A person who goes to work every day, brings profit to his boss and supports the country's economy as a whole, must be sure that he will not be left to the mercy of fate. To support an employee who finds himself in a difficult situation, compulsory employee insurance is being introduced. It is thanks to this type of insurance that you can count on the payment of disability or maternity benefits, sick leave payments, and a pension.

Kinds

Traditionally, employee insurance in Russia can be divided into compulsory and voluntary.

Compulsory insurance demonstrates the state will aimed at providing minimum guarantees to working citizens in the event of decline or loss of ability to work.

Voluntary insurance acts as additional support and can be initiated by the employer or the employees themselves.

Mandatory type is carried out in 6 areas:

- medical;

- pension:

- from accidents and occupational diseases;

- in case of complete or partial disability;

- life insurance;

- on pregnancy and childbirth.

Peculiarities

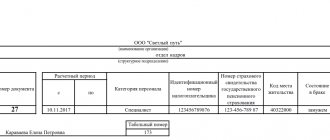

The obligation to insure your employee arises from the moment the employment contract is concluded. Based on the Labor Code, the terms of compulsory social insurance, as well as guarantees and compensation must certainly be included in the contract. In this case, you can indicate in detail the payments and benefits due to the employee, or simply make a note that he is insured in the general system.

If we are talking about a civil contract, then the customer is obliged to pay contributions only for health insurance and pension. However, the contract may provide for the obligation to pay contributions against labor costs at work and occupational diseases.

Insurance of employees (insured persons) is carried out through the classic scheme of the policyholder - the insurer.

Insurers are organizations, individual entrepreneurs (who pay both for employees and for themselves), individuals without individual entrepreneurs, and private practitioners.

The insurers are the Mandatory Medical Insurance Fund, the Social Insurance Fund and the Pension Fund of Russia.

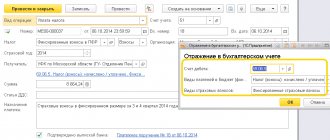

However, several years ago (since 2020), the procedure for making insurance contributions changed: now they need to be transferred to the Social Insurance Fund and the tax office.

Specifically, you need to make mandatory contributions to the tax office:

- health insurance;

- pension;

- Social insurance in case of disability and maternity.

The Social Insurance Fund is the recipient of social insurance contributions against industrial accidents and occupational diseases.

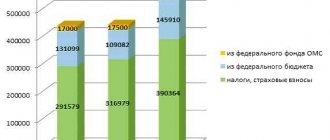

The total amount of social insurance contributions for employees is as follows:

- 5.1% for compulsory medical insurance (there is no maximum base size).

- 22% on compulsory pension insurance if payments do not exceed RUB 1,150,000. If the size of the base is greater than the specified amount, then a 10% tariff is applied.

- 2.9% for compulsory social insurance. If the size of the base is more than 865 thousand rubles, then there is no need to pay fees.

The base from which % is calculated must include all payments due to the employee, for example, salary, bonuses, vacation pay.

Employees also have non-taxable payments, including:

- State benefits;

- Compensation payments related to payment for an apartment and utilities, payment in kind, reimbursement of money for professional training, moving to work in another place, etc.;

- Financial assistance (if an employee’s family member died due to a natural disaster, at birth or adoption, etc.);

- Voluntary contributions;

- Money additionally paid by the employer for employee pension savings;

- Money for travel to and from your vacation destination;

- Money paid to persons who were involved in organizing a referendum or election campaign;

- Reimbursement of the cost of uniforms;

- Reduced amounts for travel;

- Material assistance to an employee (no more than 4,000 rubles);

- Money spent on employee training;

- Payments due to military personnel, police officers, firefighters, employees of prisons and colonies, customs, etc.;

- Payments under contracts to foreigners and stateless persons.

5.1%, 22% and 2.9% are the general rate, however, the Tax Code provides for a reduced rate for certain categories of payers, which include, for example:

- companies developing computer programs;

- organizations and individual entrepreneurs using the “simplified language” and engaged in the production of food, drinks, clothing, medicines, metal products, electrical equipment, musical instruments, sporting goods and other things;

- non-profit organizations using simplified language and working in the fields of education, healthcare, and culture;

- other organizations.

And for some employers, on the contrary, additional tariffs for employee pension insurance are provided in the amount of 2 to 9%. We are talking about employees employed in production with harmful or dangerous working conditions.

Tariffs for additional social security have also been developed for aircraft employees in the amount of 14%, and coal industry employees - 6.7%.

Entrepreneurs and private practitioners (mediators, notaries, appraisers, etc.) pay contributions to compulsory pension insurance depending on their income. If for a certain period it does not reach 300 thousand rubles, then the contribution is about 30 thousand. Such payers contribute a strictly fixed amount to compulsory medical insurance (6,884 rubles in 2019).

