Hello friends! Today we will consider the question: is a metal account at Sberbank profitable, its pros and cons, we will study the reviews and answer the question - is it worth opening a metal deposit, investing money in it in order to earn money.

Precious metals are traditionally considered a more stable monetary equivalent compared to conventional paper money. One of the manifestations of modern ideas about the value of precious metals can be considered metal accounts (abbreviated as OMS), which can also be opened in Sberbank. The prospect of operating with precious metals, the equivalent value of which does not depend on currencies, certainly looks attractive.

What is compulsory medical insurance - an impersonal metal account

Unallocated metal accounts were conceived as a real alternative to cash deposits . The instability of the world market and frequent economic crises contribute to the fact that businessmen prefer gold, silver or platinum to standard foreign exchange investments.

Sberbank provides all the necessary services for this - the client does not have to worry about storing the asset, and the procedure for purchasing precious metals under the conditions of opening a compulsory medical insurance is simple. You need to choose one of four types of assets - silver, gold, platinum, palladium.

Please note that the asset is not issued in person. The client has the right to invest, redistribute assets and receive the corresponding profit, transfer by agreement to another person, buy or sell, but they will be located on the territory of the bank. In the event that you decide to withdraw your asset from the bank's territory, you will need to pay all VAT requirements (18 percent of the value of the bullion).

Types of metal bills

All metal accounts are divided into two main types:

- safekeeping – the client only places his real bullion in a bank vault for a certain time, paying for the service;

- an impersonal metal account (OMA), which allows you to earn income from transactions with precious metals.

In turn, compulsory medical insurance can be:

- time or deposit (there is no deposit for metals at Sberbank), when the bank pays interest for storing bullion in metal accounts (here the client does not need to sell or buy precious metals to make a profit);

- current – the client receives profit due to exchange rate differences when buying or selling metal. You can close such accounts at any time without losing any profits.

There is an attempt to classify compulsory medical insurance by type of metal. But it is not relevant for the Savings Bank - it can store several types of precious metals in one account (multi-account).

Which is more profitable?

Which account is more profitable to open? If you own bullions of precious metals, it is definitely better for conservatives to open a metal account for safekeeping.

If there are no gold, silver and other types of bullion on hand, compulsory medical insurance opens. Here the precious metal is virtual, so VAT of 20% is not paid for it.

If you buy real bars and put them in a metal account for safekeeping, the amount of VAT and storage fees will not only eat up the profit, but will also drive you into the red (losses). Statistics show that even after 7 years of storing metal in a bank, the transaction does not pay off.

If compulsory medical insurance opens, then conservatives prefer deposit accounts, and speculators prefer current ones. The former are patiently waiting for the quotes to rise, the latter are gambling with buying and selling. At the same time, you can get rich and go broke. One deal could make all the difference.

How to profitably make money on compulsory medical insurance

Unallocated metal accounts are opened under special conditions when compared with other credit services. You can either earn or lose money on this due to the difference in exchange rate.

First, you need to fill out an application via the Internet, or contact a specialized credit institution of Sberbank. Keep in mind that not every Sberbank branch can provide a client with this kind of service. Out of more than 8 thousand branches, only 500 can provide you with the opportunity to open such an account.

Sberbank undertakes to establish a minimum threshold for the asset being sold. It corresponds to 0.1 g for gold, platinum and palladium, and 1 g for silver. You only pay for the purchase of the asset itself; additional funds are not required for the service.

There is no minimum threshold for the amount of profit, that is, the client can withdraw all the cash after the transaction, and the compulsory medical insurance will not close. There is also no maximum threshold; you decide how much metal you will store in the bank, but assets of one type of metal cannot be transferred to another.

Opening a compulsory medical insurance is associated with a certain amount of risk , since these deposits cannot be insured, which we will discuss in detail later.

Taxation

There is no need to pay 20% VAT when buying/selling compulsory medical insurance. However, from the profit received on the metal account, you will need to pay NFDL. For example, you bought gold for 600 thousand rubles and sold it for 700 thousand. From 100 thousand you pay 13% - 13,000 rubles.

