Deadlines for submitting reports to the simplified tax system “income”

Simplified annual declarations are submitted by:

- no later than March 31 of the year following the reporting year - if the simplifier is a legal entity;

- no later than April 30 of the year following the reporting year - if the simplifier is an individual entrepreneur.

In 2020, the deadlines for submitting a declaration under the simplified tax system for 2018 are:

- for legal entities - 04/01/2019 (postponement from Sunday, March 31);

- for individual entrepreneurs - 04/30/2019.

If you have lost your right to use the simplified tax system, submit your declaration by the 25th day of the month following the quarter in which you lost your right to use the simplified tax system. If you voluntarily refuse to use the simplified tax system, report by the 25th day of the month following the month of submitting the notice of refusal from the simplified tax system to the tax office.

Declarations submitted when under special tax regimes

In total, there are currently 4 special taxation regimes used by individual entrepreneurs:

- Simplified taxation system (USN, simplified taxation system);

- Unified tax on imputed income (UTII);

- Patent taxation system (PSN, PSNO, Patent);

- Unified Agricultural Tax (USAT)

Declaration submitted when applying the simplified taxation regime

Entrepreneurs submit reporting to the simplified tax system once a year. The declaration is submitted even if there were no income (expenses) in the tax period and the tax payable to the budget is 0. Such a declaration is called zero.

The composition of the declaration depends on which object of taxation according to the simplified tax system is chosen: “income” or “income minus expenses”.

Note: Section 3 is completed only if property, work and services are received as part of targeted financing, targeted income and charity.

Deadline

The simplified tax system declaration is submitted once a year, before April 30 of the year following the reporting year. Reports for 2020 must be submitted by May 2, 2020 , and for 2020 - by April 30, 2020 , respectively.

Reporting format

The declaration under the simplified tax system can be submitted both in paper form and in electronic form.

Submission of reports in electronic form also occurs via TCS through EDI operators.

Reporting under the simplified tax system is submitted in the form approved by Order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/ [email protected]

Note: the last digits of the barcode of the title page of the current tax return form for 2020: 2017

Declaration submitted when applying the taxation system in the form of a single tax on imputed income for certain types of activities (UTII)

Reporting on UTII is presented regardless of the presence of income in the reporting period. This is due to the fact that the tax is calculated based not on actual, but on imputed income.

The declaration consists of a title page from Sections 1, 2, 3.

Until what date is it due?

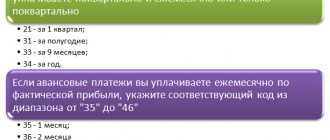

The UTII declaration is submitted based on the results of each quarter by the 20th day of the month following the reporting one.

| Reporting (tax) period | Deadline |

| 1st quarter 2017 | April 20, 2017 |

| 2nd quarter 2017 | July 31, 2017 |

| 9 months 2017 | October 31, 2017 |

| 2017 (at the end of the year) | March 30, 2018 |

Reporting format

The declaration under the simplified tax system can be submitted both in paper form and in electronic form.

Submission of reports in electronic form also occurs via TCS through EDI operators.

Reporting under the simplified tax system is submitted in the form approved by Order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/ [email protected]

Note: the last digits of the barcode of the title page of the current tax return form for 2020: 2017

Declaration submitted when applying the patent taxation system (PTS)

Entrepreneurs with a patent, unlike all other taxation regimes, do not submit any reports .

Declaration submitted when applying the taxation system for agricultural producers (UST)

Reporting on the Unified Agricultural Tax is submitted once a year, based on the results of the tax period.

The declaration consists of a title page of Sections 1, 2, 2.1 and 3.

The title page, Sections 1 and 2 are required to be completed by all payers of this taxation regime.

Deadline

The Unified Agricultural Tax declaration is submitted at the end of the year by March 31 of the year following the reporting year.

Reports for 2020 will need to be submitted by March 31, 2020.

Reporting format

The Unified Agricultural Tax declaration can be submitted both in paper form and in electronic form.

Submission of reports in electronic form also occurs via TCS through EDI operators.

Reporting on Unified Agricultural Tax is submitted in the form approved by Order of the Federal Tax Service of Russia dated 02/01/2016 N ММВ-7-3/ [email protected]

Note: the last digits of the barcode of the title page of the current 2020 declaration form under the Unified Agricultural Tax: 8018

Declaration form for the simplified tax system “income”

In 2020, a declaration form is in force, approved by order of the Federal Tax Service of February 26, 2016 No. ММВ-7-3 / [email protected] It is intended both for simplifiers who pay tax on income, and for simplifiers who pay tax on the difference between income and expenses .

