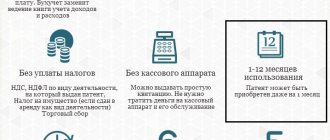

Individual entrepreneurs usually choose preferential tax regimes. This allows them to optimize costs and submit fewer reporting forms. The general taxation system for individual entrepreneurs is not the best option. As a rule, her choice is dictated by necessity. And in some cases it is not there at all, because you can end up on OSNO not of your own free will.

This will happen if you go beyond the restrictions established within the tax regime for the income of individual entrepreneurs, the number of employees or types of activities. Or if you don’t switch to a simplified tax system in time. The general taxation system for individual entrepreneurs is relevant if he works with large buyers who pay VAT. Let's figure out what the OSNO regime is and what kind of reporting needs to be submitted here.

Personal income tax on entrepreneur income

An individual entrepreneur pays personal income tax on the amount of income he receives from business activities. He has the right to reduce them by professional deductions in the amount of costs that he can confirm with documents. If there are no documents, an individual entrepreneur on OSNO has the right to deduct 20% from his income. The result is a tax base to which a personal income tax rate of 13% is applied.

The procedure for paying tax is described in Article 227 of the Tax Code of the Russian Federation. During the year, the entrepreneur makes 3 advance payments, and at the end of the year, an additional tax payment. Currently, advances are paid within the following terms:

- for the first half of the year - until July 15:

- for the 3rd quarter - until October 15;

- for the 4th quarter - until January 15 of the next year.

The amount of advance payments is calculated by the Federal Tax Service specialists based on the declarations submitted by the entrepreneur earlier. A notification is sent to him, on the basis of which he must pay the tax within the deadlines indicated above. If an individual entrepreneur on OSNO has just started his activities, he must fill out a 4-NDFL declaration. In it, he indicates the estimated income on the basis of which the Federal Tax Service will calculate the first advance payment.

From January 1, 2020, changes will be made to Article 227 of the Tax Code of the Russian Federation. Entrepreneurs themselves will begin to calculate personal income tax advances. This will need to be done at the end of the 1st quarter, half year and 9 months. Advances will need to be paid no later than the 25th day of the month following the end of the 1st, 2nd and 3rd quarters.

At the end of the year, the individual entrepreneur must independently recalculate personal income tax, based on how much income he actually received and paid in advances. Additional tax payment must be made before July 15 of the following year. And by April 30, an individual entrepreneur on OSNO is required to submit a 3-NDFL declaration to the Federal Tax Service. The entrepreneur does not submit any other reporting for this tax. The 4-NDFL declaration will be abolished from 2020, because the individual entrepreneur will calculate advance payments himself.

Free tax consultation

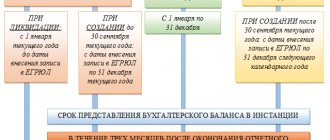

Accounting statements of individual entrepreneurs on OSNO

In accordance with paragraph 2 of Art. 6 of the Law of December 6, 2011 No. 402-FZ Individual entrepreneurs may not keep accounting records . Therefore, unlike legal entities, individual entrepreneurs are not required to send financial statements to the Federal Tax Service and Rosstat

Individual entrepreneurs must fill out books of purchases and sales, as well as a book of income and expenses. These registers, in the absence of “full-fledged” accounting, form the basis of their accounting.

However, many entrepreneurs still balance debit and credit on a voluntary basis. This allows individual entrepreneurs to assess their financial situation “in a comprehensive manner”, and it is easier to fill out tax returns when the accounting system as a whole is in place.

Sometimes an individual entrepreneur does accounting because he needs to provide financial statements to external users. These could be banks when processing loans, or counterparties if a large contract is expected to be concluded.

But even in this case, the entrepreneur is not obliged to submit a report to government agencies.

VAT

OSNO is one of two taxation systems that requires payment of VAT. Tax is calculated on the cost of goods, works and services sold. The standard rate from 2020 is 20%. There are a number of preferential goods that are taxed at a rate of 10%. These are food, goods for children, printed periodicals, and some medical products. The full list is presented in paragraph 2 of Article 164 of the Tax Code of the Russian Federation.

