The land tax declaration is an official document that contains the necessary information on the collection and is subject to submission to the authorized bodies within the period established by law.

We will tell you how to fill out the 2020 land tax return without errors, and we will go through all the stages of drawing up this important document.

IMPORTANT!

In 2020, legal entities submit a declaration for the last time; from 2021, such reporting is canceled in accordance with the order of the Federal Tax Service of Russia dated 09/04/2019 No. ММВ-7-21 / [email protected] , which will come into force on 01/01/2021.

Who needs to submit a declaration

Legal entities and individual entrepreneurs reasonably have a question: do they need to submit a land tax return for 2020, and if so, to whom? This tax document must be prepared by those organizations that own or own land plots and are recognized as taxpayers for land tax in 2020. Those who are exempt from paying it under Art. will also have to report. 395 Tax Code of the Russian Federation. This tax is local, and it is payable to the budget at the location of the land. The authorities of the constituent entities of the Russian Federation set rates by their own legislative acts, so they differ in different regions and should not exceed the limits allowed by the Tax Code of the Russian Federation.

In accordance with the amendments made to Federal Law No. 347 of November 4, 2014, for individual entrepreneurs, the payment is calculated by the tax authorities, after which they send a notification of its payment by mail.

Innings

In the case where a person has property rights in relation to a land plot, or owns land on the basis of rights of lifelong inheritance or permanent use of an indefinite nature, he is responsible for paying tax payments.

It is worth noting that a land tax is established for legal entities and citizens.

Persons who are tenants of plots or who have rights of use of a fixed-term nature are exempt from payment. Such rights are established free of charge. The obligation to submit a declaration does not apply to all entities. This is due to the fact that interaction with the tax office occurs:

- citizens receive a notice containing the amount required to be paid;

- Organizations and individual entrepreneurs are required to submit declarations to the Federal Tax Service, which indicate the calculation used to calculate the amount to be paid.

It should be noted that if a situation arises where a person has gone through the process of registering as an individual entrepreneur and owns a plot of land, but at the same time we use the land only to satisfy personal goals, there is no need to submit an act.

Criteria on which the filing of a land tax return is based:

- if the plot belongs to a person by right of ownership or he uses the plot in accordance with the rights of lifelong inheritance or perpetual possession (easement of a land plot does not include this);

- the obligation to pay rests with the entrepreneur or organization;

- the plot is used in activities of an economic nature;

- the above purpose of the land is stated in the title documentation.

Land tax

In the case when all of the above conditions coincide, the subject is required to pay the tax by initially drawing up a declaration. If one point does not apply to the payer, he can expect that the tax authority will send a notification indicating the amount of the tax payment.

After receiving the notification, payment is made in any way convenient for the payer. It is also possible to pay taxes online using developed methods.

It is worth noting that due to amendments made to legislative acts in 2020, citizens who have gone through the process of registering individual entrepreneurs do not have to submit declarations, as they will be notified by the tax office.

Tax return for land tax: sample, rules and procedure for filling out

The procedure for filling out the reporting form is regulated by Appendix No. 3 to the corresponding order of the Federal Tax Service of Russia. The report form consists of three pages:

- 1st page - title page;

- 2nd page - section 1. The amount of land tax to be paid to the budget;

- 3rd page - section 2. Calculation of the tax base and the amount of land tax.

A sample filling is given for a Russian commercial organization, VESNA LLC, which is registered in the federal city of St. Petersburg. Carries out activities in the wholesale trade of food, drinks and tobacco, the company owns one plot of land located in the same city, cadastral number - 78:06:0004005:71. The cadastral value of the plot is 1,200,000 rubles. The organization has owned it for 12 months, the tax rate is set at 1.5%. KBK 182 1 06 06031 03 1000 110. OKTMO - 45908000. The LLC made advance payments to the budget during the year and transferred the following amounts:

- I quarter - 4500 rubles;

- II quarter - 4500 rubles;

- III quarter - 4500 rubles.

1 page - title page

The title page is filled out directly by the taxpayer himself, with the exception of the field “To be filled out by a tax authority employee.”