And here’s another interesting article: Review of “eternal portfolios” TRUR, TUSD and TEUR from Tinkoff Investments

Most banks are tax agents - they themselves calculate personal income tax and transfer it where necessary. But some are not, and then you will need to fill out the declaration yourself, calculate the tax and transfer it to the Federal Tax Service.

The obligation to pay income tax does not arise in two cases:

- if the compulsory medical insurance has been active for more than 3 years, regardless of the type of metal and its amount;

- if during the year you sold metal worth less than 250 thousand rubles.

At the same time, you still need to fill out a declaration and submit it to the Federal Tax Service. The deadline is April 31 of the following year. For example, you sold silver from an unallocated metal account on November 21, 2018 in the amount of 300 thousand rubles, of which 50 thousand rubles are net profit. This means that by April 31, 2020, you need to submit a 2-NDFL declaration to the Federal Tax Service and pay 6,500 rubles in tax.

What are the differences between compulsory medical insurance and a regular cash deposit?

A cash deposit implies the presence of real currency in your account - national or international. In other words, you operate with real amounts of 1000 rubles, dollars or euros. Compulsory medical insurance is calculated in grams, and in case of profit, the client receives an amount in rubles, which is converted into currency in relation to the price per gram of gold.

A special condition is the opening of an impersonal compulsory medical insurance at Sberbank upon physical, that is, real deposit of a measured ingot of gold or other metal. Its compliance with standards is assessed by a special commission. In other cases, the client pays in rubles an amount equal to the amount of metal in grams.

How to properly invest money in gold at Sberbank?

Before investing money and opening a special deposit in metallic or virtual gold, you need to understand the features of such investments, the policies of Sberbank itself, and also take into account possible risks, advantages and disadvantages. We must remember that the cost of precious metals at Sberbank can not only rise, but also fall. For this reason, the greatest benefit will await those who decide to invest their available money in gold and store it in Sberbank for quite a long time, counting on the long term. Read about other ways to invest money in the yellow metal here.

to the list

Is it worth investing in a metal account?

Metal deposits are a kind of investment for the future. Investing in precious metals for individuals does not have an interest rate to pay the bank, but you can only get real benefits if there are serious increases in the price of the precious metal. Sberbank, like other banks, depends on the established gold rates according to daily criteria from the Central Bank (they can be found on the official website).

Sberbank, in turn, is adjusting its adjustments to the opening of compulsory medical insurance: the sale price is overstated in relation to the Central Bank exchange rate, the purchase price is understated. In theory, it looks like this: if the Central Bank rate per gram of gold is 1,600 rubles, you will buy one gram at Sberbank for 1,700 rubles. Decide to sell it on the same day for 1,500 rubles, and you will lose 200. But if after a week or a month the price per gram of gold according to the Central Bank increases to 1,900, you will begin to make a profit.

The world's supply of precious metals is limited, so logically, their prices will only rise over time. Add to this a more stable position in relation to national currencies, and you get a completely reliable means of long-term profit. Over the past 10 years alone, taking into account all the nuances, the price per gram of gold has increased from 500 to 2,300 rubles.

At the same time, it is unlikely that you will be able to constantly make a profit with the help of compulsory medical insurance. Precious metal prices fluctuate throughout the year, and if you make a good profit one month, you may well lose it the next.

The opening of compulsory medical insurance should be approached wisely, trying to predict the pricing policy of the Central Bank. If possible, carefully monitor inflation processes.

Metal or classic contribution

There are questions, such as what came first, the egg or the chicken, that cannot be answered correctly in principle. The same situation applies to the question of what is more profitable: keeping savings in cash deposits or in the form of metal ingots of precious metals.

Thus, with minimal inflation, the price of gold grows slowly (the world is calm, there are no crises), and interest on deposits allows you to get a solid income. During a crisis period, on the contrary, inflation almost completely eats up the profit received from the deposit, and the price of gold rises sharply, allowing the owner of a metal account to receive significant profits.

With sluggish inflation, which is the norm for a dynamically developing economy, the income on cash deposits is still approximately twice as high.

But the modern world does not provide such an opportunity: to develop the economy in a comfortable manner. Therefore, there is no answer to the question whether metal accounts are profitable or not.