For the simplified tax system “income” the following sections of the declaration are required to be completed:

- title page;

- Section 1.1, which records the amounts of advance payments and tax payable/reduced at the end of the year;

- Section 2.1.1, which indicates the amount of income, tax rate, taxpayer advances and paid insurance premiums, contributions under voluntary insurance contracts and disability benefits.

You may also need to complete Section 2.1.2 for the Trade Fee and Section 3 for the Taxpayer's Funding Report. These sections are filled out only if necessary: if you paid a trading fee during the year or received assets as part of charity or targeted financing (according to the provisions of Article 251 of the Tax Code of the Russian Federation).

Declaration form for the simplified tax system “income” for 2020.

Declaration form under the simplified tax system for 2020

A declaration under the simplified tax system for 2020 is a reporting document, the form of which is approved by the Federal Tax Service. You must always ensure that the declaration you submit is filled out on an up-to-date form. If the reporting form is outdated, tax reporting is considered not submitted.

How and where can I obtain a simplified taxation system declaration form?

Where can I find the declaration form for the simplified system? We tell you:

- Inquire at your tax office. But most likely, the Federal Tax Service will only provide you with a paper copy of the declaration, which must be filled out by hand, and this is inconvenient.

- Download on the Federal Tax Service website. Valid reporting forms are posted on the official website of the tax service, but they are not always easy to find through a search. Advice - find the section “Taxation in the Russian Federation” on the main page of the nalog.ru website, then “Current taxes and fees”. From there, go to “Special Tax Regimes”, where there is a list of all preferential tax systems, including the simplified tax system. On the page for this mode you can download the declaration form in electronic form for free.

- Find it in the legal reference system or in a specialized service. If you have access to such paid resources, then you can easily download the current form or immediately fill out your declaration. Here is a good example of such a service.

- In the free program “Legal Taxpayer”. This program can be downloaded from the FSN website, but to install it you must have at least minimal technical skills.

- From trustworthy sources, such as our website. We have been helping individual entrepreneurs with administrative issues for many years, and our specialists are always ready to provide qualified advice.

Get a free consultation

In any case, make sure that your declaration form for 2020 for the simplified tax system contains the correct barcode in the upper left corner of the title page - 0301 2020. And the order of the Federal Tax Service, which approved this form, has the following details - dated February 26. 2016 No. ММВ-7-3/ [email protected]

| ✏ Now regarding the two-dimensional code on the declaration form, which is not in the order of the Federal Tax Service. Some taxpayers report that the Federal Tax Service does not accept tax reporting on paper if it does not have a special two-dimensional code. This is the arbitrariness of the tax authorities, about which you can complain to a higher inspection. |

The two-dimensional code is designed to enable the Federal Tax Service to quickly process a large number of submitted declarations. It encrypts information about a specific entrepreneur, i.e. There is simply no one-size-fits-all code. However, only the “Legal Taxpayer” program and paid accounting programs, for example, 1C, generate the code.

Letters from the Federal Tax Service (dated June 13, 2012 N ZN-4-12 / [email protected] , dated April 18, 2014 N PA-4-6/7440) inform that inspections are required to accept declarations if they do not have a two-dimensional code. This is an additional and optional tax reporting detail.

Now let’s look at examples of how to fill out the simplified tax system declaration for 2018 for individual entrepreneurs with employees and for those who work themselves.

The procedure for filling out the simplified taxation system “income” declaration

The procedure for filing a declaration is specified in Appendix 3 to the Federal Tax Service order No. ММВ-7-3/ [email protected]

Let's remember the general rules:

- Amounts are indicated in full rubles, rounded according to the rules of mathematics: 50 kopecks or more are rounded to a full ruble.

- The declaration has continuous numbering.

- We do not provide sheets and sections with no indicators.

- If you fill out the declaration by hand, the ink must be black, purple or blue. You cannot correct errors with the corrector. We recommend that if an error is discovered, you rewrite the sheet where the error was made.

- If you fill out the declaration on a computer and then print it out, then double-sided printing is not allowed. We fasten the declaration sheets only with a paper clip, not with a stapler.

- We fill in the indicators from left to right, starting from the leftmost cell. But if you fill out the declaration using a program for keeping records and submitting reports, align the numerical indicators to the right margin of the report.

- Text fields should be filled in capital block letters.

- If the indicator is missing, put a dash in the corresponding line of the declaration. If a line is not completely filled in, then also put a dash in the unfilled cells of the line.

- On each page of the declaration, indicate the tax identification number (required) and checkpoint (if any).

