If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Using a percentage calculator you can make all kinds of calculations using percentages. Rounds results to the correct number of decimal places. What percentage is number X of number Y. What number is X percent of number Y. Adding or subtracting percentages from a number. The calculator is designed specifically for calculating interest. Allows you to perform a variety of calculations when working with percentages. Functionally it consists of 4 different calculators. See examples of calculations on the interest calculator below.

| Interest calculator | Add to favorites |

Examples of calculations on the interest calculator

What number corresponds to 23% of the number 857? Total – 197.11 How to calculate: We get the coefficient – 857 / 100% = 8.57. We get the final number - 8.57 x 23% = 197.11 What percentage is 24 of the number 248? Total – 9.677% How to calculate: We get the coefficient – 248 / 24 = 10.333 We get the percentage – 100% / 10.333 = 9.677% Add 35% to the number 487? Total – 657.45 How to calculate: We get the coefficient – 487 / 100 = 4.87 We get the number equal to 35% – 4.87 x 35 = 170.45 We get the final number – 170.45 + 487 = 657.45 Subtract 17% from the number 229? Total – 190.07 How to calculate: We get the coefficient – 229 / 100 = 2.29 We get the number equal to 17% – 2.29 x 17 = 38.93 We get the final number – 229 – 38.93 = 190.07

- All expenses of an entrepreneur are summed up.

500,000 rubles - for goods; 27,000 rubles - all costs to sell the goods;

- Gross revenue (Vo) is 650,000 rubles.

With these data, you can calculate the gross profit from sales (Vpr). Vpr = In (650,000) - Sbst (500,000) = 150,000 We receive 150,000 rubles of gross income.

- The difference between gross income and the cost of selling a product forms the sales profit.

Prpr = Vpr - UR - KRUr, Kr = 5,000 (delivery of goods) +5,000 (rental of premises) = 10,000 Prpr = 150,000-10,000 = 140,000 (profit from sales)

- To calculate net profit, you need to subtract taxes and other expenses from the profit figure.

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Net Prp=140,000 - (7000+10,000)=123,000 rub. Thus, Kuznetsov will receive 123,000 rubles of net profit.

What percentage is one number greater than another?

To calculate how many percent one number is greater than another, you need to divide the first number by the second, multiply the result by 100 and subtract 100.

Let's calculate how many percent the number 20 is greater than the number 5: 205 · 100 - 100 = 4 · 100 - 100 = 400 - 100 = 300% The number 20 is 300% greater than the number 5.

For example, the boss’s salary is 50,000 rubles, and the employee’s salary is 30,000 rubles. Let's find by what percentage the boss's salary is greater: 5000035000 · 100 - 100 = 1.43 * 100 - 100 = 143 - 100 = 43% Thus, the boss's salary is 43% higher than the employee's salary.

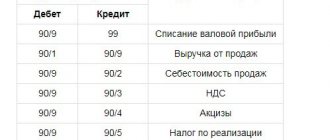

Formula for calculating profit from sales

Let's calculate the profit from the sale of vacuum cleaners: Prpr = 3,400,000 – 840,500 – 1,450,500 = 1,109,000 rubles. If you subtract all other expense lines and tax deductions from the profit indicator, you get net income. What influences the volume of goods sold? Before you find out the sources of increased profit, it is worth understanding why it depends in the first place. There are two key categories that influence a company's profit: external and internal. The internal category includes values used in the process of calculating profit, namely:

- Level of sales of goods. If the sales volume of goods with a high profitability indicator increases, the profit indicator will increase. If you increase sales of goods with low profitability, the profit margin will decrease.

- Structure of the offered range of goods.

Share of salary in revenue

By Vadim Falin / June 12th, 2020 / Alimony / No Comments

Accordingly, profits increase; Labor intensity in calculations compared to regular salary; Unevenness of salary costs throughout the year; Transparency of the enterprise's performance results for all personnel.

What percentage of phot should be from revenue in retail trade? We have a small furniture production. I think it’s more correct to calculate based on cost. But if you decide to reduce labor costs, then doing so is not so easy.

At a minimum, employment contracts need to be changed! labor-intensive, etc. The share of wages in the cost depends on this. For repair work, it is important how the cost of replaced parts is reflected. If spare parts are carried out as the sale of goods, then the share of wages is very high.

It’s very nice that we are colleagues. confused: Salaries have not been cut yet, but the question was asked - how much should the payroll be based on revenue.

What percentage of phot should be from revenue in retail trade

Important

For such a study one cannot do without management accounting data.

A joint analysis of data on the production and sales of products by the enterprise and the wages of various categories of employees of the enterprise also gives an idea of the principles of formation of the payroll.

Attention

This is well illustrated by Example 4.14. Example. The StomaRemont enterprise repairs medical equipment for dental clinics.

Info

The company's products include equipment repair services; sales of products are registered upon payment.

V.v. Kovalev, O.N. Volkova. analysis of the economic activity of the enterprise Analysis of the wage fund is carried out according to the same plan as the analysis of other types of expenses: in comparison with the standard or planned value or in comparison with the previous reporting or base period.

Payroll fund

- Share of phot in company revenue

- Payroll fund

- Salary calculation. revenue growth

- Dmitry gardener's blog

- Share of salary in total revenue

- V.v. Kovalev, O.N. Volkova. analysis of the economic activity of the enterprise

- The best staff remuneration system

Share of phot in company revenue Attention As a result of a survey conducted in the first half of 2008 by the company "

Companies engaged in wholesale trade and technical services account for 19% each.

