How to register an individual entrepreneur as an employee

- To officially employ a person, an entrepreneur must conclude an agreement with him. There are labor and civil law contracts (GPC). Read more about the types of contracts below.

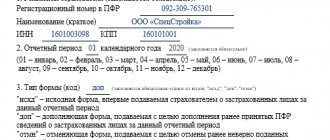

- Then you need register to the Pension Fund and in the FSS as an employer.

In accordance with paragraphs. 2 p. 1 art. 11 of Law No. 167-FZ individual entrepreneur starting from 2017 should not apply to register as an employer to the Pension Fund of Russia: “individuals who have entered into employment contracts with employees are subject to registration with the territorial body of the Pension Fund of the Russian Federation within a period not exceeding three working days from the date of submission by tax authorities to the territorial bodies of the insurer of information contained in the unified state register of taxpayers on registration or deregistration of data individuals. The procedure for transferring this information is determined by an agreement between the insurer and the tax authorities.” Now the individual entrepreneur has no obligation to submit applications to the Pension Fund. Registration is carried out automatically. The obligation to register with the Social Insurance Fund remains.The deadline for registration with the Social Insurance Fund in 2020 is 30 days from the date of conclusion of the contract with the employee (Article 6 of the Federal Law dated July 24, 1998 No. 125-FZ):

Registration of policyholders is carried out in the territorial bodies of the insurer:

policyholders - individuals who have entered into an employment contract with an employee at the place of residence of the policyholder on the basis of an application for registration as an policyholder, submitted no later than 30 calendar days from the date of conclusion of the employment contract with the first of the hired employees;

- Next, you need to draw up documents for hiring the employee (if an employment contract was concluded and not a GPC): employment order

- employee personal card

- entry in work book

Registration of an employee with an individual entrepreneur

Having found the answer to the question of how many workers an individual entrepreneur can hire on the chosen taxation system, the businessman can begin to form the team of the enterprise.

This process has the following features:

- A candidate for a position writes an application with a request to be hired for a certain position.

- An employment contract (hiring agreement) is concluded with each hired employee.

- Acceptance orders are issued.

- Make entries in work books.

- You need to register an individual entrepreneur with the Social Insurance Fund by submitting documents (employment agreement, copy of the order, copy of the work book with entry) for the first hired employee to the territorial office of the fund. The procedure should be carried out within 10 days from the date of conclusion of the contract.

- You should also register at the Pension Fund branch by submitting the same set of documents. Pension Fund employees will certainly check whether the FSS mark is on the contract. Documents must be submitted within 30 days.

When registering a second and subsequent employee for an individual entrepreneur, this procedure does not need to be completed.

Application for a job

Some of the documents drawn up during employment are not provided for by the Labor Code of the Russian Federation, but are needed for internal procedures. These documents include a job application. That is, in 2020, an individual entrepreneur can hire workers without writing an application; another question is whether this should be done?

We recommend you study! Follow the link:

Does an individual entrepreneur pay personal income tax for himself and for his employees?

The basic conditions of cooperation between the employer and the employee are stipulated in the employment contract, which is a mandatory component of the labor relationship. In accordance with this document, an order is issued recording the fact of registration for the position.

The Labor Code of the Russian Federation does not contain legal norms that make it possible to determine whether it is necessary to write an application for hiring an employee and how an individual entrepreneur can hire an employee if this application is not required. The answer follows from business practice.

The employer requires the application to be drawn up based on the following considerations:

- this document confirms that the employee agrees to the conditions offered to him;

- the application can include some nuances that are unacceptable for the strict text of the employment agreement;

- It’s easier for the HR department to rely on the date indicated on the application.

The hiring rules do not provide for a strict form of this written application; enterprises use traditional templates, even forms where only the candidate’s data must be inserted. An entrepreneur can also go this route.

Employment contract

All conditions of employment with an individual entrepreneur are stipulated in the employment contract. This document is drawn up in strict accordance with the Labor Code of the Russian Federation. As a rule, a sample is used that takes into account all the features of the enterprise.

