- Document approval stamp. If you purchase or create a new OS, the delivering company does not need to install it.

Note! The stamps of the OS-1 form contain the requisite “Print Place”. However, it is not included in the list of mandatory elements of primary documentation established by Part 2 of Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ. If the enterprise receiving/leasing the object does not use a seal (according to Law No. 82-FZ), then it does not have to put a stamp on the act.

- Information about the organization receiving the object.

- Information about the delivery company. When filling out a document for new and independently created operating systems, this information is not indicated in the document.

- Accounting data (including accounting account, date of write-off/acceptance of fixed assets).

- Description of the object: name, purpose, numbers (factory, inventory), model, manufacturer information, brand, etc.

Page 2 of the OS-1 form contains the following sections:

- Section 1. It contains information only regarding those objects that were in operation. The data is indicated on the basis of information provided by the delivery company. Information should be entered as of the day of transfer: dates of production, commissioning, major repairs, duration of use (actual and useful). The same section provides depreciation amounts accrued by the previous owner and the residual value of the fixed assets.

- Section 2. It is executed only by the recipient company in its remaining copy. Here you should indicate information about the depreciation procedure: the original cost, the duration of the useful life established by the new owner, the depreciation rate and the accrual method.

- Section 3. It briefly characterizes the object: describes its devices, accessories, indicates (if any) the presence of precious metals and other properties.

Page 3 contains:

- Information about the acceptance of the object by the competent commission. Here the degree of compliance of the OS with the technical specifications is indicated, a conclusion is drawn about the need for its improvement, etc.

- Signatures of responsible employees. The document is endorsed by the persons who are members of the commission, as well as by the entities accepting and handing over the object.

Note! If the operating system is owned by two or more enterprises, information about it is included in the act in accordance with their shares in ownership. Information is provided on the first page in the “help” section. Data about the subjects and their shares in the right must be present here. If the object was purchased for foreign currency, it is necessary to indicate its name and amount in terms of the Central Bank exchange rate on the date determined in accordance with the requirements of the accounting legislation.

At the end of the document, the accounting department of each company puts notes:

- the transferring enterprise - on the reflection in the inventory card of information about the disposal of the object (this information is entered only in the case of acceptance and transfer between owners);

- the receiving company - on the formation of an inventory card or on making an entry in the inventory book.

A sample of filling out the OS-1 form is available on our website.

Similar articles

- Form OS-1: sample filling

- Form OS-4: sample filling

- Filling out the unified form No. OS-4 - example

- Inventory card for accounting of fixed assets

- Form OS-1a

Procedure for drawing up and signing

For different employees (general director, warehouse manager, who accepts the fixed asset for safekeeping, and chief accountant, who registers it), the registration and completion procedure will look different. In general, the sequence of actions is as follows:

- At the preliminary stage, two parties (receiver and deliverer) negotiate to agree on the transfer procedure itself and the legal basis (leasing, purchase, exchange or donation). An appropriate agreement is drawn up, which takes into account the interests of both parties.

- Then comes the actual acceptance stage. It is always carried out not by one person, but by a commission consisting of at least a director, chief accountant and warehouse manager. There may also be technical specialists present who can competently assess the condition of the object and its compliance with the characteristics stated in the technical documentation.

- The act is signed - in each copy, the companies fill out their own columns: the deliverer writes down notes on delivery, the receiver - on acceptance.

- Then the chief accountant of the depositor's side withdraws the funds from account 01.

- And the chief accountant of the receiver, on the contrary, registers the object under account 01.

How to prepare the corresponding accounting entries can be seen below:

Calculation of property tax, as well as accounting for depreciation costs, does not begin immediately, but from the next month (closest to the month when the OS 1 form was filled out). Similarly, for the deliverer, accounting for depreciation and accounting for property taxes ceases from the next month.

NOTE. It can be filled in manually or in printed form. The main condition is the absence of any corrections (including those marked “Corrected to be believed”), blots, errors and inaccuracies. If incorrect information is included, the entire document should be redone, since it relates to primary reporting and is controlled by the relevant authorities.