Personal income tax amount

The amount of income tax directly depends on the tax rate at which income received by an individual is taxed.

For most income that individuals receive, a tax rate applies 13%

.

Such income includes:

- wage;

- income received on the basis of civil contracts (tutors, private consultations, etc.);

- sale of property owned for less than 5 years

(from 2020); - rental of property;

- winning a lottery or receiving a gift from individuals (except for gifts from family members or close relatives) if their value is more than 4,000 rubles

. - dividends from equity participation in the activities of organizations (since 2015).

If the above income was received by individuals who are not tax residents of Russia (staying in the country less than 183 days a year), then they are subject to income tax in the amount 30%

(for refugees since 2014 - 13%).

Tax rate of 35%

is the maximum and is applied, as a rule, when an individual receives a win or prize, in competitions, games and other events held for the purpose of advertising goods, works and services.

Income tax

This tax is paid at the expense of the employee and is officially called Personal Income Tax - Personal Income Tax. Its size is calculated as a percentage relative to wages and is:

- 13% - for a citizen of the Russian Federation or a foreigner, but staying on the territory of the Russian Federation for more than six months (183 days);

- 30% - for a foreign citizen staying in the country for less than 183 days;

- 35% - tax on other payments qualified as material benefits, applies to everyone, regardless of citizenship.

Tax return 3-NDFL

A tax return in form 3-NDFL is a document on the basis of which individuals report to the tax service on income received and related expenses.

Mandatory _

A declaration in form 3-NDFL should be submitted only by individuals who declare their income and pay personal income tax

on their own

. These include:

- individuals who received remuneration not from tax agents (employers);

- individuals who received income from the sale of property owned for less than 5 years (from 2020);

- individuals (tax residents of Russia) who received income from sources located outside the Russian Federation;

- individuals who received income from which income tax was not withheld by tax agents (employers);

- individuals who have received winnings paid by the organizers of lotteries and other risk-based games;

- individuals receiving income from individuals by way of gift.

- notaries, lawyers, and other persons engaged in private practice.

The above persons must submit a declaration in form 3-NDFL to the Federal Tax Service at their place of residence no later than April 30

the year following the year in which the income was received.

Individuals who want to submit a 3-NDFL declaration in order to receive tax deductions can do this throughout the year

.

More details about the 3-NDFL declaration.

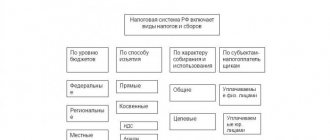

Personal income tax: characteristics

Income tax belongs to the group of direct taxes. It is taxed on almost all income of citizens of the Russian Federation and foreigners who work or temporarily stay in the territory of the state.

Personal income tax is like this:

- counted;

- withheld.

Calculated personal income tax is the amount of tax that is calculated based on the amount of income received and the tax rate applied to the taxpayer. Calculations are carried out according to the formula:

Personal income tax = Tax base * Tax rate

If the taxpayer has issued a tax deduction by the amount of which the tax base is reduced, the formula for calculation will be as follows:

Personal income tax = (Tax base - Deduction amount) * Tax rate

Withheld personal income tax is the amount of tax that is deducted from the taxpayer’s income at the time of payment. For example, an employee receives a salary minus the amount of income tax.

As soon as personal income tax is calculated and withheld, the employer must transfer it within a clearly established time frame. Penalties are provided for their violation.

When to pay income tax on wages?

In order to correctly calculate how much personal income tax on an employee’s salary will need to be paid to the state budget, the taxpayer status must be correctly established.

If you stay on the territory of the Russian Federation for more than 183 days in the previous calendar year, the person will be considered a tax resident.

In this case, the tax rate will be 13%. Otherwise, it increases to 30% for non-residents. In this case, the citizenship of a person does not matter at all.

The procedure for calculating the income tax you need to pay includes 4 important steps:

- The summation of all income received by an employee (this includes salary, allowances, bonuses).

- Carrying out necessary deductions and withholdings.

- Determination of tax rate based on payer status.

- Calculation of the amount to be paid.

We also recommend reading the article: how to calculate personal income tax if there are children in the family.