The employment contract must contain the following information:

- individual data of the employee and entrepreneur;

- place of employment, position, functional responsibilities of the employee;

- date of conclusion of the agreement and its validity period;

- work schedule;

- remuneration system, if fixed, the salary must be indicated.

These are regulatory sections that the individual entrepreneur must certainly insert into the contract.

Usually the agreement is not limited to them, and the rights and obligations of the parties, special conditions, etc. are added to the sample agreement. For all employees, except the first one, a document is drawn up in two copies. One is given to the employee, the other remains with the employer. An employee opening a staff will need two more copies - one for the Social Insurance Fund, the other for the Pension Fund.

Filling out a work book

After concluding an employment contract for an individual entrepreneur and issuing an order, an entry is made in the work book. Can an individual entrepreneur hire workers under an employment contract without registering this register? The answer to this question is not so clear-cut.

On the one hand, in modern conditions the importance of a work book is no longer as great as before. The fact is that data for registering a pension since 2002 have been taken into account in the centralized information system of the Pension Fund of the Russian Federation, which contains all the information about the payment of insurance contributions.

On the other hand, this register gives an idea of the length of service and work experience to other employers and helps in creating a resume. And the regulatory authorities still require it to be formalized. Therefore, an entrepreneur, when concluding or terminating an employment contract, must understand how to fill it out correctly, which articles of the Labor Code of the Russian Federation to indicate, when to put a stamp, etc. It is better to have in front of you a sample of several of the most likely circumstances.

We recommend you study! Follow the link:

How to draw up an agreement for the provision of services between an individual entrepreneur and an individual

Links to legislation

Employment contract:

Chapter 48.1. Peculiarities of labor regulation of persons working for employers - small businesses, which are classified as micro-enterprises.

A micro-enterprise is considered to be a legal or natural person that meets the criteria established by Federal Law No. 209-FZ of July 24, 2007 “On the development of small and medium-sized businesses in the Russian Federation”:

A standard form of an employment contract concluded between an employee and an employer - a small business entity that belongs to micro-enterprises (download from the link Resolution of the Government of the Russian Federation of August 27, 2016 N 858).

Section III “Employment contract”, “Labor Code of the Russian Federation” dated December 30, 2001 N 197-FZ (as amended on December 31, 2014)

Chapter 48 “Features of labor regulation of workers working for employers - individuals”, “Labor Code of the Russian Federation” dated December 30, 2001 N 197-FZ (as amended on December 31, 2014)

Civil contracts:

Section IV, “Civil Code of the Russian Federation (Part Two)” dated January 26, 1996 N 14-FZ (as amended on December 31, 2014)

According to the employment contract, the entrepreneur must provide his employee with social guarantees . This:

- Regular payment of wages

- Providing paid holidays

- Sick leave payment

- Payment of severance pay upon dismissal at the initiative of the employer

- Providing working conditions.

Under the GPC agreement, the employee is provided only with what was agreed upon at the conclusion of the agreement.

Under employment contracts, insurance premiums are paid in full : contributions to the Pension Fund, Compulsory Medical Insurance Fund, Social Insurance Fund. According to GPC agreements - only the Pension Fund and the Compulsory Medical Insurance Fund ( without the Social Insurance Fund ).

Despite the obvious financial benefit for an entrepreneur from concluding GPC agreements, you should not enter into such an agreement with an employee if, in essence, the relationship with the hired person is an employment one. In the event of an inspection, the labor inspectorate may recognize such an employment contract with all the consequences - the calculation of contributions to the Social Insurance Fund, the provision of leave and all payments due.

The procedure for dismissal by employees

Dismissal from an individual entrepreneur is not much different from the same procedure in another organization. The employee must write a corresponding statement. It can be in any form. Next, the manager draws up a dismissal order, reflecting the information of the employee, the employment contract and the reasons for termination of cooperation.

After this, the entrepreneur is obliged to give the employee a salary and other payments due to him. Among them may be compensation for vacation that was not used by the personnel. Those who have worked in this company for more than six months can apply for such a payment.

