Account 98 “ Deferred income ” performs an important corrective function, since it often happens that an enterprise simultaneously receives income for several reporting periods at once, for example, annual (quarterly) payment for leased property, payments for sold subscriptions or planned transportation, etc. .P. That is, the company accepts payment for services, the profit from the provision of which should be taken into account in the future. Using the 98th account will allow you to distribute revenue corresponding to each reporting period, thereby streamlining tax payments.

How accounting of future income is carried out , and by what criteria such income should be determined, this publication will tell you.

Deferred income: what applies to them

Deferred income reflects receipts for services, the implementation of which will last a long time, but payment for them has already been received. These may be payments:

- for the rental of buildings, machines, vehicles, etc.;

- for rental housing and utilities;

- for the transportation of goods;

- for passenger transportation, when purchased tickets are sold for use in future periods;

- for various subscriptions.

In addition, targeted receipts are recorded on account 98 - grants, tranches (if there are state support programs).

Accounting for budget money

Budgetary funds for financing capital expenditures when putting non-current assets into operation are also shown as part of deferred income (clause 9 of PBU 13/2000).

Then reflect the accounting of deferred income by posting:

| Dt 86 “Targeted financing” – Kt 98 |

When money is received from the budget to finance current expenses, this posting is made, for example, at the time the inventory is accepted for accounting.

Then, during the useful life of non-current assets, deferred income is recognized as other income:

| Dt 98 – Kt 91 “Other income and expenses” |

Already when valuables are released into production or for other purposes, future income is written off by this posting.

Also see “When a company can count on subsidies/investments from the budget: 11 reasons.”

Deferred income: account structure 98

The main function of the account is to combine analytical information about the income of future periods. Depending on the source of origin of payments, the following sub-accounts are opened to the account, provided for in the Chart of Accounts:

- 98/1 “Income received for future periods”;

- 98/2 “Gratuitous receipts”;

- 98/3 “Proceeds from compensation for shortfalls established for previous periods”;

- 98/4 “Differences between the amounts to be recovered from the perpetrators and the value of the missing property on the balance sheet”, etc.

By credit, incoming amounts attributable to DBP are recorded; by debit, amounts transferred when income is recognized.

There is no separate PBU “Deferred Income”; the use of the account is regulated by the Chart of Accounts, PBU 9/99 “Revenue”, PBU 13/2000 “Accounting for State Aid”. Today, future earnings may include:

- targeted budget financing;

- the cost of freely supplied OS, MPZ;

- the difference between the amount of lease payments under the contract and the value of the leased property.

Reflection in the balance sheet of the enterprise

When compiling the final balance sheet, DBP are displayed on line 1530 of the Liabilities of the balance sheet in the “Short-term liabilities” section (see figure).

It shows the value of funds received free of charge, receipts for identified thefts and shortages of past periods and the amount of targeted funding received by the organization over the past calendar year.

When filling out the balance sheet, it is necessary to remember that for the purpose of drawing up correct financial statements, advances received must be reflected separately from the DBP.

Therefore, payments transferred as an advance payment are subject to accounting on line 1520 and are one of the components of accounts payable.

In fact, line 1530 ultimately needs to show the amounts of the credit balance of account 98 and the credit balance of account 86 in the target financing provided analytics.

But in the case when the amount of unused targeted funding is large and significant in the overall indicators of the organization’s turnover, then it is advisable to show it separately. A special line in the “Short-term liabilities” section can be used for display.

Where are deferred income shown on the balance sheet?

Account 98 is passive, and in the balance sheet it is assigned line 1530, which reflects future income . The credit balance of account 98 recorded on it indicates that the company has a balance of receipts that will be recognized as revenue in the period directly related to the payment.

Note that an increase in future income indicates an increase in the company’s work aimed at attracting counterparties, the intensity of service provision, the free receipt of assets or targeted government assistance.

Reflection of deferred expenses in 1C Accounting 8.3 (3.0)

In this article we will consider the question of how to take into account deferred expenses in 1C 8.3 “Enterprise Accounting 3.0”. RBPs in the 1C Accounting 8.2 program are reflected in the same way, so you can use this instruction for older versions of 1C.

Deferred expenses (FPR) are expenses that we took into account in the current period, but in this regard we plan to receive income in the future. In other words, you spent money today in order to receive income tomorrow.