Opening compulsory medical insurance in Sberbank

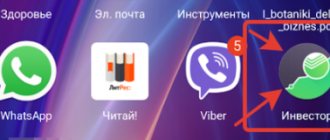

The most convenient option for opening a compulsory medical insurance is through the Internet. This is due to the fact that not every Sberbank branch works with similar categories of accounts.

To open compulsory medical insurance, you must:

- Have your passport and Taxpayer Identification Number with you.

- Be a citizen of the Russian Federation.

- Make a purchase of gold, palladium, platinum from 0.1 g or silver from 1 g (the maximum threshold for the purchase of precious metals has not been established).

Compulsory medical insurance can also be opened for a child over 14 years old with a legal representative.

Opening a metal account has a number of undoubted advantages, including:

- No fee for opening the service.

- The purchase or sale of precious metals is carried out on the spot, “here and now”.

- No VAT on transactions if you work with precious metals under the terms of compulsory medical insurance. Handing over gold means full payment of VAT.

- Maintaining an account is absolutely free, there is no minimum balance threshold.

Please note the following points:

- The agreement to transfer ownership of the account must be certified by a notary.

- Money transfers from compulsory medical insurance are not carried out. To do this you need to withdraw money. In addition, not every bank provides services for working with precious metals, as we have repeatedly reported.

Precious metals are located on the territory of the bank vault, and they are not used by the bank itself as credit funds. If a client expresses a desire to receive bars of gold or other metal, employees are obliged to fulfill his request upon his first request.

Commission payment is made for the following services:

- Export of precious metals in physical form. In this case, the client pays VAT at 18 percent of the cost of the bullion.

- Transporting the bullion to another bank.

- Opening and closing.

Gold deposit: why are bank deposits in precious metals needed?

When applying for compulsory medical insurance, the client buys precious metal from the bank, but in fact this asset is not stored anywhere and exists only on paper. That is, such an account is not tied to specific physical bullion. Payment of interest on them is possible only if this is provided for in the client’s agreement with the bank. Investment coins are issued by central banks of different countries and are means of saving or accumulation. Prices for such coins are tied to the exchange value of gold, which is determined by the London Metal Exchange. You can purchase these coins either from banks or from dealers. Thus, the new product is most similar to compulsory medical insurance, says Vadim Pogosyan, director of the department of passive, insurance and investment products at Otkritie Bank. But when applying for compulsory medical insurance, the depositor brings money to the bank, and there this amount is converted into ounces of the precious metal. When the depositor wants to withdraw it from the account, the precious metal is transferred back to rubles at the bank’s rate. A deposit in precious metals assumes that the client will be able to bring physical metal and deposit it into an account for storage at a bank. In this case, he must present a passport of the ingot and a certificate for it.

What's the catch

Read on RBC Pro

Out of spite Kawasaki: how loyalty defeated competence in Russia Billionaire downshifter: how a mortgage seller got rich by comparing prices So says Gref: there are few people with a “nuclear engine” inside Hiring with a demotion: is it worth hiring a former manager for a linear position

Of the three largest banks in terms of the volume of funds raised from the public, offering, among other things, the opening of compulsory medical insurance or a safekeeping account, only VTB24 informed RBC about plans to launch a new product. “We are considering this possibility, but the final decision will be made later, after the official publication of the law,” the bank’s press service said in a commentary. Sberbank in its commentary did not provide information about its plans regarding the new type of deposit. Rosselkhozbank did not have time to respond to RBC's request by the time of publication.

The head of the department of operations with precious metals at Lanta Bank, Irina Lozinskaya, warns that the new type of deposits, unlike ruble and foreign currency deposits, will not be insured by the DIA. “The main change in the Civil Code of the Russian Federation, which was expected by market participants and which would be quite logical, is to include accounts in precious metals in the deposit insurance system. But that didn’t happen,” she says. According to the new law, the bank is obliged to notify the client about this risk before concluding an agreement, Lozinskaya adds. According to Alfa Bank analyst Alan Kaziev, the lack of guarantees for this type of deposit is its main drawback, which offsets the positive differences between the new instrument and conventional compulsory medical insurance.

According to him, banks and their clients are unlikely to show much interest in the new type of deposit, since it looks risky compared to a traditional deposit. “Of course, for some, accruing interest is enough, but, in my opinion, we could see interest in this type of investment only after our government adopts a law on insuring this type of deposit,” Kaziev agrees.

