Remunerations received by citizens for work under an employment contract are subject to insurance premiums for injuries. This rule also applies to GPC agreements, but only if it is spelled out in them. Russian citizenship does not affect the payment. Insurers can be: a legal entity, an individual who has entered into an employment agreement with another person, as well as a business owner.

The legislative basis for compulsory insurance against industrial accidents and occupational diseases is determined by Federal Law No. 125 of July 24, 1998 in its current version. Payment of contributions is carried out monthly to the Social Insurance Fund before the 15th day after the month for which they are calculated. If the payment deadline falls on a weekend or holiday, then payment is made on the first working day following it.

The final payment amount depends on the type of activity of the policyholder (organization, individual entrepreneur), the applicable tariff and the right to benefits. The interest rate determines the professional risk class of the insured. There are 32 active classes in total (Law No. 179-FZ, clause 1).

The risk class depends on the main type of activity of the insured (separate divisions). The full list of classes along with current tariffs is listed in the corresponding Classification of types of economic activities (Order of the Ministry of Labor of the Russian Federation No. 851n dated December 30, 2016). The tariffs vary from 0.2 to 8.5%.

If the obligated person does not timely certify the main type of activity for the past year, the Social Insurance Fund has the right to classify such a payer as the highest class of professional risk. Then payments for injuries, which were calculated and paid at a lower rate, are recalculated. The missing part will need to be paid (

Deadlines for payment of insurance premiums for injuries in 2020

Payers of fees are both legal entities and individual entrepreneurs who use hired labor in production activities. The subject of taxation is the wages of employees accrued on the basis of employment agreements or civil contracts.

The following payments are not subject to personal injury contributions:

- financial assistance provided in case of emergency;

- government benefits;

- compensation for work in difficult conditions;

- monetary compensation related to the reduction of staff during the liquidation of the company;

- payments in connection with advanced training.

Tax legislation states that payments for injuries must be paid no later than the 15th day of the month following the reporting month. For example, contributions based on payments for April must be transferred before May 15. If this day falls on a weekend, payments must be made on the next business day. Otherwise, penalties will be applied to a legal entity or individual entrepreneur in the form of:

- a fine, the amount of which is 20-40% of the accrued amount of contributions;

- penalties, which are calculated based on the key rate of the Central Bank of the Russian Federation for each day of delay (1/300 of the key rate).

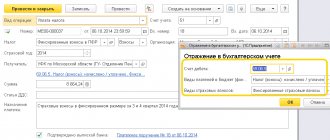

In the payment order you must correctly indicate the details: the recipient's current account, its name, code, purpose of payment indicating the payment period, BCC.

General changes

Since 2020, the bulk of the powers regarding contributions to social funds have passed to the Russian Tax Service. This fully applies to insurance contributions to the Social Insurance Fund in 2020 . First of all, we are talking about monitoring deductions at current rates, collecting debts on them, receiving and analyzing reports.

These amendments are already present in the regulatory framework. Thus, from January 1, 2020, the Law on Insurance Contributions No. 212-FZ ceases to exist, and a new Chapter 34 of the Tax Code takes its place.

From Law No. 212-FZ on insurance premiums, the following rules migrated to the Tax Code of the Russian Federation:

- about reporting periods: first quarter, half a year and 9 months;

- billing period: year;

- who is obliged to pay: firms, individual entrepreneurs, lawyers, notaries and other private practitioners;

- object: same payments;

- the size of reduced insurance premium rates;

- base for calculating contributions (the rules are almost the same).

True, you will have to deal with new reporting forms, because you will have to send them to the tax authorities. In addition, the deadlines for submitting reports have been shifted.

For more information, see “Deadline for submitting reports to the Social Insurance Fund in 2020.”

The criteria that must be met in order to be eligible for reduced rates of insurance contributions to the Social Insurance Fund in 2020 . Plus, the list of such requirements has been expanded.

The moment of loss of the right to reduced rates of insurance contributions to the Social Insurance Fund in 2020 : now the Tax Code of the Russian Federation states that this happens “retroactively” - from the beginning of the last annual period.

The most basic thing regarding policyholders has not undergone major changes: the procedure for calculating and making contributions to the Social Insurance Fund in 2017 remained the same.

Reporting on contributions for injuries in 2017 to the Social Insurance Fund

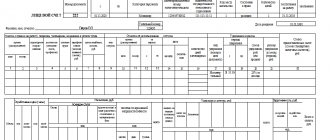

Contributions for employees are calculated and paid every month. The report is submitted quarterly. Since 2020, a new form of reporting on contributions for injuries has been introduced - 4-FSS. It was approved by FSS order No. 381 dated September 26, 2016. Now the document does not indicate information about contributions and expenses for disability and maternity. These contributions are already paid to the Federal Tax Service. The report left a section for organizations that send employees to another place of work. For example, to another company.