Important! The deadline for receiving wages as income is set on the day the funds are issued in person or the moment they are transferred to the card. At the same time, we need to keep the NLFL. And then transfer it on the day of retention or the next.

One of the controversial issues is the withholding of personal income tax from the advance part of wages. There is an opinion that income tax should be withheld and transferred directly when issuing an advance to an employee.

Another opinion says that the advance must be paid in full without withholding, and income tax must be deducted and paid from the advance when the full amount of wages is paid within the established period for transfer.

Most opinions still lean toward the second point of view.

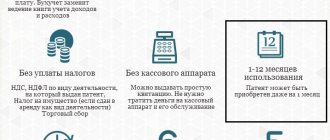

How to legally avoid paying personal income tax?

When to transfer an employee's vacation pay?

It should be immediately noted that the personal income tax rate that must be paid on vacation pay also varies depending on the status of the payer.

For residents it is the traditional 13%, for everyone else – 30%.

Until 2020, payment of personal income tax on vacation pay was carried out according to general principles that applied to the withholding of tax fees for wages.

Subsequently, the Supreme Arbitration Court of the Russian Federation decided that despite the inclusion of vacation pay in wages by the Labor Code, the current norms of the tax code relate exclusively to wages, but not to vacation pay.

Important! Starting from 2020, after the new edition of Article 226 of the Tax Code of the Russian Federation comes into force, the process and timing of the transfer of income tax accrued on vacation pay implies making payments no later than the last day of the month in which the employee received the money.

The tax base is the full amount of vacation pay actually paid. When an employee goes on partial vacation, personal income tax is calculated only on the amount of vacation pay actually paid.

From sick leave

Payments for temporary disability certificates are calculated within 10 days after the employee provides sick leave. The actual transfer of personal income tax funds is made on the nearest day of payment of wages (the main part or advance).

Thus, the deadline for paying income tax will be the last day of the month.

How is sick leave subject to personal income tax?

With compensation for unused vacation upon dismissal

Some employees do not take vacations due to personal reasons.

In this case, upon dismissal, according to the law, they are entitled to compensation for the unused rest period. The question arises whether the employer is obliged to remit income tax if the vacation is compensated by cash payments.

The answer is clear - it should.

Important! When calculating compensation for unused vacation days, the employer must withhold income tax on the employee’s last day of work - the day the dismissal is formalized.

Next, personal income tax must be paid to the budget no later than the next day.

With financial assistance

Despite the fact that receiving financial assistance cannot be classified as earnings, it is also subject to income tax. The exception is a number of cases that are clearly stipulated by law.

According to the provisions of Article 217 of the Tax Code of the Russian Federation, financial assistance is not subject to personal income tax:

- when making a payment in the form of a one-time participation;

- if assistance is provided by charitable companies;

- when compensating for losses due to natural disasters;

- if payments are made to victims of a terrorist attack;

- pensioners, subject to the requirements of the law on lump sum payments to citizens receiving a pension.

Financial assistance received from an employer is taxed if the amount of payments during the reporting period exceeds 4,000 rubles. If the amount of accruals is less, then you do not need to pay personal income tax.

Income not subject to personal income tax in 2020

Let's consider further what is not subject to personal income tax in 2020? From January 1, 2018, the procedure for calculating personal income tax was changed from material benefits from savings on interest. Material benefits received in the form of interest differences from the use of credits or loans issued by entrepreneurs or companies are subject to personal income tax. Article 212, paragraph 1, paragraph 1 of the Tax Code of the Russian Federation describes two criteria by which the possibility of taxation is determined:

- Loans or credits received by an individual from an interdependent entrepreneur or company. Or the taxpayer has an employment relationship with the organization.

- If such interest savings are actually financial assistance from the employer, then the income is subject to taxation.

In the new paragraph 37.3. Article 217 of the Tax Code of the Russian Federation states that now the down payment from the state for the purchase of a car using a loan is not subject to personal income tax.

Also, from January 1, 2020, funds received in the form of compensation to participants in shared construction in the event of bankruptcy of the developer are no longer subject to personal income tax. This is stated in paragraph 71 of Article 217 of the Tax Code of the Russian Federation.