Such expenses do not necessarily have a direct impact on profits. For example, we bought a domain (domain name) with the goal of deploying a website for our company. The purpose of the site is to attract customers who will generate income for us. Since the site must first be created and then “promoted,” it will begin to generate profit only after some time. The costs of purchasing a domain are deferred expenses.

Write-off of deferred expenses is carried out in three ways:

- monthly, within a certain date range;

- daily (meaning calendar days), within a certain date range;

- in an arbitrary (special) way. As a rule, this means a one-time write-off.

These settings are specified in the reference book of the same name “Future Expenses”.

Entering a new object and setting up write-off of deferred expenses

Let's go to the directory. Let's go to the "Directories" menu, then to the "Deferred expenses" submenu. In the list of directory elements, click the “Create” button.

The setup form will open. Let's fill in the following details of Form 1C:

- Name. Let's say we purchased a domain in the “ru” zone. So we’ll enter: “Domain in the “ru” zone.”

- For tax accounting purposes, we will indicate “Other”.

- Type of asset in the balance sheet: “Other current inventories.”

- Field "Amount": is indicated for informational purposes only. The write-off amount is calculated according to the algorithm indicated below and based on the remaining amount to be written off according to accounting data. We will indicate here the domain purchase amount – 2600 rubles. in a year.

- In the write-off parameters, we will indicate the frequency. For example, “By month”.

- Let the cost account be 26.

- Cost item – “Other expenses”.

- All that remains is to indicate the period for which the expenses should be completely written off. Let's say we plan to launch and make our website popular in 4 months. We will indicate the start date and end date of the write-off, respectively.

Now you can click the “Record and close” button and proceed to registering the accounting of future expenses:

Accrual of deferred expenses in 1C 8.3

We prepare the document “Receipt of goods and .

Go to the “Purchases” menu, then click the “Receipt of goods and services” link. Click the “Receipt” button and select “Receipt of services”.

We fill out the header of the document as usual upon admission (described more than once). There shouldn't be any questions here.

Let's move on to filling out the tabular part. Let's add a new line, select an item, indicate the quantity and amount.

The column “Accounts” is of interest. In it you need to delete what the program offers by default and click the account selection button. In the window that opens, indicate:

- Accounting cost account: 97.21.

- We will indicate the first subaccount of our account in the directory “Future Expenses”, namely “Domain in the zone “ru””.

- For completeness of analytical accounting, we will also indicate the division.

Tax accounting is set up in the same way.

Here is an example of setting up accounting accounts:

Example of a completed document:

Let's look at the accounting entries that the 1C program generated for us:

We make sure that the expenses are credited to account 97.21 and will be recorded there until they are completely written off. You can always view the balance to be written off by creating a balance sheet for the account.

Write-off of deferred expenses in transactions when closing the month

Write-off of such expenses is carried out by the routine operation “Closing the month“:

If you did everything as described above (your data may differ from mine, but the principle should be the same as I described), then the following calculation result should be obtained in the postings for the BPO:

See also our video about reflecting RBP in 1C:

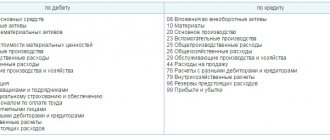

Postings for recording deferred income

Here are the main records that the accountant operates, taking into account future income:

| Operation | D/t | K/t |

| Funds arrived like DBP | 51, 52, 58 | 98/1 |

| Write-off of part of the funds relating to the current period | 98/1 | 90,91 |

| Receipt of funding from the budget | 86 | 98/1 |

| Write-off of target funds in the corresponding period | 98/1 | 90,91 |

| The initial cost of fixed assets, inventories or goods received free of charge is reflected | 08, 10, 41 | 98/2 |

| Income on gratuitously received fixed assets is recognized (on a monthly depreciation basis) | 98/2 | 02 |

| Recognized revenue from goods received free of charge, inventories | 98/2 | 10,41 |

| The amount of shortfalls for previous periods has been established | 73, 94 | 98/3 |

| Funds have been received to cover the damage caused by the shortage | 50, 51, 52 | 73,94 |

| Recognition of income from payment to repay the deficiency | 98/3 | 91 |

Thus, the amounts from the loan account. 98 are written off in installments as revenue is accepted for deferred income.

Example:

On July 10, 2020, a donation agreement formalized the receipt of 100 kg of honey in the amount of 10,000 rubles. (with an expert assessment of market value) to the confectionery production of Alpha LLC. Raw materials are written off gradually:

- in July 50 kg;

- in August 30 kg;

- in September 20 kg.