Reports can be submitted on paper before the 20th day of the month following the reporting quarter. You can also submit the report electronically. This must be done before the 25th day of the month following the reporting quarter.

Procedure for the policyholder when paying premiums for injuries

Every month after the salary is calculated, the obligated person withholds from it and pays contributions for injuries in accordance with a unified scheme.

| Step-by-step actions of the payer when deducting contributions for injuries | Explanations |

| Determine the taxable base | It includes only those payments to the employee that are subject to injury contributions by law. |

| Find out the insurance rate | Determined in accordance with the current Classification of Economic Activities |

| Take into account the right to benefits, if any. | Existing benefits apply to tariff reductions |

| Calculate the amount of contribution to be paid to the budget | The standard formula is used: earnings * insurance rate; preferential rates apply if the payer is entitled to it |

| Draw up a payment order for payment of the calculated amount of contributions | Mandatory information in which errors must not be made: KBK 393 1 0200 160, UFK account number, name of the recipient's bank; if the specified data is incorrectly indicated, the insurance payment is considered not transferred (Federal Law No. 125, Article 26.1, clause 7, clause 4) |

| Pay the fee | The deadline for payment is the 15th day of the month following the reporting month. |

Sample payment order for payment of contributions for injuries

Sample of filling out a payment order for payment of contributions for injuries

Contribution rates for injuries in 2017

Rates for payment of contributions are determined in accordance with the class of professional risk. It depends on the type of activity of the organization or individual entrepreneur, which is indicated in the Unified State Register of Individual Entrepreneurs or the Unified State Register of Legal Entities. Tariffs are set within certain limits: from 0.2% to 8.5% for payments or other remuneration in favor of insured persons working on the basis of labor agreements and civil contracts.

Injury contributions in 2020: rates

| Occupational risk class | Rate |

| I | 0,2 |

| II | 0,3 |

| III | 0,4 |

| IV | 0,5 |

| V | 0,6 |

| VI | 0,7 |

| VII | 0,8 |

| VIII | 0,9 |

| IX | 1 |

| X | 1,1 |

| XI | 1,2 |

| XII | 1,3 |

| XIII | 1,4 |

| XIV | 1,5 |

| XV | 1,7 |

| XVI | 1,9 |

| XVII | 2,1 |

| XVIII | 2,3 |

| XIX | 2,5 |

| XX | 2,8 |

| XXI | 3,1 |

| XXII | 3,4 |

| XXIII | 3,7 |

| XXIV | 4,1 |

| XXV | 4,5 |

| XXVI | 5 |

| XXVII | 5,5 |

| XXVIII | 6,1 |

| XXIX | 6,7 |

| XXX | 7,4 |

| XXXI | 8,1 |

| XXXII | 8,5 |

The risk class can be established on the basis of OKVED or a special classifier, which was adopted by Order of the Ministry of Labor No. 851. To determine the rate, you must initially confirm the OKVED. To do this, an application confirming the main type of activity is submitted to the Social Insurance Fund. An explanatory note for the previous year and a certificate of identification are attached to it.

Important! If an entrepreneur or legal entity has not submitted any information about their organization to clarify the risk class, the FSS will set the rate independently. It cannot be disputed. This is prohibited by Decree No. 551 of June 17, 2016.

In 2020, benefits remained for entrepreneurs who hire employees with disabilities: disabled people of groups I, II, III. Individual entrepreneurs pay 60% of the generally established tariff. There are no plans to cancel preferential tariffs in 2018-2019. Also, changes in future years should not affect the established rates.

BASIC

Contributions for insurance against accidents and occupational diseases can be taken into account when calculating income tax (subclause 45, clause 1, article 264 of the Tax Code of the Russian Federation).

If the organization uses the cash method, then include the accrued amount of contributions as expenses as it is transferred to the budget of the Federal Social Insurance Fund of Russia (clause 3 of Article 273 of the Tax Code of the Russian Federation).

If an organization uses the accrual method, the moment at which contributions are recognized depends on whether the remuneration from which they are accrued relates to direct or indirect expenses.

Contributions that relate to direct expenses are included in the tax base as products are sold, in the cost of which they are taken into account (paragraph 2, paragraph 2, article 318 of the Tax Code of the Russian Federation).

If an organization is engaged in the production and sale of products (works, services), determine the list of direct expenses in the accounting policy (clause 1 of Article 318 of the Tax Code of the Russian Federation).

