Law on wage indexation

The salary revision in 2020 is carried out on the basis of regulations:

- Labor Code of the Russian Federation. All issues related to indexation and compliance with social guarantees for workers are taken into account in the following articles: 22, 46, 129, 130, 134.

- Federal laws and regulations governing the mandatory increase in wages for public sector employees starting in 2020.

- Code of Administrative Offenses of the Russian Federation Article 5.27 regarding the employer’s liability for violation of the wage indexation procedure.

Additionally, salary recalculation can occur in accordance with the Constitution of the Russian Federation, decisions of judicial bodies and other regulatory documents of government bodies.

Article 134 of the Labor Code of the Russian Federation states that indexation in state and municipal institutions should occur as consumer prices for goods and services increase.

As for organizations and other forms of ownership, they can independently establish:

- conditions for indexing;

- implementation deadlines;

- calculation method.

Although the increase in wages for commercial workers is at the discretion of their employer, the Constitutional Court, in ruling No. 2618-O dated November 19, 2015, is inclined to believe that they, too, must comply with the requirements of the Labor Code in this regard. At the same time, Rostrud plans to force employers of all forms of ownership to periodically index the salaries of employees, and to impose fines for failure to comply with standards (letters No. 1073-6-1 dated 04.19.10 and No. 14-3/-1135 dated 12.26.17).

Please note that citizens working under an employment contract can count on a salary increase. This rule does not apply to civil contracts.

The Labor Code establishes that an employee who has fully worked the standard working time for a specified period must receive a salary of at least one minimum wage established by federal law throughout the Russian Federation. From January 1, 2020, the government increased it to 12,130 rubles and brought it up to the subsistence level. Therefore, those commercial organizations where the salary is set at the minimum wage level will simply have to index it.

If we talk about the frequency of changes in wages, then it is advisable to set it at least once a year based on the results of an analysis of the growth of the consumer price index. If the index falls, the employer has no right to reduce wages.

Employees retain the right to appeal to the state labor inspectorate in the event that the employer has not recalculated wages, leaving it at the same level.

For whom is it required?

Many employers deliberately avoid mentioning indexing in their internal documents. They believe that the lack of information about indexation in 2020 is not a violation. Meanwhile, the organization must at least index the minimum wage. Even though there is no legally established procedure for its implementation today. Also see “Minimum wage in 2020 in Russia”.

If they ignore the need for indexation, employers may face unpleasant consequences if labor inspectors come. By the way, further decisions of controllers may be different:

- will be required to enter information about the procedure for indexing wages at the enterprise into a current internal document or to adopt a new act on this in the organization;

- the responsible persons will be held administratively liable in the form of a fine (Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Note that the second point is controversial. And in case of disagreement with the fine, the employer can go to court. Current judicial practice shows that decisions in such a case can be made both in favor of the employer who applied and in favor of the inspectors.

If an organization has a provision on wage indexation, but the employer does not comply with it, then during an inspection the company may most likely be fined.

As noted by the Constitutional Court of the Russian Federation in Determination No. 2618-O dated November 19, 2015, the wages of all persons working under an employment contract must be indexed.

Employers - state bodies, local government bodies, state and municipal institutions index wages in the manner prescribed by labor legislation and other regulatory legal acts containing labor law norms (Article 134 of the Labor Code of the Russian Federation).

Employers not related to the public sector also do not have the right to deprive their employees of the guarantee provided by law and evade the establishment of indexation (Determination of the Constitutional Court of the Russian Federation dated November 19, 2015 N 2618-O). Such employers index wages in accordance with the procedure established in the collective agreement, agreements, and local regulations (Article 134 of the Labor Code of the Russian Federation).

Wage indexation coefficient for 2020

The salary growth rate can be calculated based on statistical values. It directly depends on the level of inflation processes over the past periods. For example, to set the coefficient in 2020, we apply the formula:

Ki = I1 × I2 × I3 / 3,

- Ki is the coefficient of wage change in 2020;

- I1, I2, I3 – price growth indices for the past quarter based on Rosstat data.

Commercial organizations can independently establish the order and size of indexation, without correlating it with statistical data. In this case, all conditions must be reflected in the collective or employment agreement. Correct wording will help avoid penalties if the procedure is not followed. For example, the phrase “Indexation is carried out subject to the availability of additional financing” is a reason to refuse a salary increase if the company’s financial result is negative.

In budgetary organizations, indexation is carried out on the basis of the relevant order. It indicates its size (percentage) based on the increase in consumer prices. This requirement is enshrined in Art. 130 Labor Code of the Russian Federation.

Example:

For budgetary organizations, salary increases are made based on the inflation rate for the past year. For 2020, it was approximately 4%; it is by this value that wages should be indexed in 2020.

Organizations independent of the state. budget, has the right to set its own coefficient or apply the same as for public sector employees.

The indexation coefficient can be calculated using the previously given formula based on statistics for the past quarter.

Example:

For example, Rosstat data showed an increase in consumer prices for the first month of the quarter at 1.7%, the second – 0.9% and the third – 2.1%. Then the average value will be:

1,7 × 0,9 × 2,1 / 3 = 1,071%,

this will be the coefficient that commercial structures can apply when revising wages for their employees.