The receipt of honey is registered with a receipt order and is recorded in the accounting records as follows:

- D/t 10 – K/t 98/2 in the amount of 10,000 rubles.

The release of raw materials into production is carried out in stages:

- in July 50 kg: D/t 20 – K/t 10 for the amount of 5000 rubles. (50 kg * 100 rub./kg.)

- D/t 98/2 – K/t 91/1 for 5000 rubles. – other income (according to PBU 9/99) of the reporting month is recognized;

- in August 30 kg:

D/t 20 – K/t 10 for 3000 rub. (30 * 100)

- D/t 98/2 – K/t 91/1 for 3000 rubles. – income for August is recognized;

- in September 20 kg:

D/t 20 – K/t 10 for 2000 rub. (20 * 100)

- D/t 98/2 – K/t 91/1 for 2000 rubles. – income for September is recognized.

Correspondent accounts of subaccounts of account 98

Since shortages, subscription fees and gratuitous transfer of materials are radically different sources of finance in the accounting sense, then the correspondence of subaccounts will differ significantly.

Postings to subaccount 98.1

Subaccount 98.1 reflects the receipt of funds in the current period, but relating to future months or quarters. This is the receipt of utility bills, payment of monthly travel tickets, subscription fees for telephone services, rental payments, etc. The credit part of subaccount 98.1 corresponds with accounts reflecting the route of receipt of this income:

- – cash acceptance;

- – non-cash payment;

- – use of currency units, etc.

Accordingly, upon the arrival of the period for which income was received, posting Dt98.1 in correspondence with the account reflecting the use of these funds.

Analytical accounting for this sub-account is carried out for each type of income.

Postings to subaccount 98.2

Assets donated to the organization are reflected in subaccount 98.2. The credit part of the subaccount corresponds with accounts reflecting the purpose of the asset receipt:

- – when investing in non-current assets;

- – upon receipt of targeted funding for the implementation of the project.

The debiting of funds from this subaccount is reflected by posting Dt98.2 - Kt91 :

- when calculating depreciation on donated fixed assets;

- when writing off production costs based on donated materials.

Analytical accounting for this subaccount is carried out for each gratuitous receipt.

Postings to subaccount 98.3

Subaccount 98.3 takes into account upcoming receipts from the guilty parties to cover the shortfall. This can be either a voluntary admission of guilt and agreement to compensation, or by a court decision. The most commonly used wiring is:

- Dt94 – Kt98.3 – reflection of the amount of shortage identified in the previous reporting period;

- Dt73 – Kt94 – reflection of upcoming receipts from the guilty parties;

- Dt50 (51.52) – Kt73 – upon receipt of compensation;

- Dt98.3 - Kt91 - reflection of actual funds received to repay the previously identified shortage.

Inventory of deferred income

Carrying out the procedure for comparing the balances on account 98 is mandatory. As a rule, they are inventoried at the end of the financial year, carefully checking the amounts of receipts with the data of analytical articles and primary documents, as well as monitoring the recognition of revenue, i.e. debiting from account 98, in those periods when future income becomes relevant.

The main task of inventory is to verify the reliability of account information and related analytics, as well as the compliance of the reflection of these transactions with the accounting policies adopted by the company.

What objects belong to the DBP

Profit received “in advance” can be attributed to several cases of receipt of income. The main feature by which this type of income can be classified as DBP is that it can, in full accordance with the law, be “stretched” over several accounting periods, that is, this asset will be used to generate profit not only now, but also in the future. .

NOTE! All incoming funds that are recommended by the DBP are specified in regulatory (methodological) documents. An accountant should not expand their list on his own.

Recommendations for DBP are presented in the following regulatory documentation:

- clause 9 of PBU 13/2000 “Accounting for state aid” – on accounting for targeted financing as a DBP;

- clause 29 of the Methodological Guidelines for the Accounting of Fixed Assets speaks of reflecting gratuitously received finances as a loan on the DBP account;

- clause 4 of the Instructions on the reflection of leasing operations in accounting - on the presentation of leasing differences as DBP;

- Chart of accounts for accounting financial and economic activities - about the presence of account 98, specifically designed to reflect DBP;

- Order of the Ministry of Finance of the Russian Federation No. 66n dated July 2, 2010 “On the forms of financial statements of organizations” - on the reflection of financial statements in the balance sheet in the section “Short-term liabilities”.