Norm ph in revenue

As a result, our employee’s salary will be calculated using the formula: Salary = (30 + 70 (Current month’s revenue/Planned revenue))*number of hours worked Let’s look at a specific example. Let the employee work 170 hours per month.

With a stable salary, he will receive 17,000 rubles. If we tie salary to revenue, then different options are possible. For example, the enterprise performed terribly and the revenue amounted to 500,000 rubles. In this case, employees will receive (30+70*(500/850))*170=12,100 rubles.

If the company worked very well and exceeded the plan by 300,000, then the employee will receive (30+70*(1150/850))*170=21,200 rubles.

What trick is used here? By introducing a minimum wage of 30 rubles, we are killing two birds with one stone - we guarantee the employee will receive the minimum wage even in the worst case scenario.

Percentage of ph by revenue

Accordingly, you cannot focus only on the turnover. Salary calculation.

revenue growth Depending on the industry sector, the individual characteristics of the enterprise’s activities and management’s policy in the field of employee benefits, the share of expenses for wages and salaries can vary from a few percent to half of the enterprise’s total costs. This is a considerable amount, which is why analysis of this item of enterprise expense is so important.

What metric do you use to measure business performance?

Like other types of costs, payroll needs to be managed, first of all, rationed.

The size of the payroll must correspond to the financial position of the company.

If the enterprise has reserves for improving production efficiency indicators, the salary intensity value for the planning period should be taken less than the current one.

Indicator 2020 2016 2020 Number of employees, people. 963 1001 987 Payroll, thousand rubles 253 730 299 840 382 443 Cost of production (Vp), thousand rubles. 883,720 1,015,330 1,274,810 Average salary of 1 employee per year (salary 1 avg), thousand rubles. 263 300 387 Labor productivity of 1 employee, thousand rubles. 918 1014 1292 Salary intensity (Ze) 0.29 0.30 0.30 The planned payroll should be calculated as follows: Payroll plan. =

Vp * Ze = 1,274,810 * 0.3 = 382,443 thousand rubles, hence the planned salary 1 avg = 382,443 / 987 = 387 thousand.

R.

Alexander: salary based on revenue - example with calculation

The second hare is that wages are growing slower than revenue.

In our example, revenue increased from 850,000 to 1,150,000 - by 35.2%.

The wage rate increased by 24.7%. How to make everything clear and transparent It is very often difficult for an ordinary employee to understand all these formulas, so for convenience we are compiling a table for calculating the hourly rate depending on revenue.

What should be the phot of the proceeds?

To stimulate the most active and responsible employees, it is necessary to introduce personal bonus points so that the best employees feel their contribution to the overall result.

And these feelings must be supported by the ruble. This technique is already complex for one blog entry.

As a rule, this is developed individually depending on the nature of the revenue, the psychology of the employee, the number of personnel and other important factors.

Do you want to apply a similar type of salary at your company? Sign up for a consultation with me.

I will suggest a calculation method for your case, nuances and pitfalls. We will look at the business models on the basis of which I made the calculation.

I can also calculate a business model for changing motivation for your business: Sign up for a consultation Read other articles on the topic of “financial motivation” in business by following the link.

What should be the phot of revenue in trade

Colleagues, I need information. What indicator do you use to evaluate business performance when it comes to personnel costs?

1. The ratio of payroll to Revenue / or the ratio of payroll to Profit (what profit?) / or Personnel costs to Gross costs? Something else?2. The amount of these costs in %? Are there any guidelines? Please indicate the area of business, because the indicators will vary depending on the industry. For example, “restaurant business, payroll – 25% (without taxes or with taxes?) of revenue”3.

Secondly, break down the revenue (in our example, the revenue is divided into intervals of 50,000 rubles).

With this approach, in the last days of the month, staff will try their best to jump to the next payroll rung.

We saw with our own eyes how on the 31st the revenue was 898,000 rubles and 2,000 was missing for the next salary increase.

The staff themselves cooperated, and as a result, revenue increased not by a couple of thousand, but by as much as 25,000 rubles. It really works, tested in combat conditions. Fly in the ointment On the one hand, with this type of payroll, all employees are interested in the overall result.

On the other hand, personal results are eroded. It turns out to be a kind of communism, when work is carried out for a common good goal.

About two years ago, on a train, I was leafing through the latest issue of Forbes. I bought it only for the sake of ranking online stores in RuNet. That year, this topic was at the top; such ratings were published not only by Forbes, but also by Kommersant and other smaller publications.

I was interested in one indicator - turnover. I was just curious, how much revenue do online stores generally make in Russia?

But in addition to turnover, my attention was drawn to the numbers of employees in each company.

And the question flashed through my head: how much turnover does each company have per employee? And do these indicators vary greatly from store to store?

I decided to get confused and do the math. I took the data from here.

Yulmart – annual turnover $1,081 million. Number of employees: 6,500 people. It turns out that one employee generates a turnover of $166,300 per year. This is 485,000 rubles per month.

Wildberries – annual turnover $530 million. Number of employees 4,500 people. The monthly turnover per employee is 343,000 rubles.

Utkonos.ru – annual turnover $200 million.

Number of employees: 3000.

Ratio of labor costs to revenue

The monthly salary per employee is 195,000 rubles.

These numbers interested me. Although the spread is large, in general we can say that there are at least 200,000 rubles per employee. The platypus is a little short, but this is within the margin of error.

It becomes clear that the major players adhere to certain numbers. There is no such thing that one employee accounts for 100,000 rubles of turnover per month. But there are no people for whom this figure would exceed 500,000 rubles.

