The process of manufacturing and selling alcoholic beverages is strictly regulated by the legislation of the Russian Federation. Only organizations that have received a special license have the right to work with alcohol-containing drinks.

Failure to comply with these rules when conducting trade is called illegal trafficking in alcoholic beverages. Articles of the Criminal Code of the Russian Federation, as well as the Code of Administrative Offences, provide for liability for such a crime.

Criminal liability

The Criminal Code contains two articles concerning illegal trafficking in alcohol. The first of them is Article 171.3. In accordance with it, the following actions in relation to alcoholic products carried out without the necessary license are subject to punishment:

- Manufacturing;

- Procurement (including import);

- Storage;

- Supply (including export);

- Move;

- Retail.

For the objective side of this crime, it is also necessary that the cost of alcoholic beverages exceeds 100 thousand rubles. If the size of the products sold or produced is smaller, then liability arises under administrative law.

Article 171.4 provides for liability for retail sale of alcoholic products committed by a person who already has an administrative penalty for a similar act, that is, less than 1 year has passed since the decision was made to impose an administrative penalty on him.

The statutory fine for selling alcohol to minors is:

- for individuals - from thirty to fifty thousand rubles;

- for officials - from one hundred to two hundred thousand;

- for organizations - from three hundred to five hundred thousand.

In addition, repeated violations may result in criminal liability.

You can read more in the article here.

Under Article 171.4, the following may be prosecuted for the illegal sale of alcoholic beverages:

- Individuals selling alcohol (including their own production);

- Entrepreneurs selling alcohol without forming a legal entity and without a license in cases where one is necessary.

How to properly sell beer and strong alcohol in public catering

Retail sale of alcohol in public catering differs from sale in an alcohol market or grocery store.

For strong and weak alcohol, the fact of sale is considered to be the opening of the container - bottle or keg. The sale is reflected in the Unified State Automated Information System using a write-off act with the reason “sale.” It must be sent no later than the next business day.

According to the rules for the sale of strong alcohol in public catering, you need to scan the excise stamp affixed to the bottle. This is a fundamental difference from selling beer. Indicate the brand code in the write-off act, as required by mark accounting.

We will tell you the details using the example of the Kontur.Market service.

- Sale of beer, cider, mead or poire in public catering

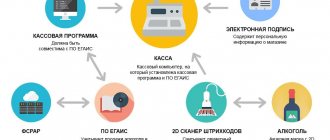

The bartender opens a keg and sells beer on tap. Two departments must know about the sale: tax and FSRAR.

Tax data is sent to the tax office instantly from the cash register through the OFD.

FSRAR learns about the sale from EGAIS when the institution sends write-off reports with the reason “sale.” The market helps you create such acts in a couple of minutes based on the sales log. What is recorded in the sales journal automatically.

For example, selling a 50-liter keg of beer will look like this in two systems:

| What does the Federal Tax Service see? | What does FSRAR see? |

|

|

- Selling strong

The bartender uncorks a bottle of cognac, pours 50 grams for the guest and knocks out a receipt at the cash register. The tax office (through the cash register) and FSRAR must find out about the sale through a write-off act in the Unified State Automated Information System.

As in the case of a beer keg, the write-off act will be for the entire bottle, and not for the 50 ml sold. If the opened cognac is no longer bought, from the state’s point of view you have sold the entire volume, for example, a 0.5 liter bottle. If a guest orders an entire bottle, the bartender must still open it.

How the sale of cognac can be reflected in two systems:

| What does the Federal Tax Service see? | What does FSRAR see? |

|

|

At what point should a bartender read the stamp on a cognac bottle?

Strictly speaking, then immediately after opening. In reality, it happens differently, because different people may be responsible for reporting to EGAIS.

- The bar owner himself or the bartender, who is trusted by EGAIS, works behind the counter.

A laptop with the Kontur.Market service is located at the bartender’s workplace. He opens the sales journal in the Market and reads the brand with a 2D scanner connected to a computer.

The bartender does the same with other bottles that he opens during his shift. All stamps are logged using scanning. At the end of the shift, Market generates a write-off act based on this data and sends it to EGAIS. It takes a minute.

- An accountant or owner works with reporting

(remotely or on a schedule that does not coincide with the establishment’s schedule).

During the shift, the bartender scans the stamps and saves the codes in a text file or Excel. After the bar closes, he sends a file with codes to the accountant by email or messenger.

The accountant uploads the file with the codes to the sales journal, and Market creates a write-off report for the Unified State Automated Information System.

Possible penalties

Article 171.3 provides for the following types of punishment for those found guilty:

- Fine from two to three million rubles;

- Forced labor for up to 3 years;

- Imprisonment for the same period with deprivation of the opportunity to engage in certain work after release.

If the illegal production or trafficking of alcoholic beverages was carried out by an organized group or on a particularly large scale (more than 1 million rubles), then the punishment is imposed under Part 2 of Article 171.3. The minimum penalty for the second part is a fine of 3 million, and the maximum is five years in prison.