Attention: when approving the list of direct expenses in the accounting policy, keep in mind that the division of expenses into direct and indirect must be economically justified (letter of the Ministry of Finance of Russia dated January 26, 2006 No. 03-03-04/1/60). Otherwise, the tax office may recalculate the income tax.

Thus, take into account salaries and contributions accrued on them for employees directly involved in production as part of direct expenses. The salary and fees accrued on it for the administration of the organization are classified as indirect expenses. In trade organizations, salaries and contributions accrued from them are recognized as indirect expenses (paragraph 3 of Article 320 of the Tax Code of the Russian Federation).

Situation: at what point should contributions for insurance against accidents and occupational diseases be taken into account when calculating income tax? Insurance premiums are classified as indirect costs. The organization recognizes income and expenses on an accrual basis.

When calculating income tax, insurance premiums that are classified as indirect expenses should be taken into account in the period in which they were accrued.

Contributions for insurance against accidents and occupational diseases are classified as other expenses associated with production and sales (subclause 45, clause 1, article 264 of the Tax Code of the Russian Federation), and represent mandatory payments that are transferred to the budget in accordance with the requirements of the law (art. 22 of the Law of July 24, 1998 No. 125-FZ). Therefore, with the accrual method, the moment of inclusion of insurance premiums in expenses must be determined in accordance with paragraph 7 of Article 272 of the Tax Code of the Russian Federation. All obligatory payments to the budget, in accordance with subparagraph 1 of this paragraph, are recognized as of the accrual date. Accordingly, the part of insurance premiums attributed to indirect expenses can be included in the calculation of the tax base in the reporting (tax) period in which they were accrued (on the last day of the month). Insurance premiums are taken into account as expenses at a time, even if the payments for which they are accrued relate to different reporting (tax) periods. This conclusion follows from letters of the Ministry of Finance of Russia dated April 13, 2010 No. 03-03-06/1/256, dated April 13, 2010 No. 03-03-06/1/258, dated April 2, 2010 No. 03- 03-06/1/214, dated February 16, 2004 No. 04-02-05/1/14 and the Federal Tax Service of Russia dated April 7, 2010 No. 3-2-12/21.

It should be noted that the letter of the Ministry of Finance of Russia dated March 28, 2008 No. 03-03-06/1/212 reflected a different position. It stated that contributions for insurance against accidents and occupational diseases should be taken into account in the same manner as other expenses for compulsory and voluntary insurance. That is, if contributions are accrued for remuneration that is included in indirect expenses, they are recognized in tax accounting at the time of payment. This approach was based on the provisions of paragraph 6 of Article 272 of the Tax Code of the Russian Federation.

With the release of later clarifications, the previous point of view of the Russian Ministry of Finance has lost its relevance. Moreover, arbitration practice confirms the first point of view (see, for example, decisions of the Federal Antimonopoly Service of the West Siberian District dated September 20, 2006 No. F04-4102/2005(26428-A27-33), dated May 16, 2005 No. F04- 3106/2005(11700-A27-40), Ural District dated June 1, 2005 No. F09-2347/05-S7). The judges point out that the norms of paragraph 6 of Article 272 of the Tax Code of the Russian Federation regulate the procedure for tax accounting of insurance contributions (premiums) that organizations accrue on the basis of agreements concluded with insurance companies or non-state funds (for example, compulsory motor liability insurance, non-state medical or pension insurance for employees, etc.). P.). At the same time, the provisions of this paragraph establish different options for writing off insurance premiums as expenses depending on the duration of the contract and the method of paying premiums (one-time payment or in installments). In the case of insurance against accidents and occupational diseases, the organization does not conclude any insurance contracts. Organizations pay contributions for insurance against accidents and occupational diseases on a monthly basis on the basis of registration certificates at the territorial offices of the Federal Social Insurance Fund of Russia in the manner and within the time limits established by Article 22 of Law No. 125-FZ of July 24, 1998. These contributions are mandatory payments that are taken into account when calculating income tax in accordance with subparagraph 1 of paragraph 7 of Article 272 of the Tax Code of the Russian Federation.

An example of how contributions for insurance against accidents and occupational diseases are reflected in accounting and tax accounting. The organization applies a general taxation system and calculates income tax using the accrual method

OJSC "Proizvodstvennaya" has established a single rate of contributions for insurance against accidents and occupational diseases - 1 percent of the wage fund. “Master” reports income tax quarterly. According to the accounting policy, for tax purposes, labor costs for workers directly involved in the production of products are included in direct expenses. Costs for remuneration of administrative and managerial personnel of the organization are taken into account as indirect costs.