But can these numbers be used as a guide for your business?

Not really.

Margins in electronics, apparel and daily necessities are very different. Very much. Accordingly, you cannot focus only on the turnover. What then?

A year ago, I accidentally had the opportunity to talk with one of the financial specialists who audits and advises campaigns. After almost an hour of conversation, this area became clearer to me.

For more correct calculations, it is necessary to calculate the margin. To do this, you need to subtract the purchase price of goods sold from the monthly turnover. Only them, other expenses do not need to be deducted.

Margin = Turnover for a month - the purchase price of goods and services SOLD for this month.

Then subtract what percentage of the resulting margin is your payroll. The wage fund must include all payments to employees, EXCEPT social taxes and personal income tax, which we pay for them. Just the salary itself. Taxes are calculated separately and are not included in this figure.

(Payroll/Margin)*100%

For trading (including online trading), the normal figure is 15-25%. The salary of all your employees should not exceed 25% of the margin. Otherwise, you will simply go into the red. Or, at best, your net profit will go to your employees.

This figure can be taken as a guide.

After all, in the pursuit of increasing turnover, the first place where you can make a mistake is always in recruiting excessive staff. You may feel that there is an urgent need to improve the quality of service.

Hire additional phone managers so that they answer the phone within the first 2 rings. Or hire additional people to work with feedback, in the warehouse, or anywhere else.

And at the same time, miss the moment that the wage fund will increase and exceed the permissible threshold of 25%. What do we get from this? Loss of profit.

You can also test some directions. Again, hire managers to improve the quality of service. Let the fund increase to 30% of the margin. If within 2 months the turnover does not increase due to improved service, then you can safely abandon this idea.

We currently hold 23-25%. At the maximum. Because you need to grow. Along with turnover, the workload on staff is constantly increasing. We reach a certain level of turnover - and only then do we hire a new person.

And so we are working on process automation. And it turns out to be very productive.

When you know for sure that you can’t hire a person, but you need to do more, then your head works towards even the slightest improvements.

What indicators are considered normal in other areas?

In production – 30% In construction – 45%

In wholesale food products – 20-22%

Use it. And if once again an employee comes to you and asks for a salary increase, you will be able to reasonably explain to the person why it will remain at the same level :) Or vice versa, if everything is very good with the indicator, then you can safely, with a calm heart, stimulate key employees raising salary

"Here and Here"

Source: https://obd2bluetooth.ru/dolja-zarplaty-v-vyruchke/

How to correctly calculate the net profit of an organization?

Why is the indicator used? The amount of net profit most reliably characterizes the efficiency of the enterprise. An increase in this amount compared to the previous period indicates the high-quality work of the company, a decrease indicates an incorrect policy of management personnel. The indicator is used by many internal and external users of information about the organization:

- Owner and shareholders.

Using this data, the company owner evaluates the results of the enterprise's activities and the effectiveness of the selected management system. This amount is also used to calculate dividends and attract individuals as investors in the authorized capital.

| What is the % of the number? | |

| 0% of number 0 = 0 | |

| What % is a number of a number? | |

| Number 0 from number 0 = 0% | |

| Add % to number | |

| Add 0% to the number 0 = 0 | |

| Subtract % from number | |

| Subtract 0% from number 0 = 0 | |

| Round to decimal places | Reset everything |

- Director. He evaluates the financial stability of the company, the correctness of management decisions, and also develops new development strategies.

The cost to revenue ratio is

Cost profitability from core activities

Cost profitability from core activities is an important indicator for analyzing the financial results of a company. It shows how much profit is generated per 1 ruble of expenses and reflects the efficiency of the company’s financial activities.

Example 1

The company carries out construction and installation work under a contract.

The cost of work includes variable and fixed costs.

The company's financial performance indicators for 3 years are presented in table. 1.

Let us trace the dynamics of the ratios of cost, income, profit and profitability of costs over three years of activity of a construction company.

The highest return on costs from core activities was in 2017: by 1 rub. expenses accounted for 0.32 rubles. arrived.

Profitability in 2020 compared to 2020

Four ways to calculate profit

For example, last year, as a result of its business activities, the company gained 150 thousand rubles. Consequently, the profit indicator increased by fifty thousand rubles, or thirty-three percent. Answering the previously posed question, the company was able to show more effective results during the past audit. How to calculate profit from sales? In the process of calculating business profits, a formula is used in which the coefficient acts as the difference between expenses and gross profit. Gross profit from sales is the difference between expenses (required to sell and create products) and flowing revenue. Cost of sales includes only those expense lines aimed at the direct sale of the manufactured product or service offered.

- Profit from product sales is the formula: Prpr = Vpr – UR – KR.

How to calculate percentage: division by 10

Calculating the percentage using this method is much easier and faster than the method described above. However, only if we are talking about percentages that are multiples of five. How to calculate percentage? First calculate the amount of 10 percent, and then multiply or divide it by the desired percentage of the amount you need to find.

Let's look at an example of how to calculate percentage. Imagine that you decide to deposit 340 thousand tenge and open an account for 12 months. The interest rate is 5%. A reasonable question arises about how much money will be in your account in a year.

How to calculate the percentage of the amount? Proceed as follows:

How to calculate profit margin

External reasons include:

- The indicator of deductions for depreciation.

- Government regulation.

- Natural conditions and situations.

- The level of difference between supply and demand (market sentiment).

- The initial price of raw materials and materials necessary for the production of a product for its subsequent sale on the market.

