What does an accountant need to know when carrying out operations to deduct from an employee’s income under a writ of execution? What payments cannot be recovered from an employee under a writ of execution? What is the maximum amount of deductions and the priority in case of its shortage?

The procedure for withholding on writs of execution is established by Federal Law No. 229-FZ of October 2, 2007 “On Enforcement Proceedings” (hereinafter referred to as Law No. 229-FZ). As a general rule, the amount of deductions from an employee’s salary is calculated from the amount remaining after deducting taxes (Clause 1, Article 99 of Law No. 229-FZ). For example, an employee was accrued a salary in the amount of 30,000 rubles, and was provided with a “children’s” deduction in the amount of 1,400 rubles (Article 216 of the Tax Code of the Russian Federation, paragraph 4, paragraph 1, Article 218 of the Tax Code of the Russian Federation). Deductions are made from the employee’s “net” salary:

30,000 rubles - ((30,000 rubles - 1,400 rubles) x 13%) = 26,282 rubles.

Let's consider the sequence of actions of an accountant when a company receives a writ of execution. Note that the writ of execution can come directly from the claimant or from the bailiff service (most often found in practice).

DEBT COLLECTION BY BAILIFFS

Important!

Taking into account the amendments made to Article 98 of Law No. 229-FZ, the bailiff, in order to collect alimony, must send the company a copy of the writ of execution (the original must only be from the collector, that is, from the recipient of the debt being collected). Such amendments are effective from June 9, 2020. And the original writ of execution can still be sent only by the debt collector.

Limit amount of deductions from wages

When withholding, it is necessary to take into account the provisions of Article 138 of the Labor Code of the Russian Federation. So, in particular, the total amount of all deductions for each payment of wages to an employee cannot exceed 20%, and in cases provided for by federal laws - 50% of wages due to the employee.

When deducting from wages under several executive documents, the employee must in any case retain 50% of the wages.

DEBT COLLECTION FROM LEGAL ENTITIES

Document “Writ of Execution” in 1C Accounting

This document assigns withholding to a specific employee.

Salary and personnel / Salary / Writs of execution

Let's create a document and indicate the necessary data in it. In the “Recipient” field, the program offers a choice from the directory of counterparties, so the recipient (it can be an individual or legal entity) must first be entered into this directory.

The retention period and calculation method are filled in according to the executive document received by the organization. If you do not specify the end of the period, the program will perform the deduction every month. There are three options for the calculation method: percentage, share or fixed amount.

Please note: in this 1C document it is not possible to indicate the withheld remuneration of the paying agent. It will have to be entered manually when calculating salaries.

The writ of execution does not make accounting entries and does not have a printed form.

However, this rule does not apply to deductions from wages (clause 3 of Article 138 of the Labor Code of the Russian Federation):

- while serving correctional labor;

- when collecting alimony for minor children;

- when compensating for harm caused by an employee to the health of another person;

- when compensating for damage to persons who suffered damage due to the death of the breadwinner;

- when compensating for damage caused by a crime.

In these situations, the amount of deductions from the employee’s salary cannot exceed 70%.

Types of executive documents

A writ of execution issued by an arbitration court or a court of general jurisdiction on the basis of a decision is the basis for deducting established amounts from wages.

At the same time, in accordance with Art. 12 FZ-229, the employer can also make deductions on the basis of the following executive documents:

- court order;

- voluntary agreement on the payment of alimony, certified by a notary;

- certificate issued by the labor dispute commission;

- act of the regulatory authority on the collection of credit debt and accrued interest;

- judicial act on an administrative offense;

- resolution of the bailiff;

- a notary's writ of execution on an agreement on an out-of-court settlement of a dispute.

In general, the basis for withholding is the original document of execution, however, if it is lost, the employer is allowed to accept a duplicate document certified in the prescribed manner.

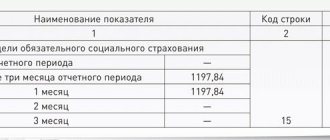

EXAMPLE No. 1

The employee has a debt on three outstanding loans (three writs of execution were presented). The first writ of execution is for the amount of 20,000 rubles, the second is 40,000 rubles, the third is 50,000 rubles.

