Home • Blog • Online cash registers and 54-FZ • Closing the fiscal drive

Closing a fiscal drive is a mandatory procedure before ending its operation. A correctly carried out process will ensure the preservation of encrypted data stored on the chip about transactions that were carried out at the checkout during the entire period of operation. After successfully generating and sending a report on closing the fiscal drive, you will need to re-register cash register equipment in accordance with the established rules of law.

In our article, we will look at how to close a financial fund on your own without making mistakes, using the example of the most popular cash registers. Following the recommendations, the procedure will not take much time and will save you from additional costs of contacting specialized companies. At the same time, if you are not confident in your own knowledge and skills, it is better to use the comprehensive services provided by Multikas specialists.

Re-registration of an online cash register with the Tax Service

Order and receive a fiscal drive replacement service for 1 rub.

and a 50% discount on connecting to the OFD. GET AN OFFER

What is a fiscal drive and why is it needed?

A fiscal drive is a microchip that is installed in a cash register. Starting in 2020, it replaced the outdated EKLZ. FN performs several functions:

- device memory - stores all generated receipts during operation in the cash register;

- encrypts information with a crypto code to protect it from changes;

- transmits information to the fiscal data operator, as required by law.

Any online cash register without a fiscal drive does not work. Also, a cash register without a FN cannot be registered with the Tax Service, and if you use a cash register without a FN, you may receive a fine. Any interference with the operation of the chip threatens to block not only the chip itself, but also the cash register equipment as a whole, as a result of which all that remains is to purchase a new part and register the device again.

Procedure for maintaining a cash book

The cash book is an important document for LLCs and individual entrepreneurs, who in their work deal with the receipt of cash. When conducting it, you must be guided by the following basic rules:

- The book is started and used in the activities of the enterprise for one calendar year.

- The book is maintained either by the chief accountant or by the person who replaces him (most often this is the cashier).

- One organization can maintain only one cash book, regardless of how many types of activities and taxation systems it uses. An exception is the situation with subsidiaries - they maintain their own separate book, a copy of the sheets of which is transferred to the company's head office at the end of the year.

- The cash book displays all transactions of the enterprise - both incoming and outgoing. The basis for entering data is PKO and RKO (receipt and expense cash orders, respectively).

- If on a certain day no operations were performed at the enterprise, then the sheet of the ledger remains blank.

- There are two forms of maintaining a cash book - electronic and paper. The rules for filling it out directly depend on the chosen form.

- Data is entered into the book immediately after the actual receipt or expenditure of funds.

- The cash book has a legally approved form KO-4.

- At the end of each day in which cash transactions were carried out, all data entered in the book is verified with the indicators of cash orders. Afterwards, the final cash balance is displayed, which is checked against the amount of cash in the cash register.

The total amount is signed by the cashier or other person responsible for maintaining the book. Also, the calculated indicators for each day are checked by the chief accountant of the enterprise, which is confirmed by his signature at the end of the sheet.

The listed rules relate rather to organizational issues related to maintaining a book. Next, it is worth considering in more detail the order of its registration.

Validity period of the FN

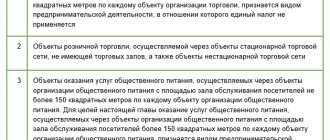

Fiscal accumulators come in two types according to their validity period: 15, 36 months. Their application depends on taxation and the scope of activity of the entrepreneur:

36 month storage

| Storage for 15 months

|

Those who are registered with OSN can apply any FN, the main thing is that the model is on the list of those approved by the tax service. It is worth considering some nuances that can lead to the drive being blocked:

- data has not been transferred to the OFD for more than 30 days - the blocking is removed immediately after sending the information;

- The FN was re-registered more than 11 times - this is the maximum provided by law. If the limit is exceeded, you will have to install a new chip.

| Read also: “Fiscal accumulator 13 and 36 months. Which one should I use? |

How to fill out a cash book: sample electronic form

The easiest way is to organize the maintenance of a cash book in an accounting program, which reflects all accounting in the organization. This function, for example, is available in 1C and other programs. In this case, the form is generated and filled out directly on the computer, the order of making entries does not change: it is necessary to enter information about each PKO or RKO. At the end of the day, the cashier must summarize, display the account balance and print out the sheets of the cash book for the day in two copies. All documents must be submitted for verification by the chief accountant, who verifies the data in the primary documents with the data in the registers and certifies them with his signature. Corrections and edits are not permitted.

Every year, and if the cash register turnover in the organization is daily, then quarterly, the printed sheets of the cash book must be formed into a journal and stitched. The last page must indicate the total number of sheets and bear the signature of the head of the organization, the chief accountant and an imprint of the company’s round seal, if any. In addition, you can maintain a cash book entirely electronically. In this case, all records must be certified by electronic signatures of authorized persons, and information and its editing must be protected from unauthorized access using additional technical means

When it is necessary to close a fiscal drive: instructions

There are several reasons for closing a financial fund, which are indicated in the explanations for the innovations:

- the deadline has expired - information will appear in the shift closure report that the remaining resource is less than a month;

- memory has run out—the Z-check displays a line about full memory. It appears when the chip is 99% full;

- change of owner of the cash register - if information about the owner of the equipment is changed, the drive cannot operate under the previous registration;

- A cash register is deregistered - there are many reasons for this, for example, a retail outlet stops working.

