Initial stage of transformation

Transformation of a legal entity is a change in its organizational and legal form.

This occurs, for example, when a limited liability company becomes a joint stock company. Or, on the contrary, a joint stock company turns into an LLC. Where does transformation begin? First of all, the owners must make an appropriate decision. Within three working days, this must be reported in writing to the “registering” Federal Tax Service and the decision itself must be brought there. Based on it, tax authorities will make an entry in the state register within three working days stating that the company is in the process of reorganization. Also, within three days about the reorganization it is necessary to inform in writing the employees of the Pension Fund and your branch of the Social Insurance Fund (clause 3, part 3, article 28 of the Federal Law of July 24, 2009 No. 212-FZ).

Next, the enterprise is obliged to publish a notice of reorganization in special publications twice (once a month). In addition, within five working days from the date of filing the application with the inspectorate, it is necessary to notify all known creditors (Article 13.1 of the Federal Law of 08.08.01 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”).

Then it is necessary to prepare a new charter and memorandum of association for the newly formed company and conduct an inventory of the property and liabilities of the “old” organization. This is stated in paragraph 2 of Article 12 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”.

The procedure for reorganizing an enterprise

The restructuring procedure consists of several stages:

- to report their decision to the Tax Inspectorate within 3 days . The territorial division of this body makes a corresponding entry in the register. At this stage, creditors are informed within 5 days from the date of notification to the registering authority. Information is published in the media twice every 30 days.

- Inventory of the property of a legal entity and preparation of a reporting document on the assessment of the property of the enterprise.

Inventory is carried out both in relation to the personal property of a legal entity, and in relation to things that are in custody or are the subject of rental relations.

- Creation of documents : transfer deed or separation balance sheet. Based on logic, the first document is drawn up during a merger, transformation or accession. A second document is required in case of division or separation.

- Removal from control by tax authorities and all funds.

- Closing the company's accounts and eliminating the organization's seal.

- If a new legal entity is created , then it goes through well-known registration procedures. An enterprise can be considered reorganized from the moment when a new legal entity has passed the registration procedure.

You can learn more about the procedure for liquidating an organization here.

IMPORTANT: during reorganization, legal entities cannot be transferred from commercial to non-profit. The law prohibits doing this.

Exceptions may be cases with the reorganization of unitary enterprises, non-profit corporations, and municipal institutions.

Transfer deed

Now you can start drawing up the transfer deed. Its date is determined by the founders. The Ministry of Finance recommends that accountants date the transfer act at the end of the quarter or year (clause 6 of the Instructions for the preparation of accounting records during reorganization*).

The form of the transfer deed can be any, since the regulations do not establish any restrictions in this regard. As a rule, the balance sheet form is taken as a basis.

The only requirement for the transfer deed is the need to include in it “provisions on legal succession” (Article 59 of the Civil Code of the Russian Federation). This is an indication of the amount in which receivables and payables (including personnel salaries, taxes and insurance contributions), as well as property, are transferred to the legal successor. It can be reflected both at residual value and at market value, depending on the decision of the founders (clause 7 of the Guidelines for the formation of accounting records during reorganization).

Disadvantages and signs of conversion

One of the main disadvantages of the reorganization of legal entities in the form of transformation is the lack of clear instructions at the legal level regarding the legal capacity of a legal entity during the period from the decision on transformation to the state registration of a new business entity. However, if you analyze the norms of the Civil Code of the Russian Federation, you can highlight the following distinctive features of transformation as a form of reorganization of a legal entity:

- 1. One legal entity always participates in the transformation, which ceases to exist after the completion of the reorganization;

- 2.

Instead of the reorganized legal entity, its legal successor appears - a new legal entity having a different organizational and legal form; - 3.

The succession arising as a result of reorganization in the form of transformation is formalized in a separate document - a transfer act, which the legislator intends to exclude from the mandatory documents indicating the transfer of rights and obligations during the reorganization.

In accordance with Article 58 of the Civil Code of the Russian Federation, with amendments that have not yet entered into legal force, with regard to reorganization in the form of transformation, the creators of the laws intend to exclude the phrase “transfer of rights and obligations from the predecessor to the legal successor,” also indicating that the rights and obligations in relation to third parties faces do not change. However, in general, the current civil legislation of the Russian Federation classifies transformation as a simple form of reorganization, since only one legal entity is involved in it, in contrast to merger, accession, division and separation, which means that during the succession only one new organization arises . Legal theorists, on the contrary, believe that during a transformation, a new legal entity does not arise, since the reorganized legal entity is preserved. Only its organizational and legal form changes. Another feature of the transformation is that its implementation does not change the property base of the reorganized organization, which must take care to ensure the protection of the rights of creditors and all participants of the transformed legal entity.

