What is a business trip?

A business trip is understood as a trip by an employee for a certain period of time outside the place of his main work. All this for the purpose of performing some kind of field work. An example would be a business trip to another city in order to persuade a new buyer or to conduct an inspection of a retail outlet. A business trip can also be considered a trip to another country, for example, to exchange experience between employees.

However, it is worth remembering that if the work initially involves traveling, then trips to other places cannot be considered a business trip. Accordingly, there is no need to calculate travel allowances here. It is also worth noting that the assignment of an employee accepted with the execution of a civil contract will not be considered a business trip.

How to calculate travel expenses?

Business travel expenses in 2020 necessarily include the cost of travel to and from the place of work duties. How are travel costs calculated? They are determined, first of all, by the type of transport used by the specialist.

- Public transport

Costs for public transport include:

- Costs associated with travel arrangements;

- Payment for tickets;

- Additional costs (for example, the cost of linen on trains, meals on planes, etc.).

In turn, the employee submits to the accounting department tickets, boarding passes, receipts, checks certifying all three items of expenses.

If it turns out that the employee’s travel ticket was lost, then a request can be sent to the travel company to issue a duplicate with information about the passenger, flight, and travel time.

- Taxi

A taxi can also be used as a means of transportation during a business trip. However, in this case, the local regulatory act must specify the reason for this choice (late departure, lack of other options, emergency departure, etc.).

What documents in this case can confirm expenses? Cash register receipt or receipt issued on a strict reporting form with mandatory details.

- Is it personal business transport?

In this case, the employee must draw up a memo that reflects:

- Length of stay on business trip;

- Funds spent on the purchase of fuels and lubricants.

The documents certifying expenses in this situation are receipts for the purchase of fuels and lubricants, waybills, routes, etc.

It is worth adding that travel costs also include consular fees, tariffs for using toll roads, visa applications, etc.

Business trips: laws governing them

The employer and employee who are involved in business trips need to know that the basic concepts and calculation rules are regulated by the Labor Code of the Russian Federation. These include:

- Article 166. The very concept of a business trip is introduced here.

- Article 167. This paragraph stipulates the guarantees of an employee sent on a business trip.

- Article 153. This article regulates payment for work on weekends and holidays.

Of course, there are other articles that directly or indirectly touch on many issues related to travel. In particular, they answer the question: “How are travel allowances calculated and what are the features of their payment?”, however, the main ones traditionally include the above.

Calculation of average earnings for business trips

In order to determine the amount of average earnings for calculating travel payments to an employee, it is necessary (Government Decree No. 922):

- Determine the amount of salary for the previous 12 months;

- Take into account all payments to the employee for the year, including bonuses, rewards, fees, allowances, increasing coefficients that are associated with the performance of his job duties;

- Exclude social payments (financial assistance for vacation, travel, food, etc.);

- Do not consider the days on which the employee received an average salary (sick leave, maternity leave, etc.);

- Do not consider periods of downtime due to the fault of the employer, as well as strikes in which the specialist did not take part.

If the average salary turns out to be below the minimum wage, then when calculating travel payments, the minimum wage in the economy is used.

If during the 12 months under review the employee received a salary in non-monetary terms, then it is also taken into account when calculating average earnings (translated into cash equivalent on the date of its payment).

Who should not be sent on a business trip

Before you understand how travel allowances are calculated, you should understand which employees should not be sent on trips without their consent, and which employees should not be sent even with the employee’s written agreement.

Pregnant women and persons under eighteen years of age cannot be sent on business trips. There are also rules for the following categories of workers:

- Women with children under three years of age.

- Single parents raising a child or children under five years of age.

- Employees who are dependent on disabled children.

- Employees who have a medical certificate that they are caring for a family member.

The above categories of employees can be sent on a business trip only with written consent and after a full medical examination.

Documents required for registration of a business trip

In order to legally send an employee on a business trip, it is necessary to prepare the documents correctly. These include an order to be sent on a business trip, a job assignment and documents that actually confirm the employee’s presence on a business trip.

It is worth noting that starting from 2020, it is not necessary to issue a job assignment; this is permitted by law. However, according to its internal documentation procedure, the employer may adhere to the old rules. This type of management is appropriate for large organizations. For example, this kind of document can be drawn up by the head of a structural unit indicating the need for a business trip. This documentation is subsequently reviewed by senior management.

An order to go on a business trip is an integral part of the document flow when traveling on official business. The documentation must indicate the details of the organization, employee data, goals and timing of the trip. The order is filled out according to the unified form No. T-9. In the case of drawing up an official assignment, this fact is also indicated in the order.

Documents that confirm the duration of a business trip are mainly considered to be travel documents, such as train tickets. If an employee travels by personal transport, a memo is drawn up.

