Deadline for submitting a transport tax return in 2020

Legal entities are required to submit a transport tax return to the tax authority:

- by place of registration (for taxpayers classified as the largest);

- at the location of the vehicle (for all others).

Clause 1 Art. 363.1 Tax Code of the Russian Federation :

At the end of the tax period, taxpayers-organizations submit a tax return to the tax authority at the location of the vehicles.

Clause 4 art. 363.1 Tax Code of the Russian Federation :

Taxpayers, in accordance with Article 83 of this Code, classified as the largest taxpayers, submit tax returns to the tax authority at the place of registration as the largest taxpayers.

The document is sent no later than February 1 of the year following the completed tax period. According to paragraph 1 of Art. 360 of the Tax Code of the Russian Federation, the tax period for transport tax is 1 calendar year. Therefore, the deadline for submitting transport tax for legal entities, for example, for 2020 is before February 1, 2020.

Clause 3 Art. 363.1 Tax Code of the Russian Federation :

Tax returns are submitted by taxpayer organizations no later than February 1 of the year following the expired tax period.

Please note: If February 1st falls on a weekend, the deadline for submitting the declaration is postponed to the next business day.

Clause 7 art. 6.1 Tax Code of the Russian Federation :

In cases where the last day of the period falls on a day recognized in accordance with the legislation of the Russian Federation as a weekend and (or) a non-working holiday, the end of the period is considered to be the next working day following it.

Tax return: who is required to file it?

To answer this question, it is proposed to study Article 363.1 of the Tax Code of the Russian Federation. According to this standard, filing a declaration becomes an obligation only for enterprises. Individual entrepreneurs, together with individuals, are exempt from this obligation.

This is also mandatory for organizations that have undergone the registration procedure in connection with the right to own vehicles.

Finally, there is an obligation for those who apply a special tax regime. No one canceled the filing of the declaration, even during registration organized in December.

The procedure for submitting the declaration and its structure

According to clause 2.6 of the Order of the Federal Tax Service of Russia dated December 5, 2016 N ММВ-7-21/ [email protected], you can send a document to the tax office:

- personally or through a representative;

- by mail (with a description of the attachment);

- via the Internet (in the manner specified in the Order of the Ministry of Taxes and Taxes of the Russian Federation dated April 2, 2002 N BG-3-32/169 ).

Note !

If documents are sent by mail or via the Internet, the day of submission is considered the day of sending. The transport tax declaration consists of 3 parts:

- Title page.

- Section 1 (Amount of tax to be paid to the budget).

- Section 2 (Calculation of the tax amount for each vehicle).

Detailed instructions for filling out each part of the document, taking into account changes, are described in Order of the Federal Tax Service of Russia dated December 5, 2016 N ММВ-7-21/ [email protected] . Below we will outline the main points that need to be taken into account when filling out the declaration, and also describe what needs to be indicated on each page.

Please note : Declarations for 2020 must be submitted using the new model. What is the difference between the old and new document format, read below.

Where to take it

Situation: where to submit and which checkpoint to indicate in the transport tax return? The organization draws up a declaration for the car it owns

The answer to this question depends on the place of registration of the car owned by the organization.

State registration of motor vehicles is carried out either at the location of the organization or at the location of its separate division (clause 24.3 of the Rules approved by Order of the Ministry of Internal Affairs of Russia dated November 24, 2008 No. 1001). Therefore, a transport tax return must be filed either at the location of the organization or at the location of a separate division, depending on where exactly the car was registered.

Tax inspectors can assign checkpoints to vehicle owners:

- by location of the vehicle;

- by location of the organization;

- by location of each separate division;

- at the place of registration as the largest taxpayer.

This follows from paragraph 7 of the appendix to the order of the Federal Tax Service of Russia dated June 29, 2012 No. ММВ-7-6/435 and paragraph 5 of Article 83 of the Tax Code of the Russian Federation.