In addition, participants in the housing renovation program are exempt from paying taxes. Compensation amounts and the excess price of a new apartment compared to the cost of housing subject to renovation are not subject to taxation.

Significant changes have been made to the Tax Code of the Russian Federation regarding gambling and lotteries (Article 217.7). If income from gambling amounts to more than 15 thousand rubles, then the tax base is determined as a decrease in the amount of winnings by the amount of the bet or interactive bet.

Tax on income from betting less than 15 thousand rubles is paid by the player himself, according to Art. 228 clause 1 clause 5.

Table. Payments not subject to personal income tax in 2020

| Type of income | Comment (is it subject to personal income tax) |

| Alimony | The amount of the payment does not affect the tax exemption |

| Pensions | Including benefits and additional payments to pensioners are not subject to personal income tax. |

| Scholarships | Students of universities and secondary specialized educational institutions are exempt from taxation |

| Compensation | Participants in the housing renovation program; participants in shared construction if the developer goes bankrupt |

| Travel allowance (daily allowance) | For business trips within Russia - no more than 700 rubles per day, abroad - no more than 2,500 rubles. |

| Benefits | Unemployment benefits, maternity benefits and others, except for disability benefits and caring for a sick child. |

| Payment for treatment of an employee by the employer | Personal income tax is not payable if the money was withdrawn from after-tax profits by the organization. |

| Down payment for buying a car on credit | No personal income tax is charged if funds for the down payment are transferred by the state under a special program. |

| Benefit from interest savings | Personal income tax is not deducted if the benefit is obtained from savings on interest from the use of borrowed and credit funds received from an interdependent company or an employing organization. |

| Income from gambling, lotteries, bookmakers, sweepstakes | If the winnings are more than 15,000 rubles, then the tax base is reduced by the amount of the bet. If the income from the game is less than 4,000 rubles, personal income tax is not charged. |

Results

Tax rates for personal income tax did not change in 2020. The last change in personal income tax rates was in 2015, when the rate for income in the form of dividends was increased from 9 to 13%.

Despite the relative constancy of personal income tax rates, changes are regularly made to the legislation regarding the procedure for calculating tax, or new tax reporting forms are introduced and the rules for filling them out are changed.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Economic Development dated October 21, 2019 No. 684

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Deadline for paying personal income tax on sick leave benefits or vacation pay in 2020

For personal income tax on sick leave and vacation pay, clause 6 of Article 226 of the Tax Code of the Russian Federation, a special date is established: no later than the last day of the month in which the income was received. That is, tax should be withheld at the time of payment of income, and transferred to the budget no later than the last day of the month in which benefits and vacation pay were paid.

If the deadline falls on a holiday or weekend, the transfer date is moved to the first day following the non-working date.

Thus, the deadline for paying income tax on sick leave or vacation pay in 2020 is set to:

| Month of payment of benefits or vacation pay | Deadline for transferring taxes to the budget |

| January 2020 | 31.01.2020 |

| February 2020 | 02.03.2020 |

| IMPORTANT! The deadlines for transferring personal income tax for March-April 2020 are given without taking into account the non-working days introduced by the president. How to pay tax for those who are subject to the non-working regime, see here. | |

| March 2020 | 31.03.2020 |

| April 2020 | 30.04.2020 |

| May 2020 | 01.06.2020 |

| June 2020 | 30.06.2020 |

| July 2020 | 31.07.2020 |

| August 2020 | 31.08.2020 |

| September 2020 | 30.09.2020 |

| October 2020 | 02.11.2020 |

| November 2020 | 30.11.2020 |

| December 2020 | 31.12.2020 |

Non-taxable base for personal income tax in 2020

The tax base is reduced by the so-called deductions for children. They are provided by law to parents, guardians and trustees, and adoptive parents. In 2020, the non-taxable personal income tax base is the amount of 1,400 rubles for the first and second children, 3 thousand rubles for the third and subsequent children.

For a parent (adoptive parent) of a disabled child, the tax-free base will be 12 thousand rubles, for a guardian (trustee) - 6 thousand rubles.

Deductions are provided until the child reaches the age of 18. If the child is disabled or is studying full-time – up to 24 years of age.

Winnings from lotteries and online casinos of less than 4 thousand rubles are also not subject to taxation.