In March, the organization calculated salaries:

- workers directly involved in the production of products - in the amount of 500,000 rubles. The amount of contributions for insurance against accidents and occupational diseases accrued on the salaries of production workers amounted to 5,000 rubles. (RUB 500,000 × 1%);

- administrative and managerial staff - in the amount of 750,000 rubles. The amount of contributions for insurance against accidents and occupational diseases is 7,500 rubles. (RUB 750,000 × 1%).

In April, the accountant calculated contributions for insurance against accidents and occupational diseases for March in the amount of 12,500 rubles. (5000 rub. + 7500 rub.).

The entire amount of insurance premiums was transferred to the budget of the Federal Social Insurance Fund of Russia on April 5.

All products manufactured in March were sold. There are no work in progress balances. Therefore, when calculating income tax for the first quarter, the entire amount of direct expenses was taken into account, including the wages of production workers and the contributions accrued on it for insurance against accidents and occupational diseases.

The salaries accrued to the administrative and managerial staff of Master are also taken into account when calculating income tax for the first quarter. When determining the composition of expenses, the “Master” accountant is guided by subparagraph 1 of paragraph 7 of Article 272 of the Tax Code of the Russian Federation. Therefore, he also took insurance premiums into account when calculating income tax for the first quarter.

The following entries were made in the organization's accounting (entries related to the calculation of contributions to compulsory pension (social, medical) insurance are not considered).

In March:

Debit 20 Credit 70 – 500,000 rub. – wages of production workers for March were accrued;

Debit 25, 26 Credit 70 – 750,000 rub. – salaries of administrative and management personnel for March were accrued;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 5,000 rubles. – contributions for insurance against accidents and occupational diseases were calculated from the salaries of production workers for March;

Debit 25, 26 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 7,500 rubles. – contributions for insurance against accidents and occupational diseases were calculated from the salaries of administrative and management personnel for March.

In April:

Debit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” Credit 51 – 12,500 rubles. – premiums for insurance against accidents and occupational diseases for March have been paid.

Situation: is it possible to take into account the surcharge to the rate of contributions for insurance against accidents and occupational diseases when calculating income tax?

Answer: yes, you can.

When calculating income tax, take into account the entire amount of contributions accrued based on the tariff established by the organization for the current year with a surcharge.

The Federal Social Insurance Fund of Russia sets the contribution rate based on the basic one, corresponding to the main activity of the organization, and an allowance (discount). That is, the tariff assigned to the organization for the current year already contains a surcharge (discount). This follows from paragraph 1 of Article 22 of the Law of July 24, 1998 No. 125-FZ and is confirmed by the form of notification of the amount of contributions. In this document, the tariff assigned to the organization must be indicated taking into account surcharges (discounts).

Contributions for insurance against accidents and occupational diseases are calculated based on the tariff containing the premium. That is, premium contributions are not calculated separately. This procedure for calculating contributions for insurance against accidents and occupational diseases follows from paragraph 1 of Article 22 of Law No. 125-FZ of July 24, 1998. Therefore, take into account the entire amount of contributions calculated based on the tariff containing the surcharge when calculating income tax (subclause 45, clause 1, article 264 of the Tax Code of the Russian Federation).

Do not pay attention to paragraph 2 of paragraph 2 of Article 22 of the Law of July 24, 1998 No. 125-FZ, which states that the amount of the tariff premium is paid from net profit. The fact is that the procedure for calculating income tax from January 1, 2002 is regulated by Chapter 25 of the Tax Code of the Russian Federation. The Law of July 24, 1998 No. 125-FZ defines only the legal, economic and organizational basis for insurance against accidents and occupational diseases (preamble to the Law of July 24, 1998 No. 125-FZ).

Situation: when calculating income tax, is it possible to take into account contributions for insurance against accidents and occupational diseases accrued from payments that do not reduce taxable profit?

Answer: yes, you can.

When calculating income tax, contributions for insurance against accidents and occupational diseases accrued in accordance with the law are taken into account (subclause 45, clause 1, article 264 of the Tax Code of the Russian Federation).

The object of taxation of insurance premiums is defined in paragraph 1 of Article 20.1 of the Law of July 24, 1998 No. 125-FZ. A closed list of payments that are not subject to insurance premiums is given in Article 20.2 of the Law of July 24, 1998 No. 125-FZ. This list does not provide any exceptions for payments that are not taken into account when calculating income tax. Consequently, contributions for payments that do not reduce the income tax base are calculated in accordance with the law. This means that they can be taken into account when calculating income tax (subclause 45, clause 1, article 264 of the Tax Code of the Russian Federation).

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated September 3, 2012 No. 03-03-06/1/457.