External factors do not have a direct impact on the profitability of the enterprise, but they can put pressure on the cost, as well as the final volume of goods sold. Ways to Increase Profit Ratios In light of a market economy, companies have two effective ways to increase their profit margins.

Company profit: concept, types, calculation formula

Gross income (GI) in this case is determined by the following formula: GD = (T1 x RN + T2 x RN + ... + Tn x RN) / 100, where T is turnover and RN is the estimated trade markup for groups of goods.

Example 2 The accountant of Biryusa LLC has the following data: Balance of goods as of July 1, rub. Trade turnover is understood as the total amount of revenue. Example: At Biryusa LLC, the balance of goods at sales value (account 41 balance) as of July 1 amounted to 12,500 rubles. The trading margin on the balance of goods as of July 1 (account balance 42) is 3,100 rubles. In July, products were received at the purchase price excluding VAT in the amount of 37,000 rubles. If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

How to calculate profit as a percentage formula

As a result, this amount will be the result of his trading activities in office supplies for the month. This is the most basic example of calculating profit. In practice, a number of other indicators are used that help more accurately determine profit. These include exchange rates, seasonality, inflation and others. All this can significantly affect the profitability of the organization. What affects sales profit? To develop options for increasing profits, you need to find out what it depends on. Profit is subject to internal and external factors. Key internal factors are:

- trading revenue;

- volume of sales;

- cost of goods;

- cost of goods;

- costs of selling goods;

- management expenses.

Entrepreneurs can influence these factors and change them if necessary. With this option, the gross income is first established, and then the markup. The accountant must apply the formula that is given in the document: VD = T x RN / 100, where T is the total turnover; RN – estimated trade markup. The trade markup is calculated using a different formula: RN = TN / (100 + TN). In this case: TN – trade markup as a percentage.

Turnover refers to the total amount of revenue. Example 1 At Biryusa LLC, the balance of goods at sales value (account 41 balance) as of July 1 amounted to 12,500 rubles. The trading margin on the balance of goods as of July 1 (account balance 42) is 3,100 rubles. In July, products were received at the purchase price excluding VAT in the amount of 37,000 rubles. According to the order of the head of the organization, the accountant must charge a trade margin of 35 percent on all goods. Its amount for goods received in July was 12,950 rubles. (RUB 37,000 x 35%). The fundamental principle of any commercial organization is to generate the greatest income. p, blockquote 1,0,0,0,0 –> Profit is direct evidence of the effectiveness (efficiency) of a business, profitability. The most significant indicator in this environment is sales profit. Any commercial organization is constantly looking for ways to increase profits. First you need to find out what profit affects, how it is formed, how it is calculated, and what factors affect the amount of profit. p, blockquote 2,0,0,0,0 –>

Cost calculation methods

The law provides for several methods for calculating the actual cost per unit of production. The enterprise has the right to independently choose one or another method. At the same time, the law obliges you to register your choice in the Regulations on the accounting policies of the enterprise, which are developed and approved once a year (at the beginning of the tax period) and are valid for at least one year. What is the cost of goods sold?

In different areas of business, the concept of cost includes different components; accordingly, the calculation of this indicator, for example, in production and in trade is carried out differently. In trade, the cost of a product is the totality of all costs spent on its purchase and pre-sale preparation (if the sales conditions require it). For example, additional packaging and logistics costs can also be included in the cost of products sold.

The main cost parameter in trade is the purchase price of goods from the supplier. The complexity of the calculations lies in the fact that the company sells a wide range of goods with different purchase prices, which can change with each arrival. Problems in calculations begin when goods are brought in batches and sold individually, when there are leftover goods at one price and a batch of the same goods is brought in, but at a different purchase price.

Cost is an important economic indicator for taxation

The profitability of the enterprise, its economic efficiency, and the feasibility of its activities depend on the correctness of the calculation. In addition, the cost determines the tax base on the basis of which income tax is calculated. Different costing methods can significantly change profit and tax rates. Therefore, it is important for each enterprise to make the optimal choice of calculation method, based on the specifics of its activities, while it is necessary to ensure the reliability of the calculations by minimizing random errors.

In trade, the three most common methods for calculating costs are:

- At the cost of an individual product unit

Suitable for retail businesses that sell unique, one-piece goods, for example, exclusive jewelry, antiques, cars, and expensive pieces of art.

Inventories are written off from the warehouse at a specific purchase price, which is easy to identify and relate to a specific product, since it is supplied in a single copy. The method is also applicable if it is possible to accurately determine which batch the product was sold from, provided that the same product is purchased in small quantities.

- Arithmetic average cost method

Suitable for trading enterprises that purchase identical goods systematically and in large quantities, for example, those selling stationery, cosmetics, clothing and other consumer goods. The cost price is calculated based on the results of the month using the arithmetic average. The method has its own errors, since it is not always beneficial to the enterprise from a tax point of view.

- FIFO method

The calculation principle is based on the “first in, first out” philosophy.

First of all, those goods that arrived earlier are written off. This is the most accurate, but at the same time the most labor-intensive way to write off inventory items. Cost calculations in examples If everything is clear with the first method of calculation (based on the cost of each specific unit), then the other two methods require more detailed explanations using specific examples.

Example of calculating average cost

To calculate the cost using the arithmetic mean principle, the following formula is used:

(Remaining inventory

in purchasing prices at the beginning of the month +

Receipt of inventory materials

in purchasing prices for the month) / (

number of inventory units

at the beginning of the month +

number of inventory units

received during the month) =

Average cost of inventory

items (product units)

Write-off of inventory items at arithmetic average cost:

Average cost of goods and materials

(product units) x number of inventory items sold per month = cost of inventory items subject to write-off

Let's say you sell women's clothing.

