What is IP

The status of an individual entrepreneur presupposes that a certain citizen who has legal capacity and capacity receives the right to engage in commercial activities. He has the right to acquire rights and material assets on his own behalf. It is believed that enterprises created on this basis are a good start for their business, and small businesses are created mostly by entrepreneurs.

However, the burden on an individual entrepreneur as an individual can be so great that it is better to register a small enterprise on the basis of a legal entity. The fact is that the founder of an organization is liable for its debts only to the extent of the contribution to the authorized capital, and the entrepreneur risks losing all personal property if financial problems arise. But this is only one, albeit the main difference between an individual entrepreneur and a legal entity.

Let's summarize all the differences in a table:

| Comparison indicator | IP | Organization |

| Number of persons participating in registration | One person whose personal data is entered into the state register | One person becoming the sole participant, a group of individuals, and even other organizations becoming founders |

| Responsibility for the obligations of the enterprise | If there is a lack of assets of the enterprise, it is liable with personal property | Responsible only in an amount equal to the authorized capital. |

| Registration actions | For individual entrepreneurs, they are carried out according to a simplified scheme with a minimum of documents | The registration procedure with the tax authority involves the formation of a package of documents, which includes a multi-page charter of the organization |

| Authorized capital | Not needed | Mandatory, otherwise the organization will not be registered |

| State duty amount | For registration of status it is equal to 800 rubles, for withdrawal from the register - 160 rubles. | For registration upon creation - 4000 rubles, for changes and exclusion from the register - 800 rubles. |

| Seal | Not required | Mandatory |

| Checking account | Not required | Required |

| Taxation We recommend you study! Follow the link: What is the difference between individual entrepreneurs and private entrepreneurs and what is better to open in Russia We recommend you study! Follow the link: What is the difference between individual entrepreneur and LLC and what to choose | Tax accounting is kept in the book of income and expenses. When choosing a simplified taxation system, part of the taxes is collected into a single payment | All transactions are recorded with a full set of tax registers. If an organization uses a “simplified” system, tax accounting is simplified |

| Accounting | No obligation to maintain accounting records | Required to be fully maintained and integrated with tax accounting |

| Cash transactions | Cash registers until 07/01/2018 may not use individual entrepreneurs on “imputation” and patent | The use of cash registers is mandatory |

| Contributions to insurance funds | Once a year, a fixed payment for yourself, even if you have no income | No income in the form of salary - no insurance premiums are charged |

| Types of activities | There are restrictions on a number of activities | No restrictions |

| Profit distribution | The individual entrepreneur has the right to use the income received for personal needs | There are legal limits for using the profits received |

| Sale and transfer of business | Not inherited, not given or sold | Shares in the organization are inherited, donated and sold |

| Power of attorney | Another person can act on behalf of the entrepreneur only with a power of attorney certified by a notary | To represent the interests of a legal entity, another person only needs the seal and signature of the manager on the power of attorney |

There is one more difference between an individual entrepreneur and a legal entity that cannot be reflected in one row of the table - this is the method of liquidation.

An entrepreneur may lose his commercial status for one of the following reasons:

- At your own request.

- Due to the bankruptcy of the enterprise.

- If the court, by its decision, required the termination of activities as an individual entrepreneur.

- Due to the death of an individual – entrepreneur.

Organizations are liquidated for reasons that only partially coincide with this list.

As for hired workers, both the individual entrepreneur and the organization must comply with the general rules for hiring and dismissing employees and drawing up work books. The procedure for settlements with employees in the event of bankruptcy of an enterprise is similar: each of them can pay creditors only after paying all the money earned to the staff.

Limited Liability Company

An enterprise in the form of a legal entity is an organization of several individuals who decided to join forces to achieve the goals set by the founders. One individual, a group of citizens, one organization, and a group of legal entities are allowed to participate in the creation of a company. Any combination of these participants is allowed. The only prohibition exists for circumstances when an organization with one founder is trying to create a company. This option is prohibited by law.

A common feature of legal entities with individual entrepreneurs is the ability to buy property rights, non-property assets on their own behalf, have responsibilities, and act as a plaintiff and defendant in court.

A legal entity, unlike an individual entrepreneur, has capital formed from the contributions of participants. These funds, tangible or even intangible assets, are initially used to pick up the pace of economic development. Throughout the existence of a legal entity, amounts invested in the authorized capital are accounted for separately from other assets accumulated in the course of activity.