Situation: how can an OSNO organization take into account when taxing the financing of preventive measures to reduce injuries and occupational diseases through insurance premiums?

When taxing profits, the amounts of contributions aimed at financing preventive measures, as well as expenses paid from these funds, are not taken into account.

When calculating income tax, an organization includes in its income:

- income from sales (Article 249 of the Tax Code of the Russian Federation);

- non-operating income (Article 250 of the Tax Code of the Russian Federation).

This procedure is provided for in paragraph 1 of Article 248 of the Tax Code of the Russian Federation.

Income for tax purposes is recognized as economic benefit in cash or in kind (Article 41 of the Tax Code of the Russian Federation). The organization must use the amounts of funding for preventive measures to reduce injuries and occupational diseases strictly for their intended purpose (clauses 12−14 of the Rules approved by Order of the Ministry of Labor of Russia dated December 10, 2012 No. 580n). The list of activities subject to such financing is given in paragraph 3 of the Rules, approved by Order of the Ministry of Labor of Russia dated December 10, 2012 No. 580n.

Thus, when financing preventive measures to reduce injuries and occupational diseases at the expense of the Russian Social Insurance Fund, the organization does not receive economic benefits, which means that such amounts do not need to be taken into account as part of taxable income.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated September 24, 2010 No. 03-03-06/1/615 and dated August 14, 2007 No. 03-03-06/1/568.

Input VAT on expenses incurred as part of the implementation of measures to reduce injuries and occupational diseases can be deducted on a general basis (clause 2 of Article 171 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated September 24, 2010 No. 03-03-06/1 /615).

Insurance premiums (part of them) can be directed to finance the prevention of injuries and occupational diseases only with the permission of the territorial branches of the Federal Social Insurance Fund of Russia (clause 8 of the Rules approved by Order of the Ministry of Labor of Russia dated December 10, 2012 No. 580n). However, some organizations incur the cost of financing preventative measures before obtaining such approval. They can be offset against the payment of insurance premiums against accidents and occupational diseases. This conclusion follows from paragraph 2 of paragraph 5 of the letter of the FSS of Russia dated February 20, 2008 No. 02-18/06-1536. This letter is based on the norms of the no longer valid Rules, approved by order of the Ministry of Health and Social Development of Russia dated January 30, 2008 No. 43n. However, it can still be used as a guide today.

At the same time, it is impossible to reduce taxable profit by the amount of expenses financed by the Federal Social Insurance Fund of Russia (clause 1 of Article 252 of the Tax Code of the Russian Federation). If the organization previously took them into account when calculating income tax, the tax base needs to be adjusted. There are no explanations from regulatory agencies regarding the period in which this needs to be done (when the organization actually incurred expenses or when the organization received permission from the Federal Social Insurance Fund of Russia to finance through contributions). The following option seems to be the most correct. The tax base needs to be adjusted in the period in which the organization received permission for financing from the Federal Social Insurance Fund of Russia. There is no need to make changes to previous reporting periods and submit an updated declaration. This requirement applies only to cases of erroneous understatement of tax (clause 1, article 54, clause 1, article 81 of the Tax Code of the Russian Federation). An organization that incurred expenses to finance preventive measures to reduce injuries and occupational diseases before receiving permission from the Federal Social Insurance Fund of Russia and took them into account when calculating income tax, acted lawfully (did not make a mistake).

An example of how expenses for financing preventive measures to reduce injuries and occupational diseases are reflected in accounting and taxation

The expenses were incurred after receiving permission from the Federal Social Insurance Fund of Russia. The organization applies a general taxation system.

OJSC "Proizvodstvennaya" finances preventive measures to reduce injuries. The organization uses the accrual method and calculates income tax quarterly.

The organization has established a rate of contributions for insurance against accidents and occupational diseases in the amount of 1 percent (corresponding to the 9th class of professional risk).

In June, the organization accrued salaries in favor of its employees in the amount of 1,250,000 rubles.

The accountant calculated contributions for insurance against accidents and occupational diseases for June in the amount of 12,500 rubles. (RUB 1,250,000 × 1%).

In June, the organization received permission to purchase personal protective equipment for employees using contributions for insurance against accidents and occupational diseases. The amount of financing was 8260 rubles. In the same month, the organization purchased personal protective equipment in the amount of 8,260 rubles for employees engaged in work with harmful production factors. (including VAT - 1260 rubles). In July, all protective equipment within the industry standards was provided to employees engaged in work with hazardous production factors. The accountant counted their cost towards the payment of contributions for insurance against accidents and occupational diseases.