- At the beginning of the month there were dresses left in the warehouse: 400 pieces for 800 rubles = 320,000 rubles

- Dresses arrived in the 1st batch: 200 pieces for 750 rubles = 150,000 rubles

- Dresses arrived in the 2nd batch: 200 pieces for 700 rubles = 140,000 rubles

Average cost of goods and materials

= (320,000 + 150,000 + 140,000) / (400 + 200 + 200) = 762.5 rubles

Let's assume that during the month 700 dresses were sold at 1000 rubles. Revenue 700,000 rub.

Write-off of inventory items

= 762.5 (Average cost of inventory items) x 700 (number of inventory items sold) = 533,750 rubles

Profit = 700,000 (revenue) – 533,750 (Average cost of goods and materials sold) = 166,250 rubles

Example of calculation using the FIFO method

We perform the calculation based on the same conditions of the problem.

At the beginning of the month there were dresses left in the warehouse: 400 pieces for 800 rubles = 320,000 rubles

- Dresses arrived in the 1st batch: 200 pieces for 750 rubles = 150,000 rubles

- Dresses arrived in the 2nd batch: 200 pieces for 700 rubles = 140,000 rubles

Within a month, 700 dresses were sold for 1000 rubles. Revenue 700,000 rub.

The first to be written off are 400 units of inventory and materials in the amount of RUB 320,000

Further:

- Inventory and materials of the 1st batch of 200 units are written off in the amount of RUB 150,000

- Inventory and materials of the 2nd batch are written off 100 units x 700 rubles = 70,000 rubles

- Write-off of inventory items = 320,000 + 150,000 + 70,000 = 540,000 rubles

Profit = 700,000 (revenue) – 540,000 (Average cost of goods and materials sold) = 160,000 rubles

Calculations clearly show that profit indicators calculated using the FIFO method are lower than the same indicators calculated using the arithmetic average method. Therefore, income taxes will be lower if you use the FIFO method.

Which method should you choose?

Obviously, every entrepreneur wants to minimize taxation by legal means. The FIFO method, although more labor-intensive, allows for more accurate accounting and logically correct write-off of inventory items from the warehouse. If we assume that you are selling the same types of goods and purchasing them from the same suppliers, then you have the right to count on discounts and bonuses. If the purchase price decreases, then the write-off of the cost of goods using the FIFO method will occur at the largest amount, and the remaining inventory will be at the minimum amount. And this provides certain tax advantages.

Warehouse accounting automation program

We suggest using the simple and understandable LiteBox program to automate warehouse accounting. You don’t have to worry about the correctness of your cost calculations or worry about tax audits. It is enough to enter data on the receipt and sale of goods - and the program will automatically give you the result for each current moment in time. For management accounting, it is also beneficial to use this program, since it gives a real picture of the profitability of a certain product group, trading division or individual product. With the program you will be confident in the accuracy of the calculations and the correctness of your decisions.

Back

Why is it necessary to calculate profit from sales?

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

The productivity of an enterprise can be assessed by comparing the profit of a given period with data from previous periods. If an increase in profit is visible, it means that the business has worked effectively. p, blockquote 3,0,0,0,0 –> Successful analysis of sales profit makes it possible to develop measures to increase it, as well as find ways to reduce the cost of goods and develop the sales market. All this will provide an opportunity to increase profits and net income.

Formula

Profit from sales is calculated using the formula. It is defined as the difference between expenses and gross profit. p, blockquote 10,0,0,0,0 –> Gross profit is determined by subtracting selling expenses from sales revenue. p, blockquote 11,0,1,0,0 –> Selling expenses (cost of sales) - only those expenses that directly go towards sales. p, blockquote 12,0,0,0,0 –> So, the formula:

If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

p, blockquote 13,0,0,0,0 –>

Prpr = Vpr – UR – KR p, blockquote 14,0,0,0,0 –> Where, KR, UR – commercial/administrative expenses; p, blockquote 15,0,0,0,0 –> Vpr – gross profit; p, blockquote 16,0,0,0,0 –> Prpr – income from the activities of the company. p, blockquote 17,0,0,0,0 –> Calculation of gross profit:

If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

p, blockquote 18,0,0,0,0 –>

Vpr = VO – Sbst Where, Sbst is the cost of selling products; In – volume of revenue. p, blockquote 19,0,0,0,0 –> If you subtract all other expenses and taxes from the profit value, you will get net profit. p, blockquote 20,0,0,0,0 –>

An example of using the formula for calculating sales profit.

Determination of net profit using the example of p, blockquote 21,0,0,0,0 –>

Entrepreneur Kuznetsov sells office supplies at retail. Within a month, he purchased goods worth 500,000 rubles from a wholesale warehouse. Arranging delivery cost him 5,000 rubles. Kuznetsov paid 5,000 rubles for renting the retail space. Taxes and fees - 7,000 rub. Another 10,000 rubles were spent on other expenses. Within a month, Kuznetsov sold all the goods. With a 30% markup, gross sales revenue will be RUB 650,000. p, blockquote 22,0,0,0,0 –> Profit calculation: p, blockquote 23,1,0,0,0 –>

- All expenses of an entrepreneur are summed up.

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

500,000 rubles - for goods; 27,000 rubles - all costs to sell the goods; p, blockquote 24,0,0,0,0 –>

- Gross revenue (Vo) is 650,000 rubles.