At the same time, not only the salary increases, but also other types of payments: bonuses, compensation, etc. With an increase in the minimum wage, wages are also adjusted, the amount of which is less than this amount.

The company can set not only the terms for wage indexation in 2020, but also the frequency of its implementation, once every:

- year;

- six months;

- quarter.

Thus, most organizations take the 1st of February as the date, when official figures for consumer price growth become known. They have the right to set other dates by local regulations, but, as a rule, this is the first day of the month.

Criteria for revising earnings in 2020

Wage indexation is a necessary procedure due to rising consumer prices. Rosstat monthly calculates consumer price indices and inflation rates for each region and all of Russia. Based on this data, employers most often make wage indexation calculations. Also see “Minimum wages today.”

The link to the price index must be made in the internal act of the organization. At the same time, wage indexation can be carried out based on changes for one month or for several at once. To get your bearings, you can view the values of consumer price indices on the official Rossat website for 2020.

Wage indexation is a way to protect earnings from inflation due to rising consumer prices.

The amount of wage indexation in 2020 may correspond to:

- the official consumer price index for the country or in a particular region (based on the results of a certain period, for example a quarter, half a year, year);

- the amount of inflation established in the annual federal law or the law of the region in which the organization operates;

- growth of the living wage of the working population.

When calculating the indexation coefficient, the main indicator is not a mandatory value. How to index salaries - taking into account inflation or depending on other conditions - is decided by management. For example, with a forecast inflation of 6%, employee salaries can be indexed by 4 or 7%. The employer may choose another arbitrary value, unless a different procedure is determined by the labor or collective agreement. Accordingly, salary indexation in 2020 will be carried out by this amount. Here's what a sample for wage indexation in 2020 in a commercial organization might look like:

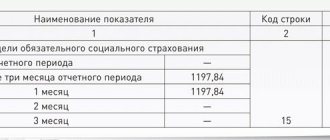

Consumer price growth index for 2020 for wage indexation

In December 2020, the increase in prices for goods and services amounted to 4.26% compared to December 2020, of which:

- food prices increased by 4.66%;

- for non-food items – by 4.10%;

- for services – by 3.94%.

Employers should focus on these indicators when setting the salary indexation coefficient. All data is contained on the official website of Rosstat.

It is permissible to set a higher coefficient, provided that its size is indicated in local regulations.

You can calculate the consumer price index (hereinafter referred to as CPI) for an arbitrary period by multiplying the indices for the corresponding months. For example, from January to April 2020:

100,01 × 101,45/100 × 101,77/100 × 102,07/100 = 105,39%

Specifics of indexing in a commercial company

In fact, mandatory salary indexation in 2020-2021 in commercial organizations is not specifically stated. There is only one norm in the legislation that mentions the adjustment of workers' salaries and it is not formulated precisely enough. Legislators made attempts to specify the provisions on wage indexation in commercial organizations, but each time they encountered resistance from the parliamentary majority.

Today, for commercial organizations, the process of adjusting earnings has specifics. Salary indexation in a commercial company is carried out on the basis of local regulations, as this is directly stated in Art. 134 Labor Code of the Russian Federation. That is, every company should have a local indexation act, but its content is not regulated; the employer, according to the requirements of the Labor Code of the Russian Federation, simply must ensure the actual content of the employees’ earnings.

Based on the clarifications of the Supreme and Constitutional Courts, indexation:

- just one way to actually increase wages. If an employer regularly increases the salary of all employees and pays bonuses, he must comply with indexation;

- can be carried out only if funds are available, if this is provided for in local regulations. That is, a clause on making salary adjustments in the presence of financial capabilities is sufficient and in the absence of sufficient profits, the employer gets rid of this obligation.

Does your employer carry out annual salary indexation?

Yes

0%

No

100%

Voted: 5

The procedure for indexing salary

The indicator that will be taken as the basis for calculating the wage increase coefficient in 2020 is set by the head of the organization. In doing so, it can rely on the following values:

- living wage;

- inflation rate;

- consumer price index or other data.

The employer has the right to provide for the procedure for indexing wages:

- collective agreement;

- internal labor regulations;

- other local acts.

This paragraph must be included in the relevant documents if such a procedure has not been established.

Example:

It was decided to revise the salary level and index it to the CPI. It amounted to 105.39%. The formula for increasing wages will look like this:

Salary × CPI / 100,

For example, before the increase the salary was 30,000 rubles, after the increase it will become 30,000 × 105.39 / 100 = 31,617 rubles.

Indexation is carried out on the basis of an order for the organization, which must indicate:

- justification for increasing salaries;

- the indicator that formed the basis for the calculation;

- date of indexation.

Example of an order:

At the same time, the courts are inclined to believe that indexation is an issue that is within the competence of only the employer. After all, increasing the level of material maintenance is a state guarantee. A private organization is an independent organization that does not depend on the state treasury.

Often, in a commercial organization that pays salaries to its employees from its own profits, a situation may arise where there are not enough funds even to pay off the current debt for its payment. Then the issue of promotion cannot even be on the agenda.

