Deposit insurance mechanism

The standard deposit insurance system significantly increases the confidence of citizens who are going to invest their own funds in bank deposits. That is why the state is taking all measures to improve the insurance system and provide optimal conditions for preserving depositors’ savings.

Currently, the insurance procedure has been significantly simplified - the depositor only needs to make a certain amount of deposit to a banking institution and draw up a standard deposit agreement. In this case, there is no need to draw up a special additional insurance contract - the entire procedure of interaction with the deposit insurance agency (DIA) is completely undertaken by the selected financial institution. The bank makes quarterly insurance contributions to this agency in the amount of 0.1% of the total deposit amount.

Thus, the insurance is not paid by the depositors themselves, but directly by the financial institution.

What is DIA?

The Deposit Insurance Agency began its work in January 2004. It was created for the purpose of regulating CERs.

The main functions of the DIA are:

- making payments of compensation to depositors on deposits in case of insured events;

- maintaining a register of participating banks of the CER;

- controlling the formation of a deposit insurance fund;

- fund management.

As of February 20, 2020, the number of financial institutions participating in the deposit protection program was 778 units, and the number of recorded insured events was 431 (as of March 5, 2020).

Insurance compensation

In the event of an insured event, the depositor has the right to receive insurance compensation from the deposit insurance agency. Moreover, in accordance with current legislation, in 2020 the amount of insurance paid is 100% of the deposit amount, but this payment has a limitation - the depositor receives compensation of no more than 1,400,000 rubles. This procedure is carried out in accordance with the resolution of the federal law, paragraph 2 of Art. 11 Federal Law No. 177-FZ

.

According to this law, the maximum amount of standard insurance compensation for all deposits and accounts of individuals for which an insured event occurred after December 29, 2014, the amount of payments has been significantly increased to 1.4 million rubles.

Moreover, this rule also applies to individual entrepreneurs.

Compensation of insurance deposits

If investing in a bank through a deposit does not pay off and the company closes, the owner of the deposit can count on reimbursement of the insurance savings deposit. The rules apply here:

- The maximum amount of compensation payment in case of an insured event is 1,400,000 rubles;

- Foreign exchange investments are first recalculated at the Central Bank exchange rate, after which they are paid in rubles;

- Deposits made in two banks can be compensated in an amount of no more than 2,800,000 rubles.

It should be noted that compensation for funds invested in the bank’s activities is carried out only if an insured event occurs. There are only two such cases - either the liquidation of a bank by revoking its license, or the introduction of a moratorium on the implementation of creditors’ claims by the Bank of Russia. In other situations, funds are not returned, since the insured event does not occur.

Actions upon the occurrence of an insured event

The basic procedure for paying insurance compensation is regulated by Art. 12 Federal Law No. 177-FZ

. This article provides that the deposit insurance agency, within 1 week from the date of receipt of the register from the banking organization, undertakes to publish in the publication “Bulletin of the Bank of Russia” an information message about the designated place and time for accepting applications from citizens to whom insurance is due. Additionally, each depositor must be sent a repeated message within a month about the possibility of insurance payments.

How to return a deposit if the bank’s license has been revoked

Only the Central Bank terminates the activities of a credit institution. The reimbursement process starts immediately after the bank's license is revoked.

Within a week from the date of receipt of the register of debt to depositors, the Deposit Insurance Agency sends a message to the “Bulletin of the Bank of Russia” and the official city newspaper at the location of the bank.

The text indicates the place, time, form and procedure for accepting applications for payment of compensation for deposits. Similar information is posted on the websites of the Agency and the bank itself. Then, within 30 days, the same messages are sent to depositors by mail.

Most often, depositors learn about the revocation of their bank’s license from the media; this is usually always talked about in the news on central channels, written on major news sites and portals, such as Yandex, Mail, etc.

Finally, if you go to the bank and the office is suspiciously closed during the middle of the working day, here is what you should do:

1 Go to the DIA website and then either call the hotline or enter the name of your bank in the search bar. If it turns out that the bank’s license has been revoked, then find out which bank has been appointed as the DIA agent for compensation payments. This data is posted on the Deposit Insurance Agency website, or you can ask a hotline specialist.