The employee was accrued a salary in the amount of 30,000 rubles, and was provided with a “children’s” deduction in the amount of 1,400 rubles.

Deductions are made from the employee’s “net” salary:

30,000 rubles - ((30,000 rubles - 1,400 rubles) x 13%) = 26,282 rubles.

As noted above, the maximum amount of deductions cannot exceed 50% of accrued wages:

26,282 rubles x 50% = 13,141 rubles.

The total amount of debt under three writs of execution is 110,000 rubles (20,000 rubles + 40,000 rubles + 50,000 rubles).

Thus, the maximum amount of deductions per month is not enough to collect debts under all writs of execution (13,141 rubles < 110,000 rubles).

LEGAL ADVICE IN MOSCOW

Therefore, the amount of debt must be proportionally distributed among three writs of execution (clause 3 of Article 111 of Law No. 229-FZ):

- deductions from the employee under the first writ of execution will be:

13,141 rubles x (20,000 rubles/110,000 rubles) = 2,389.27 rubles;

- deductions from the employee under the second writ of execution will be:

13,141 rubles x (40,000 rubles/110,000 rubles) = 4,778.55 rubles;

- deductions from the employee under the third writ of execution will be:

13,141 rubles x (50,000 rubles/110,000 rubles) = 5,973.18 rubles.

Withholdings are made until the requirements contained in the executive document are fulfilled in full. Deductions will be made in the following months of accrual of wages and other income to the employee.

Deductions based on writs of execution and accounting

It is necessary not only to correctly calculate and make monetary deductions, but also to correctly carry them out in financial accounting. In accounting, the credit item of account 76 “Settlements with various debtors and creditors” is intended for this purpose.

If the organization is large and such deductions need to be made frequently, then it is advisable to open a sub-account specifically to record such deductions. In this case, such a sub-account must be registered in the working plan of accounts (clause 4 of PBU 1/2008, approved by order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n). The accounting entry will look like this:

- debit 70, credit 76, subaccount “Deductions according to use. sheets": deduction from an employee’s salary on the basis of an executive document (name);

- debit 76, credit 50 (51), subaccount “Deductions according to use. sheets": the withheld financial resources are sent to the claimant.

Additional expenses intended for the delivery of funds to the address (bank commission for transfer, postage, etc.) are collected from the debtor, and the accountant also needs to write them off correctly. You can also open a separate sub-account for this.

The employee can agree to voluntarily write off this amount or deposit it in cash at the cash desk. If consent is not received, these funds will be collected forcibly - the organization will simply add another writ of execution. Wiring:

- debit 70, credit 76, subaccount “Additional expenses on writs of execution”: deduction from the employee’s salary of expenses associated with withholding on the basis of a writ of execution (name);

- in case of voluntary contribution of funds by an employee - debit 50(51), credit 73, subaccount “Additional expenses under writs of execution”: an amount has been deposited to reimburse the employer’s expenses for the payment of funds under the writ of execution (name).

For example

Collection cannot be applied to the following types of income:

- sums of money paid in compensation for harm caused to health in connection with the death of the breadwinner;

- sums of money paid to persons who received injuries (wounds, injuries, concussions) in the performance of their official duties, and members of their families in the event of death of these persons;

- monthly cash payments and (or) annual cash payments accrued in accordance with the legislation of the Russian Federation to certain categories of citizens (compensation for travel, purchase of medicines, etc.);

- sums of money paid as alimony, as well as amounts paid for the maintenance of minor children during the search for their parents;

- compensation payments established by the labor legislation of the Russian Federation (for example, in connection with a business trip, transfer, admission or assignment to work in another locality);

- pensions in case of loss of a breadwinner, paid from the federal budget and funds from the budgets of the constituent entities of the Russian Federation.

A List of types of wages and other income from which alimony for minor children is withheld was approved by Decree of the Government of the Russian Federation of July 18, 1996 No. 841 (hereinafter referred to as the List).