The procedure for filling out the title page of the simplified tax system declaration “income”

When filling out the title page, please indicate your Taxpayer Identification Number and Taxpayer Identification Number. If the report is submitted by the successor organization for a reorganized company, indicate the TIN and KPP of the legal successor, and in the field “Taxpayer” and “TIN/KPP of the reorganized organization” - the name, TIN and KPP of the reorganized company.

If you are submitting a declaration for the first time during the reporting period, in the “Adjustment number” field, enter “0 – -”; if you are submitting an update, indicate the serial number of the update.

The tax period code when submitting the simplified tax system “income” declaration for 2018 is 34.

Also put on the title page:

- the year for which the declaration is provided;

- tax authority code;

- full name of the company or line by line full name of the entrepreneur;

- activity code according to OKVED-2;

- taxpayer's telephone number;

- number of pages in the declaration;

- the number of additional sheets - for example, a power of attorney confirming the authority of the taxpayer’s representative.

If the report is submitted by the head of the company or individual entrepreneur personally, in the field “I confirm the accuracy and completeness of the information specified in this declaration” should be put 1, if the representative - 2.

Also on the title page is the full name of the head of the organization, his personal signature and the date of signing the report. Entrepreneurs do not re-indicate their full name, but only sign and set the date of signing. If the report is submitted by a representative of the taxpayer, then he indicates his full name line by line, signs and dates it. You will also need to provide a document confirming the authority of the taxpayer's representative.

In turn, tax officers on the title page of the simplified taxation system “income” declaration fill out the method of submitting the declaration, the number of pages in it, the number of sheets of attached documents, the date of filing the declaration, the full name and signature of the inspector who accepted the declaration.

The procedure for filling out section 1.1 of the simplified tax system declaration “income”

Fill out Section 1.1 of the simplified tax system declaration for 2020 as follows:

| Line numbers | Information to fill out | Note |

| 010, 030, 060, 090 | OKTMO at the location of the company/place of residence of the individual entrepreneur. | You can determine this on the Federal Tax Service website. Line 010 is always filled in, lines 030, 060, 090 - only if there was a change in OKTMO. If OKTMO has not changed, there should be a dash in lines 030, 060, 090 |

| 020 | Advance amount for simplified tax for the 1st quarter of 2020 | |

| 040 | Advance amount for simplified tax for the 1st half of 2018 | |

| 050 | The amount of advance payment for simplified tax to be reduced based on the results of the 1st half of 2020 | Fill in if the advance for half a year is less than the advance for the 1st quarter of 2018 |

| 070 | Advance amount for simplified tax for 9 months of 2020 | |

| 080 | The amount of advance payment for simplified tax to be reduced based on the results of 9 months of 2020 | Fill in if the advance for 9 months is less than the advances for previous periods |

| 100 | Additional tax for 2020, taking into account previously paid advances | Taxpayers who have lost the right to the PSN and switched to the simplified tax system indicate in this line the simplified tax minus the cost of the “unspent” patent (letter of the Federal Tax Service of Russia dated June 29, 2017 No. SD-4-3 / [email protected] ). |

| 110 | Tax to be reduced for 2020, taking into account previously paid advances |

When is the IP submitted?

As for individual entrepreneurs, the deadline for submitting their declaration under the simplified tax system for 2020 has been shifted exactly 1 month later (subclause 2, clause 1, article 346.23 of the Tax Code of the Russian Federation) - until April 30, 2020 inclusive. Although it will be Monday, it will be an official non-working day due to the following first May holidays.

Also see 2020 Production Calendar.

As a result, the deadline for filing an individual entrepreneur’s declaration of the simplified tax system for 2020 is also subject to the rule of the Tax Code of the Russian Federation on postponing the deadline. It falls on May 03 – Thursday. This will be the first working day after the extended May weekend:

Thus, entrepreneurs on a simplified basis in 2020 have two additional days to prepare and submit their declaration for 2020. Let us remember that merchants do this at their place of residence.

The deadlines for submitting declarations under the simplified tax system for legal entities and individual entrepreneurs differ. The law gives simplified entrepreneurs exactly 1 month more to fill out and submit this annual report. And interim declarations - based on quarterly results - are not submitted by individual entrepreneurs under the simplified tax system.