Important! If an employee is fired due to the cessation of the company's activities, he is entitled to severance pay. However, in the case of an individual entrepreneur, an employee can claim such compensation only if it was specified in the employment contract.

In addition to renting premises and other issues for running an effective business, individual entrepreneurs often need to hire staff. There are a lot of nuances in this matter. In particular, the manager is required to submit reports on his personnel. You need to report regularly. The main important points are hidden in the number of those who can be hired and the contributions that the employer must make. The entrepreneur also needs to compile and confirm the average number of personnel. After all, the number of employees may change over the course of a year. Someone new may appear, or there may be a reduction in staff. This information is necessary for the tax office to find out how best to interact with this individual entrepreneur. The staffing table helps with the preparation of such a document. It allows you to find out how many people work in the organization, with what salary, identify the difference between last year and this year, and so on.

How to register with the Social Insurance Fund as an employer

To register, you need to contact the funds with applications and a set of documents. This must be done no later than 30 days from the date of conclusion of the contract with the Social Insurance Fund. The fine for late registration with the Social Insurance Fund is 20 thousand rubles.

7. Registration of policyholders specified in subclause 2 of clause 3 of this Procedure is carried out by the territorial bodies of the Fund at the place of residence of an individual on the basis of an application for registration as an insured - an individual (hereinafter - the application for registration of an individual), the form of which is provided for in Appendix No. 2 to the Administrative Regulations of the Social Insurance Fund of the Russian Federation for the provision of state services for registration and deregistration of policyholders - individuals who have entered into an employment contract with an employee, approved by order of the Ministry of Labor and Social Protection of the Russian Federation dated October 25, 2013 N 574n (registered by the Ministry Justice of the Russian Federation on March 21, 2014, registration N 31687), submitted no later than 30 calendar days from the date of conclusion of the employment contract with the first of the hired employees.

Documents for registration with the Social Insurance Fund

The procedure for registration in the Social Insurance Fund and the list of documents are established by Order of the Ministry of Labor 202n:

To register as an insurer the individuals specified in subparagraph 2 of paragraph 3 of this Procedure, in addition to the application for registration of an individual, copies of an identity document of the individual and work books of accepted employees or employment contracts concluded with these employees are required.

- application for registration of an individual entrepreneur with the Social Insurance Fund as an insurer;

- passport of an individual (IP);

- a copy of the certificate of state registration of an individual as an individual entrepreneur;

- a copy of the certificate of registration with the tax authority (if available);

- copies of employment contracts or work books;

An application for registration with the Social Insurance Fund can be sent electronically through State Services (an electronic signature will be required).

Documents for registration with the Pension Fund <- Registration with the Pension Fund has been canceled since 01/01/2017

- Application for registration of an individual entrepreneur with the Pension Fund of Russia as an employer

- Certificate of registration as an individual entrepreneur

- IP passport

- Certificate of registration of individual entrepreneurs with the tax authorities (TIN)

- Agreement with the employee.

Within five days, the funds will issue notifications with numbers to the entrepreneur.

You only need to register with the funds as an employer when you hire an employee for the first time ; for all subsequent employees, additional registration is not required.

In what cases is this combined?

Running a business and working as an employee can be successfully combined. There is a whole list of positions that allow you to earn good money and leave time and energy for developing your own business in order to replenish your budget with additional income.

However, current practice leads to certain conclusions: not every field of activity has conditions that allow working and developing an individual business. What aspects should you pay special attention to?

Situation 1.

Official citizens want to open their own business. First, they need to find out exactly whether it is possible to simultaneously work as an employee and be an individual entrepreneur at the same time. The main risk is the danger of going broke if the new business does not bring the planned profit. Such fears are justified, so it is better not to interrupt the employment relationship at first.

There are also restrictions when registering a new status. For this to happen, the citizen must meet the requirements established for opening an individual entrepreneur. He must:

- be of legal age;

- have Russian citizenship;

- meet the category of full legal capacity;

- document the absence of prohibitions on such activities.