2 14 days after the announcement of the revocation of the bank’s license (its date is indicated on the Agency’s website), the depositor, his representative or heir writes an application in the DIA form. The form can be downloaded on the Agency’s website (https://www.asv.org.ru/insurance/, section “Document Forms”) or filled out at an agent bank. There is no need to rush, but you need to be in time before the end of the bank bankruptcy procedure (this date will be announced on the websites of the DIA and the closed credit institution). If the investor or his heir “blundered”, the term can be restored by proving that the applicant was prevented by force majeure circumstances, military service or serious illness.

Reasons for refusal of compensation

Not all investors can receive compensation payments - there are a number of reasons why insurance compensation is not possible.

Grounds for refusal may include

the following cases:

- Deliberate actions of depositors that are aimed at the immediate occurrence of an insured event;

- Commitment of an intentional crime by the policyholders, as well as by the person for whom the insurance contract was drawn up for the purpose of receiving compensation payments;

- Provision by the policyholder of false information about the insurance procedure.

Thus, the reasons for refusal of compensation payments are any illegal actions of the insurer and the policyholder aimed at obtaining compensation.

How to get your deposit if the bank has closed or its license has been revoked?

If one of the insured events (described above) occurs in relation to the bank in which you kept your savings, then you have the right to reimbursement of your money in the amount of 100%, but not more than 1.4 million rubles.

In order to receive your money, you need to contact the DIA or the bank that has undertaken obligations to pay deposits. You can apply for money from the day the insured event occurs until the completion of the procedure. If the specified period is missed, it will be possible to withdraw the money only after submitting the appropriate application to the ASB, and then only in the presence of circumstances that are prescribed by law.

In order to apply to receive your money, you must submit the following documents:

- application , which is filled out in the form specified by the ASB (can be found on their website);

- document that identifies the depositor (passport);

- if you are the heir of the investor , you will need to present a document that confirms your right of inheritance.

Payment of funds is made 2 weeks after the occurrence of the insured event. The money will be transferred to the depositor’s account within 3 days from the date of submission of the necessary documents.

Video: how does the deposit insurance system work in banks?

How does the Russian deposit insurance system work?

In the Russian Federation, the compulsory bank deposit insurance system is a special measure of social support for citizens. This program is regulated by a special provision of the law “On insurance of deposits of individuals in banks of the Russian Federation” No. 177-FZ dated 23. To implement and implement this provision, a special organization called the DIA (deposit insurance agency) was created. This system deals with the return of insurance and organizes all actions for payment to the insurer.

If the banking system in which the deposit was made goes bankrupt, the depositor must submit an identification document to the deposit insurance agency with a special application.

Which banks are included in the deposit insurance system?

According to the DIA as of November 13, 2020, the deposit insurance system includes 476 operating Russian banks, which contain over 24 trillion rubles of deposits of individuals and individual entrepreneurs.

The law obliges all credit institutions that accept deposits from the public to participate in the CER. To have the right to display the “Deposits are insured” banner on their website, banks must meet several requirements:

- Reliable reporting (according to the standards of the Central Bank), errors and inaccuracies should not affect the assessment of the financial stability of the organization;

- Compliance with Central Bank standards on reserves, capital, etc.;

- The financial stability of the bank was recognized by the Central Bank as sufficient (primarily in terms of liquidity, quality of risk management and other similar parameters);

- Timely provision of information about persons under whose control the bank is located.

- Timely correction of identified violations.

Not all banks meet these requirements. 4 credit organizations are now deprived of the right to attract funds from the public. Thus, the Central Bank points out to banks the problems with accounting for deposits and the suspicion of maintaining “notebook” accounts, when money is taken from depositors, but not recorded according to documents.

After the prohibition of attracting new deposits, the Central Bank of the Russian Federation begins to check for the presence of off-balance sheet accounts - for example, about 800 depositors were identified at Miko-Bank, whose money (828 million rubles) did not pass through the bank’s balance sheet and was lost in an unknown direction. As a rule, restrictions on accepting deposits result in the revocation of the license.

There are several ways to check if your bank is a member of the CER. The easiest thing is to look on the website of the Deposit Insurance Agency (section “Participating Banks”, sorted alphabetically: https://www.asv.org.ru/insurance/banks_list/). You can also clarify the information you are interested in by calling the toll-free hotline .

A special sign developed by the DIA is posted on the Internet resources of banks included in the deposit insurance system. This sign is also placed on glass at cash desks and at bank tellers.