The accountant reflects personal protective equipment included in the materials on account 10-10 “Special equipment and special clothing in warehouse” and account 10-11 “Special equipment and special clothing in operation” (clause 11 of the Methodological guidelines approved by order of the Ministry of Finance of Russia dated December 26, 2002 No. 135n).

In accounting, the Master's accountant made the following entries.

In June:

Debit 20 Credit 70 – 1,250,000 rub. – salaries for June have been accrued;

Debit 20 Credit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 12,500 rubles. – premiums for insurance against accidents and occupational diseases for June have been calculated;

Debit 76 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” Credit 86 - 8260 rubles. – permission was received to purchase personal protective equipment for employees using contributions for insurance against accidents and occupational diseases;

Debit 10-10 Credit 60 – 7000 rub. – personal protective equipment was purchased for employees engaged in work with harmful production factors;

Debit 19 Credit 60 – 1260 rub. – reflects the “input” VAT on property acquired as part of measures to reduce injuries and occupational diseases;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 1260 rub. – accepted for deduction of VAT on property acquired as part of measures to reduce injuries and occupational diseases;

Debit 60 Credit 51 – 8260 rub. – paid for personal protective equipment;

Debit 69 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” Credit 76 subaccount “Settlements with the Social Insurance Fund for contributions to insurance against accidents and occupational diseases” - 8260 rubles. – the debt to the Federal Social Insurance Fund of Russia for insurance premiums was reduced by the amount of expenses incurred;

Debit 86 Credit 98-2 – 8260 rub. – funds allocated to finance preventive measures are reflected in deferred income.

When calculating income tax for the first half of the year, the accountant included the amount of contributions for insurance against accidents and occupational diseases (12,500 rubles) as expenses.

In July:

Debit 10-11 Credit 10-10 – 7000 rub. – personal protective equipment was issued to employees engaged in work with harmful production factors, the cost of which is financed by the Federal Social Insurance Fund of Russia;

Debit 20 Credit 10-11 – 7000 rub. – the cost of personal protective equipment issued to employees has been written off;

Debit 98-2 Credit 91-1 – 8260 rub. – other income is recognized in the amount of expenses actually incurred aimed at financing preventive measures to reduce injuries and occupational diseases.

The amounts of targeted financing of preventive measures to reduce injuries and occupational diseases (RUB 8,260) are included in other income in accounting (paragraph 3 of clause 9 of PBU 13/2000). When calculating income tax for nine months, this amount is not taken into account as income. As a result, a permanent difference in the amount of 8,260 rubles arises in accounting. and the corresponding permanent tax asset (clauses 4, 7 PBU 18/02):

Debit 68 subaccount “Calculations for income tax” Credit 99 – 1652 rubles. (RUB 8,260 × 20%) – a permanent tax asset is reflected.

The cost of personal protective equipment is 7,000 rubles. In accounting it is included in production expenses. When calculating income tax for nine months, this amount is not taken into account. As a result, there is a permanent difference of 7,000 rubles. and the corresponding permanent tax liability (clauses 4, 7 PBU 18/02):

Debit 99 Credit 68 subaccount “Calculations for income tax” – 1400 rubles. (RUB 7,000 × 20%) – a permanent tax liability is reflected.

Contributions for injuries in 2020: details

In the payment order for the transfer of contributions, you must indicate the correct information about the recipient:

- the name of the regional division of the Social Insurance Fund and the UFC in the region;

- Checkpoint and TIN of the regional FSS;

- name of the recipient's bank in the region;

- Bank BIC;

- recipient's current account.

In the main part you need to indicate the basis for the payment, its priority, the period of payment, as well as the purpose of the payment. In the KBK field (“104”) indicate the correct budget classification code. You can find it on the Tax Inspectorate website. You also need to indicate your taxpayer status. He is selected on the basis of Appendix No. 5 to Order No. 107n.

Responsibility for failure to pay contributions on time

The type of liability depends on which contribution is not paid on time:

- In case of temporary disability and maternity (at the Federal Tax Service).

Missing the deadline for paying the contribution to VNIM (in the absence of errors in the DAM) threatens the employer with the accrual of penalties for each day of delay (Article 122 of the Tax Code of the Russian Federation, paragraph 19 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57). If the reason for not transferring the contribution was an error in the DAM, then in addition to penalties, the tax office will charge a fine of 20% of the amount owed. In case of intentional non-payment, the fine will be 40%.

- From industrial accidents and occupational diseases (in the Social Insurance Fund).

Responsibility for non-payment of contributions to the Social Insurance Fund is established by Law No. 125-FZ of July 24, 1998 “On compulsory social insurance against accidents...”. For late payment of injury contributions, the employer will be charged both penalties and a fine. It does not matter what caused the payment deadline to be missed: an error in the calculation or the forgetfulness of the accountant.

