Until recently, financial insolvency was considered the prerogative of exclusively legal entities, but now individuals can also file for bankruptcy. There are just a few specifics about how to go through the bankruptcy procedure for individuals. First of all, this concerns the bankruptcy scheme of an individual. The fact is that often ordinary people simply do not need to go through all the stages that they would have to go through as representatives of legal organizations or even individual entrepreneurs. But to understand what awaits a person who decides to declare bankruptcy, it is important to consider the procedure step by step.

The necessary conditions

Before going through bankruptcy proceedings, you need to make sure that there are rational grounds for this. First of all, an applicant for bankruptcy status must meet certain requirements. They are listed in No. 127-FZ. In particular, all applicants must have signs indicating their insolvency:

- the presence of debt in an amount exceeding 500 thousand rubles (it makes no difference to whom - a bank or another individual);

- the period of delay in loan payments exceeds 90 days from the date of the last installment;

- the presence of circumstances that may further impede the restoration of financial solvency.

Regarding the first two points, everything is very clear, but the third point about a citizen’s bankruptcy is worth considering in more detail, because if it is possible to repay the debt, even if it is overdue, there is no need to urgently submit documents to the Arbitration Court. So, circumstances that can be interpreted as an obstacle to debt repayment include:

- dismissal from work;

- long-term illness that prevents work;

- loss of a family breadwinner;

- force majeure such as a burned house, etc.;

- loss of business.

In other words, a crisis has come in the life of the alleged bankrupt, and it will not be possible to get out of it soon. In such circumstances, it is not necessary to wait until the debt grows to 500 thousand rubles, but to submit an application as quickly as possible.

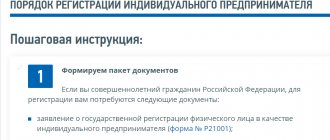

Step-by-step instruction

In order to file for bankruptcy as an individual yourself, you need to carefully prepare for this process. To do this, there are step-by-step instructions for the bankruptcy procedure for individuals, which must be followed if you want to successfully overcome the procedure and obtain the desired status.

To confirm your lack of creditworthiness and forget about debts, you should follow these steps step by step:

- collect documents that confirm financial insolvency;

- write an application and send it, along with the collected documents, to the Arbitration Court;

- send notices to creditors about the commencement of bankruptcy proceedings;

- undergo an initial hearing in court;

- carry out the stages prescribed by the court.

The procedure is completed by officially declaring the person bankrupt. As a result, his debts are written off. But to understand, it is important to study the procedure in more detail.

Responsibilities and tasks

The bankruptcy trustee has broad powers that are transferred to him from the previous management of the company. According to Art. 129 Federal Law No. 127, the duties of the bankruptcy trustee include:

- publications in the media and the EFRS about the beginning of bankruptcy proceedings;

- financial analysis of the company's activities;

- ensuring the safety of assets and documents of a legal entity;

- organizing an inventory of the debtor's property;

- valuation of the company's property with the involvement of specialized specialists;

- regular notification of participants in the process about ongoing procedures;

- entering information about the debtor's property into the register;

- increasing the bankruptcy estate by identifying the company’s debtors and seeking company funds from third parties;

- maintaining a register of lenders' claims;

- notification of company employees about their layoffs;

- dismissal and settlements with company personnel;

- concluding transactions that will improve the financial position of the debtor;

- submission of reports on the work done for a specific period;

- fulfillment of other duties established by the court in accordance with the norms of current legislation.

All actions and functions of the bankruptcy trustee are aimed at preparing and organizing auctions of the company’s property to further satisfy the claims of creditors and other persons. After assessing the company’s property, the specialist provides the information received to creditors, describing the conditions for the sale of the debtor’s property and the payment of his debts.

Possible options for bankruptcy of an individual

There are three options for what procedure the court will order. They can act as stages of one process, or be independent, for example, if the debtor can cope with the debt without drastic measures.