- Rent. The lease agreement may provide for payment in advance for a certain time. A security deposit, which is paid at the beginning of the lease, but is offset for its last month, can also be recognized as deferred income.

- Advance payments are funds transferred under a contract for goods or services that have not yet been provided to the buyer (in advance) on account of subsequent payments. DBP will be recognized if the advance is made more than 1 accounting period in advance.

- Subscription (prepayment) to periodicals.

- Sale of tickets for various events, performances, performances.

- Revenue from subscriptions and long-term obligations, for example, income from the transportation of passengers who bought a “pass” for a quarter or a year, subscription fees for communication services, etc.

- Sponsorship "gifts". For a long time, gratuitous receipts provided for in the gift agreement were attributed to the period of receipt, and tax was also reflected and paid on this profit. But if we consider this asset as a long-term asset that will “work” for the company for several years, then it can quite legitimately be considered as deferred profit. This also includes grants received.

- Funds from the budget received to cover costs.

- Funds allocated for specific purposes that are not fully used (fund balances in account 86 “Targeted financing”).

- When leasing, the difference between the amount of lease payments and the cost of the property leased (it must be on the balance sheet of the recipient of the property).

- Probable return of previous shortages. If a loss has been incurred, it can be irrecoverable (when the guilty party has not been identified) or it can be attributed to accounts receivable (when the amount is planned to be collected from the financially responsible person). In the second case, payment of such a shortfall may also be considered DBP.

- Leasing difference. If the company is a lessor, then the difference between the value of the property leased and the total amount of lease payments is also recognized as DBP. In this case, it does not matter that the property is already on the balance sheet of the lessee.

FOR YOUR INFORMATION! If fixed assets are received as a gift in this way, then depreciation in future periods will not be charged for them (otherwise it would level out the “profit” from deferring profits for the future), but the transfer of part of the DBP to current expenses is recorded. Thus, the cost will not include depreciation, which in this case will act as a transfer of expenses incurred earlier.

Where are deferred income reflected?

Special account 98, which is called “Deferred Income,” is designed to reflect all types of deferred profits. The instructions for the Chart of Accounts allow you to open a number of sub-accounts for this account, specified by DBP objects:

- “income that will be received in future accounting periods”;

- “gratuitous receipts” – gifts, sponsorship, etc.;

- “future receipts for past shortfalls identified in earlier periods”;

- “the difference between the cost of recovery according to the balance sheet and the amount payable by the guilty party”, etc.

In the balance sheet, a special line 1530 is intended to account for this type of profit.

ATTENTION! It can reflect only those incomes that are recognized by the DBP in the regulatory documents of this organization.

Active or passive?

Are deferred receipts an asset or a liability when reflected on the balance sheet? Line 1530 reflects the item “DBP” as a balance sheet liability, despite the fact that it takes into account income.

The reason is that this line has a direct connection with another line, also related to the liability “Retained earnings (uncovered loss)”. It records the profit that the organization “owes” to its owners. But in practice, there are often situations when the debt to the owners has not yet arisen, but the money has already arrived on the balance sheet. For example, money was received as funding from the budget. They should be classified as “cash” assets. How to balance a liability? These are not retained earnings, because the organization has not yet done anything of what they were intended for, which means they have not yet become a profit. The profit from them is only in the future, so it is appropriate to include them in the liability line “Future income”. As this money is spent, that is, expenses are recognized, the amounts from the DBP liability will be transferred in parts to the Retained Earnings liability.

We carry out accounting

To reflect the DBP, the credit of account 98 “Deferred Income” and correspondent accounts are intended for accounting for finances and settlements with counterparties.

To write off amounts of income from future periods when this very “future” occurs, the debit of this account (98) is used, as well as the correspondence of the account in which the income was recorded (90 or 91, this determines the type of receipt).

Subaccounts that define a specific DBP object also provide for the corresponding correspondence:

- “Gratuitous receipts” – 08 “Investments in non-current assets”, 86 “Targeted financing” (loan 91 “Other income and expenses”);

- “Forthcoming receipts of debt for shortfalls for past periods” - 94 “Shortfalls from loss and damage to valuables”, 73 “Settlements with personnel for other operations”, subaccount “Reimbursement of material damage” (credit 91 “Other expenses”);

- “The difference in the amount of recovery from the perpetrator and the book value” - 73 “Settlements with personnel for other operations” (credit 91 “Other expenses”).