Mandatory payment of taxes is a legal obligation for individuals, enterprises and individual entrepreneurs. This obligation is necessary to provide the state with funds. For working citizens, such payment is usually made by the employer, and representatives of organizations must personally carry out the payment procedure, observing all possible nuances. Paying income taxes on time is extremely important; this will help avoid the accrual of fines and penalties.

general information

The procedure and deadlines for paying income tax are strictly regulated. Almost all organizations in Russia are tax payers here.

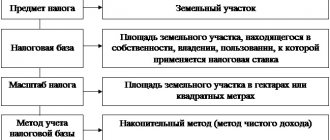

The subject of taxation is the profit generated by the organization. According to generally accepted ideas, profit is the amount remaining from income after deducting all the company's expenses from it. Income is the benefit for which the organization exists.

The tax period is considered to be a whole year (from 01/01 to 31/12). And reporting periods are divided into: quarter, six and nine months. The tax base is the monetary form of the profit obtained, which, in turn, is subject to taxation. If at the end of the year expenses exceed income, then the tax base is given a zero value.

Income tax: pay on time

Payment of taxes and fees is a legally established obligation not only for individuals, but also for enterprises and individual entrepreneurs. And if for the first category this is most often done by the tax agent - the employer, then organizations independently go through the entire procedure from calculating the amount to filing a declaration with the Federal Tax Service. Paying income tax in 2020 on time is also important because it will help avoid the accrual of penalties, which are expressed as a percentage of the amount of debt and can be quite significant for large enterprises.

Income tax rate

In accordance with the Tax Code, the income tax rate is 20%; only in some exceptions the rate may be lower. 2% of the tax received goes to the Federal budget, and 18% to local budgets.

The tax rate on profits, the material funds of which are transferred to local budgets, can be reduced by local governments for certain categories of organizations that are tax payers. In this case, the tax rate cannot be less than 13.5%.

Tax calculation

Before deducting a sum of money, you need to know its exact amount. The calculation is as follows:

- The tax rate is being determined. Often it is 20%, but in some cases it may be different. For example, medical institutions use a zero rate. A reduced rate is provided subject to certain conditions being met. In case of non-compliance, the organization returns to the maximum rate.

- We determine the tax base. By and large, the tax base is profit. Profit before interest and taxes contributes to the creation of the tax base. Information about income must be taken from primary tax accounting documents. The profit remaining with the company after paying taxes is called net profit.

- We select a method for calculating profits. Two methods are used: accrual and cash. The accrual method determines profit by income and expenses, depending on the date of their occurrence, and in the cash method - depending on the day the money is received into the account or cash register.

- We apply the tax formula. Tax = tax base * rate.

Income tax: deadlines for submission and payment

Advances are made every month during the reporting period. These funds are transferred until the 28th of the month. Thus, the deadline for paying income tax has clear boundaries.

Payment is made step by step. Advances are made throughout the year, and at the end of the tax period, additional payments are made, if necessary. The deadline for paying income tax for organizations has the following criteria:

- Funds are deposited based on the results of 3, 6, 9 and 12 months.

- The maximum deadline for depositing the amount is the 28th day of the month following the end of the period. For example, advance payments for the first quarter ending March 31 are made until April 28, and in order to pay off the annual income tax, the payment deadline is extended until March 28.

There are tax and reporting periods. Each of the periods presented has its own nuances:

- The tax period lasts 12 months, at the end of this period the organization must pay the tax in full. The final tax is the income tax for the year. The deadline for paying this tax is March 28 of the new reporting year.

- The reporting period is a time period equal to 1, 3, 9 and 6 months, after which the advance payment is made and the necessary reporting is submitted.

The mechanism that includes the deadline for paying income tax under the simplified tax system is approximately the same, but has its own important differences.

Deadline for paying income tax: annual, quarterly, monthly

The procedure for paying income tax is regulated by Art.

287 of the Tax Code of the Russian Federation, where, among other things, the deadlines for transferring to the budget the tax calculated at the end of the year and advance payments calculated within it are determined. The annual income tax is paid no later than the deadline established for filing tax returns for the year, that is, no later than March 28 of the year following the year for which the tax was calculated (clause 1 of Article 287, clause 4 of Article 289 of the Tax Code of the Russian Federation) .

The deadline for paying income tax at the end of reporting periods depends on how the organization calculates advance payments.