If the car is registered to an organization, submit a declaration to the inspectorate at the location of the organization and indicate the checkpoint assigned to the organization at its location.

If the car is registered to a separate subdivision, submit a declaration to the inspectorate at the location of the separate subdivision and indicate the checkpoint assigned to the location of the subdivision to which the car is registered.

If an organization is classified as a major taxpayer, it submits all tax reports at the place of registration in this capacity (clause 3 of Article 80 of the Tax Code of the Russian Federation). Including the transport tax declaration. At the same time, she must comply with the following procedure for indicating checkpoints in transport tax declarations. If the car is registered to an organization, indicate the checkpoint assigned to the location of the organization. If the car is registered to a separate subdivision, indicate the checkpoint assigned to the location of the subdivision. Do not use the checkpoint assigned at the place of registration as the largest taxpayer when filling out a transport tax return.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated October 6, 2008 No. 03-05-05-01/61, dated February 7, 2008 No. 03-05-04-01/6 and the Federal Tax Service of Russia dated October 2, 2012 No. BS-4-11/16504 and dated November 22, 2007 No. 11-0-09/1357.

General rules for filling out a tax return

When filing a transport tax return, adhere to the following rules:

- fill out the document with blue, purple or black ink;

- use only printed capital letters ;

- corrections and errors are unacceptable ;

- If you are submitting a paper declaration, print each page on a separate sheet . Do not staple sheets using products that damage the paper;

- indicate calculations in full rubles . Values less than 50 kopecks are not indicated , 50 or more are rounded to the nearest ruble;

- Each cell must contain only one character ;

- all cells of the field where any indicator is missing must contain a dash . A dash is also placed if there are extra cells left in the field.

Who is required to submit?

The transport tax declaration is submitted so that the taxpayer can report to the inspectorate on the calculation of the tax for all available vehicles (vehicles) (you can find out about transport tax reports and their reflection in the accounting department here). The amount indicated in the declaration is subject to payment within the time limits established by law . The obligation to transfer such a document to the tax office falls only on legal entities.

An organization is obliged to make tax deductions if a vehicle is registered with it in the manner prescribed by law (Article 357 of the Tax Code of the Russian Federation). If the enterprise does not own such property, there is no need to file a zero tax return (Article 357 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated March 4, 2008 No. 03-05-04-02/14).

Individuals and individual entrepreneurs whose vehicles are registered do not submit a transport tax return (read about transport tax for individual entrepreneurs and its calculation here).

It is worth noting that if an organization transfers taxes to the budget under a special regime, this does not exempt it from filing a transport tax return in the prescribed manner.

We talked in more detail about transport tax for organizations in this article.

Sample of filling out a tax return for transport tax in 2020

As we have already said, the transport tax declaration consists of a title page, sections 1 and 2. Since section 1 indicates the total amount of tax, it is best to fill it out last - after you have calculated the cost in section 2. Let's take a closer look at an example of filling out a transport tax return.

A correctly completed title page looks like this:

From the sample, you can see that every cell on the page is filled in or contains a dash . You only need to leave empty fields in the lower right part of the title page; it will be filled out by a tax official.

How to fill out the title page correctly:

- At the very top of the first page, indicate the TIN and KPP of the organization .

The TIN and KPP are duplicated at the top of each page of the declaration. It is necessary to write the TIN and KPP, which are indicated in the tax registration certificate of the organization.

- Correction number.

Indicate the adjustment number “ 0— ” if the declaration is submitted for the first time. If you are re-submitting a declaration with amendments, please indicate the number “ 1— ” for the first adjustment, “ 2— ” for the second, etc.

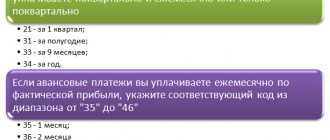

- Tax period (code).

The calendar year corresponds to the code “ 34 ”. In the case of the last tax period of the organization due to liquidation or reorganization, enter the code “ 50 ”.

- Indicate the reporting year for which you are submitting the declaration. For example, "2020".