Photo: Sticker deposits are insured

Deposit Insurance Agency ASV

A special agency involved in deposit insurance was created in 2004 with the aim of ensuring compensation for deposits in the event of any insured events stipulated by the contract. In addition to paying insurance compensation, the organization is engaged in the following activities:

- Maintains a standard register of banks that are the main participants in the insurance procedure;

- Provides high-quality control over the replenishment and maintenance of the main fund, where all insurance premiums go;

- Manages the funds contained in the insurance fund.

Additionally, the agency maintains a master register of non-state pension funds.

The organization monitors the timeliness and quality of receipt of special guarantee contributions.

Up to what amount are bank deposits insured?

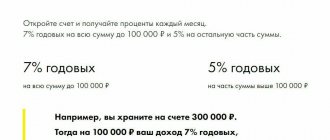

So, what amount is insured in banks for deposits? The upper limit of this amount in 2020 is 1.4 million rubles. For example, from 2004 to 2006 this figure was equal to 100,000 rubles.

It follows from this that funds exceeding this amount should not be kept in one bank. You can return more than 1.4 million rubles, but this cannot be guaranteed 100%. First, the client will receive the maximum allowable amount, and will have to stand in line to return the remaining funds. And when the assets of the bankrupt bank are sold off, it will be possible to receive the rest of the amount. I must say that in this case the wait will be very long.

What deposits are insured by the state in 2020?

In accordance with legislative norms, the following types of deposits are subject to the insurance procedure:

- Special demand deposits, time deposits, as well as all types of foreign currency deposits;

- All current accounts of clients - this includes plastic cards, scholarships, and pensions;

- Finances held in individual accounts of entrepreneurs;

- Funds held in the accounts of trustees, as well as guardians - the beneficiaries in this case are their wards.

How to check if a deposit is insured?

Some banks are unfair to depositors and use double-entry bookkeeping to create unofficial accounts of certain types of deposits. In such cases, insurance compensation is not paid to clients. Therefore, before creating a deposit, you need to make sure whether it is on the balance sheet of the financial institution. To do this, you need to perform the following steps:

- It is necessary to save the main agreement, as well as all existing receipts for payments made;

- You should definitely visit the personal account of the bank where the deposit is open and check whether your own deposit is registered with the financial organization;

- After opening a deposit, you must call the call center and, through the operator, make sure that there is a confirmed deposit amount in your personal account;

- It is necessary, once every few months, to take bank statements confirming the availability of the main documentation - bank details, as well as information about your own account and the amount of funds on it;

The presence of standard documentation will allow you to prove the existence of a deposit in the event that the bank has committed fraudulent actions against the depositor.

How does bank deposit insurance work?

The procedure for reimbursement of funds from individuals through the DIA does not depend on the basis of official liquidation that the agency is guided by - revocation of a license by the Central Bank of the Russian Federation, or a bankruptcy procedure initiated by the owners, or a court decision.

Important: the right to compensation also appears when the regulator imposes a moratorium on the bank on the claims of its creditors.

In each case, monies related to private insured funds are subject to unconditional reimbursement to clients up to the applicable maximum amount.

Until August 9, 2006, the maximum amount of compensation was limited to a ceiling of 100 thousand rubles. Subsequently, it gradually increased:

- 190 thousand rubles. - since August 9, 2006;

- 400 thousand rubles. - since March 25, 2007;

- 700 thousand rubles. - from October 1, 2008;

- 1.4 million rubles - from December 29, 2014

Accordingly, in order to 100% protect your money from loss due to the deprivation of a bank’s license, it is enough to keep in all deposits and accounts an amount not exceeding 1 million 400 thousand rubles (for foreign currency - in equivalent).

Money deposited in different branches are considered deposits (funds) in one credit institution.

If, however, in a Russian bank that ceased operations, there was an amount exceeding the ceiling of the compensation guaranteed by the DIA, the depositor has only a very slim chance of receiving the rest of the money or part of it during liquidation procedures.

Register of banks with insured deposits

In the Russian Federation, more than 500 banks are participants in the main deposit insurance system in 2020. If a deposit is opened in a state bank, it is subject to a mandatory insurance procedure.

There is a list of banking organizations that are participants in a specific state deposit insurance system. To find out whether a financial organization is in the register of banks belonging to this category, you must contact the deposit insurance agency hotline - 8 (800) 200-08-05

.

How to profitably insure deposits for individuals and legal entities - 3 useful tips

Despite the fact that deposit insurance in banks participating in the CVS program is a mandatory procedure, many clients have questions regarding the mechanisms and principles for protecting their savings.