Thus, in one of the recently considered cases, a citizen appealed to the highest judges to invalidate paragraph “a” of paragraph 2 of the List from which alimony for minor children is withheld from income in the form of a social pension assigned in connection with disability and equal the cost of living of the pension recipient.

The citizen indicated that after he made payments of alimony obligations for two minor children, the amount of his personal income as a person receiving a social pension for disability group II is less than the minimum subsistence level established for pensioners in the Moscow region.

The plaintiff believed that the List violates the right to life, health, and the standard of living necessary to maintain health and well-being, including paying for utilities, purchasing food and basic necessities.

However, as the senior judges noted, the Federal Law “On the Living Wage in the Russian Federation,” to which the plaintiff referred in the appeal, establishes the legal basis for determining the living wage in the Russian Federation and taking it into account when establishing state guarantees for citizens of the Russian Federation to receive minimum cash incomes and when implementing other measures of social protection of citizens of the Russian Federation and does not regulate issues related to determining the types of earnings and other income from which alimony is withheld for the maintenance of minor children.

Important!

Senior judges recognized as legal subparagraph “a” of paragraph 2 of the List of types of wages and other income from which alimony for minor children is withheld (Appeal ruling of the RF Armed Forces dated October 12, 2017 No. APL17-312).

The procedure for accounting for withholding transactions based on writs of execution

Reflection of deductions from an employee's wages on the basis of a writ of execution is carried out on the basis of the Chart of Accounts and is reflected in the accounting entry:

| Contents of a business transaction | Debit | Credit |

| The amount deducted from the employee’s salary according to the writ of execution is reflected | 70 | 76 subaccount “Calculations based on writs of execution” |

| Other expenses related to deductions under executive documents are deducted from wages (for example, postage, fees for transferring funds) | 70 | 76 subaccount “Expenses associated with deductions under executive documents” |

| The withheld amount has been paid to the claimant | 76 subaccount “Calculations based on writs of execution” | 51,50 |

| Withheld funds from employees' wages on the basis of executive documents can be issued to the claimant personally from the organization's cash desk, transferred to him by mail or to his account at a bank institution | ||

Legislative justification

Federal and labor legislation regulates the process of withholding part of labor income under executive documents.

Art. 98 of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings” speaks of the obligation of employers or other persons making payments, on the basis of enforcement documents, to deduct part of the funds from the amount due to the debtor and transfer them to the recoverer. This act also lists the documents that serve as legal grounds for monetary deductions.

IMPORTANT! The withholding and transfer of money under executive documents in no way depends on the will of the payer of the salary and the employee himself; this is an unconditional obligation.

The Labor Code of the Russian Federation (Article 138) limits the percentage of possible deductions, and also stipulates cases to which the limit does not apply.

Accounting records of deductions are made in accordance with the instructions set out in Letter of the FSSP of Russia dated June 25, 2012 No. 12/01-15257.

Normative documents

Deduction from wages is regulated by the following types of documents:

- TC of Russia;

- IC of Russia;

- Federal Law No. 229 of October 2, 07.

In 2020, the procedure for this process has rules, namely:

- The requirement to pay the debt under the writ of execution is sent using the Russian Post by registered letter with notification.

- Upon receipt of a registered letter, a detachable notification is sent to the body exercising control over execution. As a rule, these are bailiffs at the debtor’s place of residence.

- On the part of the organization, after receiving the request, it should be registered in the incoming journal. This is a mandatory requirement.

- Deductions from wages are made every month on the days when the employee's salary is paid.

The process of deduction from wages based on writs of execution is carried out in accordance with the rules and regulations of accounting:

- A calculation is made for all income that an employee receives in the company, incl. additional payments, accruals, bonuses. The exception is those payments that are not covered by the executive documentation.

- Personal income tax (NDFL) is withheld from wages.

- The amount to be transferred to third parties is calculated. This must be done within three days after the fixed date for payment of wages. It is necessary to transfer according to the specified details in execution.

Next, we will talk about which employee payments are not subject to withholding.