Is advance payment issued before a business trip?

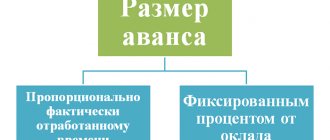

Before an employee goes on a business trip, he receives a specialized advance, which is formed from a preliminary calculation of the parameters of the price of travel and accommodation, other expenses, as well as the amount of daily plan payments. In fact, accounting specialists determine the approximate cost of travel, taking into account the selected transport and the class determined by the internal documents of the enterprise. In this situation, the road there and back is taken into account. The amount of daily payments is also determined either by the employment agreement or internal documents, therefore, such payments are necessarily provided based on the number of days that a person must spend on a business trip. Other expenses that may arise for the employee during the entire period of completing the tasks assigned to him are also calculated.

Please note that an advance payment is certainly provided to the employee; it is possible to provide these payments in person at the cash desk of an enterprise or organization. You can also carry out the process of transferring the corresponding payments to the employee’s card.

It is recommended that all data on the procedure for issuing an advance (with a definition of the method of providing funds) be indicated in the local documents of the enterprise, so that in the future there will be no difficulties or problems with this aspect. It should also be taken into account that the organization can immediately make direct payments in the form of purchasing tickets remotely, booking and paying for a room, etc. After returning, the employee provides management with all the necessary documents that confirm the rationality of spending money.

What to do if you need to extend your business trip?

There are situations when it is necessary to increase the length of an employee’s business trip. In this case, you need to fill out an additional package of documents. These include:

- Order to extend a business trip. This document is filled out in any form. Here you should indicate the reason for the extension of the trip and the new end date.

- Written permission to extend the business trip from the persons listed above.

- Notifying the employee about the extension of the business trip. This can be done by sending a fax with the order.

- Calculation of travel allowances and daily allowances for an additional period and transfer of funds.

First steps in accounting: daily allowances, travel allowances and advances

After the referral order is ready, the employee must be given an advance. It includes daily allowances for the entire period of the trip, as well as the estimated amount of expenses. It is worth noting that the issue can be carried out either in cash or by transfer to the employee’s card.

How are travel allowances calculated? They are paid at the end of the month along with the rest of the salary. This is due to the fact that the calculation of this type of payment is carried out after the end of the month, regardless of when the employee reported.

After the employee returns, the accountant recalculates. The results are summed up and it becomes clear what amounts were spent. In conclusion, the employee is either paid the missing amount or the overpaid amount is withheld.

Conclusion

Travel payments must be processed without fail. At the same time, such payments are reflected in the accounting documentation and are necessarily taken into account in expenses, if it is necessary to calculate net income for taxes. Among other things, the legislation stipulates that travel payments can include data on expenses for transportation services, both to the place of business trip and locally (if necessary).

In addition, daily allowances are required, as well as other additional payments that cover incurred expenses. The accountant is required to first calculate the estimated amount of expenses, and the employee is provided with an advance. After completing all work on a business trip, the employee draws up a report and also attaches documents confirming expenses. If the advance payment is not enough to cover expenses, an additional payment will be made. If the advance exceeds payments, the employee hands over the remaining funds to the company's cash desk.

Payment for travel allowances. Basic formula

How are travel allowances calculated? Before you accrue any funds to an employee, you should calculate them. Please remember that payments are made based on average earnings. The business trip is paid in amounts calculated according to the formula. The following indicators are taken for calculation:

- Payments that are taken into account to calculate average earnings. The full list can be found in the Regulations on the specifics of calculating average earnings. In most cases, this is salary, personal allowances, minus one-time bonuses and financial assistance.

- Number of days in the billing period.

- Number of business trip days.

To calculate travel allowances, the payments described in the first paragraph are taken and divided by the number of days of the billing period. This indicator indicates how much the employee receives for one day of business trip. This figure is then multiplied by the total number of working days away.

How are travel allowances calculated?

The employer is obliged to pay the employee's travel expenses in full, subject to the provision of supporting documents. These can be tickets, checks, receipts for the use of any type of transport (river, sea, air, land), except for taxis for budgetary institutions. Tickets for the use of taxi services as travel expenses can only be accepted if other modes of transport are not available. The question is relevant for small settlements.

A list of restrictions has been established for federal public sector employees; it is presented in paragraph 2 of Resolution No. 916.

The situation is similar with living expenses (renting residential premises). Payment is made for actually incurred and confirmed expenses. In order to save money, the institution may set a limit on the cost of accommodation per 1 day. As, for example, it is established for federal civil servants - no more than 550 rubles. The law allows payment of excess costs by saving money on this expense item, but an order from the manager is required.