In addition, in some cases there is a zero VAT rate. It is used for export, international transport and cargo transportation. There are also a number of transactions that are not subject to VAT (Article 149 of the Tax Code of the Russian Federation). Among them are the sale of certain medical goods and services, care for the disabled, activities with children in clubs and others.

The VAT allocated in the incoming invoice can be deducted by the buyer. It is because of this opportunity that entrepreneurs often choose the main tax regime. This allows their counterparties to reduce the tax payable. The individual entrepreneur himself can also take advantage of the deduction and reduce VAT by the amount of the “input” tax charged to him by suppliers.

VAT is calculated at the end of each quarter. The amount received is divided into 3 equal parts and paid before the 25th day of each month of the next quarter.

VAT returns are submitted 4 times a year - before April 25, July 25, October 25 and January 25. The peculiarity is that this report is submitted only in electronic form. You cannot fill out a paper form and bring it to the Federal Tax Service or send it by mail. In this case, it is considered that the declaration has not been filed. This rule also applies to “zero” VAT returns.

PROS AND CONS OF OSNO in 2020

Each tax regime has both positive and negative aspects. Everything is very subjective, but it is necessary to list them to help readers make the right choice.

Advantages of OSNO:

- payment of VAT. On the one hand, there is a need to increase documentation and reporting, and on the other hand, there is the opportunity to work with large and medium-sized companies. When purchasing goods, such companies very often choose counterparties who are VAT payers. Therefore, if your business is sufficiently developed, then OSNO is your option;

- absence of restrictions that special tax regimes have: volume of revenue; number of employees; size of fixed assets; Kind of activity. When documenting a loss, there is no need to pay income tax.

Cons of OSNO:

- paying more taxes;

- increasing the volume of reporting;

- the need to increase the administrative staff - accounting.

Property tax for individuals

Property tax is levied on real estate that an individual entrepreneur on OSNO uses in his business. This could be an apartment, a room, a residential building, including an unfinished construction project, an outbuilding or structure, a garage, or a parking space.

The tax rate varies from 0.1 to 2%. The key point is at what value of the property the tax base is determined - cadastral or inventory. This rule is valid until the beginning of 2020. Further, all assessments will be made at cadastral value.

Property tax is calculated by inspection specialists. The entrepreneur receives a notification and makes payment no later than December 1 of the following year. This tax is not reported.

Personal income tax for employees

If an individual entrepreneur is an employer or hires individuals under civil contracts, he must transfer personal income tax to the budget from the payments he makes to them.

The tax is paid from the amounts accrued to the individual. The order is:

- income subject to personal income tax is calculated;

- the amount of tax is calculated taking into account the deductions due to the employee (Articles 218-220 of the Tax Code of the Russian Federation);

- the tax is calculated at a rate of 13% for residents of the Russian Federation and 30% for non-residents;

- the amount received is withheld from income and transferred to the budget no later than the next day.

Certain types of income have their own tax payment deadlines. For example, personal income tax on sick pay or vacation pay must be transferred by the end of the month in which they were paid.

Personal income tax reporting for employees is submitted in the following forms:

- calculation of 6-NDFL - at the end of each reporting quarter, no later than the last day of the next month;

- 2-NDFL certificates - until April 1 of the next year (if personal income tax cannot be withheld - until March 1).

Free accounting services from 1C

Insurance premiums for individual entrepreneurs for themselves

Every entrepreneur, regardless of the tax regime he has chosen, pays the following contributions for his insurance:

- Medical. In 2020 it is 6,884 rubles, in 2020 - 8,426 rubles.

- Pension. The contribution amount consists of two parts. The first part is fixed - 29,354 rubles for the entire 2020, 32,448 rubles - for 2020. If an entrepreneur’s income does not exceed 300,000 rubles, he pays only this part. If his income is greater, then he pays 1% on the excess amount. Individual entrepreneur on OSNO to calculate this amount reduces the income received for professional deductions. The maximum amount of pension contributions for an entrepreneur in 2020 is 234,832 rubles.