With this data, you can calculate gross profit from sales (GPR). Vpr = In (650,000) - Sbst (500,000) = 150,000 We receive 150,000 rubles of gross income. p, blockquote 25,0,0,0,0 –>

- The difference between gross income and the cost of selling a product forms the sales profit.

Prpr = Vpr - UR - KR Ur, Kr = 5,000 (delivery of goods) +5,000 (rental of premises) = 10,000 Prpr = 150,000-10,000 = 140,000 (profit from sales) p, blockquote 26,0,0 ,0,0 –>

- To calculate net profit, you need to subtract taxes and other expenses from the profit figure.

Net Prp=140,000 - (7000+10,000)=123,000 rub.

p, blockquote 27,0,0,0,0 –> Thus, Kuznetsov will receive 123,000 rubles of net profit. As a result, this amount will be the result of his trading activities in office supplies for the month. p, blockquote 28,0,0,0,0 –> If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

This is the most basic example of calculating profit. In practice, a number of other indicators are used that help more accurately determine profit. These include exchange rates, seasonality, inflation and others. All this can significantly affect the profitability of the organization. p, blockquote 29,0,0,0,0 –>

IFRS, Dipifr

The profitability of sales can be expressed in two ways: through the gross margin ratio and through the markup on cost. Both coefficients are derived from the ratio of revenue, cost and gross profit:

Revenue 100,000 Cost (85,000) Gross profit 15,000

In English, gross profit is called “gross profit margin”. It is from this word “gross margin” that the expression “gross margin” comes.

The gross margin ratio is the ratio of gross profit to revenue.

In other words, it shows how much profit we will get from one dollar of revenue.

If the gross margin ratio is 20%, this means that every dollar will bring us 20 cents of profit, and the rest must be spent on producing the product.

The markup on cost is the ratio of gross profit to cost.

This ratio shows how much profit we will get from one dollar of cost.

If the markup on cost is 25%, this means that for every dollar invested in the production of a product, we will receive 25 cents in profit.

Why do you need to know all this during the Dipifr exam?

Unrealized gains in inventories

Both of the Dipifr exam profitability ratios described above are used in the consolidation problem to calculate the adjustment to unrealized profits in inventory. It occurs when companies in the same group sell goods or other assets to each other.

From the point of view of separate reporting, the selling company receives a profit from sales.

But from the point of view of the group, this profit is not realized (received) until the purchasing company sells this product to a third company that is not part of this consolidation group.

Accordingly, if at the end of the reporting period the inventories of the group companies contain goods received through intra-group sales, then their value from the group’s point of view will be overstated by the amount of intra-group profit. When consolidating, adjustments need to be made:

Dr Loss (seller company) Kt Inventories (buyer company)

This adjustment is one of several adjustments that are necessary to eliminate intercompany turnover on consolidation.

There is nothing difficult about making this entry if you can calculate what the unrealized gain is in the purchasing company's inventory balance.

Gross margin ratio. Calculation formula

The gross margin coefficient (in English gross profit margin) takes 100% of the sales revenue. The percentage of gross profit is calculated from revenue:

In this picture, the gross margin ratio is 25%. To calculate the amount of unrealized profit in inventory, you need to know this coefficient and know what the revenue or cost was equal to when selling the goods.

Example 1. Calculation of unrealized profit in inventories, GFP - gross margin ratio

December 2011

Note 4 – Intra-Group sales of inventories

As at 30 September 2011, Beta and Gamma inventories included components purchased from during the year. Beta purchased them for 16 million.

dollars, and Gamma for 10 million dollars. Alpha sold these components with a gross margin of 25%. (approx.

Alpha owns 80% of Beta's shares and 40% of Gamma's shares)

Alpha sells goods to Beta and Gamma companies.

The phrase “Beta purchased them (the components) for $16,000” means that when they sold those components, Alpha's revenue was equal to 16,000.

What the seller (Alpha) had as revenue is the buyer (Beta)'s cost of inventory. The gross profit for this transaction can be calculated as follows:

If you put together a proportion to find X, you get:

gross profit = 16,000*25/100 = 16,000*25% = 4,000

Thus, Alpha’s revenue, cost and gross profit for this transaction were equal:

This means that with revenue of 16,000, Alpha made a profit of 4,000. This amount of 16,000 is the value of Beta's inventory. But from the group's point of view, the inventory has not yet been sold, since it is in the Beta warehouse.

And this profit, which Alpha reflected in its separate financial statements, has not yet been received from the group’s point of view. For consolidation purposes, inventories should be stated at cost of 12,000.

When Beta sells these goods outside the group to a third company, for example, for $18,000, she will make a profit on her transaction of 2,000, and the total profit from the group's point of view will be 4,000 + 2,000 = 6,000.

Consolidation adjustment for unrealized gains in Beta inventory:

Dr Loss OPU Kt Inventories - 4,000

RULE 1

To calculate unrealized profit in inventory:

If the condition gives a gross margin coefficient, then you need to multiply this coefficient in % by the remaining inventory of the buyer’s company.

Calculating unrealized profits in inventory for Gamma will be a little more complicated.

Typically (at least in recent exams) Beta is a subsidiary and Gamma is accounted for using the equity method (associate or joint venture).

Therefore, Gamma needs to not only find the unrealized profit in inventory, but also take from it only the share that the parent company owns. In this case it is 40%.

10,000*25%*40% = 1,000

The wiring in this case will be like this:

Dr Loss of operating profit Kt Investment in Gamma - 1,000

If you come across a general physical product during the exam (as in this example), then it will be necessary to make adjustments in the consolidated general physical product itself in the “Inventories” line:

for the line “Investment in an associated company”:

and in calculating consolidated retained earnings:

The rightmost column shows the points awarded for these consolidation adjustments.