Period until conversion is completed

The transfer deed must be accompanied by an application for state registration of the newly emerging legal entity, a decision on reorganization, a document on payment of state duty and other papers listed in paragraph 1 of Article 14 of Federal Law No. 129-FZ dated 08.08.01.

The package of documents must be submitted to the “registering” tax office and wait for it to make an entry in the Unified State Register of Legal Entities. The appearance of such a record will mean that the previous company has ceased to exist, and the new one has begun to operate.

In practice, the waiting period usually lasts from several days to several months. At this time, the “old” organization continues to operate. In particular, it calculates wages, depreciation, issues invoices and issues invoices and invoices.

SUBTLES IN THE PROCEDURE OF REORGANIZATION OF LLC

A very important point in the reorganization of an enterprise is the timing of this procedure.

Calculating the reorganization period, and based on the MOST favorable conditions, we have a minimum reorganization period of 75 days. At the same time, it is virtually impossible to carry out the reorganization of an LLC within such a time frame. The fact is that this reorganization period includes the amount of time required for registration. authority to register the reorganization and to publish messages about the reorganization in the media1. And in addition to this, it is also necessary to prepare documents, sign them by all parties, notarize them, and submit them to the registry office. Organ and so on. At the same time, in practice, it also happens that the protocol alone takes a week to sign, or the director cannot get to the notary and certify the necessary application, not to mention other more serious factors influencing the reorganization process.

Therefore, if I propose to you to carry out a reorganization in a very short time, less than 2.5 months, do not doubt that this is a scam!

Final financial statements

On the day preceding the date of registration of the new organization (that is, the date of entry in the Unified State Register of Legal Entities), the reorganized company must draw up final financial statements. These are the balance sheet, profit and loss account, statements of changes in capital and cash flows, explanations and the auditor's report (if the company was subject to a statutory audit).

The final statements will reflect transactions completed during the period from the signing of the transfer deed to the closure of the predecessor organization. As a result, the figures in the final balance sheet will differ from the data in the transfer deed. As for account 99 “Profits and losses”, it should be closed, and profits can be distributed according to the decision of the founders.

Accountants often ask the question: when do you need to submit final accounting reports to the Federal Tax Service? Immediately after the reorganization or at the end of the current quarter? It’s better to ask “your” inspector about this. Sometimes tax authorities prefer to receive the balance immediately, sometimes they agree to wait.

Let us add that after the final reporting, the reorganized company should not prepare balance sheets and other documents, because the last reporting period for it is the time from the beginning of the year to the date of reorganization.

Introductory accounting of the successor company

The newly created organization needs to draw up an opening balance sheet as of the date of transformation (that is, on the day on which the entry was made in the Unified State Register of Legal Entities). The data in the opening statements will coincide with the data in the closing balance sheet of the predecessor.

The only thing that may differ is the size of the authorized capital, because the founders have the right to either increase or decrease it.

Column 3 of the balance sheet should reflect information as of the date of reorganization. There will be dashes in columns 4 and 5, since as of December 31 of last year and the year before, the successor enterprise had not yet been created.

The opening balance is submitted to the Federal Tax Service either immediately after registration or at the end of the current quarter, depending on what is more convenient for “your” inspector.

Conversion Features

The law imposes certain restrictions on business companies, which can be transformed into a rather limited range of legal entities, for example, limited liability companies can be transformed into Joint Stock Companies (JSC) and Companies with Additional Liability, into business partnerships and production cooperatives (PC). In turn, JSCs can be transformed into LLCs, PCs and Non-Profit Partnerships. Since Joint Stock Companies are divided into Open and Closed, the transformation of CJSC and OJSC should also be distinguished from each other. Closed Joint Stock Companies can freely transform into joint stock companies of employees, i.e. We are talking about national enterprises, and for OJSCs such transformation is not available by force of law if their employees own less than 49% of the authorized capital.

In addition, if we turn to the Federal Law “On Joint-Stock Companies”, then in Article 7 we will see that joint-stock companies whose shares are in state or municipal ownership cannot be reorganized in the form of transformation into legal entities of a different organizational and legal form than Joint Stock Companies. The law establishes certain restrictions on LLCs, which, like CJSCs, cannot be transformed into OJSCs if the size of the authorized capital of the newly created company is less than the minimum level established for an Open Joint Stock Company by law. However, reorganization in the form of transformation will be possible if the shareholders increase the size of the company's authorized capital to the required level.

Quantitative restrictions are established by law regarding the number of participants in new legal entities for business entities wishing to carry out reorganization in the form of transformation. So, for example, when transforming a JSC into an LLC, the number of participants should not exceed fifty. While when transforming a business company into a production cooperative, the number of participants - individuals cannot be less than five people. In addition, the current Civil Code of the Russian Federation, in Article 88, also establishes those cases when reorganization is carried out without fail in relation to an LLC. Due to the fact that the number of participants in a Limited Liability Company cannot be more than fifty legal entities and or individuals, if this minimum is exceeded, the LLC becomes obligated to transform it into an OJSC within one year from the date of excess.