Vadim Pogosyan also believes that the lack of insurance will scare away retail clients: Russians rarely store funds in metal, not least because they strive for maximum protection of their savings. “Most likely, this is a story for wealthy citizens who are now storing bullion for some reason,” says the financier.

There are other difficulties that can scare customers away. Unlike a deposit in rubles, a deposit in precious metals can hardly be opened at any bank branch, adds Pogosyan. The fact is that when placing a bullion on deposit, the bank is obliged to check it - this is done by specially trained people. Banks doubt that Russian banks will be able to afford to keep such specialists on staff at each branch.

In addition, there are features of bullion storage that can affect the value of the asset. “For example, if there is even one fingerprint on a gold bar, then it is greatly discounted in price. This bar can be sold at a price 30% cheaper,” says Pogosyan. Another difficulty is that when withdrawing physical bullion from metal accounts, VAT is deducted, the expert recalls. It is possible that if the owner of the new deposit decides to withdraw his deposit, he will also have to pay tax, as in the case of compulsory medical insurance, Pogosyan concludes.

Who will find it useful?

Financiers interviewed by RBC agree that the new deposit is suitable for conservative investors who keep a small part of their savings in precious metals as “protective” assets. According to the portfolio manager of Finam Financial Group Alexey Belkin, such a deposit is a more attractive instrument than compulsory medical insurance, since the owner receives interest income on it.

However, investors should not forget that metals are a rather volatile asset, the prices of which can fall sharply. In this case, it is unlikely that you will be able to make money on them. “For example, silver in April 2011 cost $50 per ounce, and now it costs about $16. If a person had been buying silver all these years, he would now have a smaller amount in monetary terms. But if he had speculated in silver futures, for example, played against it on the futures market, he would have been able to significantly increase his capital,” the expert gives an example.

Vasily Koposov, head of the financial market analysis department at KIT Finance Broker, agrees that there is no reason for gold and silver prices to rise in the near future, so clients are unlikely to receive much benefit from rising metal prices. Koposov considers the best option for investing in precious metals to be investments in securities linked to them, for example, shares of an exchange-traded fund (ETF) for gold.

Koposov calls the American SPDR Gold Trust the most liquid gold ETF - its quotes have increased by 7% since the beginning of the year. Since this fund is traded in the United States, a Russian would need qualified investor status to buy shares in it. To obtain status, an investor needs to have 6 million rubles in his account. or have a qualification certificate of a professional participant (FSFM, CFA). An alternative could be the FinEx Gold ETF, which tracks physical gold prices and is traded on the Moscow Exchange. Also, an investor who wants to invest in gold can buy shares of mining companies traded on Western exchanges, the financier says. For example, securities from the FTSE Gold Mines industry index - since the beginning of the year, this indicator has grown by 3.5%.

Open compulsory medical insurance with your precious metal bar

When opening an account with your own bullion, you must have all the documentation (certificates from the bullion manufacturer, which will indicate the serial number and fineness). If the metal meets all the standards and regulations of the country, the depositor fills out a written order to transfer the bullion to the Sberbank vault. During registration, the ingots undergo control and are inspected by specialists (both visually and using technical means). A legal transfer and acceptance agreement is signed with the investor in two copies. One of the copies is issued to the client.

If the bullion does not meet the established criteria, Sberbank has the right to refuse the depositor.

Upon expiration of the period specified in the contract, the client is returned the bullion that was left for storage.

Who can open compulsory medical insurance

Opening accounts is available to adult citizens of Russia. If parents decide to open an account in the name of a child under 14 years of age, the document is issued to the legal representative.

The list of documents for opening an account for a child under 18 years of age differs, depending on the status of the person applying. For example, a parent must provide a child’s birth certificate, a guardian must provide a certificate or certificate from the guardianship authorities, a citizen of the Russian Federation aged 14 to 18 years must provide written permission from a legal representative.