- Indicate the tax authority code , which is indicated in the organization’s registration documents.

- Code by location/registration.

Enter code “ 260 ” if you are submitting a declaration at the place where the vehicle is registered; “ 213 ” - at the place of registration of the largest taxpayer; “ 216 ” - at the place of registration of the largest taxpayer-successor.

- Write the full name of the legal entity. person in the same way as it is indicated in the constituent documentation .

- Indicate the code of the type of economic activity according to the All-Russian Classifier OK 029-2014 (NACE Rev. 2) .

- The taxpayer's telephone number begins with the country and city code; it should not contain extra characters (brackets or pluses) or spaces.

- Write the number of pages of the declaration and additional documents, if you are attaching them. For example, " 3—- ".

- Section “ I confirm the accuracy and completeness of the information .”

Enter the number 1 if you are the head of an organization; 2 - if you are his representative. Last name, first name and patronymic must be written on a new line. Indicate the full name of the person who provides the declaration, that is, the manager or representative. If the representative is a legal entity. person, write the full name of the head of this organization, as well as its full name in the field below.

- Sign and date . The person whose last name is listed above must sign. The date is set in the following order - day, month, year.

- Indicate the name of the document that confirms the authority of the representative, or put dashes if the declaration is submitted without a representative.

There is no need to fill out anything else on the title page.

Additional recommendations for filling out the declaration

Next comes the following data.

- Code designation for identifying the reporting period.

34 is the code used for the calendar year. 50 is the figure for the last tax period of an enterprise that is being reorganized or liquidated.

- It is necessary to write down the reporting year for which the declaration is being submitted.

- It is necessary to designate the tax authority itself, where the reports are submitted, also with a code. The numbers are easy to find in the registration certificates after registration.

- Next, you need to enter numbers to receive a code indicating the location or address where the registration took place.

- Name of the legal entity, in full form. Must match what is specified in the constituent documents.

- A type of activity in the economic system, according to the requirements of the classifiers adopted in Russia.

- Phone number without spaces or other unnecessary characters.

- Next they write how many pages there were in the documentation.

- Information that the compiler confirms the accuracy and correctness of the information.

The leaders of the organization put the number 1. 2 - for representatives. Full name is written on a new line. They must belong to the person filing the return. If the document is drawn up by a legal entity, then you must write the full name of the person who acts as the manager.

How to fill out section 2 of the transport tax return?

Section 2 of the declaration is devoted to calculating the amount of tax. We deliberately skip section one and start with section two, since without its calculations we will not be able to provide information on the full amount of tax that section 1 requires.

To correctly fill out section 2, follow these instructions:

- Indicate the TIN and KPP at the top of the page, as on the title page.

- Write the code according to OKTMO (All-Russian Classifier of Territories of Municipal Entities) at the place of registration of the vehicle in the line “ 020 ”.

You can find the code using the official website of the Federal Tax Service. To do this, on the main page of the site, go to “ Electronic Services ” and select from the list.

- Indicate the vehicle type code in the line “030».

The codes differ depending on the type of vehicle. The code for a passenger car is “ 510 00 ”. You can view the codes for other vehicles in Appendix No. 5 of the Order of the Federal Tax Service of Russia dated December 5, 2016 N ММВ-7-21/ [email protected] .

- In line “ 040 ” write the VIN code (for land vehicles), IMO (for water vehicles) or serial number (for air vehicles).

- In line “ 050 ”, indicate the vehicle make (as it is indicated in the vehicle registration certificate).

- In line “ 060 ” is the vehicle registration plate number .

- In line “ 070 ” - write the vehicle registration date .

- In line “ 080 ” - the date of deregistration . If the car has not been deregistered, put dashes .

- Enter the tax base code in the “ 090 ” field.

For land vehicles with engines, the code corresponds to horsepower. For information on how to calculate the tax base code for air and water vehicles, read clause 5.9 of Order of the Federal Tax Service of Russia dated December 5, 2016 N ММВ-7-21/ [email protected] .