Insurance of employees against occupational diseases and accidents at work

So insuring is extremely important as it protects them from any adverse consequences of work activities.

The tariffs by which the size of contributions are determined vary from 0.2% to 8.5% depending on the class of pro-free. For these purposes, a classifier of types of economic activity has been developed (No. 851n).

If an insured event occurs, the injured employee can count on any of the following payments:

- allowance;

- lump sum payment;

- monthly payments.

In case of death, relatives can receive financial support.

The funds of the Social Insurance Fund pay for treatment, rest and recovery in sanatoriums, resorts, as well as the purchase of special equipment (prostheses, wheelchairs, etc.).

Benefits of corporate insurance

CS has its advantages and benefits. It provides organizations with tax benefits (for VAT, personal income tax, etc.). In addition, thanks to its reliability and care for a large group of people, the insurance company becomes especially relevant in the conditions of the unstable economy of the Russian Federation.

KS is distinguished by an integrated approach to the provision of insurance services: the insurance company provides the organization with a number of insurance services, for which contracts are drawn up. It is not limited to concluding only one insurance policy, and therefore is the most effective tool for protection against various risks. Registration takes a little time, since the company is an intermediary between the insurance parties. In addition, if desired, not only employees, but even members of their families can use the insurance policy.

A distinctive feature of corporate insurance for clients is the program for opening a long-term savings account. It can be used as an alternative to the state pension or as a supplementary pension. The validity of corporate policies extends to the entire term of the contract; employees of the organization and members of their families are reliably protected.

Many people mistakenly believe that corporate insurance programs are only relevant in the workplace. The corporate agreement extends its effect at all stages of the organization’s activities.

Corporate insurance is also useful for an enterprise in terms of cost savings. The insurer simultaneously enters into a large number of contracts with many companies, so it can provide substantial discounts without prejudice to itself. As a result, such cooperation is mutually beneficial.

Principles of the CoC:

- Comprehensiveness: takes into account all customer risks.

- Long-term: designed for long-term cooperation.

- Combination: carried out with a joint insurance policy or within the framework of a free union of insurance companies.

Main advantages of SC:

- Minimizing risks in the activities of the enterprise. The company's assets are reliably protected from theft, destruction or damage.

- Motivation of personnel due to the confidence of each employee in protection from problems associated with illnesses, accidents and other insurance risks. By taking out corporate insurance, an employee receives a social guarantee. As a result, employee motivation increases and labor productivity increases.

Important! Corporate insurance is especially relevant in an unstable economic situation, since it reliably protects the company’s assets from sudden financial disasters.

Voluntary view

The mandatory type for employees always provides the most basic benefits in insurance cases. Therefore, voluntary insurance is used to expand opportunities.

The insurer here is the company. Accordingly, tariffs, a list of insurance situations and amounts of payments will be established by the terms of the contract.

Many employers resort to voluntary insurance of employees against industrial accidents and occupational diseases. After all, the payments due under compulsory insurance are hardly enough for treatment and recovery.

In general, the voluntary type distinguishes the foresight of the manager and increases his authority in the eyes of the staff.

Conclusion

Employee insurance reflects the social orientation of state policy and supports the material well-being of a person who has completely or temporarily lost the ability to work.

Payment of contributions for mandatory types of social insurance is the responsibility of every law-abiding employer. And, indeed, a good employer will also take care of additional support for employees through voluntary support.

Rate this article:

[Total: 4 Average: 4.5/5] (Article Rating: 4.5 out of 5)

Author of the article Elena Simakina Lawyer

Employee social insurance: what is it?

Art. No. 236 of the Labor Code of the Russian Federation requires: all employees must be subject to OSS. This responsibility lies entirely with the employer. Each type of insurance has its own established rates, the volume of which depends on the type of taxation adopted in production. Some managers, as a supplement to compulsory social insurance for personnel, provide guarantees in the form of voluntary insurance.

Insurance subjects: who are they?

Partners or other “players” equated to insurance are subjects of OSS. Every person experiences situations that require government assistance.

Insurance protection for employees

Social insurance of employees is regulated by Art. No. 212 of the Constitution of the Russian Federation. Employers are required to provide such insurance protection to their employees at work. The law guarantees the following types of payments:

Operating principle of OSS

Compulsory social insurance for employees is built taking into account the principle of non-strict equivalence. The established liability for insurance payments operates according to the principles:

The key source of financial investments in favor of various funds is contributions received from compulsory insurance.

Payments of insurance premiums must be made by the following insurers:

- those who make deductions and other payments to employees;

- those in private practice do not provide employee benefits.

OSS was introduced as an additional form of social protection for able-bodied citizens. If a person loses the opportunity to work, loses his job, the main breadwinner, then the obligations for social protection fall on the shoulders of the state.