Let's consider a sample of filling out a tax return for land tax for 2020 for each field separately:

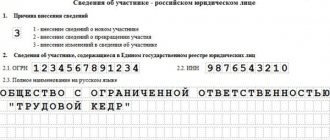

- the corresponding values are indicated in “TIN” and “KPP”, then they are automatically entered on each page;

- in the “Adjustment number”, if provided for the first time, indicate 000, for subsequent adjustments - 001, 002, and so on;

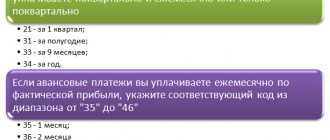

- in the “Tax period” we enter the required date of the tax period. For a calendar year - 34;

- in the “Reporting year” - the date the form was filled out;

- Each inspection to which reports are submitted has a personal, non-repeating four-digit code in its Federal Tax Service Inspectorate or on the official website of the Federal Tax Service. The 2 digits of the code at the beginning indicate the region, the other 2 digits indicate the code of the inspection itself. Since the tax return for land tax 2020 is submitted to the Federal Tax Service at the location of the plot or share in the plot, in our case the Federal Tax Service Inspectorate No. 9 of the Central District of St. Petersburg is indicated;

- The taxpayer enters the code at the location (accounting). In our case - 270;

- We enter the name of the organization in the empty and longest field of the title page, separating the words from each other with an empty cell. For our example: VESNA LLC;

- in the next line we enter the payer’s contact phone number;

- Next, we indicate the number of pages to be submitted to the inspection. Ours submits a report for 2020 on 3 pages, without attachments;

- in the place where it is necessary to indicate the taxpayer, enter the value 1 and full name. director or proxy;

- at the end we will put a date and signature;

- in the “Name of the document confirming powers under a power of attorney” there is a dash, since the report was signed by the director of the company in his own hand.

Page 2 - section 1. The amount of land tax payable to the budget

Let's look at a sample of filling out a tax return for land tax 2020 for each field separately:

- first you need to indicate the name of the production sharing agreement, since in our situation it is missing, we put a dash;

- in 010 we write the budget classification code KBK in accordance with the legislative acts of the Russian Federation on budget classification. Each time we check the relevance of the specified BCC. Our plot is located in the federal city of St. Petersburg - we indicate KBK 182 1 0600 110;

- 020 “OKTMO” indicates the code of the municipality in whose territory the mandatory fee is paid. For our company, we will enter 45908000 in the 2020 land tax return;

- 021 - total amount of payment calculated and subject to payment to the budget according to the corresponding codes KBK and OKTMO;

- from 023 to 027, the values of advance payments paid for the 1st, 2nd and 3rd quarters are recorded, respectively;

Advance payments = 1/4 × interest rate × cadastral value of the land plot (share) = 1/4 × 1.5% × 1,200,000 = 45,000 rubles;

- 030 is calculated as follows: 021 - (023 + 025 + 027). If the result is a value with a “–” sign, then a dash is placed everywhere;

- 040 = 021 – (023 + 025 + 027). The amount is calculated to decrease, therefore, if the result is: a negative value, put it without the minus sign;

- positive - put a dash. In fields 030 and 040, according to the conditions of our example, we put dashes;

Page 3 - section 2. Calculation of the tax base and the amount of land tax

Let's consider filling out section 2 of the tax return for each field separately:

- TIN and checkpoint are entered automatically from the first page;

- We enter the cadastral number of the plot, this number is included in the certificate of state registration of ownership, from an extract from the Unified State Register or from the cadastral passport. 78:06:0004005:71;

- 010 - from Order of the Ministry of Finance No. 150n dated December 16, 2014, select and indicate the budget classification code;

- 020 - from the All-Russian Classifier of Territories of the Moscow Region we enter into the OKATO declaration;

- 030 - from Appendix No. 5 to the Federal Tax Service order No. MMV-7-11 / [email protected] select and indicate the land category code. Other lands - 003008000000;

- 050 - we take the cadastral value of the plot from the relevant Rosreestr documents or from the cadastral passport;

- 060 — enter the share size. If the land belongs entirely to the organization, put a dash;

- from 070 to 100 in the declaration we fill in the relevant information about benefits, which we take from the Tax Code of the Russian Federation and from documents confirming the rights to benefits. In most cases, commercial enterprises do not have benefits. In our case, there are no benefits either, which means dashes are added;

- 110 - the cadastral value of the object is indicated here. We have 1,200,000 rubles;

- 120 - we take the rate from the legislative acts of the local regulatory level, since the fee is local. For the category of our site, a rate of 1.5% is applied;

- 130 - indicate the period of ownership of the plot during the tax period. Indicated in full months. 12 full months;

- 140 - calculated as follows: line 160 (KV) = tenure / 12, for us = 1, since VESNA LLC owned the site for 12 months;

- 150 - determined by the formula: 110 (tax base) × 120 (rate) × 140 (Q coefficient). This amount is also reflected in field 250. 150 = 1,200,000 × 1.5% × 1 = 18,000 rubles;

- from 180 to 240 - we will fill in the data on the existing benefit. In our case there are none - we put dashes;

- 250 - enter the total payment amount that the organization pays to the budget.