So, among the stages of bankruptcy of an individual we can distinguish:

- Restructuring. Appointed if the court decides that the debtor is able to pay the debt, albeit with certain amendments. To realize this, an individual payment schedule is developed for a maximum of three years.

- Sale of the debtor's property in order to pay off the debt.

- Settlement agreement. The debtor and creditor agree on the basis of which the bankruptcy procedure is terminated. In this case, some of the debts can be written off, but not all.

Which procedure from the list presented will be used depends on many factors. Including whether creditors agree to make concessions, or how serious financial problems the debtor has. However, each procedure is worthy of being studied in more detail.

Option 1. Debt restructuring

Restructuring is the procedure for reviewing all debts of individuals and drawing up the most convenient scheme for repaying them. Moreover, you only need to pay the body of the debt, that is, everything except interest, penalties, fines, etc. Also, during the restructuring, part of the debt may be written off.

This procedure is impossible if the debtor does not have a stable source of income, which is usually wages. Moreover, the size of the salary is also important. Typically, the court can order restructuring if the debtor has the opportunity to receive an income of 30 thousand rubles per month. Although this is for Moscow and the Moscow region, in the regions financial limits may be more modest.

However, the procedure has its own nuances:

- the restructuring plan is introduced for 3 years;

- within 2 months, a register of creditors is compiled;

- the restructuring plan is approved at a meeting of creditors, at which the debtor must also be present, although he does not take part in the voting itself;

- Following the plan is a must, otherwise the procedure will be stopped.

In this case, the consequences for the debtor are as follows:

- The ability to pay the debt without taking into account the interest that will be written off.

- The need to communicate about ongoing restructuring.

- It is prohibited to invest in the authorized capital, buy shares, securities, etc.

If claims are made against an individual regarding a debt, it will be considered that the deadline for payment of monetary obligations has arrived.

Option 2. Sale of property in favor of creditors

Usually, when an individual goes bankrupt, the matter ends with the sale of the debtor’s property. But at the same time, there are conditions under which one property can be taken away, but another cannot. If there is no property that could be sold, the debt will be written off.

Typically, the sale of property can be ordered after a restructuring that has not yielded results. But there are cases when the property is sold immediately, without an intermediate stage. But such a decision can only be made by the court.

The property becomes part of the bankruptcy estate and will subsequently be sold at auction. This usually happens if the debtor does not have a job or the salary is too low. The property is appraised by a financial manager. But you can hire a professional appraiser who can confirm or refute the correctness of the manager’s assessment.

The property is sold for no longer than 6 months. To collect the bankruptcy estate, the trustee carefully examines the debtor's assets, looking for undeclared real estate, securities and other valuables that can be used. It is possible that the debtor will try to hide something in order to write off the debt.

An amount of funds equal to 10 thousand rubles can be excluded from the bankruptcy estate. This is the minimum amount for a decent life, excluding the source of income. Sometimes this amount can be increased if the cost of living is higher in the region where the debtor lives.

The following property is excluded:

- the only housing, but only if it is not collateral;

- tools through which professional activities are carried out;

- personal belongings;

- household items, etc.

The funds received are distributed among creditors depending on priority.

Option 3. Settlement agreement

Sometimes it is possible to reach an agreement without critical measures in the form of bankruptcy. For example, when the parties manage to find a common solution without involving the court. In this case, bankruptcy stops at whatever stage it is, even in the process of selling the property.

The borrower must independently cope with his responsibilities. But such an outcome is quite rare even in the business world, not to mention the debts of individuals who find themselves in a critical financial situation.

If it is unprofitable for creditors and debtors to initiate bankruptcy proceedings, the most favorable moment is to make a settlement agreement. If things don't work out, you can always file for bankruptcy later.

Types of managers

The bankruptcy trustee has numerous rights and responsibilities. Functions may change depending on various factors and circumstances, as well as decisions made.

Specialists may be called differently depending on what specific actions they perform, as well as at what stage of bankruptcy they carry out their activities.

How long does the procedure take?