For those who have already been brought to administrative responsibility for similar actions, Article 171.4 provides for the following types of penalties:

- Fine up to 80 thousand rubles;

- Correctional work for up to a year.

Beer trading without a license

Good afternoon

If you will carry out retail trade in beer and rent out premises, we recommend that you indicate the following types of activities in the Unified State Register of Entrepreneurs:

— 47.25.12 Retail sale of beer in specialized stores

— 47.11 Retail trade primarily in food products, including drinks, and tobacco products in non-specialized stores

— 68.20.2 Rent and management of own or leased non-residential real estate

Sale of alcoholic beverages, incl. beer, on the territory of the city of Omsk is carried out in accordance with the Federal Law of November 22, 1995 No. 171-FZ “On state regulation of the production and turnover of ethyl alcohol, alcoholic and alcohol-containing products and on limiting the consumption (drinking) of alcoholic products” (hereinafter referred to as the Federal Law ), as well as the Law of the Omsk Region of December 28, 2005 No. 717-OZ “On state regulation of the retail sale of alcoholic beverages in the Omsk Region.”

An individual entrepreneur does not need to obtain a license to sell beer.

For retail sale of beer and beer drinks in accordance with Art. 16 of the Federal Law, a seller-entrepreneur must have stationary retail facilities and warehouse premises in ownership, economic management, operational management or lease. At the same time, there are no restrictions on the size of the total area of these premises for the retail sale of beer and beer drinks.

As for organizations engaged in the retail sale of alcoholic products (with the exception of beer and beer drinks, cider, poiret, mead) in urban settlements, they must have for such purposes ownership, economic management, operational management or lease, the period of which is determined by the contract and is one year or more, stationary retail facilities and warehouses with a total area of at least 50 square meters, as well as cash register equipment.

In addition, from January 1, 2020, when carrying out retail trade in beer, you must record the fact of purchasing beer in the EGAIS system. To do this you need:

— purchase a JaCarta crypto key;

— obtain a qualified electronic signature (CES) and record it on JaCarta;

— register on the website egais.ru and create a Personal Account there;

— download for free from your Personal Account on egais.ru and install the UTM utility (universal transport module of the EGAIS system) on your computer.

For these types of activities, you can choose a general, simplified, patent taxation system or UTII. In this case, you need to maintain separate tax records. When carrying out retail trade in beer when using UTII or a patent taxation system, it is allowed not to use cash register equipment.

It is also necessary to take into account that when renting out part of the premises, the premises must be demarcated.

Monitoring compliance with these Rules is carried out by the Ministry of Foreign Economic Relations of the Russian Federation, the State Committee of the Russian Federation on Antimonopoly Policy, the State Committee of the Russian Federation for Standardization, Metrology and Certification, the Ministry of Health of the Russian Federation, the Federal Service of Russia for Ensuring the State Monopoly on Alcohol Products and their territorial bodies, other federal executive authorities and their territorial bodies within their competence. Approved by the Decree of the Government of the Russian Federation of August 19, 1996.

Administrative responsibility

The Code of Administrative Offenses contains several articles related to illegal activities in relation to alcoholic products.

Did you know

Drinking alcoholic beverages in public places is considered an administrative offense and faces a fine of 500 to 1,500 rubles.

So part 2 of article 14.16 of the Code of Administrative Offenses for the circulation of alcoholic products (except for retail trade) without the appropriate documents, which, according to the law, can confirm the legality of the production of these products. The sanction of the article for these violations provides for a fine:

- For officials – from 10 to 15 thousand rubles;

- For organizations – from 200 to 300 thousand.

Additionally, punishment is applied in the form of special confiscation - all alcoholic products without the appropriate documents are confiscated.

Article 14.17 of the Code of Administrative Offenses provides for liability for legal entities for the illegal circulation of alcohol, as well as its production without a license. The fine that the organization may face is from 200 to 300 thousand rubles with confiscation of alcoholic products and raw materials.

Under Article 14.18, persons who use ethyl alcohol produced from non-food raw materials to produce alcoholic beverages can be punished. The sanction is the same as under Part 2 of Article 14.16.

How much does a liquor license cost?

The amount of the state fee for obtaining a license depends on the type of activity and the alcohol you produce or sell:

| License type | State duty amount |

| Retail sale of alcohol | 65,000 rubles |

| Production and wholesale of any alcohol (except wines) | 9,500,000 rubles |

| Production and wholesale of wines | 800,000 rubles |

| Production and wholesale of alcohol-containing products | |

| Wholesale supplies of alcohol |

The validity period of any of these licenses is one year. Next year you will need to pay the fee again. You can also pay for the license several years in advance (up to five). To renew your license, send an application for renewal and a receipt for payment of the state fee to the regulatory authority.

Responsibility for moonshine

Despite the severity of measures taken by the state to combat low-quality alcoholic products, brewing moonshine for personal use is not limited by law.