Organizations have another attractive property: if an enterprise has to pay its obligations forcibly (for example, in case of bankruptcy), then collection is imposed only on the money available in the accounts and in the cash register, as well as on the property belonging to it. The founders' contributions remain intact.

An entrepreneur is forced to start with personal or borrowed funds, which increases the risk of losing private money and property.

The legislation provides for fines for organizations, sometimes several times higher than the sanctions established for entrepreneurs. Thus, the state compensates for losses resulting from the limited liability of the founders.

For example, for inviting a foreigner to work without registration documents, an entrepreneur will be fined a maximum of 50 thousand rubles, and a legal entity can be fined up to 800 thousand rubles.

Differences between plant, fungal and animal cells

Despite the unity of the general plan, the structure of the eukaryotic cell of different kingdoms of organisms has some differences. Plant cells do not contain lysosomes or a cell center. Animal and fungal cells are characterized by the absence of plastids and vacuoles. The cell wall of fungi contains quinine, and the cell wall of plants contains cellulose. Animals do not have a cell wall, but the membrane contains a glycocalyx. The structure of the eukaryotic cell also differs in reserve nutritional carbohydrates. Starch is stored in plant cells, and glycogen is stored in fungal and animal cells.

Additional Differences

Not only the structure of a eukaryotic cell and a prokaryotic one differs, but also the methods of their reproduction. The number of bacteria increases as a result of the formation of constriction or budding. Eukaryotic cells reproduce by mitosis. Many processes characteristic of eukaryotic cells (phagocytosis, pinocytosis and cyclosis) are not observed in prokaryotes. For normal functioning, cells of fungi, plants and animals require ascorbic acid. Bacteria don't need it.

The table compares the cells of bacteria, plants and animals according to morphological characteristics.

Table “Comparison of plant and animal cells”

| Cellular structure | Function | Bakt. | Rast. | Stomach. | Mushrooms |

| Core | Storage of hereditary information, RNA synthesis | No | Eat | Eat | Eat |

| Cell membrane | Performs barrier, transport, matrix, mechanical, receptor, energetic, enzymatic and marking functions | Eat | Eat | Eat | Eat |

| Capsule | Protects bacteria from damage and drying out. Creates an additional osmotic barrier and is a source of reserve substances. Prevents bacterial phagocytosis | Eat | No | No | No |

| Cell wall | The polysaccharide shell above the cell membrane, through which the regulation of water and gases in the cell occurs. Impermeable even to small molecules. Does not interfere with diffuse movement | Eat | Eat | No | Eat |

| Contacts between cells | Linking tissue cells together. Transport of substances between cells. | No | Plasmod-esma | Desmos-ohms | Septs |

| Chromosomes | Nucleoprotein complex containing DNA, as well as histones and histone-like proteins | Nucleoid | Eat | Eat | Eat |

| Plasmids | Storing genomic information that encodes enzymes that destroy antibiotics, thereby avoiding their harmful effects | Eat | No | No | No |

| Cytoplasm | Contains cell organelles and evenly distributes nutrients throughout the cell. | Eat | Eat | Eat | Eat |

| Mitochondria | Organelles that take part in the transformation of energy in the cell. They have internal membranes on which ATP synthesis occurs | No | Eat | Eat | Eat |

| Golgi apparatus | Produces the synthesis of complex proteins, polysaccharides, their accumulation and secretion | No | Eat | Eat | Eat |

| Endoplasmic reticulum | Performs synthesis and ensures transport of proteins and lipids | No | Eat | Eat | Eat |

| Ribosomes | Organelles, consisting of two subunits, carry out protein synthesis (translation). | Eat | Eat | Eat | Eat |

| Centriole | During cell division, a spindle is formed | No | No | Eat | No |

| Plastids | Double-membrane structures in which photosynthesis reactions occur (chloroplasts), starch accumulates (leucoplasts), and give color to fruits and flowers (chromoplasts) | No | Eat | No | No |

| Lysosomes | Produces the breakdown of various organic substances | No | Eat | Eat | Eat |

| Peroxisomes | Produces the synthesis and transport of proteins and lipids | No | Eat | Eat | Eat |

| Vacuoles | Accumulate cell sap. To move bacterial cells in the water column. Maintains the tense state of cell membranes | No | Eat | No | No |

| Cytoskeleton | The musculoskeletal system of the cell. Changes in cytoskeletal proteins lead to changes in the shape of the cell and the location of organelles in it. | Happens | Eat | Eat | Eat |

| Mesosomes | Artifacts arising during sample preparation for electron microscopy | Eat | No | No | No |

| Drank | Serve to attach bacterial cells to various surfaces | Eat | No | No | No |

| Organelles to move | Serve for movement in space (cilia, flagella, etc.) | Eat | Eat | Eat | No |