Many users are interested in how long the bankruptcy procedure can last. The only thing we can say for sure is that it is quite long, but the specific timing depends on the specifics of the situation. For example, the following factors may affect the duration:

- whether the debtor has property that can be sold;

- whether the debtor has suspicious transactions that have been concluded over the past three years, and whether they can be cancelled;

- the amount of debt and the number of loans that formed it;

- other circumstances that may affect the case.

Under normal circumstances, the procedure will take no more than 6-8 months. It takes about 2 months to approve a restructuring plan. It will take up to six months to complete all activities.

How much will bankruptcy cost the debtor?

To carry out the bankruptcy procedure for individuals, the debtor needs to invest financially. This is due to the fact that specialists take part in the procedure, and you also need to pay legal costs.

It will be useful for individuals to know that the cost in each case is individual. But there is an approximate price that you can use as a guide, and it averages 50 thousand rubles. This cost should include the following items:

- payment for the work of the financial manager - 25 thousand rubles;

- the cost of publishing about bankruptcy is 10 thousand rubles;

- expenses for a court case (state fees, postage, etc.) within 10 thousand rubles.

Debtors can also spend money on consultations with lawyers, payment for representation services in court, and payment for the work of independent experts. As a result, the price increases significantly.

Manager concept

The bankruptcy arbitration manager is a specialist with knowledge and skills in anti-crisis management of companies and assets of individuals. It is appointed exclusively by the court. Its main function is to control the activities carried out by companies or individuals. He ensures that the debtor's credit obligations are satisfied as much as possible.

Based on the Federal Law “On Bankruptcy”, the basic rules for the work of a specialist include:

- he acts as a link between the debtor, creditors and the court;

- they must respect the interests of all parties;

- all his actions must be aimed at ensuring that the debtor is declared insolvent on the basis of legal requirements;

- all participants must be satisfied with the work of the specialist, since otherwise they have the right to replace him;

- if there is no manager, the debtor will not be able to independently cope with the claims and demands of numerous creditors represented by companies or individuals;

- a specialist is appointed by the court, although each debtor has the opportunity to nominate his own candidate for this position.

For his work, the specialist receives a certain remuneration, and all expenses incurred by him are also reimbursed.

Consequences of bankruptcy for individuals. faces

Often debtors try to hold out until the last minute without starting bankruptcy proceedings. The reason is that those undergoing the procedure have certain restrictions that they must follow. There are indeed consequences, but they are not so critical as to continue accumulating debt.

The restrictions that a person who has undergone the procedure receives include:

- you cannot repeatedly request bankruptcy status for 5 years;

- for three years it is prohibited to hold leadership positions in companies (that is, to be a director, chief accountant, etc.);

- notify the bank of all financial transactions for five years;

- prohibition on operations for the sale of property, its transfer, etc.

It is necessary to carefully follow the procedure and file for bankruptcy status on time without fear of consequences. Being in limbo, the debtor has much more trouble. For example, he is not allowed to travel abroad.

Bankruptcy of an individual became possible not so long ago, but now this procedure is popular among people who, for some reason, cannot fulfill their financial obligations. This process takes from six months to several years and is a way out of a situation when it is not possible to cope with debts using other methods.

Who can become a manager?

The bankruptcy trustee performs many different activities and tasks at once, so he is appointed only when numerous requirements are satisfied. These include:

- a citizen must have higher education;

- he must be a member of an SRO specially created for the training of managers;

- a specialist works with two or three assistants;

- only after working as an assistant for several years can he become a full-fledged manager;

- required to successfully pass an exam based on a program created for training specialists;

- a criminal record is not allowed;

- work experience in any managerial position must exceed 2 years;

- You are required to purchase a professional liability insurance policy.

The specialist must have Russian citizenship. He has the right to initiate various official procedures within the framework of the bankruptcy of any citizen or enterprise. A bankruptcy trustee may insist on debt restructuring or assess assets, initiate bankruptcy proceedings, or take numerous other actions. At the same time, it is important that he complies with the requirements of the SRO of which he is a member.