Persons under 14 years of age cannot independently manage deposits. The account is operated by a legal representative if there are documents on permission from the guardianship authorities. After reaching 14 years of age, the depositor himself uses the money, but with written consent from his legal representative. A signature and date of application are required. Also, with written permission, the owner of the compulsory medical insurance who has reached 14 years of age can transfer the deposit to another person. To do this, fill out a special power of attorney certified by a notary. There are no restrictions on making deposits for persons over 18 years of age.

Why do we need compulsory medical insurance?

It would seem, why do we need impersonal accounts? You can just buy a bar of the same gold. Well, it's not that simple.

Firstly , for the purchase of physical gold you are required to pay VAT, which is as much as 18%. Somehow I don’t want to overpay almost 5 parts.

Secondly , buying bullion is fraught with risks. They need to be stored somewhere: either at home, which means there is a risk of becoming victims of robbers, or renting a safe deposit box in a bank, which is again an additional expense.

Thirdly , when selling, you must have all the necessary documents confirming the origin of the bars and the hallmark. If you don’t have this, you will have to submit everything for examination, and this again means additional financial and time costs.

Fourthly , when purchasing physical bars, their cost starts from several tens of thousands of rubles. And not everyone can afford this. Perhaps you will have this amount for the initial purchase. But if you decide to constantly invest money in precious metals, then you will need to accumulate a certain minimum amount for a repeated purchase.

Compulsory medical insurance allows you to carry out purchase transactions even every day if you have only a few thousand rubles (and sometimes even hundreds). When I had some free money, I went and bought a couple of grams of gold.

Fifthly . Here the situation is reversed compared to the previous point. If you urgently need money, you must sell a whole bar of gold at once. It is impossible to pinch off a piece from it for current expenses.

Compulsory medical insurance allows you to sell part of the purchased metal - 100, 50, 10 and even 1 gram. The rest remains safe in your account.

Pros and cons of opening a metal account with Sberbank

To summarize, it should be said that the owner of compulsory medical insurance has a number of undeniable advantages:

- Money is held in its “real value”, much less subject to the effects of inflation.

- If market prices for precious metals rise, the depositor receives a real profit, despite the fact that the bank does not require commission payments when withdrawing funds.

- Unallocated accounts with precious metals are much more liquid than real bullion. When the latter is received by a bank from an individual or legal entity, a lengthy process of verification by specialists follows for compliance with Russian standards. The bank always has the right to refuse the client, while impersonal funds are quickly converted into cash and banks always buy back such funds.

- Compulsory medical insurance is not subject to taxes on income from an individual (if open for a period of up to 3 years) and is not subject to VAT.

- The risk for the safety of precious metals lies entirely with the bank in which the deposit was opened.

At the same time, opening an impersonal metal account is associated with a certain risk. First of all, this is the lack of insurance for anonymous bank deposits. If the bank goes bankrupt, you are unlikely to see your money. Also, each bank, at its own discretion, sets the difference between the actual Central Bank exchange rate for the precious metal and the purchase/sale cost. An inattentive investor can accidentally lose a lot of money on this.

Is it profitable to invest in gold?

When buying metal, you need to remember, by analogy with exchange rates, about the difference in quotes for sale and purchase. At the same point in time, the bank buys gold or other metal from you cheaper than it sells. Therefore, in order to benefit, you must wait for a significant increase in the rate.

If you make a purchase and receive a gold bar, you will have to pay 18% VAT. And the benefits from compulsory medical insurance are subject to income tax, which you must declare and pay for yourself. But if the bullion remains in storage at the bank, VAT is not required to be paid, only upon actual receipt.

Investments in gold can bring much higher returns than a regular deposit.

The monthly increase in value sometimes reaches 5-8%, and the most profitable deposit rarely offers 7% annual income. But if you look at the dynamics of exchange rates, you can find periods of negative dynamics. In particular, from the autumn of 2012 to the winter of 2013, gold prices fell significantly against the ruble.

You also need to take into account that Sberbank quotes for metal accounts are expressed in rubles, and on world markets trading is carried out in relation to the dollar. Therefore, the dynamics of national quotations largely depends on the exchange rate of the national currency. A slight drop in the value of gold in dollars when the ruble depreciates will increase losses on gold compulsory medical insurance.

Taking into account all the factors, we can conclude that long-term investment in gold is advisable and there is a high degree of risk and dependence on stock market speculation.