Calculation of contributions for injuries in 2017

Every month, an individual entrepreneur or legal entity must pay contributions for injuries. They are accrued depending on the accounting program: for each employee or for the general wage fund. To make the calculation, you must first determine the tax base. It includes the following payments:

- wage;

- vacation pay for educational and annual leave;

- bonuses;

- payment based on average earnings for business trips;

- payments for work under civil law contracts (if they stipulate the calculation of contributions from the Tax Service).

For correct calculations, the following formula is established:

Base for contributions for injuries = Payments under employment agreements (GPA) – Non-taxable payments

Next, you need to take into account the contribution percentage that is established by the Social Insurance Fund. After this, you can calculate the amount of the injury contribution. For this, the following formula is established:

Contribution base for injuries (taxable payments) x Tariff (%)

The amount received is transferred as payment for contributions for injuries to the Social Insurance Fund. To ensure that the tariff of an individual entrepreneur or legal entity does not change, it must be confirmed every year. To do this, a corresponding application is submitted to the FSS.

An example of calculating insurance premiums for injuries in 2020

The company needs to calculate and pay contributions for injuries for May 2017. The accountant accrues to employees:

- salary – RUB 1,542,120.00;

- travel allowances – RUB 3,520.00;

- remuneration for length of service – RUB 125,470.00;

- pregnancy benefit – RUB 284,250.00;

- vacation compensation – RUB 58,730.00;

- bonus for the quarter – RUB 617,800.00.

These payments need to be summed up. Subtract from them those that are not subject to contributions.

2542120+125470+3520-284250+617800-58730 = 1,945,930.00 rubles.

According to the OKVED classification, the enterprise code is 10.52. It is classified as risk class “3”. The tariff is 0.4%. Let's do the calculations:

1945930 x 0.4% = 7,783.72 rubles.

This amount must be transferred to the Social Insurance Fund.

Calculation of contributions for injuries: standard formula and benefits

The payer is obliged to calculate contributions monthly immediately after accrual of earnings. The taxable base can be: salary, additional payment for length of service, allowances, bonuses, vacation pay, travel allowances, remuneration under GPC agreements.

The standard formula for calculating the paid amount of contributions for injuries is the same for all obligated persons: earnings * insurance rate. In this case, earnings include only those payments that are subject to insurance contributions. The list of amounts from which contributions are not calculated is indicated in Article 20.2 of Federal Law No. 125. Thus, insurance amounts are not withheld from state benefits, tuition payments, compensation for work in hazardous conditions, or accruals upon liquidation of an organization. There is no maximum base for calculating this type of insurance.

The amount of the injury contribution, which, according to the results of calculations, is payable, the obligated person has the right to reduce by the amount of certain payments . These include:

- Vacation pay for additional rest (vacation for sanatorium treatment under the Social Insurance Fund voucher).

- Sick leave benefits (in case of an accident at work or occupational disease).

- Other types of financing that are carried out to reduce injuries at work.

The calculation also takes into account the benefits that certain categories of payers are entitled to. For example, individual entrepreneurs have the right to pay contributions for disabled people of groups 1, 2, 3 in the amount of 60% of generally accepted tariff rates. An organization (IP) can receive a discount on the tariff rate if the following conditions are met:

- The activity is carried out for at least 3 years from the date of registration.

- There are no “insurance” debts.

- There were no fatal accidents.

- All insurance payments are made correctly and on time.

The maximum discount that can be claimed if these conditions are met is 40% of the tariff. To obtain the right to use a preferential rate next year, the payer must submit an application before the end of November of this year (Read also the article ⇒ Fixed insurance premiums for individual entrepreneurs in the Pension Fund of the Russian Federation in 2020).

How to calculate contributions for injuries to the Social Insurance Fund for a disabled person in 2020

If a legal entity or individual entrepreneur employs disabled people of groups I-III, he is entitled to benefits when paying contributions for injuries. He must pay 60% of the basic tariff rate corresponding to OKVED.

For example, the company has been assigned the third class of professional risk. It corresponds to a tariff of 0.4%. Injury contributions for payments to disabled employees are assessed at a reduced rate of 0.24%. It is calculated as follows: 0.4x60% = 0.24%.

FSS income

They are formed from insurance premiums of employers (administration of enterprises, organizations, institutions and other economic entities, regardless of their form of ownership), as well as insurance premiums of citizens engaged in self-employment and required to pay social insurance contributions in accordance with the law.