Mark-up on cost (in English mark-up on cost) takes 100% of the cost value. Accordingly, the percentage of gross profit is calculated from the cost:

In this picture, the markup on cost is 25%. Revenue as a percentage will be equal to 100% + 25% = 125%.

Example 2. Calculation of unrealized profit in inventories, general physical transfer - markup on cost

June 2012

Note 5 – Intra-Group sales of inventories

As at 31 March 2012, Beta and Gamma's inventories included components purchased from them during the year. Beta purchased them for 15 million.

dollars, and Gamma for 12.5 million dollars. When setting the selling price for these components, Alpha applied a markup of 25% of their cost. (approx.

Alpha owns 80% of Beta's shares and 40% of Gamma's shares)

The gross profit for this transaction can be calculated as follows:

If you put together a proportion to find X, you get:

gross profit = 15,000*25/125 = 3,000

Thus, Alpha’s revenue, cost and gross profit for this transaction were equal:

What affects sales profit?

To develop options for increasing profits, you need to find out what it depends on.

Profit is subject to internal and external factors. p, blockquote 30,0,0,0,0 –> Key internal factors are: p, blockquote 31,0,0,0,0 –>

- trading revenue;

- volume of sales;

- cost of goods;

- cost of goods;

- costs of selling goods;

- management expenses.

Entrepreneurs can influence these factors and change them if necessary.

The ratio of cost to sales revenue is

Info

Let us determine the minimum sales volume (critical) point in this case. The adjusted production and sales plan is presented in table. 4.

Sales critical point:

882,000 rub. / (420 rub. – 208 rub.) = 4160 pcs.

Before optimization, the critical sales volume was 5104 units. And now the company needs to produce only 4160 units. products so as not to be at a loss.

Conclusion

With such optimization of costs and sales price growth:

- the planned profit will increase by 398,000 rubles.

(RUB 2,298,000 – RUB 1,900,000), the growth rate will be 17.32% (RUB 2,298,000 – RUB 1,900,000) / RUB 2,298,000 × 100%));

How to calculate the profit indicator from the sale of products in the planning period?

When organizing his work, an entrepreneur needs to take into account the size of the projected profit.

To determine it, you need to have data on the type of product, price and sales volume (planned). p, blockquote 36,0,0,0,0 –> The most accessible method of calculation is using the profitability indicator. p, blockquote 37,0,0,0,0 –> For example, next month a trading organization plans to sell 8,000 goods, the price of which is 700 rubles per unit. The profitability of sales of these goods is 11% (according to calculations of previous periods).p, blockquote 38,0,0,0,0 –> Thus, the planned profit will be: p, blockquote 39,0,0,0,0 –> If If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Prpr (plan) = 8000 * 700 * 11% = 616,000 rubles. p, blockquote 40,0,0,0,0 –> Calculation and analysis of planned trading profitability is an important component of business management. The result of this event will be an increase in the efficiency of the organization. p, blockquote 41,0,0,0,0 –>

How to make everything clear and transparent

It is often difficult for an ordinary employee to understand all these formulas, so for convenience we are compiling a table for calculating the hourly rate depending on revenue. Our basic formula is still the same (30 + 70 (Current month revenue/Planned revenue)

As a result, you will end up with a table something like this:

| Revenue | Hourly rate | Hourly rate (rounded) |

| 700 000 | 87,647 | 87 |

| 750 000 | 91,765 | 91 |

| 800 000 | 95,882 | 95 |

| 850 000 | 100 | 100 |

| 900 000 | 104,118 | 104 |

| 950 000 | 108,236 | 108 |

| 1 000 000 | 112,353 | 112 |

| 1 050 000 | 116,47 | 116 |

| 1 100 000 | 120,588 | 120 |

| 1 150 000 | 124,71 | 124 |

| 1 200 000 | 128,824 | 128 |

There are 2 tricks to use here. First, round up your salary to make calculations easier. Secondly, break down the revenue (in our example, the revenue is divided into intervals of 50,000 rubles). With this approach, in the last days of the month, staff will try their best to jump to the next payroll rung. We saw with our own eyes how on the 31st the revenue was 898,000 rubles and 2,000 was missing for the next salary increase. The staff themselves cooperated, and as a result, revenue increased not by a couple of thousand, but by as much as 25,000 rubles. It really works, tested in combat conditions.

Ways to increase profit ratio

To figure out how to increase profit, you need to understand what parts it is formed from.

The main indicators of the sales system are the coefficients of the formula, which determines the amount of income of the organization from business activities. p, blockquote 42,0,0,0,0 –> In retail, profit mainly depends on sales volume. p, blockquote 43,0,0,0,0 –> To determine the moments of projected sales growth (and profits, respectively), sales volume must be broken down into key units. p, blockquote 44,0,0,0,0 –> Sales volume = (Incoming flow) x (Conversion rate) x (Average bill)

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

p, blockquote 45,0,0,0,0 –>

- 1) The conversion rate determines what part of the total customer flow has become real. This indicator depends on the range of goods, the professionalism of employees, and the visual component of the store design.

- The incoming flow is practically not affected by these factors, but it is influenced by advertising, the location of the trading organization, the design and brightness of shop windows.

- The size of the average check depends on the quality of work of the sales staff, on ongoing promotions, discounts, special offers and other “promotional” events.