Therefore, when talking about indexation in 2020, we can mention a reasonable balance between the team and the employer. The Labor Code suggests that organizations not related to the public sector must adhere to Article 134 and establish a mechanism for increasing wages:

- in a collective or labor agreement;

- local regulations with their approval by the primary elected body (trade union).

Documentation of changes to the internal regulations of the organization is a prerequisite. If there is a trade union cell, then its chairman can come up with an appropriate initiative. It can come from both the administration and the workforce. In any case, a meeting must be held and proposals made to change the collective agreement.

Organizations classified as micro-enterprises can prescribe the indexation procedure in the employment contract concluded with the employee. In this case, there is no need to approve the indexation provision.

The organization’s regulatory documents must specify the procedure for increasing wages and indicate:

- mechanism for choosing the wage indexation increase coefficient;

- frequency or date when wages will be recalculated;

- what payments will be subject to increase. Each organization has its own remuneration system, consisting of salary, additional payments, bonuses, one-time payments, etc. Indexing may concern one or more items that must be indicated.

The employer may index the amount of wages in accordance with:

- consumer price index, formed based on the results of last year and published on the official portal of Rosstat;

- the level of inflation taken from the law on the federal budget or regional regulations;

- percentage of the cost of living in Russia or the specific region where the organization is located.

The local act must reflect one of these principles, which will apply when determining the salary increase coefficient.

The basis for making changes to the staffing table with increased salaries is a decision of the administration of a commercial organization, supported by an order from the manager. After changing the staffing table, additional agreements are drawn up to the employees’ employment contracts, with which they must be familiarized with signature.

It is legally established that significant changes in working conditions must be communicated to the organization’s employees against signature two months before they occur. Wage indexation is not one of these and does not require prior notification.

Reasons for indexing and how often it is carried out

The level of real wages should increase in connection with inflation, that is, with an increase in the price level. However, this does not mean at all that he should be equal to her. Although employers often index wages based on this indicator.

As already mentioned, Article 134 of the Labor Code does not disclose the frequency and order of the procedure. Therefore, each employer decides these issues himself and prescribes it in the relevant documentation.

However, he is not obliged to index wages in accordance with Rosstat publications. However, as judicial practice shows, these indicators should be regarded as the minimum calculation figure for increasing the level of payments. In addition, according to the fourth part of Article 57 of the Labor Code of the Russian Federation, the organization establishes working conditions that do not worsen the employee’s position in comparison with those established by law.

The employer can be guided, in addition to increasing prices throughout Russia, by the following indicators:

- regional price increases;

- an increase in the cost of living of the population capable of working both in Russia and in the region;

- inflation, according to federal law;

- inflation, according to regional law.

This procedure is discussed in detail in the following video:

How to index your salary

Recalculation of wages occurs subject to a certain procedure.

To do this, the employer must establish:

- Indexing frequency. It could be:

- minimum period – monthly (rarely used);

- once a quarter;

- semiannually;

- once a year.

- The mechanism of the procedure. In 2020, when indexing, you should focus on:

- on the consumer price index according to statistics for the past year;

- on the minimum wage, indexation occurs when this indicator changes, but at least once a year;

- on the inflation rate, this indicator is required to establish the indexation coefficient for public sector employees;

- other indicators, taking into account that they are not lower than those established by law.

How is vacation pay indexed when salaries increase in 2020?

Example

A commercial organization has a staffing table, where salaries are set in accordance with the wage scale. For the chief accountant, the salary from January 1, 2020 is 45 thousand rubles.

The collective agreement stipulates that wages will be indexed taking into account inflation included in the budget for the next year. Based on this, the employer decided to apply a wage indexation coefficient of 1.06 . After the increase, the chief accountant's salary will become:

45,000 × 1.06 = 47,700 rubles.

Often, it is salaries that are subject to an increase, but the employer may not set new salaries, but adjust the size of the bonus. This can also have a significant impact on pay. But if the opportunity arises, guided by its own local regulations, the manager can also impose a penalty on the employee, while cutting the percentage of the bonus.

Are commercial organizations required to carry out indexing?

Article 134 of the Labor Code of the Russian Federation speaks of the obligation to timely index the salaries of managers of both budgetary organizations and private businesses. But the provisions of this article cannot be interpreted entirely unambiguously, as many lawyers note. It says that the real level of wages should be in accordance with rising consumer prices. And there are no exceptions to this rule for private companies.

The difference is that budgetary organizations, when indexing salaries, are guided by the norms of other federal and local laws, and private businesses are guided by local acts. The first sources are public and accessible to the public, so they must be followed strictly. Local acts, on the contrary, are valid only within the enterprise, so it is not necessary to comply with them. Nobody is watching this. The heads of these companies themselves and some lawyers think so.

Are private firms required to index wages? Definitely yes. Legally there is no difference.

Budgetary organizations carry out indexations based on the level of inflation and various laws issued by federal, local and municipal authorities. Managers of private enterprises calculate increasing coefficients on their own, and they do not necessarily have to be tied to the level of inflation or other official data related to price increases.