All funds of the fund are not included in the budgets of the corresponding levels, other funds, are not subject to withdrawal and are federal property. The Fund’s budget and the report on its implementation are approved by the federal law “On the budget of the Social Insurance Fund of the Russian Federation”, and the budgets of the regional and central sectoral branches of the fund and reports on their implementation are approved by the chairman of the Fund.

For example, the total amount of money received by the Social Insurance Fund in 2009 amounted to 440.1 billion rubles, in 2010 - 463.8 billion rubles, in 2011 - 558.6 billion rubles. Structure of FSS income for 2009-2011 presented on the chart (in million rubles)

3.1 Reporting to the FSS

Payers of insurance contributions who make payments to individuals transfer contributions and submit reports to the Social Insurance Fund. Organizations and individual entrepreneurs with employees submit reports to the Social Insurance Fund (individual entrepreneurs without employees do not submit reports to the Social Insurance Fund).

FSS reporting - calculation of accrued and paid insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity (administered by the tax office from January 1, 2017) and for compulsory social insurance against industrial accidents and occupational diseases, as well as expenses for payment of insurance coverage.

3.2 Deadline for transferring FSS contributions and their amount

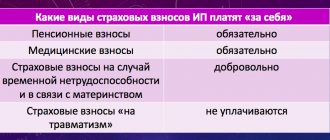

In addition to submitting reports, policyholders are required to transfer contributions to the Social Insurance Fund. Two types of contributions are subject to transfer:

- contributions to the Social Insurance Fund for temporary disability and in connection with maternity (administered by the tax office from January 1, 2017);

- contributions to the Social Insurance Fund for injuries.

The amount of contributions to the Social Insurance Fund for temporary disability and in connection with maternity is 2.9% of the salary.

The amount of contributions to the Social Insurance Fund for injuries ranges from 0.2% to 8.5% of wages. After you confirm your main activity, the Fund will assign your organization a professional risk class, according to which you will transfer the interest.

If reporting is submitted once a quarter, then contributions must be transferred to the budget monthly, until the 15th of the next month.

3.3 FSS fines

For accurate execution of the revenue side of the FSS budget, a tool is provided - fines:

- Violation of the registration deadline by the policyholder - fines from 5 to 10 thousand rubles (Article 26.28 125-FZ);

- Failure to pay FSS contributions . For non-payment or incomplete payment of amounts of insurance premiums as a result of understating the base for calculating insurance premiums, other incorrect calculation of insurance premiums or other unlawful actions (inaction) of insurance premium payers, entails a fine of 20% of the unpaid amount of insurance premiums (Article 26.29 125-FZ) ;

- Evasion of payment of insurance premiums . On August 10, 2020, two Laws came into force at once, aimed at improving the legislation on liability for crimes and other offenses related to non-payment of insurance premiums. Thus, criminal legal protection of these payments has been restored. From August 10, 2020, evasion of payment of insurance premiums is recognized as a criminal offense, the minimum penalty for which is a fine of 100,000 rubles, and the maximum is imprisonment for up to six years (Federal Law N 250-FZ). Criminal liability begins if the arrears arise on a large or especially large scale. In relation to contributions administered by tax authorities, an amount that includes arrears not only of contributions, but also of taxes and fees will be considered unpaid. Such arrears should amount to more than 5 million rubles. within three financial years in a row, provided that the share of unpaid taxes, fees, and insurance premiums exceeds 25% of the amounts payable. If the arrears turn out to be more than 15 million rubles, its share will not matter. For insurance premiums for injuries, evasion of payment on a large scale is considered to be an amount exceeding RUB 2,000,000. However, if the crime is committed for the first time, you can be released from criminal liability. To do this, you must fully pay off the arrears, penalties and fines. Also on August 10, Federal Law No. 272-FZ came into force, which regulates the interaction of the Social Insurance Fund, the Department of Internal Affairs and investigative authorities in identifying cases of evasion of payment of insurance premiums for injuries. Now the territorial bodies of the Social Insurance Fund are obliged to send the relevant case materials to the investigative authorities if the payer, within two months from the date of expiration of the established period, has not fulfilled the requirement to pay arrears in insurance premiums, penalties and fines, the amount of which allows us to assume that an offense containing elements of a crime has been committed;

- Failure to submit calculations for accrued and paid insurance premiums to the Social Insurance Fund . A fine of 5 percent of the amount of insurance premiums accrued for payment for the last three months of the reporting (calculation) period, for each full or partial month from the date established for its submission, but not more than 30 percent of the specified amount and not less than 1000 rubles (Article 26.30 125-FZ);

- Refusal to submit or failure to provide the insurer with documents necessary to monitor the payment of insurance premiums. A fine of 200 rubles for each document not submitted (Article 26.31 125-FZ).