When calculating daily allowances for business trips in 2020, no maximum or minimum limit has been established, that is, the payment for one day on a business trip can be 5 rubles or 10,000 rubles. Article 217 of the Tax Code of the Russian Federation establishes the maximum values for payments that are not subject to taxation: in Russia - 700 rubles per day and 2,500 rubles when traveling abroad. If the daily allowance in an organization exceeds the approved norms, then insurance premiums should be charged on the difference and personal income tax should be withheld.

For federal government employees, a daily allowance limit is set at 100 rubles per day.

Determine the average earnings for calculating travel allowances according to the rules:

- To calculate the average salary, take into account accrual data for the previous 12 calendar months. If the employee has not yet worked for one year, then make calculations for the period actually worked (Article 139 of the Labor Code of the Russian Federation).

- Exclude from the total number of days periods spent on sick leave, maternity leave or child care. Details about which periods to exclude are given in paragraph 5 of Resolution No. 922.

- From your total earnings, exclude accruals for sick leave, benefits, and parental leave. Accruals for a previous business trip should be included in the calculation.

We divide the resulting amount of total earnings by the days actually worked to obtain the average daily wage. Now we multiply the resulting figure by the number of days spent on a business trip.

IMPORTANT!

When calculating vacation pay, be sure to take into account the payment of average earnings for a business trip, since the employee worked (performed a job assignment). If we exclude travel payments from the calculation, the vacation pay will be less than if the employee did not travel anywhere. The posted employee retains his place of work (position), as well as his average earnings for the period of his stay on the trip, as stated in Article 167 of the Labor Code of the Russian Federation.

Number of days: an important factor!

Please note that the first day of the business trip is the day on which the tickets are sent. That is, if the plane takes off on the twentieth at ten o’clock in the evening, then the calculation for this day is made in full.

The rules for calculating travel allowances also suggest that if travel to the place of departure requires time, then it must also be paid in full.

An example would be a situation in which an employee needs to fly from an airport located outside the city. In order to catch the plane, the employee must leave at 23:30. In this case, this day must also be paid in full, despite the fact that the plane is scheduled to depart only the next day.

Daily payments

These payments are additional expenses that are incurred due to the fact that a person is forced to live away from home. The legislator determines the absence of restrictions on this amount, at the same time, these restrictions can be established by internal documents. Let's say that these payments must be provided for all days that a person is on a business trip, while the calculation also includes weekends, as well as those days on which the employee was on the road.

Please note that personal income tax is not deducted from daily allowances, but in this situation the legislator provides for certain restrictions that relate to the tax-free amount of payments provided. If an enterprise provides clearly established parameters for daily allowances, then no tax will be deducted from them. If the amount is higher than the established norm, then tax is deducted from the difference received.

In expenses, per diem will be determined by providing certain confirmations. For example, this is an action of a production nature - the employee performed a task assigned by the entrepreneur, as well as the duration of the employee’s stay outside his permanent place of residence.

A business trip is determined based on the following factors:

Availability of travel documents with specified dates, as well as documents that determine the rental of residential premises in a clearly established place (if the employee used personal or commercial transport and simply does not have tickets);

Service-type notes must also be drawn up, as well as other documents that form a clearly defined date of arrival, as well as the subsequent departure of the employee;

A mandatory element in determining travel payments in calculations is the provision of documents from the accounting department, which form a reflection of the fact that the employee has received funds allocated for the business trip. For example, a cash type order is provided;

Also, information on receipt of a visa, passport, invitations, similar documents defining the company’s invitation to attend a certain event, etc. can be used as confirmation of the existence of a business trip.

I would like to note that all travel expenses are certainly taken into account in the documents for tax on profits received (income minus expenses). Moreover, expenses should be taken into account in a general manner (as payment to an employee for fulfilling his professional obligations).

Payment for travel allowances. Holidays

It should be noted that payment for such a plan as daily allowance and travel allowance on holidays requires special clarification. Thus, daily allowances are paid for each day that a person spends on a business trip. This includes holidays and weekends. Despite the fact that the employee was not engaged in work on those days.

Travel allowances may not be paid on weekends. If the employee worked on his day off, then payment is made in the same way as for work on holidays and weekends outside of a business trip. That is, for these days the employee is entitled to double pay or additional time off, but with single pay per day.

We calculate the average daily earnings and the amount of travel allowances

We divide earnings for the billing period by the number of days actually worked in the billing period. Then we multiply the resulting number by the number of days spent on a business trip. Business trips are subject to personal income tax.

Example:

(438,086.96 / 225) × 5 = 9,735.27 rubles of travel allowance must be paid to A.A. Popova. The employee will be charged personal income tax for this amount.