Note! A bottle of moonshine, brewed at home, but exclusively for one’s own consumption, cannot become the basis for bringing a person to criminal or administrative liability.

But if such a product is sold, the “moonshiners” will have to answer for one of the articles discussed above, depending on the situation, as well as for illegal business activities.

Cost of lawyer services in Moscow

It is worth noting that the services of a lawyer cannot be free. They are paid either by the client, the company, or the government. The cost of our lawyers’ services varies widely and depends on the following nuances:

- legal scope of the issue;

- number of services provided;

- complexity of the issue.

Often the services of a lawyer in court

relate not only to such general powers as familiarization with the case or direct participation in the trial, but also special ones, which include collecting documentation, interviewing witnesses or other services. The client always independently decides how much of the services provided by the lawyer he will need. Based on this, the final price of legal services is determined.

Many people wonder how much a lawyer’s services cost.

and how good are they? Our company’s tariffs allow the lawyer to receive a decent remuneration for his painstaking work, without being distracted or scattered on other small orders. And this is a 100% guaranteed result of immersion in the client’s problem.

Lawyers will help give a qualified assessment of the current situation, conduct a competent analysis of the problem and help develop the most successful position for the client. To resolve the issue you are interested in and achieve the desired result, our lawyers use all possible methods. Call!

Company concept and product description

First of all, a novice entrepreneur should determine the concept of organization and development of the company, based on the range and types of alcoholic products produced. Strong alcoholic drinks are an indispensable attribute of a festive feast, while light alcohol enjoys its own popularity, especially when it comes to outdoor events.

The concept of organization and development of the company directly depends on the range of alcoholic beverages and the use of additional sources of income.

Rules for the sale of alcoholic beverages in 2018

To do this, you must submit the necessary documents to the relevant tax authority:

- application for a license;

- documents on registration and tax registration;

- bank account details;

- confirmation of the absence of tax arrears;

- lease agreement or ownership of a retail outlet;

- documents confirming the existence of the corresponding authorized capital requirement;

- conclusions of the relevant services that the retail outlet complies with sanitary, fire and environmental standards.

Please note: the duration of the obtained alcohol license can range from one to three years. If the permit expiration date is approaching, you need to submit documents for its renewal.

Advantages and disadvantages

There are more and more people wanting to join the alcohol business every year. This is due to the almost unlimited possibilities for increasing your investment. Let’s consider the main advantages of trading in alcohol:

- quick payback;

- high demand, independent of the level of the economy;

- profitability;

- popularity of the product;

- the opportunity to receive excess profits on holidays;

- resistance to bankruptcy.

Among the disadvantages of entrepreneurship based on the retail sale of alcoholic beverages, the following should be noted:

- availability of high starting capital;

- strict legal framework of permissibility;

- mandatory license;

- competition;

- unfriendly attitude towards this business;

- work time restrictions.

An organization that has taken upon itself the responsibility of opening an alcohol business must comply with all laws governing the production and sale of alcohol products, failure to comply with which can lead to heavy fines, deprivation of the right to sell, and even confiscation of property.

Tags

Business ideas selling alcohol

At home

After purchasing a drink at foreign sites, many have difficulties with transportation to Russia. Firstly, this is due to the fact that no more than 5 liters of alcohol of different strengths can be transported across the border, of which only 3 liters are duty-free, and for each liter an additional tax of €10 is paid, explains David, head of tax practice at BMS Law Firm Kapianidze.

At the same time, the total cost of imported alcohol should not exceed €10,000 by air and €1,500 by any other transport. This follows from the rules for the movement of goods for personal use across the borders of the countries of the Customs Union.

“If the value is more than the specified standards, but less than 650,000 rubles, then for exceeding the limit you will have to pay 30% of the customs value, but not less than €4 for each kilogram,” says the expert.

The investor will have to spend even more if he uses the delivery services of official exchanges. For example, London's Whiskyexchange charges a minimum of £120 for a maximum of two 0.7-litre bottles of whiskey. The Dutch exchange WWI charges 2% on any quantity of whiskey with a total value of up to £5,000. The higher the cost of the drink, the lower the exchange commission.

However, it is not at all necessary to transport whiskey to Russia - you can use a depository on stock exchanges. Thus, according to the price list of the WWI exchange, the storage fee per year is 2% of the minimum portfolio in the amount of €5,000.

Rules for the sale of alcohol

- characteristics of the products that will be licensed;

- certificate of registration of the cash register;

- official permission from authorities;

- contact information, details;

- document confirming payment of the authorized capital;

- company charter.

Regional rules for trade in alcoholic products Legislative conditions for industrial warehouses and property premises:

- the area of the village must correspond to 25 sq.m;

- the area in the city should be from 50 sq.m.;

- conclusion of a lease for a period of at least 1 year.

The time frame clause contains its own characteristics: in Moscow, the sale of an alcoholic product is allowed from 8.00 to 23.00, and in the Moscow region the sales policy is more limited to the schedule from 11:00 to 21:00.