Limitation of legal capacity is established by a court decision. This procedure can be performed on people with mental disorders or those diagnosed with drug, alcohol or gambling addictions.

Note! The parameters of a certain age and legal capacity are established because entrepreneurial activity is accompanied by a high degree of risk, and a beginning businessman must have a good understanding of the potential danger.

The requirements that must be met before registration do not contain a clause stating that only an unemployed person can become a businessman. The legislator designates this OJSC or LLC as a legal form of organization. Individual entrepreneur is interpreted as a special status of an individual. It makes it possible to engage in commercial activities legally.

With their new status, entrepreneurs also take on certain responsibilities. They have to:

- maintain reports and submit them to government agencies;

- pay mandatory contributions to the Pension Fund and the Federal Tax Service;

- independently bear responsibility for the obligations assumed.

By registering as an individual entrepreneur, a person remains an individual; he retains all the rights and obligations of an ordinary Russian citizen. He can still carry out work if he wishes.

Situation 2.

An individual entrepreneur wants to get a hired job. The legislation in force in 2020 does not prohibit combining business and work activities. So the answer to the question whether an individual entrepreneur can get a job officially is positive.

An individual entrepreneur is the same individual, and the Constitution of the Russian Federation protects his rights. In Art. 37 states in detail that every person has the freedom to dispose of his own labor as he sees fit. These postulates are enough for an individual with the status of an individual entrepreneur to enter into an employment contract with a third-party organization.

It is possible to combine your business and your main job, but it is quite problematic. Business, especially at the development stage, requires constant monitoring of what is happening. If a person runs his own business and at the same time has an employment relationship, then he needs to plan his time so that productivity at his main job does not suffer. Otherwise, difficulties may arise with your superiors.

How to find your Pension Fund branch to register as an employer

From January 1, 2020, you DO NOT need to register as an employer with the Pension Fund of Russia (Federal Tax Service).

From January 1, 2020 to persons making payments to individuals, including organizations, individual entrepreneurs, individuals; individual entrepreneurs (including heads of peasant farms), lawyers, arbitration managers, notaries engaged in private practice, and other persons engaged in private practice and who are not individual entrepreneurs; organizations at the location of their separate divisions that have a current account and accrue payments and other remuneration in favor of individuals do not need to contact the Pension Fund for registration and deregistration.

Director at IP

As noted above, an individual entrepreneur is not prohibited from hiring employees and appointing them to various positions, including senior management positions.

These include, for example:

- CEO.

- Executive Director.

- Financial Director.

- Commercial Director.

- Technical Director.

- Director of Marketing/HR/Logistics/Quality.

The list goes on for a long time. It is important to understand the following: an individual entrepreneur can indeed have a director. The entrepreneur himself appoints him. True, all responsibility for what is happening in the company (especially for the financial condition and ability to pay debts) is still borne by its owner, and not by the hired personnel.

In the event of bankruptcy of a company, the individual entrepreneur, and not the manager, remains liable for the obligations.

In practice, there are very rarely cases when a citizen, after registering an individual entrepreneurship, appoints other persons to management positions. Most often, he himself is the head of his company.

Companies that have directors or other top management are most often legal entities.

Links to legislation

Regulations for registration in the Social Insurance Fund:

Order of the Ministry of Labor of Russia dated October 25, 2013 N 574n “On approval of the Administrative Regulations of the Social Insurance Fund of the Russian Federation for the provision of public services for registration and deregistration of policyholders - individuals who have entered into an employment contract with an employee”

Procedure for registration with the Pension Fund:

Resolution of the Board of the Pension Fund of the Russian Federation dated October 13, 2008 N 296p “On approval of the Procedure for registration and deregistration in the territorial bodies of the Pension Fund of the Russian Federation of policyholders making payments to individuals”

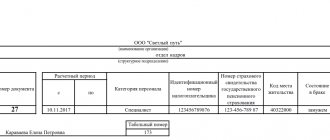

How to apply for hiring an employee

According to Art. 68 of the Labor Code of the Russian Federation, it is necessary to make an Order for employment in the T-1 form, approved by Resolution of the State Statistics Committee No. 1. The order is issued on the date of the employment contract or later, according to the terms of the contract. The order must contain the signature of the employee.