Medical contributions and the first part of pensions are paid during the calendar year. The estimated portion of pension contributions must be transferred no later than July 1 of the following year. Reporting on individual entrepreneurs' own contributions is not provided.

Who should use OSNO in 2020

A general taxation system for individual entrepreneurs and organizations is mandatory if these individual entrepreneurs and organizations by law cannot apply the simplified taxation system (USNO) and the unified agricultural tax (USAT), and more specifically:

- foreign organizations;

- organizations whose authorized capital consists of more than 25% of contributions from other organizations;

- organizations (IP) whose income at the end of the reporting or tax period amounted to more than 150 million rubles in 2020 ;

- organizations whose residual value of fixed assets (intangible assets) amounted to more than 150 million rubles in 2020 ;

- organizations (IP) with an average number of employees of more than 100 people;

- companies and organizations that produce excisable goods;

- pawnshops;

- notaries;

- banks;

- Insurance companies;

- lawyers.

Employee insurance contributions

Employers must provide insurance to the individuals they employ. This obligation applies not only to individual entrepreneurs in OSNO, but also in other tax systems. Insurance is provided at the expense of the employer. The current contribution rates are presented in the table.

| Type of contribution | Rate |

| Pension |

|

| Medical |

|

| Social | 5,1% |

| For injuries | 0.2% - 8.5% depending on the risk class of the activity |

Employee contributions must be paid every month. The payment deadline is the 15th of the next month.

List of taxes according to OSNO

To understand what reports are required to be submitted, it is important to determine the range of taxes that an entrepreneur is required to pay.

Let's consider the basic types of taxation under the general system:

- Personal income tax – paid from the salaries of officially employed employees and amounts to 13%;

- IP tax according to OSNO – 13%;

- VAT – 20% (from January 1, 2020) or 10% when selling a certain category of goods;

- contributions to the Pension Fund - 22%, the Federal Migration Service - 5.1% and the Social Insurance Fund - 2.9%;

- transport, land and property taxes - the amount of transfers depends on the resources used by the entrepreneur.

In some cases, individual entrepreneurs pay the following types of taxes: excise taxes, water taxes and fees for the use of biological resources and objects of the natural world.

We recommend you study! Follow the link:

Can an individual entrepreneur work simultaneously with VAT and without VAT?

The list of taxes paid depends on the type of activity of the enterprise, as well as on the presence or absence of employees on staff. Dimensions are set at the federal and regional levels. Benefits and discounts are provided for a number of business entities.

Individual entrepreneur reporting forms

In conclusion, we list what kind of reporting an individual entrepreneur submits with his employees. It does not depend on whether the entrepreneur chose the main tax system, simplified tax system, UTII, unified agricultural tax or patent. If there is at least one hired employee, the individual entrepreneur is required to take:

- Calculation of insurance premiums. Submitted to the tax office at the end of the quarter by the 30th of the next month.

- Forms of personalized accounting. SZV-M is submitted to the Pension Fund every month, the submission deadline is the 15th of the next month. At the end of the year, before March 1, the SZV-STAZH is submitted along with the EDV-1 form.

- 4-FSS. Submitted to the Social Insurance Fund every quarter. Deadlines: in paper form - until the 20th day of the month following the end of the quarter, in electronic form - until the 25th day.

- Information on the average number of employees. Submitted only by those individual entrepreneurs who hired individuals during the reporting year. The deadline is January 20 next year.

BASIC: system features

OSNO or the general taxation system is quite complex, especially in terms of reporting. However, it allows an entrepreneur to work without fear of the restrictions that Russian legislation imposes on other taxation options:

- by number of employees;

- by annual income;

- by the number of activities that a businessman is engaged in.

Since the development of an enterprise may involve various areas of activity, in some cases OSNO can be combined with various options for simplified systems. For organizations, it is possible to combine the general system with UTII. For individual entrepreneurs, you can use OSNO in combination with a patent and a single tax.