A closure report is not required if the device is stolen or completely locked, i.e. in cases where this is not possible.

How to stitch a cash book?

When maintaining a cash book, an important point is not only its correct filling, but also compliance with all requirements for registration of accounting documentation. First of all, this concerns stitching sheets and fastening them.

The order of stitching the sheets of the cash book also depends on how it is maintained:

1. A book purchased from a printing house is bound immediately. Before you start filling it out you must:

- number all sheets;

- sew all sheets;

- on the last page indicate the total number of sheets;

- put a seal (wax or mastic);

- sign (this must be done by the head of the enterprise and the chief accountant).

2. The book, printed on a computer, is stitched at the end of the year. During the year, the cashier or accountant fills out the printed sheets and stores them in a separate folder, and then staples them according to the same rules as the finished book (indicating the number of pages, the seal and signatures of the manager and chief accountant).

When maintaining and registering a cash book, it is worth remembering several important points:

- Having a book is necessary for those organizations and entrepreneurs who deal with cash in their activities.

- For use, you can either buy a ready-made cash book or print it yourself on your computer.

- A special responsible person is responsible for maintaining the cash book: the chief accountant or cashier.

- In the paper version, the book can be kept either by hand or using technical means (that is, filled out on a computer and printed).

Watch also the video on how to fill out the cash book correctly:

Closing the ATOL fiscal drive

Using the example of one of the most popular brands, we will consider how to make a report on the closure of a fiscal drive.

First of all, you need to close your shift at the checkout. Regardless of the brand and model of the cash register, as mentioned above, it is important to check that all data is completely sent to the OFD because during further operations and commands, the equipment will generate an error. Information can be found in the X-report. If everything has been checked and sent, you can proceed to the next steps:

- STEP 1. Launching the ATOL cash register registration application.

- STEP 2. Select from the menu that appears the item with the command to close the archive of the fiscal drive.

- STEP 3. Synchronization of the cash register with the computer. Be sure to check that the dates and times match on both devices.

- STEP 4. Select close the FN archive

- STEP 5. At this stage archiving is carried out, it is important to wait until it is completed. A corresponding message will be displayed on the screen.

- STEP 6. A report on closing the fiscal drive in ATOL will be generated automatically.

After this, a message will appear requiring you to send changes to the OFD. We make sure that the check for closing the fiscal accumulator went to the OFD. As a result, you should get a check “Report on closing the fiscal drive.”

If an error is made at any stage, it will be displayed as a warning. This means that the closure did not take place and all previous actions are canceled. Under no circumstances should the drive be removed until the procedure is completed. Repeat the steps again, checking each step carefully. If the report is successfully received, you can remove the FN and install a new one. Next, if you plan to use cash register equipment, you will need to re-register it with the Federal Tax Service.

Corrections in the cash book

Regardless of the method of keeping the book, no blots or corrections are allowed. If a mistake was made when filling out the book, there are two ways to make changes:

- In the event that the error does not affect the final amount of cash balances, the incorrect value is crossed out with one line, and the correct data is placed above or below it. The correction made is certified by the signatures of the responsible persons - the cashier and the chief accountant.

- If, due to an error, changes occur in the reflection of balance amounts, it is necessary to completely cancel the page and draw up new cash sheets, with the correct data entered. Erroneous sheets are crossed out.

In the latter case, the person who made the mistake (cashier) draws up a report addressed to the chief accountant or director. Next, a special commission is appointed, responsible for making corrections to the cash book. After the adjustments are made, the cashier draws up a corresponding certificate indicating the errors made and the corrections made.

When changing data in the cash book, you must strictly comply with all established requirements. Otherwise, during the audit, tax inspectors may discover existing violations and fine the company. However, it should be taken into account that the right to a fine is only in the case when the detected violation and the date of inspection have a time difference of no more than two months.

Closing the Evotor fiscal drive

Evotor cash register equipment is no less popular on the cash register market, so let’s look step by step at how to make a report on closing a fiscal drive on devices of this brand.

- STEP 1. First you need to close a shift at the cash register: main menu - reports - cash reports - close a shift - print the report

- STEP 2. To identify unsent data to the FD operator, you need to log in as an administrator to your personal account, and then select the settings for servicing the cash register. In the corresponding section informing about the remaining data without sending, there should be a zero. This means that all information has been transferred to the service and further actions can be taken.

- STEP 3. Select the OFD item, and then the “Replace FN” line at the bottom.

- STEP 4. At this stage, it is better to re-register the cash register with the tax office. To do this, you need to log into your personal account of the Federal Tax Service and fill out the appropriate application.

- STEP 5. In the cash register menu, activate the item to close the archive of the fiscal drive. If a shift is not closed on the device at this time, the cash register will prompt you to do so. When the reason for replacing the microchip is the end of its validity period, in this case you need to set the date and time of the last punched check manually.