Moreover, a huge number of depositors are not aware that their deposit is reliably insured against loss in the event of bankruptcy and revocation of the company’s license.

Some tips for banking clients who want to protect their money 100%.

Tip 1. Make sure that the bank is a participant in the SSV

How to make sure that a financial institution is included in the CER program? It’s very simple - go to the official website of the DIA and find your bank in the list of participants.

If an institution is not on the list or, moreover, is on the list of companies excluded from the system, then you should not trust your assets to such an institution.

Tip 2. Avoid mistakes when filling out documents

When making a deposit, always check that your personal data is written correctly – full name, passport number, residential address.

If you change your name, address or passport, always notify your bank of such changes. This will help you easily find your contract when paying for insurance.

Tip 3. Make sure your contribution is covered by the CER

There are deposits that are not subject to compulsory insurance. We have already given a list of them above.

Remember also that the insurance covers not only the deposit body, but also the accumulated interest.

If you have any questions about how to insure your deposits and not make mistakes, you can seek help from the experienced lawyers of the Pravoved.ru online service.

Watch an interesting video on the topic of deposit insurance.

What deposits are not insurable?

Some types of deposits are not subject to compulsory state insurance:

- Funds that are in the bank accounts of notaries and lawyers, if these accounts were opened for the direct implementation of professional activities.

- Deposits that were opened by individuals in bearer form.

- All deposits that were transferred by individuals to the management of a banking organization.

- Funds that were placed on deposit outside the territory of the Russian Federation.

- Deposits in the form of electronic currency.

- Funds held in metal accounts.

Insurance of metal accounts

All funds that were placed in standard metal accounts cannot be insured by the state

. The basis for this is a special law - “On insurance of deposits of individuals in banks of the Russian Federation”, which provides that only cash accruals that were placed with the bank on the basis of a personal bank deposit agreement can be subject to the main insurance procedure.

Metal accounts record not cash, but precious metals. The value of these metals is “measured” in grams - their value is calculated through this unit. These accounts are metal and are not subject to insurance procedures.

Goals, functions and composition of participants

In 2003, the law “On insurance of deposits of individuals in banks of the Russian Federation” was adopted. This document is the main one in resolving controversial issues arising in the event of bankruptcy of a financial institution.

The goals of adopting such a law are obvious:

- Protecting citizens' savings from the onset of negative events in the bank.

- Protection of depositors from unscrupulous banks.

- Increasing the attractiveness of deposits for the population and, consequently, attracting more funds for development.

- Increasing the loyalty of the population to the state in general and to the banking sector in particular.

The main function of the law is compulsory insurance of bank deposits of the population. The state assigned it to the Deposit Insurance Agency (DIA).

Until 2020, the law applies only to individuals, but as of January 1, 2020, a new version comes into effect, which changed the name of the law, removing the words “individuals.” This change was required due to the fact that not only individuals, but also legal entities (small enterprises) are now subject to compulsory insurance.

Accordingly, new provisions have been added. I consider this a serious step in supporting small businesses.

In the lives of my friends who own their own small printing house, the absence of such a law previously played a cruel joke. The account of their company was opened in a bank that was deprived of its license by the Bank of Russia a couple of years ago. According to the bankruptcy procedure, the friends turned out to be third-priority creditors.

Competent people in narrow circles confirmed that there is no point in waiting for a refund. This jeopardized the very existence of the business. Unfortunately, friends still cannot cope with the negative consequences of this incident.

I will return to entrepreneurs at the end of the article, but for now let’s deal with the current version of the law. It does not involve drawing up and signing a separate agreement. Each depositor automatically becomes a participant in the system.

On the DIA website you can get answers to all questions that arise regarding insurance. First of all, what every depositor should pay attention to is the list of banks included in the deposit insurance system (DIS). It is easy to find on the DIA website. Now there are 762 banks.

But it is worth keeping in mind that this list also includes those who are in the process of recovery. For example, I saw such well-known banks as B&N Bank, Uralsib, Investtorgbank, and Russian Capital on the list of those recovering. There are 22 banks in total. For me, this information would be very useful if I were choosing the option of placing money.

Also, among the 762 banks included in the SSV, there are financial organizations in the process of liquidation. There are 326 of them in total.

In addition, you can look at banks that have a moratorium on accepting deposits. Today there are 4 of them, among them PromSvyazInvest, for example.