Under GPC agreements, there is no need to issue an order for employment, create a personal employee card or make an entry in the work book. We employ employees only under employment contracts.

Then the employee’s personal card is issued according to the unified T-2 form.

Afterwards, an entry is made in the work book about hiring. An entry in the work book is made within a week from the start of work.

If this is the employee’s first place of work, then the employer must create a work record. In addition, the employer is obliged to provide the employee with a pension insurance card (SNILS). When concluding an employment contract or a civil contract, the employer sends the employee’s data and a completed questionnaire to the territorial body of the Russian Pension Fund within two weeks. An insurance certificate with SNILS is issued within three weeks and is first transferred to the employer, who issues it to the employee. An employee can obtain SNILS on their own. To do this, the employee needs to present a passport to the Pension Fund and fill out a form.

Below is the video How to register an employee

Should I notify the employer?

The law does not oblige the entrepreneur to inform the employer about his new status, and there is no need for this. Work for hire and within the framework of your own individual entrepreneur have no documented overlap. In other words, an entrepreneur does not need to make an entry in his own work book, since he cannot work in “his own” individual entrepreneur. After all, according to the law, a citizen cannot enter into an agreement with himself.

But upon learning that the employee has become an entrepreneur, the employer may offer him to re-register the relationship, that is, instead of an employment contract, enter into a civil law one. This is much more profitable for the employer - fewer mandatory payments.

There will be a benefit for the individual entrepreneur himself - he will be able to save a little on tax. After all, personal income tax is withheld at a rate of 13% from the wages paid by the employer. If an individual entrepreneur switches to a preferential tax regime, for example, to the simplified tax system with the object “Income,” then he will pay 6% tax on the same amount.

Let's give an example. Employee Ivanov I.I. received a salary of 56,500 rubles, including personal income tax of 13%. That is, they gave him 50,000 rubles in his hands. If he becomes an individual entrepreneur using the simplified tax system of 6% and, instead of an employment contract, enters into a civil contract with his company, then with the same cost of services, his income after tax will be 53,110 rubles (56,500 - 56,500 * 6/100).

What to submit for employees to the tax office

Report on average headcount

Employees must submit a report on the average number of employees to the tax office. This report is submitted once a year in January before the 20th of the previous year (for 2020 until January 20, 2020).

2-NDFL and 6-NDFL

For tax , an Income Certificate 2-NDFL is submitted for employees for each employee once a year until April 1. In addition to the certificate, every quarter we submit Calculation 6-NDFL for accrued and paid tax amounts. Due date is the last day of the first month of the next quarter.

Deadline for submitting Calculation 6-NDFL in 2020:

- for 2020 until April 1, 2020

- for the 1st quarter of 2020 until April 30, 2020

- for the half year 2020 until July 31, 2020

- for 9 months of 2020 until October 31, 2020

- for 2020 until April 1, 2020

Calculation of insurance premiums

Insurance premium payments are submitted to the tax office quarterly. The filing deadline is no later than the 30th day of the month following the reporting period.

Deadline for submitting calculations of insurance premiums in 2020:

- for the 1st quarter of 2020 until April 30, 2020

- for the half year 2020 until July 30, 2020

- for 9 months of 2020 until October 30, 2020

- for 2020 until January 30, 2020

Individual entrepreneur reporting to the Social Insurance Fund for employees

4-FSS

Social insurance submits a report on Form 4-FSS every quarter. In 2019, the deadline for submitting a paper report is no later than the 20th day of the month following the reporting quarter (by January 20, April 20, July 20 and October 20). You can submit your report electronically until the 25th of the same month.