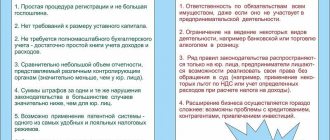

Advantages and disadvantages of each legal form

Analyzing the table given in the section above, we will sample the positive and negative aspects of each business entity. First, let's look at the pros and cons of individual entrepreneurs.

The attractive aspects of this status are:

- simple and quick registration with the tax office, which does not require the preparation of a package of documents (if you participate in person, you need a passport, an application and a receipt for payment of state duty);

- you can do without a current account;

- no round seal required;

- Accounting may not be kept; tax accounting comes down to recording business transactions in the book of income and expenses;

- the most complex taxes have been replaced by a single budget payment, which is paid once a year (if there were no quarterly advances);

- the amount of the single tax paid when using special regimes and “simplified taxation” is significantly lower than the rates that are inherent in VAT, income tax, etc.;

- if there is no staff of hired workers, reporting is submitted quarterly at worst, and once a year at best in the form of a declaration;

- it is possible to do without cash registers, accounting for relevant transactions is simplified;

- a simple procedure for liquidating status, which does not require stage-by-stage meetings, notification of creditors, etc.

The status of an individual entrepreneur also has negative features, such as:

- You will have to answer for obligations that are not secured by the assets of the enterprise with personal funds and property - this is the fundamental difference between an individual entrepreneur and a legal entity;

- not all types of classes are available (excise, some licensed, etc.);

- Individual entrepreneurs usually operate without VAT, as a result of which it is not profitable for organizations to make transactions with entrepreneurs;

- entrepreneurs are reluctant to enter into export-import contracts;

- it is impossible to hire an executive director of an enterprise;

- the business cannot be passed on by inheritance, sold, or even donated;

- You have to pay insurance premiums for yourself even with zero income.

The positive qualities of organizations are:

- members of the company are liable for the obligations of the organization exclusively within the framework of their shares in the constituent capital;

- the participant is given by law the right to leave the company at any time he needs, he is paid the value of the share;

- the enterprise can be sold using legal schemes, the share can be donated or inherited;

- the organization has the right to choose from all existing types of activities;

- you can hire a company manager;

- The purchase of a trademark is permitted.

The negative properties of companies are as follows:

- the registration procedure upon opening involves the preparation of a large volume of documents;

- for registration it is necessary to form an authorized capital and document this process;

- It is difficult to liquidate a company, and it is necessary to carry out a set of measures to hold several meetings of participants, notify creditors through printed means, etc.;

- You cannot work without a current account;

- a round seal is not required by law, but in practice it will be difficult to conclude a deal without it;

- you need to keep accounting records in full, unlike individual entrepreneurs;

- significantly greater responsibility for the offenses committed than that of an individual entrepreneur.

The organization is more complex in management, in the number of registers, but this quality cannot be considered negative, it is dictated by necessity.

Cells of plants, animals, fungi and bacteria

For all organisms, there are two types of cells. These are prokaryotic and eukaryotic cells. They have significant differences. The structure of a eukaryotic cell has a number of differences from a prokaryotic one. Therefore, in the animal world, two superkingdoms were identified, which were called prokaryotes and eukaryotes.

Main difference

The structure of a eukaryotic cell is different in that it has a nucleus in which chromosomes consisting of DNA are located. The DNA of a prokaryotic cell is not organized into chromosomes and does not have a nucleus. Therefore, prokaryotic organisms are called prenuclear, and eukaryotic organisms are called nuclear. The cells differ in size. Eukaryotic cells are much larger than prokaryotic cells. Bacteria are prenuclear organisms.

Eukaryotes include plants, fungi and animals. Consequently, the structural features of a eukaryotic cell consist in the presence of a nucleus. Of course, there are other differences between cells, but they are not significant.