Land tax benefits in 2020

There are two types of benefits for calculating land tax:

- federal significance;

- local level.

Federal benefits apply to indigenous peoples of the North, Siberia and the Far East, as well as their communities - in relation to areas that are used to preserve their traditional way of life. The full list of preferential categories is located in paragraph 5 of Art. 391 Tax Code of the Russian Federation.

The federal land tax benefit in terms of tax reduction is valid when calculating tax for certain categories of payers: disabled people of groups 1 and 2, Heroes of the USSR and the Russian Federation, WWII veterans, pensioners, parents with many children, and Chernobyl survivors. When owning a plot of less than 6 acres, the categories of citizens listed above are exempt from paying land tax.

If there are several plots, the tax exemption benefit for 6 acres is valid only for one of them. The choice of such an object is left to the taxpayer himself.

To do this, he needs to submit to the Federal Tax Service a notification about the selected land plot in the form approved by Order of the Federal Tax Service dated March 26, 2018 N ММВ-7-21/ [email protected]

Municipal authorities may, by their acts, introduce additional benefits for certain categories of citizens. They allow you not only to reduce the amount of land tax required to pay, but also not to pay it at all. Such information must be sought on the government websites of a particular region.

To receive a land tax benefit, an individual only needs to send an application to the Federal Tax Service once using the form from Order No. ММВ-7-21 dated November 14, 2017/ [email protected] The application is submitted only once; then the benefit applies automatically.

For organizations, starting from 2020, a new procedure for obtaining land tax benefits will come into effect.

An organization will be able to receive a land tax benefit if it submits an application to the tax authority in the form approved by Order of the Federal Tax Service of Russia dated July 25, 2019 No. ММВ-7-21/ [email protected] and attaches documents confirming the benefit (Federal Law dated April 15. 2019 No. 63-FZ).

The page has been edited in accordance with current legislation 12/17/2019

Delivery deadlines

Information regarding owned land plots must be submitted before the beginning of February of the current year. This means that before the beginning of the specified month of the current year it was necessary to provide information on the calculation of the tax amount payable, as well as make a payment to the budget.

The period for which you need to pay, according to legal regulations, is 12 months. It should be noted that with regards to legal entities, every three months the obligation to make advance payments is established, which is a kind of reporting period.

Procedure for paying land tax for individual entrepreneurs

Entrepreneurs must pay in the same manner as above. Individual entrepreneurs make advance payments, however, at the regional level, authorities may establish different rules regarding this provision.

According to the rules of law, the authorities in charge of taxation issues do not have the authority to make demands on citizens who are owners of land plots allocated for profit-making to make tax payments in full before the specified date.

In 2020, amendments were made to the legislation stating that taxes will be paid by individuals, including those who have been registered as individual entrepreneurs, from now on until the beginning of October of the current year.

A notice containing information regarding the amount due is sent to the payer one month before the specified date. The reporting form in question is sent to the tax authority located at the place where the land plot is registered.

When several plots are owned, an equal number of declarations are filled out. Each document is submitted to the tax office at the location of the land.

The bodies of the Federal Tax Service have the authority to impose penalties on persons who missed the deadline for paying taxes. This procedure takes place in court. Punishment is expressed in fines. Responsibility in this case is provided for in the Tax Code and the Code of Administrative Offenses of the Russian Federation.

The amount of the fine is regulated at the legislative level and is equal to 5 percent of the amount of land tax collected. This amount is calculated for each month of delay. It takes into account whether the month is full or not. In this case, restrictions are set regarding the amount.

It is indicated that it cannot be less than 1000 rubles and more than 1/3 of the tax amount.

***

The declaration is filled out and submitted once a year only by legal entities; individuals are exempt from this obligation. Filling out the declaration does not present any great difficulties; you just need to carefully study the procedure.

Similar articles

- Sample of filling out a land tax return

- Tax return for corporate property tax

- Where and how to find out the land tax debt?

- Tax return for land tax for 2017

- Land tax: advance payments – payment deadlines in 2017