The procedure for filling out section 2.1.1 of the simplified tax system declaration “income”

Section 2.1.1 is filled out as follows:

| Line numbers | Information to fill out | Note |

| 102 | 1 - if the company or individual entrepreneur has employees; 2 - if the individual entrepreneur does not have employees | A simplifier who has employees reduces advances and tax under the simplified tax system on insurance premiums and employee benefits by no more than half. A simplified individual entrepreneur without employees can reduce the tax on insurance premiums completely |

| 110-113 | Amounts of income received on an accrual basis for the 1st quarter, half year, 9 months, year | Income is determined in accordance with Art. 346.15 Tax Code of the Russian Federation |

| 120-123 | Tax rate | Indicated in accordance with Art. 346.20 Tax Code of the Russian Federation. May be reduced by regional legislation |

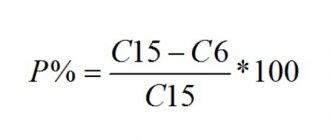

| 130 | Advance amount for the 1st quarter of 2020 | Line 110 * line 120 /100 |

| 131 | Cumulative advance amount for the 1st half of 2020 | Line 111 * line 121 /100 |

| 132 | Cumulative advance amount for 9 months of 2020 | Line 112 * line 122 /100 |

| 133 | Cumulative tax amount for the year | Line 113 * line 123 /100 |

| 140-143 | Amounts of insurance premiums paid to employees for disability benefits and amounts of contributions for voluntary insurance for the 1st quarter, half a year, 9 months and 2020, respectively | Individual entrepreneurs without employees indicate the amounts of pension and health insurance contributions paid for themselves for the 1st quarter, half-year, 9 months and year, respectively |

Advance payment deadlines

The annual report using the simplified system is submitted only once a year. However, legal norms establish the obligation to calculate and transfer advance tax payments to the budget.

This operation must be performed at the end of each quarter. The Tax Code stipulates the deadlines within which the entrepreneur is obliged to do this - until the 25th day of the month following the previous quarter. The final annual payment is due by April 30 of the year following the reporting year.

When determining the deadline for payment, you must remember that it is subject to the transfer rule. It follows from this that if such a day falls on a weekend or holiday, then it must be shifted forward to the next working day.

You might be interested in:

Form P-4 NZ in statistics: sample filling

In 2020, tax transfers according to the simplified tax system will need to be completed within the following deadlines:

| Period | Payment deadline under simplified tax system |

| For 2020 | 05/03/2018 |

| 1st quarter 2020 | 04/25/2018 |

| 2nd quarter 2020 | 07/25/2018 |

| 3rd quarter 2020 | 25-10-2018 |

| For 2020 | 04/30/2019 |

When transferring the amount of the advance payment or the final tax, you must correctly enter the KBK code in the payment order.

Due to the fact that the simplified system offers two ways to determine the amount of tax - based on income, or to reduce them by the amount of expenses incurred, there are two groups of BCC:

- "Income":

– Tax 182 105 01011011000110

– Peni 182 105 01011012100110

– Fine 182 105 01011013000110

- “Income minus expenses”:

– Tax 182 105 01021011000110

– Peni 182 105 01021012100110

– Fine 18210501021013000110

If an entrepreneur uses the “Income reduced by expenses” system, then in certain cases he may be required to pay a minimum tax. This necessarily arises if a loss is received, or a certain amount of tax is below the minimum level.

Attention! Previously, a separate BCC was in force for the minimum tax. Now it needs to be transferred to the same place where the tax is sent according to the “Income minus expenses” system - 182 105 01021011000110.

Sample of filling out the simplified taxation system “income” declaration

To help you understand the procedure for filling out the simplified tax system “income” declaration, we have prepared an example of tax calculation and a sample of filling out the report.

Example

LLC "Kadrovik", type of activity - provision of accounting and legal services. The staff has a director (he is also the only founder, he does not receive a salary) and 1 employee (salary 30 thousand rubles per month). Contributions to pension, medical and social insurance are transferred from the employee’s salary - 30.2% of the salary amount. The tax rate under the simplified tax system for “income” is standard - 6%.

The accountant of Kadrovik LLC will fill out the simplified taxation system declaration for 2020 based on the following data:

| Reporting period | Amount of income, rub. | Line number in section 2.1.1 | Payroll fund, rub. | Contributions from the payroll fund, rub. | Line number in section 2.1.1 | Tax payable, rub. | Line number in section | Tax payable including insurance premiums for employees, rub. | Advance and annual tax, rub.. | Line number in section 1.1 |

| 1st quarter | 350 000 | 110 | 90 000 | 10 500 | 140 | 21 000 | 130 | 10 500 | 10 500 | 020 |

| half year | 720 000 | 111 | 180 000 | 21 600 | 141 | 43 200 | 131 | 21 600 | 11 100 | 040 |

| 9 months | 935 000 | 112 | 270 000 | 28 050 | 142 | 56 100 | 132 | 28 050 | 6 450 | 070 |

| year | 1 110 000 | 113 | 360 000 | 33 300 | 143 | 66 600 | 133 | 33 300 | 5 250 | 100 |

The tax payable is calculated as 6% of the income. It is reduced by insurance premiums, but not by more than half.