- Tax base unit code (line “ 100 ”).

For land vehicles, the unit of measurement of the tax base is horsepower, its code is “ 251 ”. If the tax base was not calculated by horsepower, then look for the required code in Appendix No. 6 of Order of the Federal Tax Service of Russia dated December 5, 2016 N ММВ-7-21/ [email protected] .

- Line “ 110 ” - write the environmental class of the vehicle .

- Line “ 120 ” - indicate the number of years the car has been used .

The number of years of use of a car is calculated from the next year after the car was released until January 1 of the current year. For example, the number of years of operation for a car manufactured in 2010 for a tax return for 2020 will be 7 years (we start counting from 2011 and take into account the entire year 2020).

- In the “ 130 ” field, write the year of manufacture of the vehicle .

- In the line “ 140 ” - the number of months of owning the car this year (write 12 if you owned the car for a full year).

- Indicate the ownership share of the vehicle in the “ 150 ” line in the form of a fraction. If only you own the vehicle, format it like this: “ 1——-/1——- ”.

- The coefficient Kv (line “ 160 ”) corresponds to the number of months of vehicle ownership to the number of months in a year according to clause 3 of Art. 362 Tax Code of the Russian Federation .

The coefficient is indicated as a decimal fraction. If you registered a car, for example, earlier than July 15, and owned it for 6 months, that is, 6/12 years. In this case, the coefficient Kv will be 0.5.

- Line “ 170 ” is the tax rate at the location of the vehicle.

Tax rates are set by the constituent entities of the Russian Federation. If in your region the legislature has not determined tax rates, then the rates specified in paragraph 1 of Art. 361 Tax Code of the Russian Federation . For cars with power less than 100 hp. the tax rate, for example, is 2.5.

- Line “ 180 ” - increasing coefficient Kp .

The size of the increasing coefficient is determined by clause 2 of Art. 362 Tax Code of the Russian Federation :

The tax amount is calculated taking into account the increasing coefficient:

1.1 - in relation to passenger cars with an average cost of 3 million to 5 million rubles inclusive, from the year of manufacture of which 2 to 3 years have passed;

1.3 - in relation to passenger cars with an average cost of 3 million to 5 million rubles inclusive, from the year of manufacture of which 1 to 2 years have passed;

1.5 - in relation to passenger cars with an average cost of 3 million to 5 million rubles inclusive, no more than 1 year has passed since the year of manufacture;

2 - in relation to passenger cars with an average cost of 5 million to 10 million rubles inclusive, no more than 5 years have passed since the year of manufacture;

3 - in relation to passenger cars with an average cost of 10 million to 15 million rubles inclusive, from the year of manufacture of which no more than 10 years have passed;

3 - for passenger cars with an average cost of 15 million rubles, the year of which no more than 20 years have passed.

In this case, the calculation of the periods specified in this paragraph begins with the year of manufacture of the corresponding passenger car.

- In line “ 190” write the tax calculation amount .

To calculate the amount, multiply the values of the tax base, tax rate, share of ownership, coefficient Kv and increasing coefficient.

- Lines “ 200 ” - “ 290” should be filled out if you have benefits .

- In line “ 300 ” the total amount of tax on the vehicle is entered, minus the benefit , if any.

If you own several vehicles, make calculations for each of them using this algorithm.

Principles for setting deadlines for transport taxes

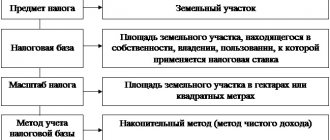

Transport tax is one of the taxes at the regional level. This circumstance leads to the fact that the Tax Code of the Russian Federation (Chapter 28) defines only the basic points related to its calculation and payment:

- circle of payers and mandatory list of beneficiaries;

- objects of taxation and non-taxation;

- object-by-object base valuation units and possible rates;

- algorithm for calculating both the tax itself and advances on it; the use of mandatory increasing/decreasing coefficients;

- long tax and reporting periods;

- The deadlines are common for all of Russia, of which there are only two for this tax and they correspond to the final dates:

- payment by an individual;

- submission of reports on it by a legal entity.