If the requirement established by law to carry out the transformation is ignored, and the number of participants - individuals and or legal entities - is not reduced to the required threshold, then after one year, i.e. We are talking about the deadline established for transformation; the LLC is subject to liquidation in court. A similar situation may occur for closed joint stock companies, when the number of its participants also exceeds fifty. In this case, the CJSC is also subject to transformation into an OJSC, on the basis of Article 7 of the Federal Law “On Joint-Stock Companies”, by introducing appropriate changes to the Constituent Documents of the company, and not through reorganization. And this is the main difference from exceeding the number of participants in an LLC. In addition, the transformation of a closed joint stock company into an open joint stock company does not require the execution of a transfer deed and notification of the company's creditors, and also will not provide the shareholders of a Closed Joint Stock Company with the right to repurchase shares.

If we talk about the possibilities for transforming Business Partnerships, Business Societies and Production Cooperatives into a different organizational and legal form, the Civil Code of the Russian Federation treats them quite liberally, with the exception of state and municipal unitary enterprises, since this issue presents theoretical and practical complexity.

"Primary" in the transition period

At the transformation stage, organizations are faced with the following problem: contracts with counterparties were signed by the predecessor, and the successor will have to work on them. Does this mean that new agreements or additions to them need to be concluded? Or is it enough to send out information letters indicating the name and details of the new organization?

We believe that such letters are quite sufficient. The fact is that when the organizational and legal form changes, the rights and obligations of the reorganized company are transferred to the newly emerged legal entity under a transfer deed (Clause 5 of Article 58 of the Civil Code of the Russian Federation). This also applies to contractual relationships. It turns out that no additional agreements signed by counterparties are required.

Acts of work performed, invoices and invoices should ideally be written out like this: up to the day of reorganization on behalf of the predecessor, on the date of reorganization and further on on behalf of the successor. But given that after the transformation, the terms of the contracts actually remained the same, it is permissible to begin drawing up a “primary agreement” on behalf of the new organization from the first day of the month in which the reorganization took place. At the same time, in our opinion, the numbering of primary documents can not be interrupted.

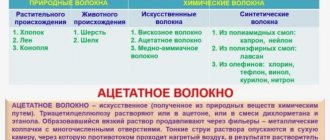

Forms of enterprise reorganization

The Civil Code of the Russian Federation defines five forms of reorganization: merger, accession, division, separation, transformation .

Merger

During the merger process, several companies go out of business.

Instead, a new legal entity is created, to which powers and property are transferred.

If the total assets of the company that have ceased to exist exceed 30 million minimum wages, the merger requires the consent of the antimonopoly authorities.

Selection

In the process of separation, instead of one legal entity, a new organization or several enterprises are formed.

But the company, which was reorganized, does not stop working.

Accession

In the process of joining organizations to each other, one of them stops working. This is how an affiliation differs from a merger: one of the organizations participating in the process remains functional.

Separation

During a division, one company is divided into several legal entities.

Conversion

In this process, the organization receives a new organizational and legal form. And all powers and property are transferred to the created organization, with a new name.

Who pays taxes and submits returns for their predecessor?

In case of transformation, the newly created organization is the sole legal successor of the reorganized company. It is to the successor that the obligation to pay taxes passes (Clause 9, Article 50 of the Tax Code of the Russian Federation). In this regard, inspectors usually transfer the balances from the settlement card with the budget of the “former” legal entity to the personal account of the new organization.

But it happens that tax authorities, in order to avoid confusion, ask the taxpayer to carry out a reconciliation before reorganization, pay off all debts and return all overpayments. Strictly speaking, this approach is not legal. But in life, many accountants meet the controllers halfway and bring all budget calculations to zero.

If the “old” organization ceased to exist without having time to report taxes, then this is done for it by its successor, who submits reports to the Federal Tax Service at the place of its registration. Moreover, the deadlines for submitting declarations are not shifted due to the reorganization. For example, for income tax for the year you need to report no later than March 28 of the next year, and for the simplified tax system - no later than March 31 of the next year.

Tax base for profit, property and transport tax

There are two different approaches to income tax. The first is based on the fact that at the time of reorganization the last tax period of the predecessor ends and the first tax period of the successor begins. Accordingly, the tax bases are different and cannot be combined. And if so, then in the declarations of the new company it is impossible to take into account the data reflected by the predecessor from the beginning of the year. A similar point of view was expressed by officials (letter of the Federal Tax Service of Russia dated November 11, 2010 No. ШС-37-3/15203).