So, if the reporting period for an organization is the first quarter, half a year and 9 months and the organization does not pay monthly advance payments, the deadlines for paying the quarterly advance will be as follows (clause 1 of Article 287, clause 3 of Article 289 of the Tax Code of the Russian Federation):

- April 28;

- July 28th;

- 28 of October.

If, in addition to the quarterly advance, the company pays monthly payments, they are transferred no later than the 28th day of each month of the corresponding reporting period.

In this case, paid monthly advances are counted towards the quarterly advance, and quarterly advances - towards the tax for the year (Clause 1, Article 287 of the Tax Code of the Russian Federation).

Those organizations that pay advances on actual profits transfer them no later than the 28th day of the month following the one based on the results of which the tax was calculated (clause 1 of Article 287 of the Tax Code of the Russian Federation).

In all cases, the 28th is the regulatory deadline. If this date falls on a weekend or non-working holiday, then the payment deadline is postponed to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Detailed explanations on filling out payment slips for payment of advance payments for income tax, as well as their samples, were provided by K+ experts. Get a free trial access to the system and proceed to the tips.

To learn about the consequences of non-payment of advance payments, read the material “The only consequence of non-payment of advances on profits is penalties .

Quarterly payment of payments

The deadline for paying income tax by transferring advance payments each quarter has some features:

- It is possible to make quarterly transfers only when the average income does not exceed ten million rubles.

- The beginning is considered the first annual quarter. The advance payment must be made to the budget no later than April 28. A declaration indicating this payment is also provided.

- After six months, the resulting advance amount is the difference between the payments already made and the payments accrued for the second quarter. The transfer must be made before July 28, since income tax is paid next month.

- For nine months, the amount of the advance will be the difference between the calculated tax amount for the given period minus the two payments already made. Reports must be submitted and payment made no later than October 28.

- The final period is one year. The procedure for calculating and paying income tax based on the results of the year: submit a declaration, make an additional payment for income tax for the year. The payment deadline is until March 28 of the new year.

Monthly advances

The deadline for paying income tax through monthly advances and the monthly payments themselves also have their own specifics:

- They are produced when the average income for the previous year was over ten million rubles.

- If the limit is exceeded, you need to start making monthly payments. Then the amount calculated for the quarter is divided into three parts and paid every month until the 28th day inclusive.

If quarterly transfers are not allowed for all organizations, then the company can switch to monthly payments at its discretion. In order to make payments every month in the next period, you must submit an application to change the payment mode before the end of the year.

Documents and transactions used

Information for calculating and paying income tax is found in accounting and tax records, as well as in the tax return. In the registration documents, the operation is displayed as follows:

- To calculate the tax, the following entry is used: Dt 99 Kt 68.

- After paying the tax, the entry appears: Dt 68 Kt 51.

Factual evidence is also needed when determining expenses by which profit will decrease when determining the base. Each cost must have a correct explanation and expediency specifically for the activities of a given organization.

The generalized document at the end of the year and reporting periods is the declaration. The tax and amount are calculated there. It serves as confirmation of information about expenses, income, and contains all the data about the payer and type of management.

Payment of the tax amount is done at the bank or by bank transfer. But a tax return submitted on time or a tax not paid on time may result in fines or penalties. The deadlines for making advance payments of income tax must be strictly adhered to.

An example of paying income tax based on the results of the year

Let's look at this procedure using a specific example. Based on the results of the year, she made a profit of 2,000,000 rubles. Income tax is obtained:

- to the federal budget - 40,000 rubles (2,000,000 rubles × 2%);

- to the regional budget - 360,000 rubles (2,000,000 rubles × 18%).

For the year I made advance payments in the amount of:

- to the federal budget - 34,000 rubles;

- to the regional budget - 306,000 rubles.

Advance payments for income tax amounted to a smaller amount of income tax payable at the end of the year. Therefore, the additional payment was:

- to the federal budget - 6,000 rubles (40,000 rubles - 34,000 rubles);

- to the regional budget - 54,000 rubles (360,000 rubles - 306,000 rubles).

Before March 28 of the new reporting year, the accountant must generate an additional payment of this tax (based on the results of the previous year).

Who must file an income tax return for 2020

Taxpayers applying the general tax regime must submit an income tax return. According to Art. 246 of the Tax Code of the Russian Federation, such economic entities include:

- Russian companies;

- foreign companies operating in Russia through permanent representative offices;

- foreign companies receiving income from sources located in Russia.

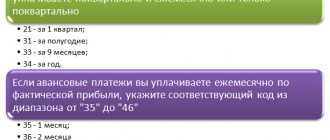

Important! Income tax taxpayers are divided into two groups depending on the frequency of payment of advances - monthly or quarterly. In accordance with this, they submit an income tax return to the Federal Tax Service at the same frequency.