All other rules for working with this tax are established by the region defined as the location of the transport. In this case, regional authorities can:

- expand the list of benefits;

- increase, decrease or differentiate rates;

- to introduce or not to divide the tax period into reporting periods;

- set deadlines for paying advances and the final tax amount for the year.

The obligation to prepare reports (and, accordingly, independently calculate the amount of tax) of the Tax Code of the Russian Federation (clause 1 of Article 363.1) is assigned only to legal entities. For individuals, the tax is calculated by the tax authority (clause 3 of Article 363 of the Tax Code of the Russian Federation).

Sample format for section 1 of the transport tax return

A sample of Section 1, which indicates the full amount of transport tax, looks like this:

To correctly fill out section 1, follow these steps:

- Duplicate the TIN and KPP at the top of the page;

- Specify the budget classification code (KBK);

You can view the current BCC on the official website of the Federal Tax Service. To do this, go to the “Taxation in the Russian Federation” section and find “ Russian Federation Budget Income Classification Codes ”. At the moment, the BCC for transport tax for organizations is as follows:

- Write the OKTMO (we wrote about how to find out the OKTMO code in the instructions for section 2);

- In line “ 021 ” indicate the total tax amount . To calculate it, add all the values indicated in the “ 300 ” lines of section 2 with the same OKTMO code;

- In the fields “ 023 ”, “ 025 ” and “ 027 ” indicate the amount of advance payments for the 1st, 2nd and 3rd quarters , respectively. The amount of the advance for each quarter is calculated by the formula ¼ × tax base × tax rate × coefficient Kv × coefficient Kp;

- If in your region you do not need to make advance payments, leave a dash in lines “ 023 ”, “ 025 ” and “ 027 ”;

- In line “ 030 ” write the amount calculated for payment. This amount is calculated using the formula: total tax amount (line “ 021 ”) minus the amount of advances for the 1st, 2nd and 3rd quarter (“ 023 ” + “025 ” + “027 ”). If the total in the results is less than zero, put a dash;

- If the tax amount in line “ 030 ” is less than zero, enter it without the minus sign in line “ 040 ”. If more than zero, put a dash in line “ 040 ”;

- Check the data, sign and indicate the date .

Where is the transport tax return?

By order of the Federal Tax Service of Russia dated December 5, 2016 N ММВ-7-21/ [email protected] a new form of tax return for transport tax was introduced. The use of the new document format is mandatory for submitting reports for 2020. This means that from now on declarations using old forms will no longer be accepted.

Changes in the declaration affected section 2. Additional items were added to it (for example, the date of registration and deregistration of the vehicle, year of manufacture of the car, etc.).

You can download the new declaration from the website of the Federal Tax Service. To return transport tax:

- scroll down the main page of the site to the section "TAXATION IN THE RF" and go to the subsection "Taxes and fees in force in the Russian Federation";

- scroll down to "Regional taxes" and click on "Legal entities»;

- An article dedicated to the payment of transport tax will open. Scroll to the section " Tax payment and reporting»;

- You will find the new declaration forms in the document “ Tax declaration form and procedure for filling it out .

Remember that the deadline for submitting your 2020 vehicle tax return is February 1 of the following year . Pay your taxes on time and you will avoid fines and other unpleasant consequences of late tax debts.

Results

The frequency of reporting on transport tax is established by the Tax Code of the Russian Federation equal to a year, despite the possibility of introducing reporting periods in the regions. For a region, the establishment of a reporting period does not mean the introduction of reporting for it. The last day of the deadline for submitting the annual declaration is February 1 of the year following the reporting year. For reporting for 2020, it will be on 02/03/2020, because 01.02 - day off. The region can link the last day of the tax payment deadline for the year to any of the days coming after it.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.