The advance for the 1st quarter is equal to the amount of tax payable taking into account employee insurance contributions for the 1st quarter. The advance for the half-year is calculated as the difference between the tax payable taking into account employee insurance contributions for the half-year and the advance paid for the 1st quarter. The advance payment for 9 months and the annual tax to be paid are calculated in the same way.

Sample of filling out the simplified tax system “income” declaration for 2020.

Filling out the declaration: example

Studying the procedure for filling out a tax return can significantly simplify this process and minimize the risk of making mistakes . When preparing reports, you should fill out only those pages that correspond to the chosen taxation system. The new edition of the tax return contains six pages. You should start filling out this document from the title page. Here you need to indicate the entrepreneur’s details, calendar year and reporting period code. In one of the sections you should indicate the code assigned to a specific tax office. Lastly, fill out the column intended to indicate the number of pages of the document.

There are several important things to consider when writing reports. In the case of initial generation of reports, the code “0” is indicated in the “Adjustment number” item. In the “reporting year” paragraph, you should indicate the time of filling out the declaration. You can obtain information about the code assigned to a specific tax office department on the official resource of this authority. In addition, you can personally contact your local tax office. In the “taxpayer” column, you should indicate the name of the company or the last name, first name and patronymic of the business owner. The next paragraph indicates the code of the main type of economic activity.

The section “reorganization form” is filled out only in case of changes in the internal structure of the company. In the case when an entrepreneur attaches copies of additional acts to the report, it is necessary to indicate their number in the appropriate paragraph. The completed page must be certified by the signature of the businessman.

Next, you should begin filling out the first section. Here you need to indicate the total amount of accrued tax and the amount of funds transferred in the form of an advance. The first page of your tax return has two sections. The first section indicates the amount of net income received during the reporting period. The second section records the amount of income from which all costs associated with the business have been subtracted. Below is a list of the main lines that an entrepreneur needs to fill out:

- Line numbered “010” - this line indicates the OKTMO code.

- Lines numbered “090”, “060”, “030” - these items need to be filled out only if the place of residence (location of the company) changes. In other situations it is necessary to put a dash.

- Lines numbered “100”, “070”, “040”, “020” - these items should be filled in after business-related expenses have been deducted from income.

When filling out your tax return, you should carefully number all pages. The procedure for filling out the second sheet of this document depends on what object of taxation is used by the entrepreneur. The first section of this document is intended to be filled out by those entrepreneurs who use a simplified system with the “income” object. In the case of this regime, the tax rate is six percent of the total amount of funds received during the reporting period. When filling out this section, it is recommended to pay special attention to the following points:

- Points “110-113” - here you should indicate information about the amount of income received for the first quarter, half a year and nine months of work.

- Line “120” - this line is provided to indicate the tax rate.

- Points “130-133” - here you need to indicate the amount of accrued taxes.

- Lines “140-143” - here you should record the amount of insurance premiums paid. It is important to note that this amount should not exceed the amount of accrued tax.

The deadline for submitting the simplified tax system declaration for 2020 is regulated by clause.

1 and 2 paragraphs 1 art. 346.23 of the Tax Code of the Russian Federation The second section of this page is intended to be filled out by those entrepreneurs who use a simplified system, where the object of taxation is income minus the costs of doing business. The bet size under this system is fifteen percent of the difference between the above indicators. Filling out the lines in this section is carried out according to the order described above.

The third page of the tax return is filled out in situations where the company received property assets as part of a targeted activity or charity. In the absence of such income, the person filling out the declaration may skip this sheet.

In this section you should indicate the receipt code, the date of receipt of material assets and the period for their use. In this section it is very important to indicate the value of the property received. It should be noted that tax inspectors, after receiving the completed documentation, check the data reflected in the reports. If a discrepancy is found between income and expenses, tax officials can go to court with a claim to recover the missing funds.

The procedure for submitting the simplified taxation system “income” declaration

You can submit the declaration:

- personally;

- through a representative by proxy - please note that inspections require a notarized power of attorney from the representative of the individual entrepreneur;

- sending by mail - we recommend sending by registered mail with an inventory and receipt of receipt: then in a controversial situation you will be able to confirm to the inspection that you have fulfilled your obligation to submit the report;

- electronically, signing with an electronic signature.

You need to submit a report:

- for an entrepreneur - to the inspectorate at the place of registration;

- for a legal entity - to the inspectorate at the location, that is, at the legal address.