In accordance with Art. 80 of the Tax Code of the Russian Federation, taxpayers with an average number of employees of up to 100 people can submit a declaration on paper. Other business entities should transmit the report only in electronic form.

Tax payment when combining OSNO and UTII

If a company uses UTII and during the year moves to combine this tax regime with the general taxation scheme, it will have obligations to pay income tax. For the first time, the amount of income tax paid must be calculated and reflected in the declaration based on the results of the quarter in which income falling under the general taxation regime was received.

For example, if a company received its first income in April, then it must be noted in the declaration for the first half of the year, and the first payment in the form of an advance on income tax must be transferred no later than July 28. In addition, the income tax return records the amounts of monthly advance payments for income tax, which must be transferred to the budget in the next quarter. These amounts must be calculated by companies with income (received within the framework of the general tax system) exceeding the limit established by paragraph 3 of Art. 286 Tax Code.

Changes in the income tax return in 2020

When submitting an income tax return, you should use the form approved by the Order of the Federal Tax Service dated September 23, 2019 No. ММВ-7-3/ [email protected] Compared to the previous form, the new form has significant changes, one of which is the use of a new barcode.

In addition, a new coding of taxpayer characteristics is provided. At the moment, in addition to the standard code 01, used by most taxpayers, the following codes are provided:

- 07 and 08 - when participating in investment projects and contracts;

- 09 and 10 - for institutions related to education and medicine;

- 11 - for organizations combining educational and medical activities;

- 12 - for institutions providing social services;

- 13 - for travel companies;

- 14 - for regional MSW operators.

Important! If a taxpayer submits an income tax return on the old form, the tax office will not accept the reporting.

Payment of tax by a re-established organization

A re-established organization has the right to make advance payments on income tax every quarter or month, based on actual revenue.

Based on the results of each reporting period, companies calculate the amount of the advance payment, relying on the tax and profit rate calculated as an incremental total from the beginning of the year to the end of the relevant period. Thus, based on the results of each tax period, the reconstituted company must make quarterly advance payments. The initial reporting period will be the period from the date of incorporation to the end of the quarter in which the company was incorporated. You can submit your declaration and meet the deadline for paying advances on income tax by transferring the first quarterly payment no later than the 28th day of the month following this reporting period.

After a full quarter has passed from the date of state registration, the reconstituted organization may have an obligation to switch to the transfer of monthly advance payments. This happens when the amount of sales revenue exceeds 5 million rubles per month or 15 million per quarter. The company must make monthly advance payments starting from the next month.

Re-established companies are exempt from advance payments of income tax until the end of the entire quarter from the date of their establishment. However, they must provide a declaration based on the results. Failure to provide this document will result in tax and administrative liability.

Based on the results of the audit, the tax inspectorate may impose a fine on the organization and suspend the operation of its current accounts.

Transition to advances based on actual profits until the end of 2020

How to calculate payments

Organizations that pay income tax quarterly and make contributions every month can switch to paying monthly advance payments on actual profits during 2020 (Clause 2.1, Article 1 of Federal Law No. 121-FZ of April 22, 2020). Previously, the transition was possible only from January 1 of the following year.

Organizations will calculate advance payments based on actual profits, calculated on an accrual basis from January 1, 2020 until the end of the corresponding month.

If you switch to paying advances on actual profits in April, then the first reporting period will be January–April, if you switch to May, January–May, and so on. The payment amount must be reduced by the tax amounts previously paid during the reporting period.

Changes in the procedure for calculating advance payments will be reflected in the accounting policy.

When and how to notify the tax office

The transition to paying advances on actual profits must be reported to the tax office. For this, the Federal Tax Service recommended a special form (letter from the Federal Tax Service dated April 22, 2020 No. SD-4-3/ [email protected] ).

You can also send a notification electronically through EDF operators. But please note: the directory of document formats on the Federal Tax Service website says that the notification format for advances comes into force on May 4. This means that the tax office will not accept a tax document in this format before.

Send notification of advance payments via Extern for free

Deadlines for notification of the transition to payment of advances based on actual profits

| First reporting period | notice period |

| January–April | May 8 |

| January–May | May 20 |

| January June | 22nd of June |

| January–July | July 20 |

| January–August | August 20 |

| January–September | September 21 |

| January–October | The 20th of October |

| January–November | 20 November |

| January December | 21 December |