- STEP 6. Having confirmed your intentions, remember that now the cash register will not be able to sell goods until a new chip is installed. Therefore, it is worth preparing it in advance.

- STEP 7. After this, Evotor will print a report on the closure of the fiscal drive, sending the information to the operator.

- STEP 8. To complete a new registration with the Federal Tax Service, the cash register will require you to enter some data from the receipt. Exactly what information needs to be entered will be displayed on the screen. As a rule, these are the basic details and fiscal indicator.

- STEP 9. At this point, closing the archive is completed; you need to restart the device and install a new fiscal microchip.

Immediately, without leaving the menu, you can continue to fill out an application for a new registration. Note that, by law, the owner can independently perform all these actions, however, it is better to check the terms of the equipment supplier’s contract in advance. It may indicate the nuances of opening the device, after which you may lose the warranty.

Rules for registering a cash book

When maintaining a cash book in electronic form, all data is entered into it on a computer; there is no need to print the book at the end of the reporting period. There are no particular difficulties in filling out such a book, so it is worth considering the paper version in more detail.

There are two ways to maintain a cash book in this format:

1. A ready-made book is purchased (for example, printed in a printing house). A standard book of this kind is made in the form of a magazine and usually has 50 or 100 sheets.

If one book is not enough for the current calendar year, you need to create a new one and continue recording transactions in it. In this case, on the title page of the new book you need to indicate the period of time for which transactions are entered into the book. After the end of the year, you need to start a new book, even if there are still leaves in the old one.

All sheets in the journal are divided into two types:

- loose-leaf - filled with a ballpoint pen;

- tear-off documents are kept as carbon copies, that is, they completely duplicate the information entered on the loose leaf.

Both types of sheets must have the same numbering and contain identical data. After filling out, the loose leaf remains in the book, and the tear-off sheet is handed over to the accounting department by the cashier. This sheet is his reporting and must be submitted along with other documents: PKO, RKO, payment statements, etc.

2. Electronic sheets of the book are prepared, then they are printed and filled out by the responsible person. These sheets can be filled out either by hand or on a computer (in the latter case, they are printed after completion).

The numbering of the sheets is continuous; they are numbered from the beginning of the year in ascending order. It is also necessary to indicate the total number of sheets for each month and the total annual value.

What's next?

Installing a new fiscal drive

In each online cash register model, the fiscal drive can be located differently, so you need to find its installation location:

- open the cover, remove the old chip and insert the new one into the connector;

- old FN must be stored for five years, because it may be required by the tax authorities;

- close the compartment and connect the model to the network.

Re-register cash register

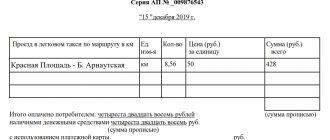

To do this, you must enter the report number on the closure of the fiscal accumulator, as well as the fiscal attribute reflected in the check.

Register a new drive in your OFD personal account

It is recommended to store all of the above documents, reports and storage devices, ensuring optimal conditions for this - appropriate temperature, humidity and safety precautions.

Need help closing a fiscal accumulator?

Don’t waste time, we will provide a free consultation and help you replace the FN and re-register the cash register.

Cash book: sample manual filling and filling requirements

Maintaining a cash book in 2020 begins with numbering and stitching its sheets. The ends of the lacing at the back of the journal must be sealed with a paper strip on which you must indicate the number of sheets, the start date of maintaining the cash book and the end date. To certify the record, the chief accountant and the head of the organization must sign, and a seal, if available, must be affixed. It should look like this:

On the title page of the cash book you must indicate the name of the organization and the period for which the document was opened. All entries must be made only with blue or black ballpoint pen or ink.

Each sheet is divided into two parts:

- one remains in the book;

- the second is detachable and is stored together with the RKO and PKO registers.

To fill out the sheet, the cashier places carbon paper so that the entry in pen is on the sheet that remains in the document. The entries must be completely identical, but you cannot sign a carbon copy. Therefore, at the end of the day, the cashier must sign on each copy of the cash book. All records about cash settlements and cash settlements are entered line by line in the appropriate columns, indicating the details of the person who deposited or received the money. Income and expense are entered in different columns. If one sheet is not enough to reflect all transactions for one day, the cashier must fill out the “transfer” line, which records the total amount of money received and spent at that moment. The next sheet of the cash book begins with the same amounts.

At the end of the day, you should sum up the results and indicate the total turnover at the cash register for the day and withdraw the remaining cash at the end of the day. If the cash register included amounts intended for the payment of wages or benefits according to the payroll or payroll, the cashier must allocate them in the line “including wages, social payments and scholarships.” After all the entries have been made, they are checked against the primary documents and certified by the chief accountant.

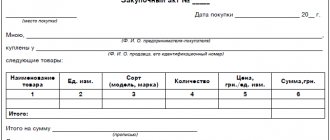

A correctly completed cash book sheet for the day looks like this:

You might also be interested in:

Online cash registers Atol Sigma - how to earn more

How to make a return to a buyer at an online checkout: step-by-step instructions

MTS cash desk: review of online cash register models

Scanners for product labeling

Shoe marking for retail 2020

Online cash register for dummies