Additional payment before salary

If the payment for travel allowances based on average earnings is significantly less than the salary that the employee would have received if he had not been sent on a business trip, an additional payment can be made up to the actual earnings.

If such an additional payment is provided for by an employment or collective agreement or a local regulatory act, the tax base for income tax can be reduced by it (see paragraph 25 of Article 255 of the Tax Code of the Russian Federation and letter of the Ministry of Finance dated December 3, 2010 No. 03-03-06/1/ 756 and dated September 14, 2010 No. 03-03-06/2/164).

However, you should always calculate travel allowances based on average earnings, and then compare them with the salary, so as not to worsen the situation of the employee if it is more profitable for him to receive average earnings.

Weekend business trip

If the days of a business trip coincide with days when the employee has a scheduled weekend, and he did not work on these days, payment is made not according to average earnings, but according to the rules for payment on a day off. If the employee was not involved in work on these days, then they are not paid. And if an employee was involved in work on a business trip on a day off or was on the road, the average earnings for such days are not saved. Weekends are paid at least double or single, but with the right to “take off” the day off later (see Articles 153 and 106 of the Labor Code of the Russian Federation).

When calculating double pay, you need to focus on the employee’s remuneration system used (see letters from the Ministry of Finance dated December 25, 2013 No. 14-2-337 and dated September 5, 2013 No. 14-2/3044898-4415).

Prepare and submit a zero calculation for insurance premiums through Extern. 3 months free.

Register

Calculation of daily allowances

For each day of being on a business trip, including weekends and non-working holidays, as well as for days on the road, including during a forced stopover, the employee is paid daily allowances (Clause 1. Regulations on the specifics of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749).

The employee does not have to report on daily allowance (see letters from the Ministry of Finance dated November 24, 2009 No. 03-03-06/1/770, dated April 1, 2010 No. 03-03-06/1/206).

The amount of daily allowance is established by the organization and enshrined in a collective agreement or local regulation (Article 168 of the Labor Code of the Russian Federation). Expenses for the payment of daily allowances are taken into account when taxing profits without restrictions.

Payment of daily allowances is exempt from personal income tax within the framework of the following standards: 700 rubles for each day of a business trip within the country and 2,500 rubles outside the country.

Example of calculating travel allowances

It is better to use examples to understand the situation. The accrual of travel allowances can be explained using a typical situation.

An employee of the company was sent to Kostroma on a business trip from April 1, 2020 to April 12, 2020. Moreover, during this period there were eight working days, since the company established a five-day working week; on weekends the employee rested.

During the billing period, the employee worked 230 days, earning 360,000 rubles.

With this calculation, the daily payment for D. A. Sergeev’s business trip will be 1,565 rubles 22 kopecks. That is, in eight days the employee will receive 12,521 rubles 76 kopecks in travel allowances.

Examples of calculating limits and personal income tax deductions

For example, an employee went on a business trip for 7 days. The employer established that during the entire period of work the daily rate will be 700 rubles. Accordingly, the employee receives an amount of 4,900 rubles before the start of the business trip. In accordance with the law, no deductions are made from this amount.

Another example is when internal documents establish that the daily rate for a business trip is 1,500 rubles. The employee goes on a business trip for 4 days, which means the payments he will receive will be 6,000 rubles. According to the standards, it is determined that in 4 days the employee must receive (4 * 700) = 2800 rubles. This means that from 6000-2800 we get the difference in the amount of 3200. From this amount it is mandatory to deduct the amount of taxes, as well as the amount of social plan payments.

What is a daily allowance? Features of accrual

Daily allowances are amounts that are aimed at reimbursing the employee’s expenses associated with living in another locality. Their payment is regulated by law. The payment is made for each day you are on a business trip, including days en route.

The amount of daily allowance is determined by each employer independently. For enterprises whose activities are carried out outside the Russian Federation, it is advisable to include in the company documents information about the amount of daily allowance for foreign business trips.

It is worth noting that the daily allowance prescribed for trips abroad is accrued for the day when the employee leaves the Russian Federation and for the day when he arrives back. That is, upon arrival in the country at nine in the morning, the whole day will still be paid according to the amount of daily allowance for a foreign business trip.

Daily allowance for a business trip of one day

An interesting situation arises if an employee is forced to go on a business trip lasting a day. In this case, there is a peculiarity of paying per diem. For example, a trip abroad is paid in the amount of fifty percent of the full daily allowance.

At the same time, business trips within the country are less profitable. No daily allowance is accrued for this day. However, it is worth remembering that this is only relevant when the day of departure and arrival coincide. If the departure was at eleven in the evening of the previous day, then the business trip is considered a two-day trip.