If an individual entrepreneur does not have employees during the year, there is no need to submit RSV and 4-FSS. We submit reports 2-NDFL and 6-NDFL only if there are salary payments for the employee in the reporting period. There are no zero 2-NDFL and 6-NDFL. Therefore, do not report if the physicists have not been paid all year.

When can you hire individual entrepreneurs and self-employed people instead of full-time employees?

Despite all the benefits of working with individual entrepreneurs and the self-employed, it will not be possible to replace all full-time employees with them. This will be a gross violation, for which the labor inspectorate will fine you, and the tax authorities will charge additional personal income tax and contributions.

It is possible to replace full-time employees with contractors only if we are not talking about performing a permanent job function. In our calculations, we used an accountant as an example. This option is suitable if you do not need an accountant to be constantly present in the office and there is no workload for the whole day. You order him a certain amount of work (for example, preparing reports), which he performs on his territory and when it is convenient for him, but within a specified time frame.

In the same way, you can outsource the work of a lawyer, marketer, transport services, cleaning and logistics. That is, something that is not directly related to the production process, and where a specific result can be measured. For example, you pay a lawyer for drawing up a claim and for representing interests in court, a marketer for conducting research and drawing up a strategy, an accountant for processing the initial report and filling out a declaration. To do all this, the contractor does not need to be next to you in the office from 8 a.m. to 5 p.m. and work only for you.

It will not be possible to hire a contractor instead of a mechanic at the machine, a salesperson or a cashier, a secretary and other specialists who perform a permanent labor function and are required to be at the workplace for this and obey internal regulations. Such employees can only be hired under an employment contract.

What salary should I pay to an individual entrepreneur?

The salary amount is set taking into account regional requirements. So in Moscow, starting from 2020, the minimum wage is 18,781 rubles. (Moscow GD dated September 19, 2018 No. 1114-PP).

For the Moscow region, the minimum wage is set at no lower than 14,200 rubles. (Article 1 of Law No. 82-FZ of June 19, 2000 on the minimum wage). Individual areas may have their own minimum wages. Thus, in the city of Mytishchi, Moscow Region, the minimum salary in 2020 cannot be less than 18,460 rubles. This value is set for the period from 2018 to 2020. starting from April 1, 2020. You can read about this in pp. 2.4.1 Mytishchi territorial tripartite agreement of the city of Mytishchi.

What salary should I pay if an individual entrepreneur is registered in Moscow and the employee works in the Moscow region?

The regional minimum wage should be applied, because the employee carries out his labor activity in the Moscow region. In this case, it does not matter where the employer is located (see Part 2 of Article 133.1 of the Labor Code of the Russian Federation).

How much to pay per employee

In addition to the salary itself, the entrepreneur needs to withhold and transfer to the budget personal income tax for his employees, 13% of the salary. Those. with a salary of 15 thousand rubles. the employee will receive 13,050 rubles.

Additionally, you need to pay contributions to the funds: to the Pension Fund of the Russian Federation 22%, Social Insurance Fund 2.9% + injuries, Compulsory Medical Insurance 5.1% - the individual entrepreneur pays these payments in addition to the employee’s salary at his own expense.

For example, calculation of taxes and contributions from a salary of 15 thousand rubles.

Salaries are supposed to be paid twice a month in equal parts (advance and salary) and taxes and contributions must be transferred once a month.

And a video for a snack: How an individual entrepreneur reports for employees

Let's sum it up

We found out that a person who works for hire can simultaneously engage in business. Whether he should quit, time will tell. Practice shows that individual entrepreneurial activity is rarely profitable at the start.

An officially employed person, having opened an individual entrepreneur, retains the right to all the guarantees that the employer must provide him. They pay taxes and contributions together: the employer - from wages, the entrepreneur - from business income.

The registration process for an employee does not have any special features. There is no need to notify the employer that the employee has become an entrepreneur. If desired, a citizen can quit and then get hired for another job - the status of an individual entrepreneur is not a hindrance to this. It is only important to remember that if no activity is carried out, the obligation to pay contributions is not suspended.