But there is a second approach, according to which, in the event of a transformation, tax bases for profits can be combined, and this will not lead to distortion. Inspectors who adhere to this position require a declaration from the successor, which takes into account the data of the predecessor from the beginning of the year.

We accept both the first and second approaches. Therefore, it is worth finding out the opinion of “your” inspector.

For property tax, the calculation of the taxable base is not interrupted. In other words, after the reorganization, the successor includes in the declaration information about the value of the objects as of the 1st day of each month, starting from the beginning of the year.

For transport tax, the successor company that inherited the cars must submit a single return for the entire year. It must show the amount of transport tax in relation to all cars that previously belonged to the transformed organization and were newly accepted onto the balance sheet. This is stated in the above-mentioned letter No. ШС-37-3/15203.

Tax base for VAT

If the transformation took place in the middle of the tax period (for VAT it is equal to a quarter), then the base is divided into two parts. The amounts accrued by the predecessor will fall into his tax base and, as a result, into his declaration. Accordingly, the assignee's accruals will be reflected in the base and in the assignee's declaration.

With deductions the situation is as follows. The “new” organization has the right to accept a deduction for the “old” one if a number of conditions are met. Thus, in order to deduct advances received for future payments, it is necessary that the sale occurs, or the successor records the termination of the transaction and returns the advance payment. There is one limitation here - the deduction must be accepted no later than one year from the date of return (clause 4 of Article 162.1 of the Tax Code of the Russian Federation).

For tax that the predecessor paid to his suppliers (or at customs), but did not have time to accept for deduction, the “usual” conditions must be met. This is the presence of an invoice, a “primary” document and registration for use in transactions subject to VAT. In addition, there is an additional condition: the successor has the right to accept a deduction only if there are documents confirming payment.

We add that special attention should be paid to the date of the invoice issued in the name of the predecessor. If the document is dated after the conversion, then the tax authorities will most likely not allow the tax amount on such an invoice to be deducted. In this situation, the accountant can only contact the supplier and ask him to correct the document.

Personal income tax reporting

During reorganization, the personal income tax tax period is not interrupted. This is explained by the fact that the company is not a taxpayer, but a tax agent. In addition, labor relations with personnel continue, which is directly provided for in Article 75 of the Labor Code of the Russian Federation. This means that no interim reporting on personal income tax is required during the transformation.

Let us note one feature: if an employee brings a notice for property deduction, where the “former” organization is indicated as the employer, the accounting department of the “new” company must refuse him. The employee will have to go to the inspectorate again and get another notice, which confirms the deduction related to the legal successor. Such clarifications were given by the Federal Tax Service of Russia in letter dated September 23, 2008 No. 3-5-03/ [email protected]

Insurance premiums and reporting to funds

There is a controversial issue here. Is the newly formed organization obliged to calculate the taxable base for contributions from scratch or is it allowed to continue the countdown that began before the transformation? The amount of insurance premiums depends on the answer to this question. If the assignee resets the base, then he automatically loses the right to exempt accruals from contributions that exceed the maximum amount (in 2011 it was equal to 463,000 rubles). If he “inherits” the base, then along with it he will receive the right not to charge contributions for the excess amount.

In our opinion, in the event of a transformation, the base does not need to be reset, since only the organizational and legal form changes, and the employing company remains the same. But those who choose this path will likely have to argue with fund officials.

In any case, paying contributions and submitting settlements for them for the predecessor is the responsibility of the successor (Part 16, Article 15 of the Federal Law of July 24, 2009 No. 212-FZ).

Conversion

A distinctive feature of the most popular form of reorganization, transformation, is the presence of one legal successor and one legal predecessor. The reason for the transformation may be, for example, a change in the corporate name of the organization with the renaming of its individual bodies. However, during the transformation, a complete change in the internal structure of the legal entity occurs, and its degeneration occurs, through the elimination of one participant in civil circulation and the emergence of a completely new one. The very process of changing the organizational and legal form of a legal entity through transformation is carried out on the basis of the current civil legislation of the Russian Federation and is subject to the rules on the reorganization of legal entities.

Is it possible to inherit the “simplified”

If the predecessor was on the simplified tax system, and the successor plans to remain on this special regime after the transformation, no applications need to be submitted. If all the conditions necessary for the application of the “simplified tax” are met, the right to it automatically passes to the newly formed company. And although officials do not agree with this (see letter from the Federal Tax Service for Moscow dated 10/08/10 No. 16-15/105637), judges are entirely on the side of taxpayers (resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 06/15/10 No. 563/10).

* Full title of the document: Guidelines for the preparation of financial statements during the reorganization of organizations (approved by order of the Ministry of Finance of Russia dated May 20, 2003 No. 44n).