We measure key indicators: p, blockquote 46,0,0,0,0 –>

- In practice, only the incoming flow needs to be measured (special sensors at the inlet or manually for a small amount).

- Conversion rate formula: Conversion rate = (Number of sales) / (Incoming flow).

- The average check is calculated by dividing daily revenue by the number of sales. Data from sales performance indicators must be recorded and statistics must be kept on them. This needs to be done for the further development and implementation of strategic measures to increase each of them.

The conversion rate can be increased by analyzing the work of sellers, demand, and the sales floor itself.

Customers may not find or see a certain product, or such product may not be in circulation at all in your trading organization. The average check can be increased by developing various promotions that will motivate you to buy more. (No ratings yet)

Payroll fund: how to determine the amount of payroll – Business website TRIZ-RI

sh: 1: –format=html: not found

Asking how the payroll (payroll fund) depends on the company’s turnover is the same as asking what prices should be on the market if you have 100 rubles in your wallet, and what they should be if there are any 1000.

No matter how much a company earns, people will compare their salary with the market one. An employee will be inclined to change jobs if he is offered more for similar work in another company. Therefore, Frederick Taylor believed (and nothing has changed since) that the enterprise should:

a) organize work in such a way that the employee shows greater results with less effort (this means that in a competing company either his results will be lower, or he would have to work harder to earn the same amount), i.e. to be a technological enterprise;

b) when completing (and not exceeding) the task, pay the employee higher than the average pay on the market for specialists of this category in a given city. This “above-market” pay to a high-performing employee is what Taylor calls a “performance bonus.”

Thus, the scope of the payroll is determined by the level of wages in the market and the level of labor organization at the enterprise.

Payroll is made up of (a) employee salaries, rather than employee salaries coming from (c) payroll.

If (a) and (c) do not coincide, then it is time to think about the economics of the enterprise or its technological effectiveness, perhaps about the business idea itself, but do not adjust the salary to the low actual results.

Strictly speaking, it would be correct not to use the expression “wage fund”, not to write (above) “the wage fund is determined by the level of wages on the market,” but to write: “Your wage costs are determined by the level of wages on the market.”

The word “fund” draws the inertia of thinking specifically about a certain fund that needs to be formed. But there is no such task. There is a task to assess the overall level of planned costs of an enterprise (or project) for wages.

Therefore, just as it is impossible to pay an employee a percentage of turnover, it is also impossible to form a payroll in the form of a share in the structure of the company’s turnover.

How to “divide it correctly”?

Taking into account the above, this question loses its meaning. Because Since total wage costs are formed by combining employee salaries, and their level is determined by the market and manufacturability, the division procedure itself is not required.

It makes no sense to look for the “correct ratio” of salary levels between different positions (relative to each other). Some positions in the labor market may become more expensive, while others may become cheaper, completely independently of each other. Even if specific positions are rare, there are analogues that employees will look to when looking for a standard for their salary.

What if wage costs become disproportionate to income?

Please think: when asking this question, which cell of the table below do you mean?

It is also clear that if the remuneration model is correct, then if employee performance falls, wages will not increase.

Is it still possible to insure against rising wages by tying it to profit, revenue, or income?

Can. But when bad times come (for you), if employees have somewhere to go, they will go there. And in good times? ... But you didn’t ask about how to overpay above the market. After all, by acting this way, in bad times you will lay a mine that will explode in good times.

And by the way, you asked about how to transfer business risk to employees in bad times. Don't think about it anymore. Think about why times have gotten worse. And do something. You are the entrepreneur, not your employees.

What to do if payroll costs are truly “inflated”?

Managers of other companies are trying to reduce wage costs by laying off employees or cutting salaries, looking for various instructions, such as: how much time an accountant spends on issuing money according to cash settlement, or how many subordinates a manager should have.

But just as you cannot change the temperature by adjusting the thermometer, you cannot improve the economy by changing the amount of money in the system. Equally, it is impossible to improve efficiency by adjusting the level of wages to current incomes.

After all, the salary level is a “sensor” that signals the work of the company as a single organism and reports that “something is wrong” in the company. You cannot redo a thermometer instead of making the patient healthier. It is not the salary level that needs to be “treated”, but the company: changing the structure, improving work technology, improving remuneration models, etc.

Read more about this here: S.V. Sychev, A.B. Kavtreva “Four stories with consequences”

How do wage levels change over time?

Is it true that wages should increase annually depending on inflation? Or maybe they should, on the contrary, decrease if there is a crisis in the country?

There are certain professions. There is a price for them in the labor market.

And if the overall cost of living has increased, then when selecting an employee, we will still ask: “How much is such a specialist paid on the market?”

Note that it is not at all necessary that as the cost of living rises, all professions will become more expensive. Some will become cheaper. For example, accountant salaries (on average) have been falling in recent years. And there was a period when they grew at an inappropriately fast pace.

There are tasks that we instruct you to complete. And there is a price we pay for their implementation. It is those described above that are the starting point when making decisions regarding changes in wages.

- Gasoline prices are rising, but workers' salaries at gas stations are not.

- Furniture prices are falling, and salespersons' salaries are rising.

- Furniture prices are falling, but the salaries of programmers in furniture companies are not.

Of course, the level of wages on the market can either increase depending on inflation (this is how we see the salaries of public sector workers adjust annually) or decrease due to reasons of the crisis.

But again, when planning administrative expenses for wages, it is better to focus on the market value of a specialist, rather than looking for the correct coefficient to link to certain disasters.

Source: https://www.triz-ri.ru/motive/?id=6875&name=fond_oplatyi_truda